Sandbagging…anyone?

Stevanato's Q1 2025

This article is free to read, just like my in-depth report on Stevanato (a 5-part series on a wonderful and arguably overlooked company). Don’t forget that a paid subscription gives you access to all the in-depth reports, all the content, my portfolio and transactions, and a private community of like-minded investors:

Just as a heads up, no NOTW (News of the week) this weekend as I’ll be travelling. I expect to publish my earnings analysis on Nintendo early next week.

Without further ado, let’s jump into the article.

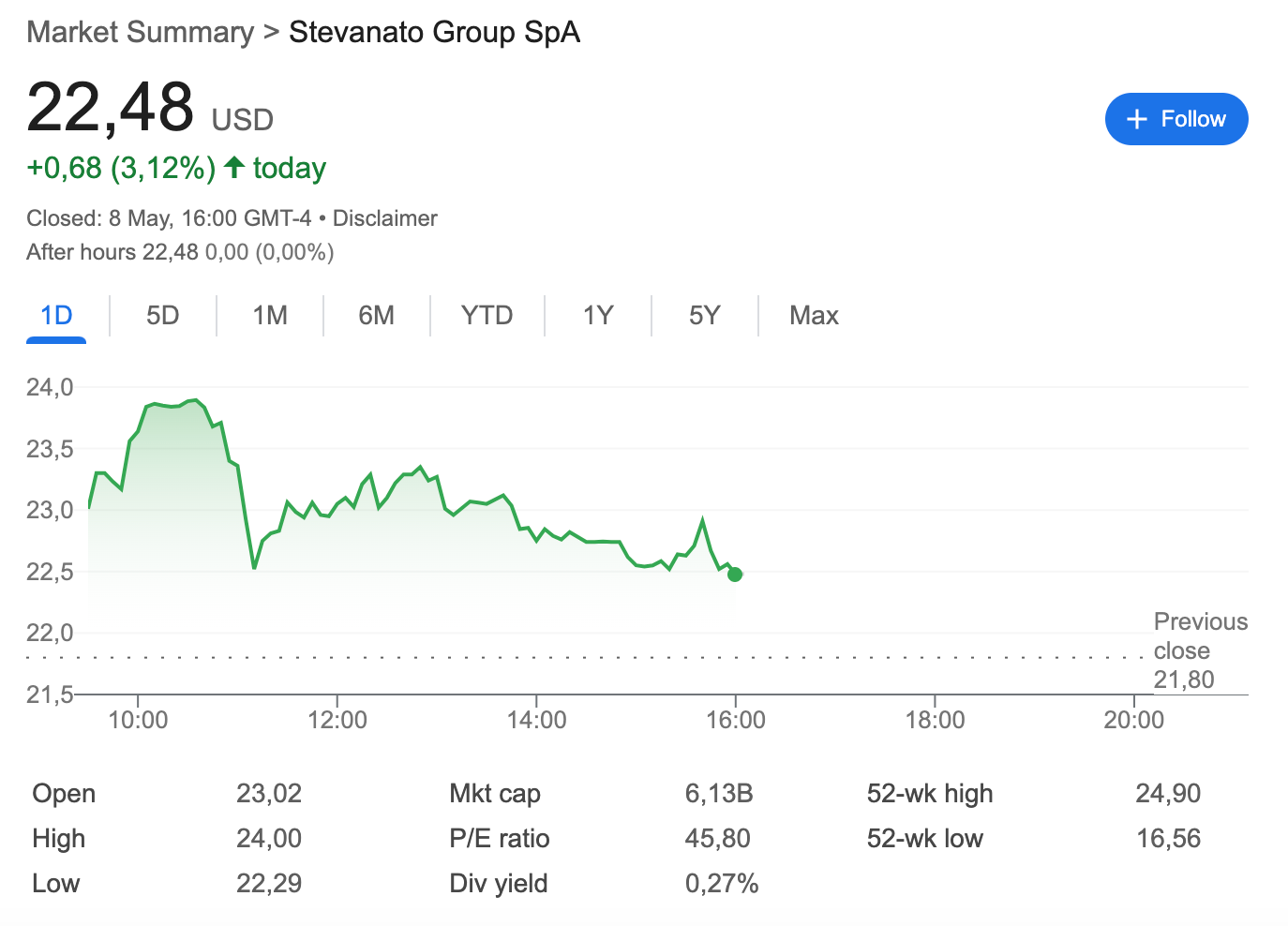

Stevanato reported very good earnings on Thursday, and the market was not blind to this fact: the stock soared in early trading, but in pure Stevanato fashion, gave up most of this gain through the day:

While one might think that the post-earnings move would mean that there was a lot of positive news, I want to focus this article on two main topics: the margin opportunity and the sand-bagged guidance. Before going into these, let’s take a look at the quarter as such.

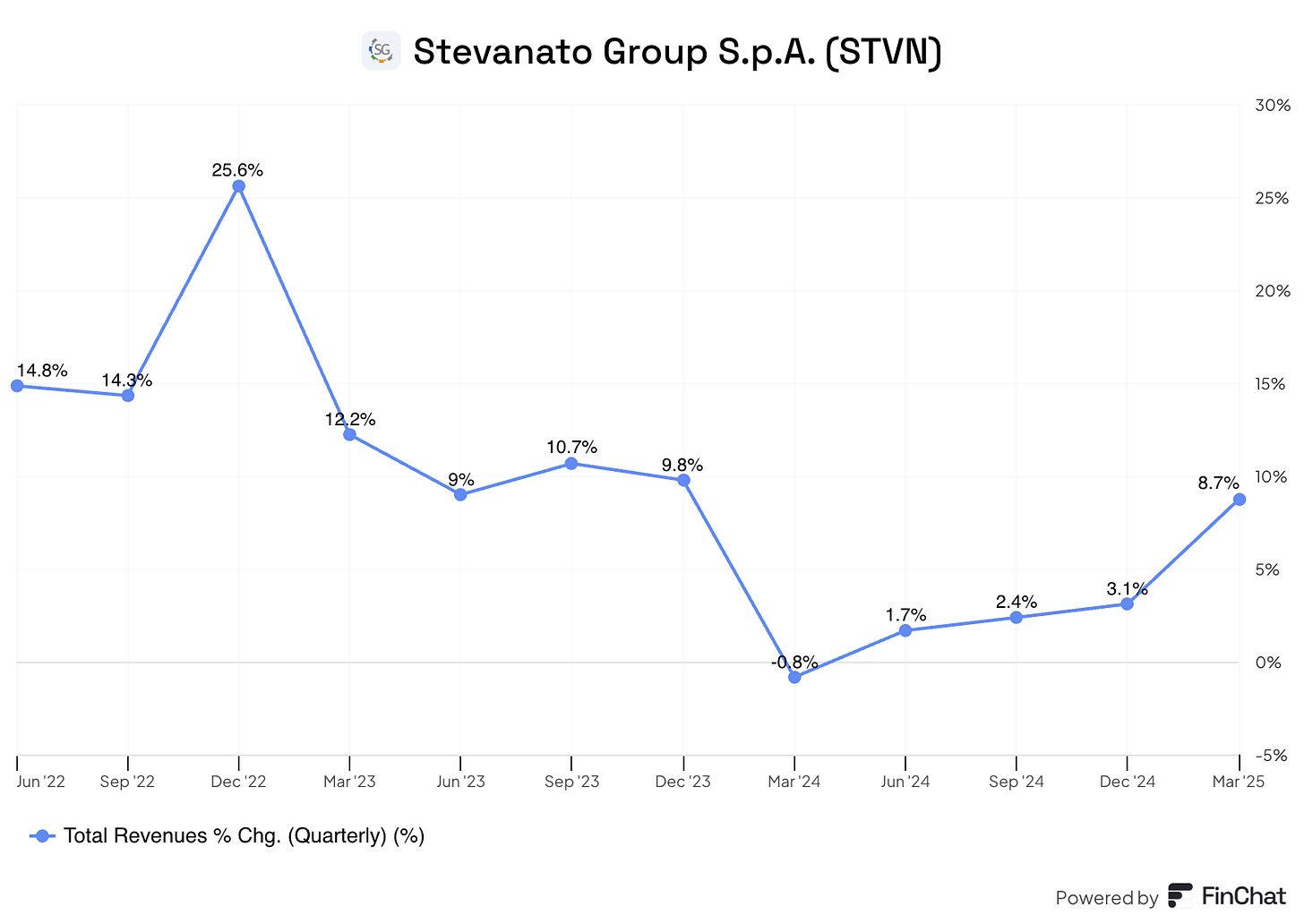

Revenue grew 9% (8% in constant currency) to €256.6 million. Consensus was just under 5% growth, so Stevanato demolished top-line estimates. Revenue growth recovery is in full force, even though vial destocking has stabilized but has not yet become a tailwind. 2024 was undoubtedly a bad year, but the company is firmly back on its growth path:

As discussed, vials were not a significant growth tailwind. The two most significant growth drivers currently are the ramp-up of Latina and Fishers and the shift to HVPs (high-value products). More than 100% of the growth achieved in Q1 was driven by BDS (+11% YoY) as management continues implementing operational efficiency measures to stabilize the engineering segment (-4% YoY). One can only wonder what can happen to growth when vials and engineering return to their historical growth path.

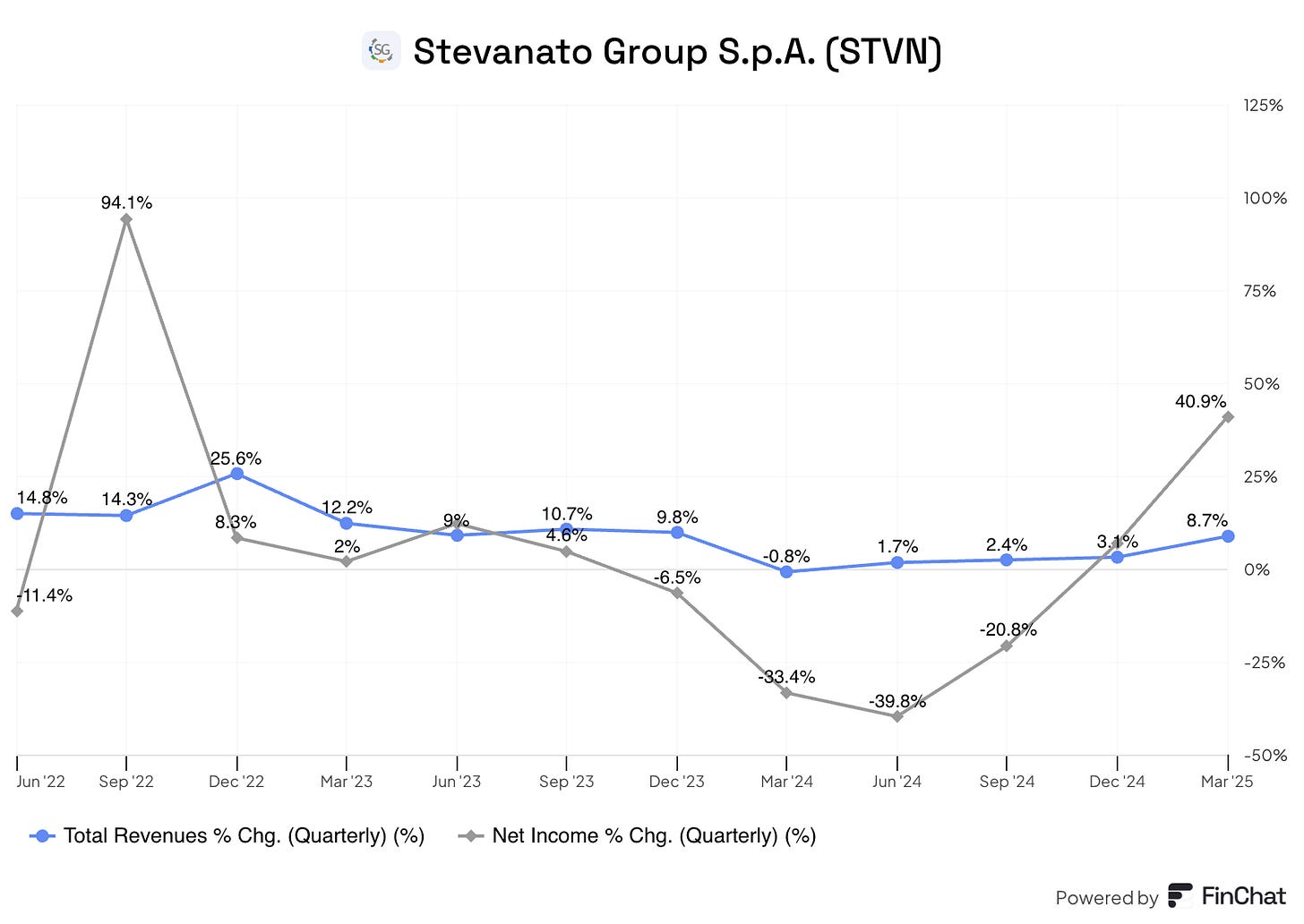

Despite Stevanato growing at a good pace in Q1, it’s the combination of fast growth and vast margin expansion opportunities that makes it (even) more interesting. Margins expanded significantly in Q1 as Latina and Fishers continued ramping up and the industry continued its transition to HVPs. Stevanato reported 41% growth in net income on a 9% revenue growth (wow!).

The best thing about this is probably that the true margin profile of the business remains masked behind several things:

Engineering still has to work through the backlog of projects and return to a normalized level of profitability

Latina and Fishers are still margin dilutive despite the ongoing ramp

Vial lines are still underutilized despite the stabilization of the destocking

The first two points are unlikely to be fully resolved this year, and the third is a TBD (to be defined). Still, the good news is that, even in the face of these ongoing headwinds, Stevanato is already growing earnings at a significant pace. Stevanato is a textbook example of why valuation multiples are so misleading. I remember that a couple of months ago, when I was talking about Stevanato on YouTube (in Spanish), someone wrote a comment along the following lines:

40x earnings for 1% growth, no thanks.

This comment illustrates how taking multiples at face value can be terrible (although it’s also a reason there’s opportunity in the market). What this person was missing was that none of those numbers were normalized. A lot of investors will see a 40x P/E ratio and will jump to the next company on their watchlist (if they have one), despite this not being the optimal choice (this is also why I like semi-cyclical companies, which Stevanato is not, but COVID caused an industry-wide destocking that has made the company temporarily cyclical).

The good news is that those three margin levers I discussed above are inherently short to medium term, so even when Stevanato realizes those, there will still be a significant opportunity to continue expanding margins through a shift to HVPs. HVPs made up 50% of BDS revenue, but due to their significantly higher ASPs (Average Selling Prices), this proportion is arguably much lower in units. HVPs still have a lot of share to take from bulk, and we can do a quick exercise to understand how accretive this can be to BDS margins.

BDS' gross margin this quarter was 31.3%. If we take at face value what the management team has told us about HVPs having roughly double the gross margins of bulk products, we can do some quick calculations (please don’t take them as extremely accurate) to understand the margin opportunity. That quote by management basically means that HVPs' gross margins are roughly 40% compared to bulk’s 20%. This ultimately means that BDS gross margins can potentially expand 900 bps if all bulk revenue is eventually replaced by HVP revenue (and this assumes no additional growth and doesn’t consider that utilization is still low in vials). There are also signs that the HVP mix will increase considerably over the coming years. Management mentioned a significant project in Ez-Fill cartridges, a category that still has a long way to go in its transition to HVPs (the “customer” is most likely Novo Nordisk):

On the top of this, we are starting to prepare the next phase for the large capacity for cartridges, ready to fill with one big customer that will be launched at the end of 2026, beginning of 2027, in commercial production revenue.

If we add that engineering is significantly below its normalized margins, we get to an even higher margin expansion opportunity for the consolidated company. Underwriting a +1,000 bps margin expansion seems widely optimistic for pretty much any company, but it’s definitely possible for Stevanato. Note that a portion of this margin expansion also offsets the higher capital intensity that comes with HVPs. This means that the end state for Stevanato is significantly higher margins coupled with somewhat higher Capex (expectations are for 1% of Capex for every % of growth).

Contextualizing guidance: sandbagging…anyone?

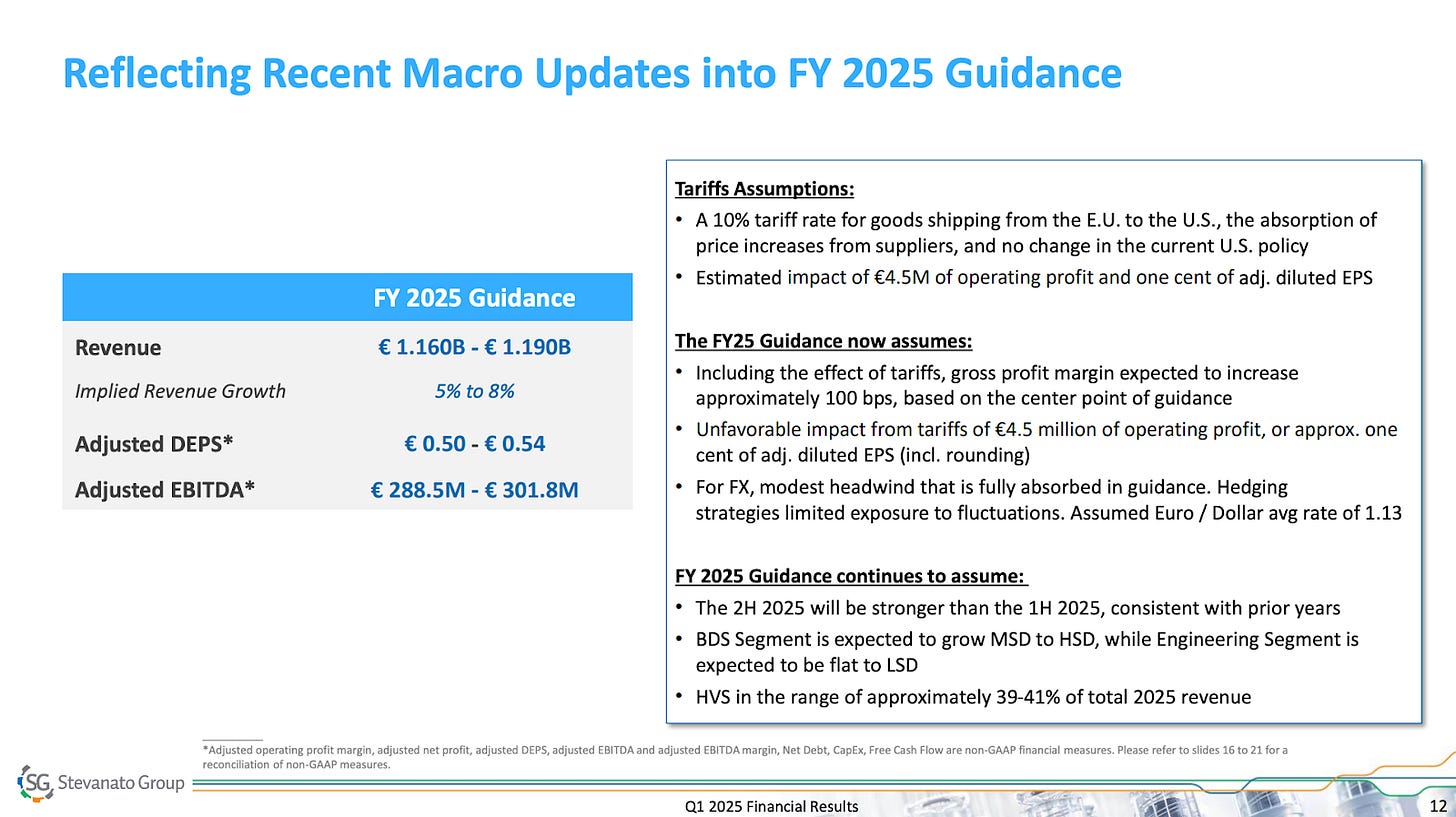

Stevanato’s revenue growth not only beat the market estimates by a significant margin, but it also landed significantly above management’s full-year guide. Last quarter, management guided for 2025 growth of 6.4% (midpoint). One could think that the decision not to raise guidance stems from a weaker rest of the year, but this seems unlikely to be the case, for several reasons:

Management argued that they entered Q2 with momentum

Stevanato expects a stronger second half. Management said they expect 44% revenue in the year's first half compared to 56% in the second half.

Comps indeed get tougher as the year progresses, but they don’t get much tougher as to justify not raising the guidance. We must also remember that vial growth was moderate in Q1, so that’s also a potential tailwind for the rest of the year. Speaking of comps, while they do get tougher on the revenue growth front, they don’t get tougher on a margin expansion basis. Management claimed they expect margins to expand through the year, meaning we are in for pretty fast earnings growth this year.

Assuming Q2 revenue grows around 9% sequentially (not far off regular seasonality), we get to €279.7 million in revenue for Q2, for a total of €536.3 million for the first half. Taking management’s word for the revenue distribution through the year, we get to yearly revenue of €1.22 billion (€536.3 millions/0,44), 2.5% above the high end of management’s current guidance, and 10.5% growth for the year. Double-digit growth this year is doable.

Management argued that they did not raise guidance because they see an offsetting impact between higher prices due to passing on tariffs to customers (tailwind) and a stronger dollar (headwind). While this seems like a plausible explanation, it really isn’t because it doesn’t explain the above-average performance in Q1. The dollar started depreciating towards the quarter end, and liberation day took place early in Q2, so no, it doesn’t explain the Q1 outperformance and its extrapolation to the full year. Stevanato got surprised by the 2024 destocking, so it’s also normal to see management sandbag guidance.

This said, the most interesting thing for Stevanato is not this year’s growth but how long the growth runway is. ASPs for HVPs can be up to 10x higher than for bulk, and this mix dynamic, combined with underlying industry growth, results in a very durable and appealing growth algorithm. This, along with the margin expansion opportunity, sets up Stevanato for significant earnings growth for many years. The best thing about the company’s growth is that, rather than relying on external factors, a good chunk of the growth algorithm relies on simply replacement demand.

All this said, management lowered the Adjusted EBITDA guidance for 2025 by €4.5 million. The reason was tariffs. Management argued that tariffs will eventually be passed on to customers, but that it’s a slight headwind in 2025. As I discussed in this article, Stevanato can potentially benefit from tariffs over the long term due to its early investments in the US. The company is far ahead of Schott in building its US capacity, so if tariffs become the new norm, the Fisher plant suddenly becomes a very interesting option for US drug manufacturers.

Even when considering this lower EBITDA guidance, management still expects to end the year at a 25% Adjusted EBITDA margin compared to last year’s 23.5%. This means that (assuming you believe management’s guidance, which I don’t) EBITDA grows 14% on a 6% revenue growth despite the tariff headwinds. I honestly think that Stevanato can potentially grow double digits this year, so my hunch is that adjusted EBITDA can grow considerably faster. We’ll see!

Have a great weekend,

Leandro

Hi Leandro,

To your comment on Novo potentially being a big customer for Ez-Fill. I believe Novo purchased 3 manufacturing/fill-finish sites from Catalent at the end of 2024, to me this was an indication that maybe they were trying to take this work in-house. Curious as to your thoughts on that.

Great note. When you weigh up the pros and cons, do you think they should still have an engineering department?