Market overreaction or justified drop?

Zoetis' Q1 Earnings Analysis

This article is free to read. My Zoetis in-depth report for paid subscribers can be found here.

Zoetis reported earnings on Tuesday. The market did not like them, and the stock dropped more than 5% that day. It did, however, recover a good chunk of this drop on Wednesday:

I have received many questions asking if the numbers warranted such a drop. While it’s always impossible to know why stocks drop or rise any given day (I recommend reading ‘Flash Crash’ to understand why), I think there was a palpable reason for this drop. Before discussing this, let’s take a quick look at the numbers:

Focusing on the business’ organic performance is more important than ever because Zoetis recently divested its MFA (Medicated Feed Additives) business, and FX has been all over the place. Revenue grew 9% operationally but only 1% on a reported basis because the MFA divestiture and FX shaved 400 bps each of the underlying growth.

The good news is that, to an extent, the MFA divestiture is already becoming somewhat palpable in the margin profile. The divestiture was accretive to margins (i.e., the MFA business had lower margins than average), so Zoetis has become smaller but more profitable (the sharp rise in companion as a percentage of sales was driven by the MFA divestiture, as it was a livestock business). Zoetis saw its gross margin expand 140 bps and its operating margin expand 150 bps. The MFA divestiture is not the only moving part here, but it’s definitely a tailwind.

Another thing worth pointing out is buybacks. These were the reason why EPS grew 300 bps faster than net income, and while they might seem minor in any given quarter, they surely add up over the long term. Zoetis has been scaling up buybacks as its cash flows have grown. The company repurchased $443 million of shares in Q1 and has spent almost $2 billion in buybacks over the last twelve months, corresponding to around 83% of the Free Cash Flow generated over the same period. Shares outstanding dropped 2.4% year over year. This might not seem much, but it adds up and eventually becomes a strong tailwind so long as the company keeps growing its intrinsic value. Zoetis' outstanding shares are down 5.5% over the last three years, which has helped the company grow its EPS considerably faster than its net income:

One could pinpoint two main “lowlights” from the summary table. First is the declining growth rate (I’m referring to organic here): Zoetis grew 300 bps faster in the comparable quarter (Q1 2024). This slowdown concerns the new OA pain MABs franchise, and I’ll go into this topic later on.

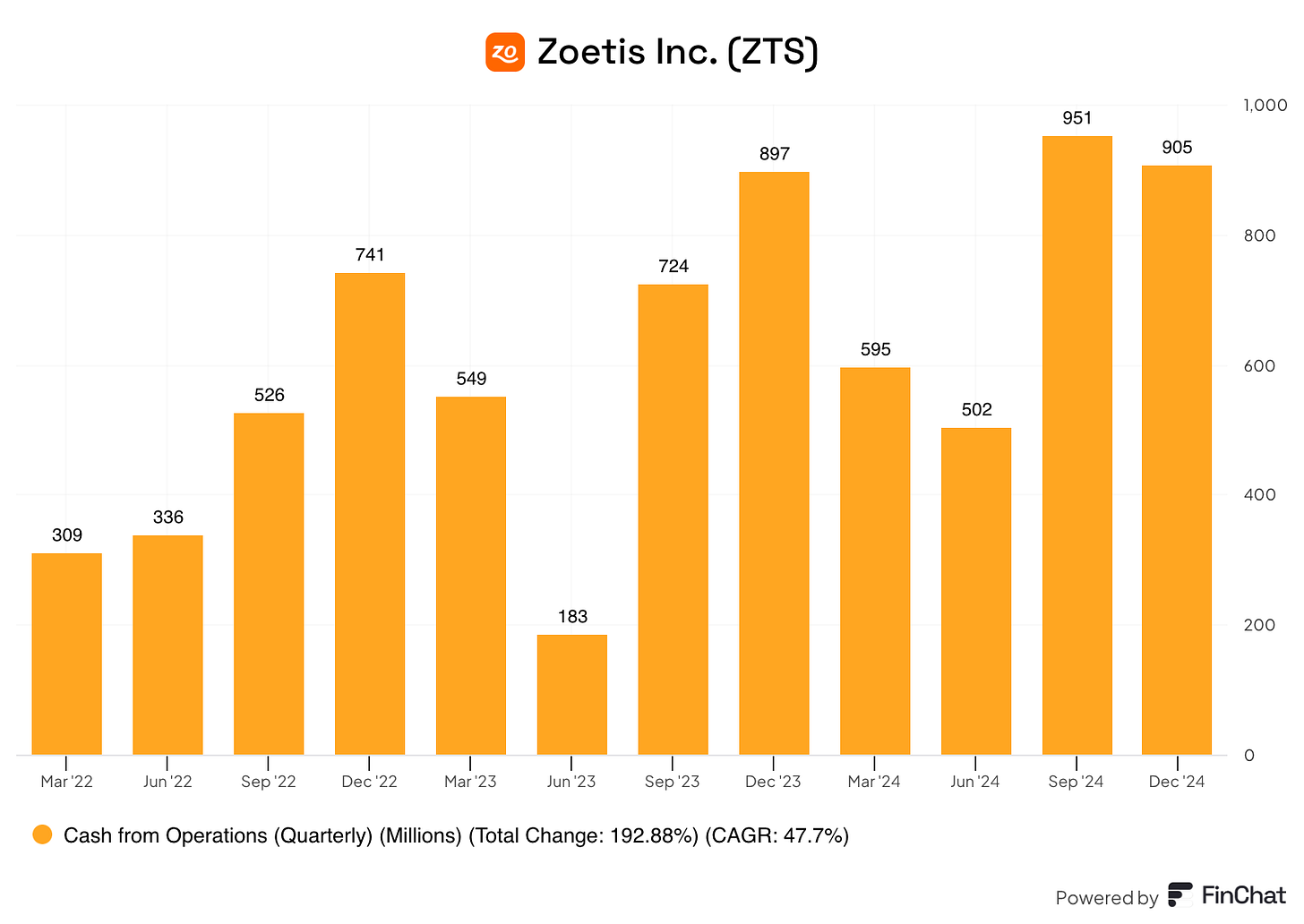

The other thing one could point out is cash flows. Despite growth in revenue and adjusted net income, cash flows were down slightly. Note that cash flows don’t exclude the MFA divestiture (i.e., it’s not an organic metric). To this, we have to add the fact that Zoetis’ cash flows are pretty volatile and not necessarily indicative of anything in any given quarter:

Another thing that needs context is guidance. Zoetis raised the absolute figures in revenue and adjusted net income for FY2025, but (important “but”), this rise was caused almost entirely by the dollar's depreciation. Zoetis reports in dollars but has a significant international business, so it benefits materially from a weaker dollar.

On an operational basis (which excludes the impact of FX), the company maintained the revenue guidance, but dropped the adjusted net income guidance from a midpoint of 7% to a midpoint of 6%. This drop was caused by the topic du jour: tariffs.

Management mentioned that tariffs would have a short-term net impact of around $20 million. Zoetis exports much more to the US than it imports, so the impact primarily comes from retaliatory tariffs. However, this was inconsistent with what management said in the call. They said the main headwind came from API imports from China for its livestock business. Not very related, but API (Active Pharmaceutical Ingredients) are the core substance used in drug manufacturing, and API production has moved significantly to China over the last decade to save costs (this is likely what Trump doesn’t like).

The key franchises and the never-ending topic of competition

Zoetis’ key franchises (parasiticides, dermatology, and OA pain mabs) kept growing at a good pace despite their already significant size (I’ll discuss OA pain mabs separately and will focus on the other franchises here). The Simparica franchise (parasiticides) generated revenue of $367 million, growing 19% year over year. Key dermatology (mainly Apoquel) rose 10% and generated $387 million in revenue. While these numbers at this scale are pretty impressive for an animal health franchise, management could not avoid the everlasting questions around competition.

There’s no denying that the market is getting more competitive in parasiticides and dermatology, but the numbers speak for themselves. Competition is not new, and these franchises continue to grow at double-digit rates. So, why is this? I’ve discussed this before, but the competition topic is interesting for Zoetis and the animal health industry in general.

As there are many unmet needs and it’s a relatively immature industry, competition can have a positive impact on the incumbents. The main reason is that competition, instead of raising the competitive intensity, helps build awareness. The case of Simparica Trio is pretty illustrative of how this works. Competition for Simparica Trio (Zoetis’ triple-combination antiparasiticide) has been available for some time, and despite this the product continues to grow at a good pace. Why? Because entrants are accelerating the shift to triple combinations, which benefits Zoetis as the incumbent and a first-mover:

I think what we’re really seeing is that, there’s still 40% growth in a combined flea chick heartworm space and the more people that enter, the more people get switched into combo therapies from single therapies or topicals or collars. So, we continue to see that regardless of who is entering. We have an excellent product. It’s continued to compete really well in the market.

We’re really proud of the execution on this in the US and around the globe. So, we’ve seen competition. We’re obviously going to continue to see more competition. I think what’s also something to focus on is that right now, we have a 40% share in puppies. And obviously, once one dog goes on a product, it’s, rare that it’ll switch. So I think that’s a really good indication of where that’s going in the future.

This is one of the things that makes the animal health industry interesting: the available whitespace protects against higher competition resulting in significantly higher competitive intensity. This will definitely change at some point when markets get saturated, but that point seems to be pretty far away in many of Zoetis’ markets.

Another thing worth noting relates to the distribution channel. Zoetis mentioned several interesting stats related to sales through non-vet channels:

Retail grew 40% in the quarter

Retail already makes up around 21% of its US business

Retail makes up to 40% of sales for products like Simparica and Apoquel

I have mixed feelings here. While I completely understand that the retail channel makes it easier for people to have access to Zoetis’ products and helps drive awareness, I also feel it somewhat reduces the moat by displacing the friendly middleman (the vet). Displacing the friendly middleman also means that Zoetis is even less exposed to vet visits, but can potentially make it easier for new entrants to scale. The good news is that:

Most of Zoetis' products require a prescription and therefore require at least one visit to the vet

Competition is coming from the incumbents because you need the know-how and the scale to invest in R&D (meaning there are still significant barriers for new entrants)

Both of these things make me net positive on the move to the retail channel. The friendly middleman is not Zoetis’ only moat.

OA Pain MABs: what’s going on with Librela?

OA Pain MABs in general, and Librela in particular, were, imho, the reason for the post-earnings drop. Librela kept growing at a double-digit clip globally, but despite posting a strong +17% growth in the US, management mentioned that “adoption has been more gradual than they expected.” They blamed this on two things…

A deceleration in spending on chronic medications due to macro weakness (sounds like an excuse)

Poor execution around awareness and education surrounding Librela

Before considering why this might have happened, let’s look at the numbers. International and US numbers are not comparable because international includes the launch of new geographies, but just looking at the US data, it’s pretty obvious that Librela has decelerated significantly in the US:

It may well be that the benefits of Librela are not well understood, or maybe the negative publicity that Librela has suffered lately and the label change have played a role in the reduced demand (I don’t really know what the exact reason may be, but these are some options). What is puzzling is that Librela’s development in the US and Europe has been so different. While management has managed to spur growth internationally by penetrating milder cases, growth has decelerated in the US before even covering all severe cases. It’s honestly very strange considering that it’s exactly the same drug and that animals are unlikely to be very different in Europe than in Germany (for example).

Regardless of the underlying reason, this deceleration is not great news for Zoetis for two reasons. First, Librela was expected to be a significant growth tailwind in the coming years. Management still believes that OA pain is a $2 to $3 billion market, but growth is significantly decelerating at around a $600 million in global sales. They still believe the category is vast and have confidence in recovering Librela’s growth…but the interesting thing is that they gave some unexpected data regarding the new long-acting OA pain mab they expect to get approval for this year. They mentioned that the new long-acting…

Will require one dose every three months (compared to Librela’s 1 injection per month)

Is a different molecule from Librela and therefore will not carry its name

It contains 10 times fewer dose than Librela

The first point is important because it should help with compliance; putting an injection once every three months is much better for a pet owner than every month. The second point is interesting because it should theoretically reset some of the negative publicity Librela has received; not carrying the Librela label might be good in the US. The third point is also very important because a lower dose probably results in significantly fewer adverse events.

All this said, management was clear in that they still trust Librela and that they will not need the commercialization of this new long-acting MAB to return to growth. Note that if the MAB gets FDA approval this year in Q4 (for example), we will not see it commercialized likely until the second half of 2026 (meaning that it’s unlikely to compensate for the lower growth in Librela). The second reason this is not great is that OA pain mabs like Librela have an accretive margin profile, and therefore, lower sales should result in a lower margin. Management also argued they would invest aggressively in awareness, so it’s actually a double-whammy for margins. This was not discussed as a reason for the reduced net income guidance, but it might well be.

What I have said here is not great news, especially because I don’t feel management has been fully transparent. Last quarter, management attributed the sequential decline of Librela sales to simply volatility related to building a new category. That commentary made sense, but things seem to have changed now. It’s not only the fact that Zoetis is building a new category; it’s also a lack of execution. Still, I remain surprised by the differences between Librela in the US and international markets, and that makes me believe this is just a bump along the way. The best news for Zoetis is that it’s currently the only OA pain Mab available in the market, and the alternative (NSAIDs) is significantly worse, meaning that hiccups are unlikely to cost the company much in terms of market share and future opportunity. The long-acting MAB should, in theory, widen the gap with competitors and allow Zoetis to take a good chunk of this market (TBD if it’s as big as Zoetis claims).

Taking a look at the valuation

For the valuation exercise, I would refer you to my Q4 earnings digest because the current stock price is pretty much the same as in February, and I would not change any of the assumptions.

In the meantime, keep growing!

Loved this article and your nuanced view!

Good observations re: Librela, Sir! 🫡