Unforcasteability and a Downgrade (NOTW#43)

Best Anchor Stocks has a partnership with Finchat (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

The indices were up again this week and are now close to ATHs (all-time highs). This teaches us two lessons, which I discuss in the brief market commentary. There was some good and bad news this week, the latter of which came in after the market closed on Friday.

Without further ado, let’s get on with it.

Articles of the past two weeks

I have published 6 articles over the past two weeks.

The first one was my report on Medpace. It’s a comprehensive report with everything there is to know about the company.

Medpace Holdings (MEDP)

Welcome to yet another in-depth report. It’s Medpace Holdings’ turn today. Medpace is a CRO (Contract Research Organization) that has compounded at a 30% CAGR since its IPO in 2017. The stock is currently in a

The second article was Zoetis’ Q1 earnings digest. I go into detail on the topic of Librela.

Market overreaction or justified drop?

This article is free to read. My Zoetis in-depth report for paid subscribers can be found here.

The third article was Stevanato’s earnings digest. The company reported much better than expected earnings in Q1 but did not raise guidance (which seems very conservative).

Sandbagging…anyone?

This article is free to read, just like my in-depth report on Stevanato (a 5-part series on a wonderful and arguably overlooked company). Don’t forget that a paid subscription gives you access to all…

The fourth article was Nintendo’s earnings digest. I go over the FY 2025 numbers but go more in-depth into the guidance, which is what should matter right now.

Nintendo: Finally looking forward

Nintendo reported FY 2025 earnings on Thursday last week. I don’t think this year’s earnings are relevant, but before jumping into what’s important (guidance and Switch 2 commentary), let’s take a quick look at the numbers. As expected,

The fifth article explained which position I am selling and why.

I am selling a position

One of my portfolio companies reported earnings on Tuesday, and while this article will go over these, the main goal is to explain why I am selling my position in the company. I still believe this company is a brilliant business (one of its segments might be one of the best I have ever encountered), and my decision to sell is not related to its business quality but rather to

Finally, the sixth article of the past two weeks was an article on Constellation’s Q1, AGM, and valuation.

Constellation’s Q1, AGM, and Valuation

Constellation Software reported Q1 earnings and held its Annual General Meeting this week. Recall that the company does not host earnings calls; therefore, the AGM is pretty much the only moment when…

Market Overview

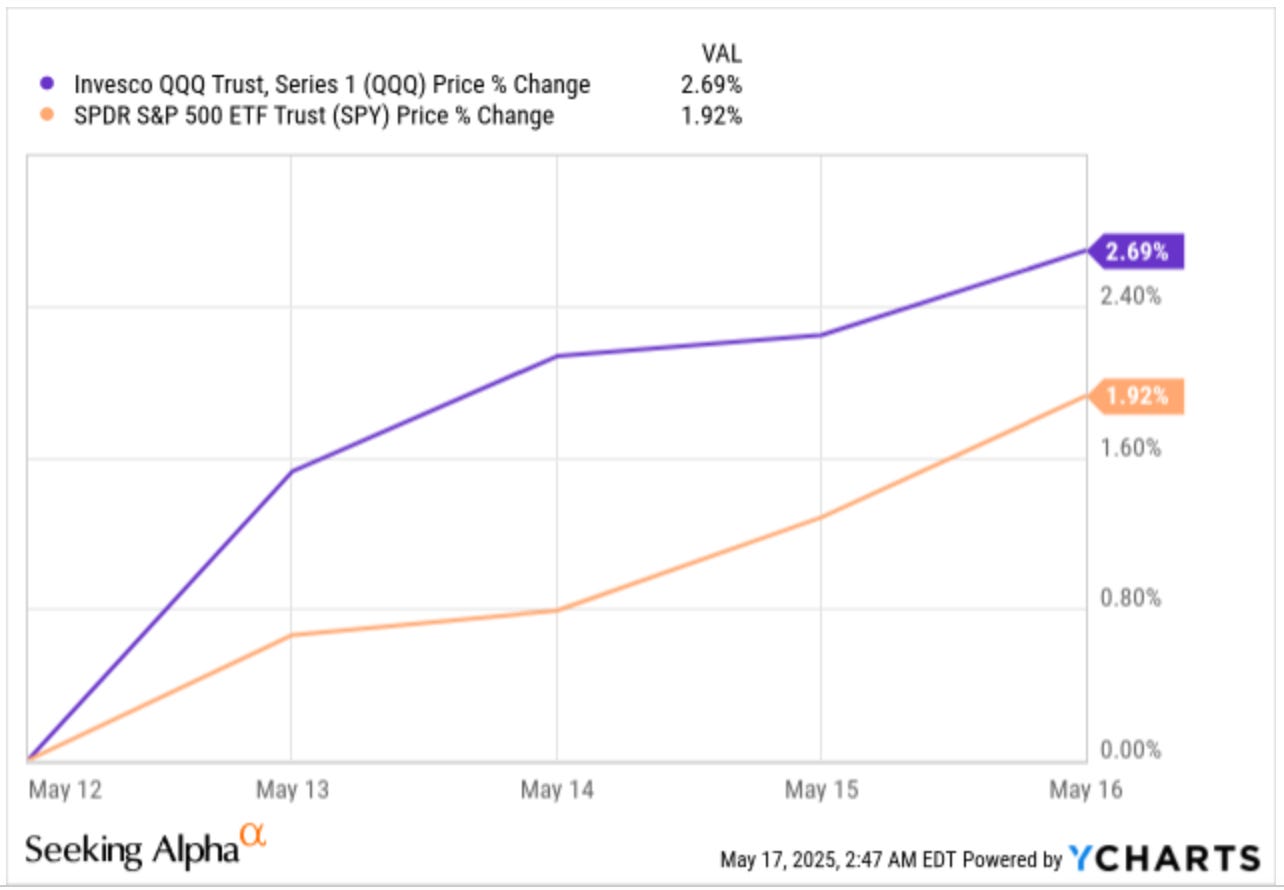

The market was up again significantly this week. The Nasdaq rose almost 3%, whereas the S&P 500 rose almost 2%:

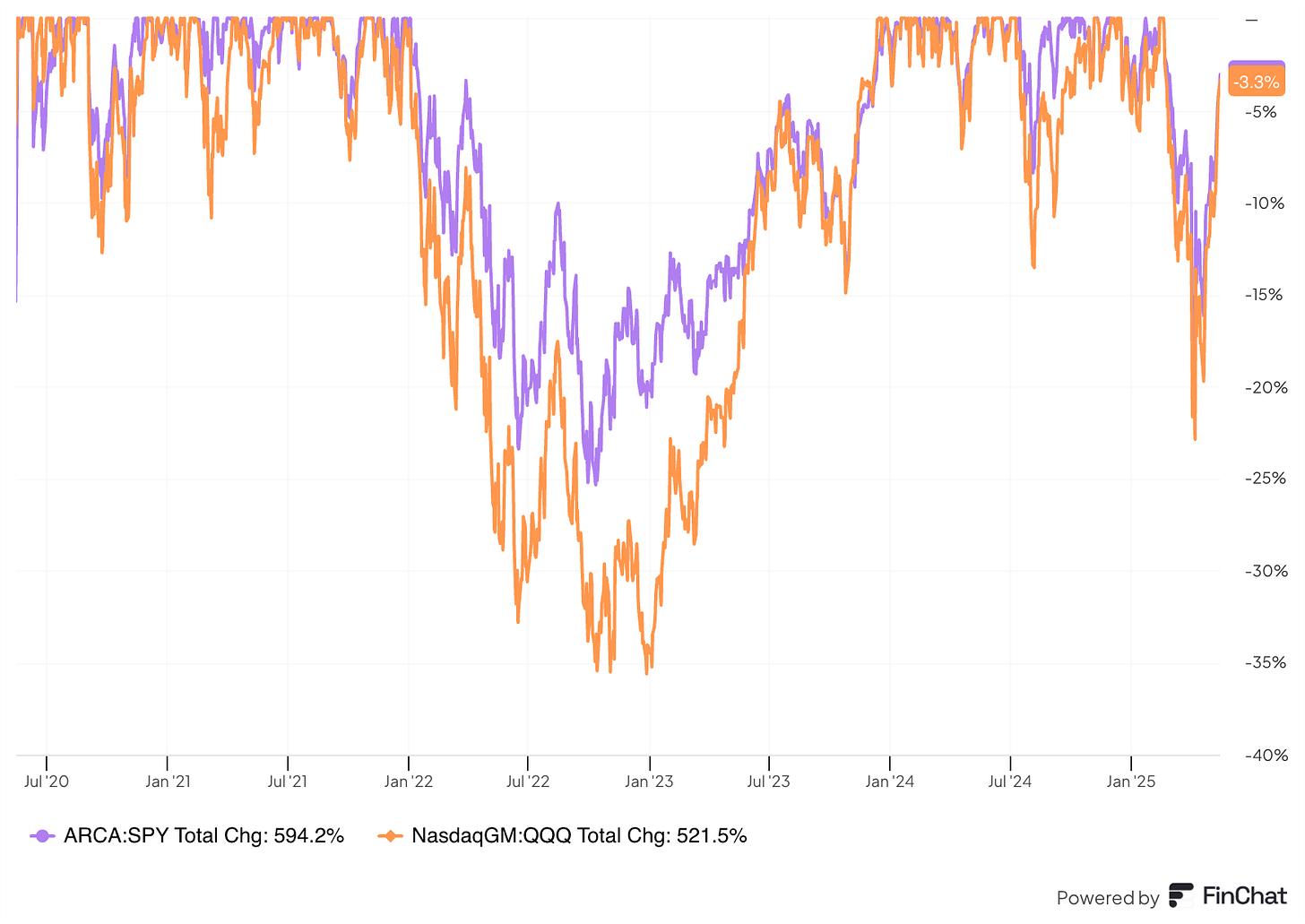

Both indices are now barely down from highs (around 3%) despite all that has happened over the past few months:

There are, in my opinion, two lessons here somewhere. The first one is that macro is completely unpredictable, and even if you get it right, it’s almost impossible to forecast what markets will do. This is a similar case to the pandemic. Despite the pandemic, global inflation, and fears of a slowdown, markets marched to all-time highs against the forecasts of many. Who would’ve said that markets would be close to ATHs when told that the US will enter a commercial war against the world? The answer is evident when we look at the sentiment over the past few weeks: few.

The second lesson is that there are a lot of charlatans in financial markets. How many people claimed in the April lows that it was foolish (put mildly) to “buy the dip”? A lot, and they have thus far been proven wrong. Plenty of people have been waiting for a financial apocalypse for a long time, and while they’ll be right some time, the amount of money they will have left on the table until that happens will probably be significant. I’m sure we’ll have a financial “apocalypse” at some time, the only problem is that I don’t know when, and the opportunity cost of not being invested is significant.

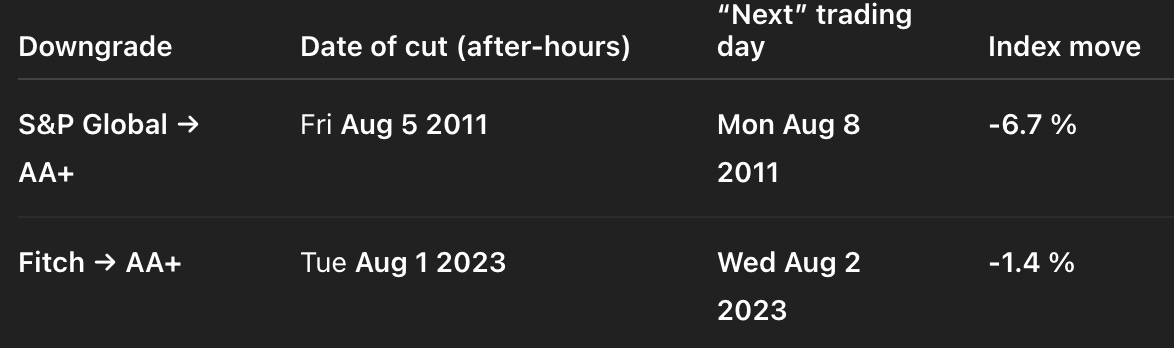

The week had, imho, one excellent news and some bad news. The good news is that the US and China agreed on a “pause” (or a reduction) of tariffs for 90 days while they negotiate. The escalation of the trade war seems to be over. The bad news happened on Friday after markets closed: Moody’s lowered the US’s credit rating from AAA (the highest) to AA, citing escalating debt. This is not the first downgrade the US gets (there was one from S&P Global in 2011 and one from Fitch in 2023), but it’s the first one from Moody’s. The indices suffered negative reactions the first two times around, but the only significant negative reaction came with the 2011 downgrade and that was an entirely different macroeconomic context:

I have no clue what will happen this time around (the QQQ dropped around 1.3% in after-hours trading) but the S&P 500 is up 429% since August 8th 2011 and 32% since August 2nd 2023. What seems obvious is that the debt might have become a tad more expensive both for the US and its underlying businesses.

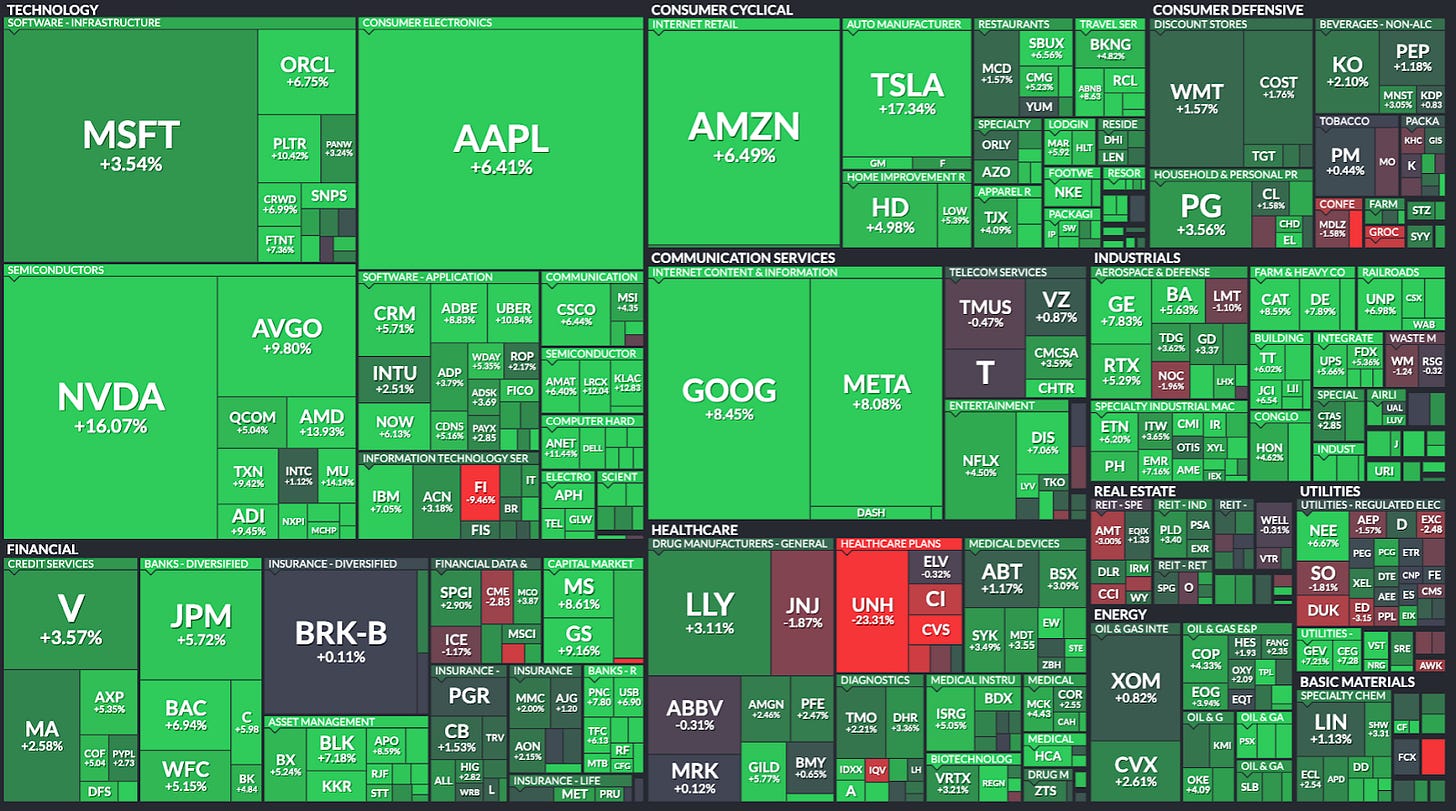

The industry map was mostly green this week, with few exceptions:

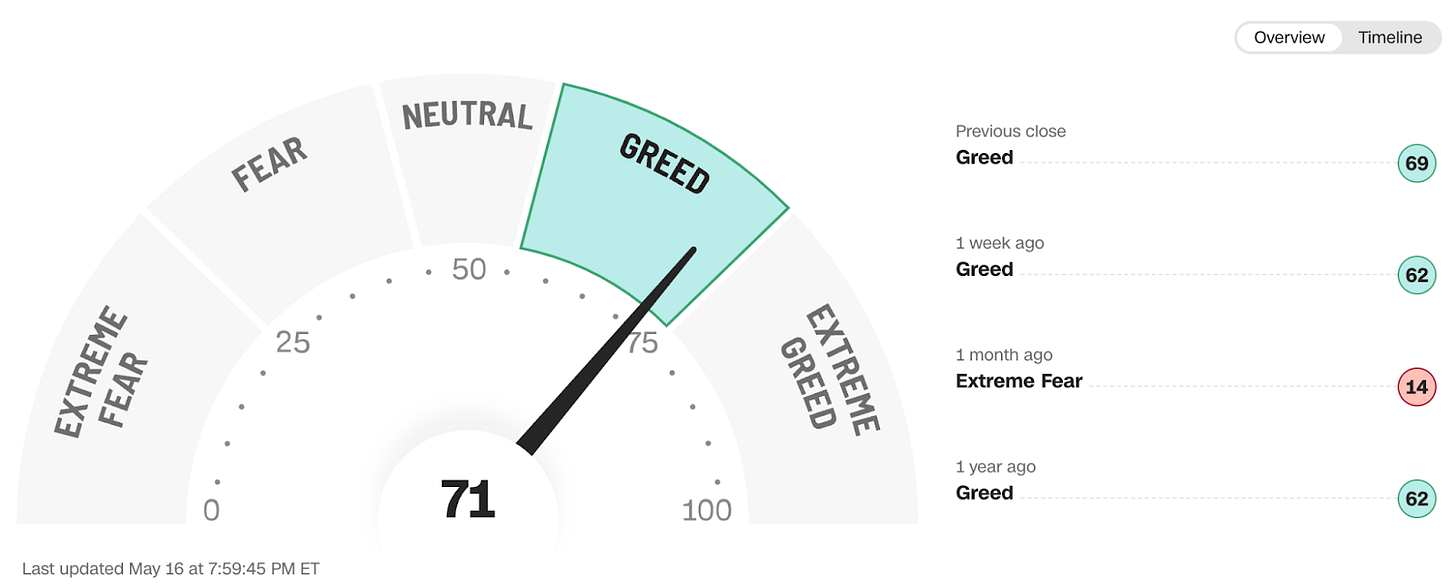

The fear and greed index is now close to extreme greed:

It was in extreme fear barely a month ago! This portrays how sentiment changes move stock prices over the short term entirely. Sentiment can change on a dime, but it takes much more to move fundamentals.

The rest of the content where I share my transactions and the news of the weeks is reserved for paid subs.