Nintendo: Finally looking forward

FY 2025 Earnings Digest

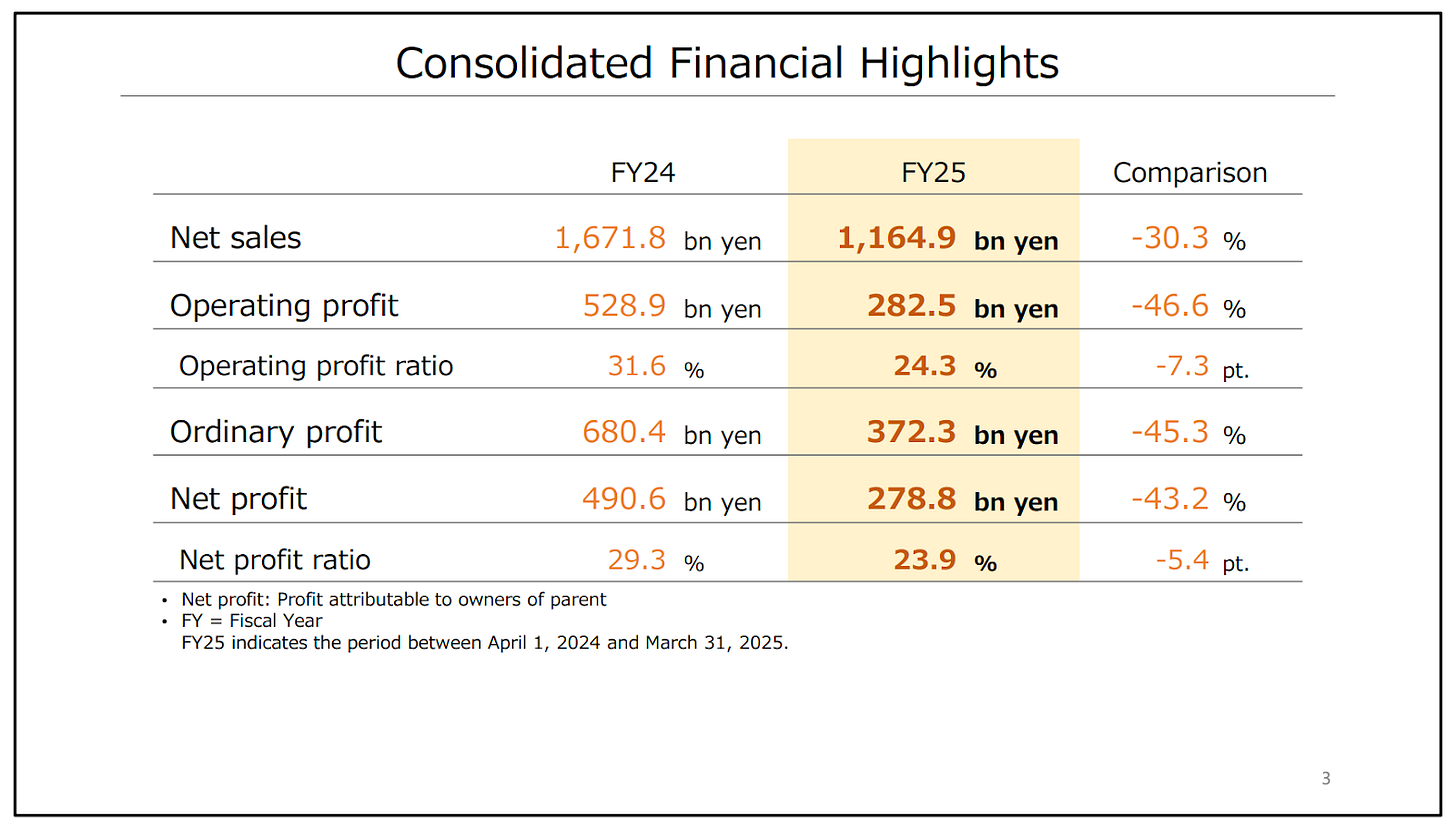

Nintendo reported FY 2025 earnings on Thursday last week. I don’t think this year’s earnings are relevant, but before jumping into what’s important (guidance and Switch 2 commentary), let’s take a quick look at the numbers. As expected, both sales and profits dropped considerably in FY 2025:

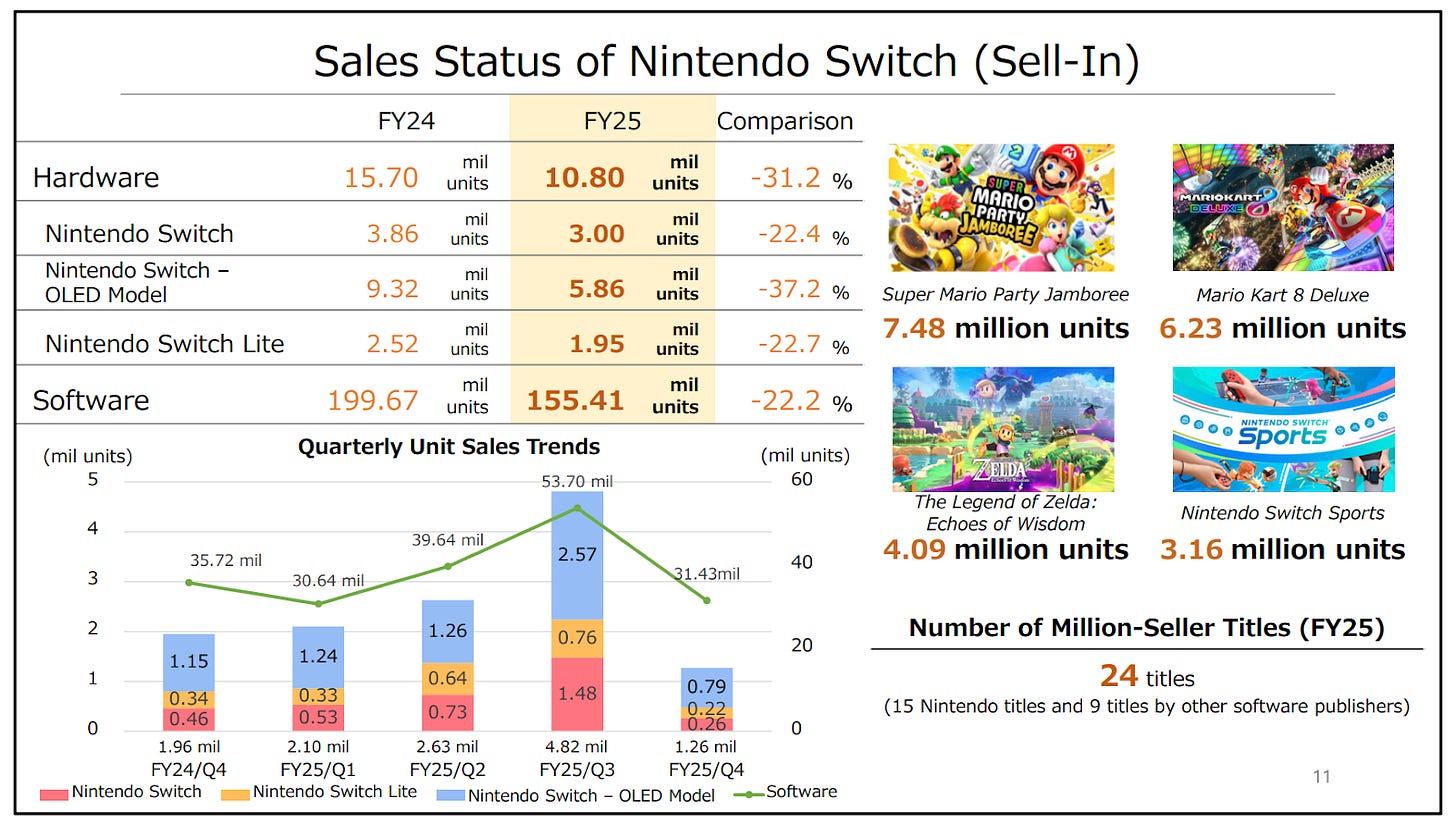

The underlying reason for this drop is straightforward: the Switch 1 is in its eighth year and Nintendo has not launched many strong 1p titles lately (which makes sense considering the imminent arrival of the Switch 2). We also must consider that Nintendo first mentioned the Switch 2 on January 16th (even though the Direct was hosted on April 2nd) and that this announcement might have significantly reduced sales in Q4. The Switch 2 announcement likely impacted Q4 sales (when it was officially announced) and the entire year, as pretty much everyone was expecting an announcement by Nintendo. Despite this, Nintendo sold 10.8 million Switch 1 in FY 2025 (short of the 11 million Q3 forecast) and enjoyed a strong holiday season:

As usual, management was more optimistic about hardware sales than software sales. Software reached 155 million, almost 4% above the guidance set in Q3. I’ve discussed this before, but it’s a regular pattern at Nintendo. It’s great for shareholders because software carries a significantly higher margin, and therefore Nintendo tends to be more pessimistic with its earnings than its sales guidance.

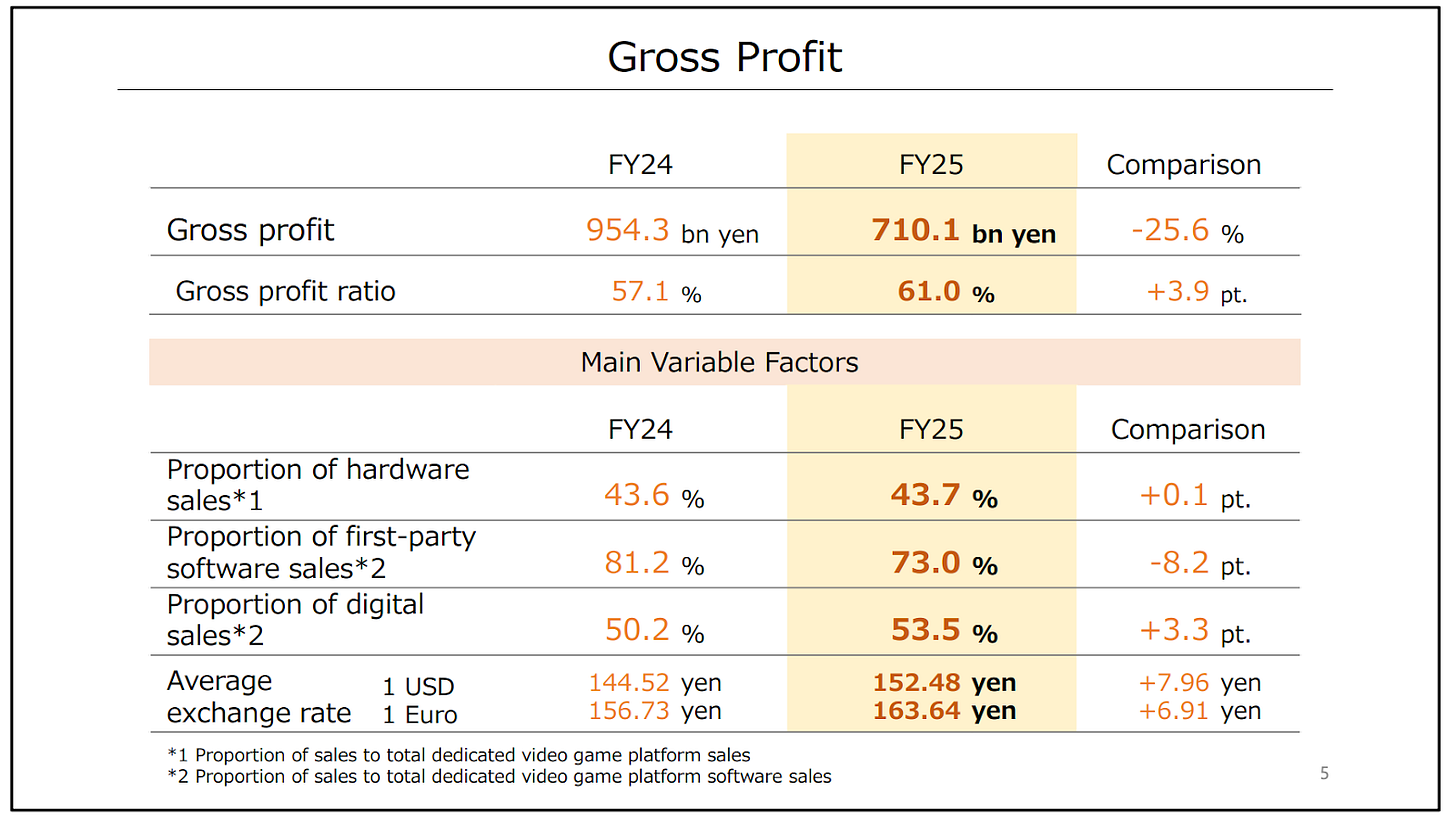

Margins are an interesting topic when looking at the Switch 1 and the Switch 2 guidance and how margins might develop throughout the lifecycle of the latter. Nintendo’s gross margin actually expanded by 390 basis points despite the drop in sales.

The reason? The higher proportion of software sales as hardware units falls faster than software sales. Nintendo makes a good chunk of its software profits in software, so if these weigh more in overall sales, then it’s relatively normal to see margins expand. This is a good framework when thinking about FY 2026 guidance and the lifecycle of the Switch 2 in general, but I’ll discuss that later.

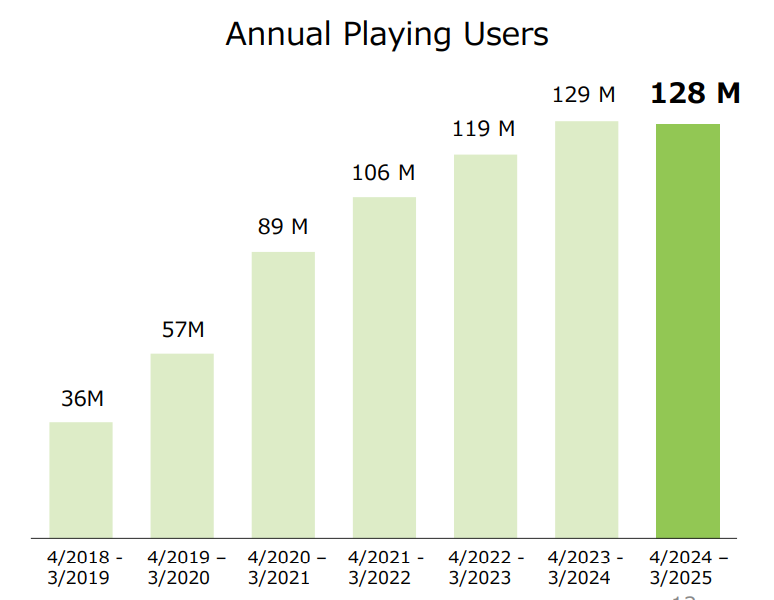

Operating margins dropped significantly despite the gross margin expansion. The main reason for this contraction is that Nintendo continues to invest ahead of the SW2 launch. This ultimately means that current investments are not met with sales from the SW2 (something that will change over time). From this year’s numbers, I would also highlight the first drop in a while in annual playing users:

Not extremely surprising considering the lack of 1P blockbusters and the announcement of the SW2. The launch of the SW2 should help reinvigorate this metric (especially thanks to all of its collaborative features), but one of the good things about the launch of the SW2 is that it builds off this existing user base. We shouldn’t expect to see it grow at the same pace it did for Switch 1, but at the same time, it will start from a significantly larger base.

After taking a quick look at the (mostly irrelevant) yearly numbers, let’s take a look at what everyone was focused on: guidance.

Nintendo’s SW2 guidance

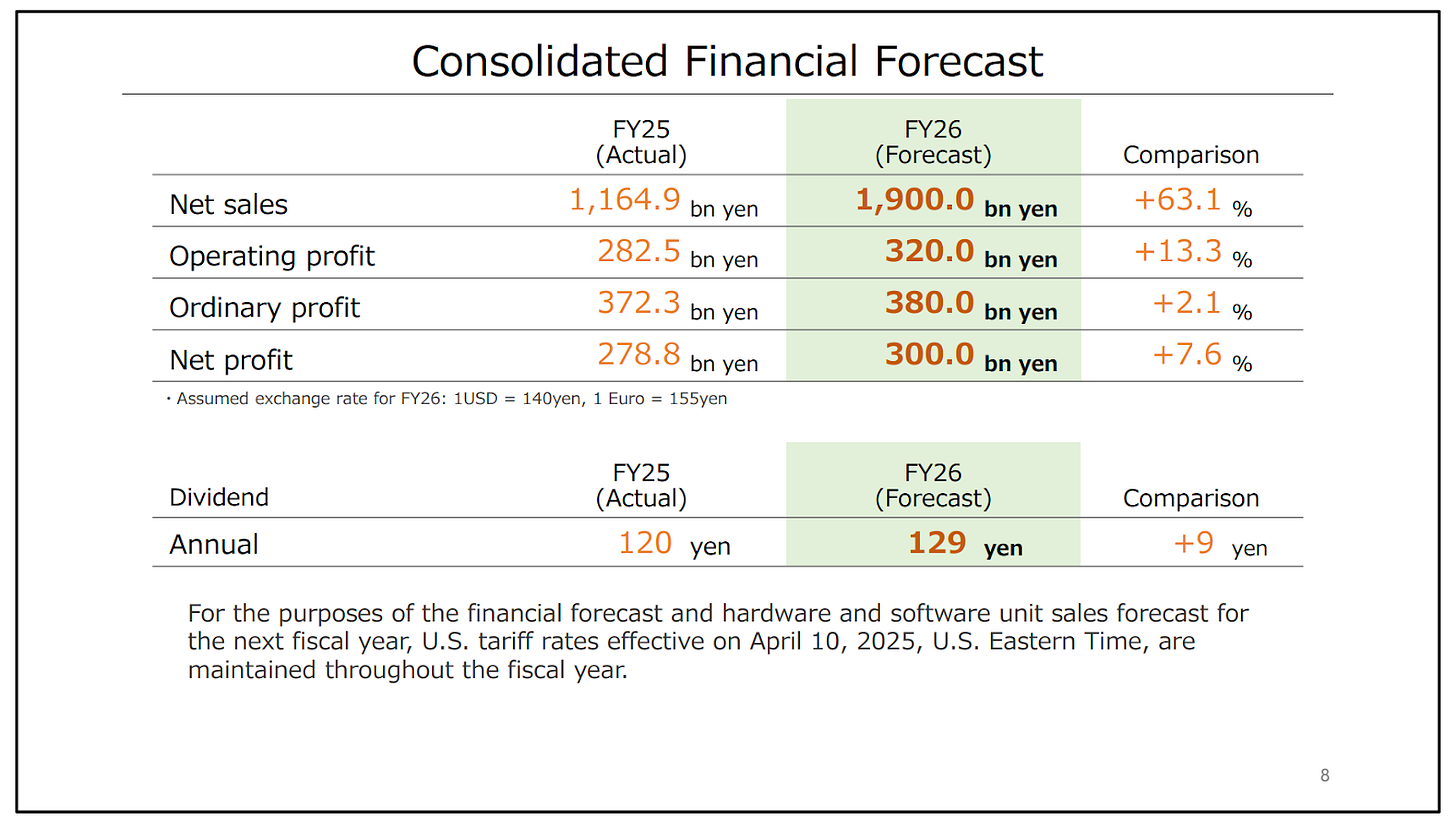

Nintendo released a two-part guidance, one with the financial figures and another with hardware and software units of the different platforms (as it typically does). The financial guidance portrayed a significant rise in sales (+63%) coupled with a significantly lower rise in operating profit (+13%):

This margin contraction might have worried some people, but it requires context and I believe there is a significant upside opportunity. First, it’s inevitable for margins to come down when a new system is launched. The reason is the opposite of what I discussed earlier. During a new platform’s early years, revenue will be more tilted toward hardware sales, which carry a significantly lower margin than software. Nintendo even mentioned that SW2 gross margins are lower than those of the SW1, putting to rest some concerns around price gouging its customers. Seeing a price hike definitely hurts, but let’s not forget that Nintendo had been 9 years without raising prices!

As the installed base expands and more titles are launched, margins should naturally expand as software becomes a bigger portion of the pie. In short, it’s natural to see an immediate margin reset at system launch.

This said, I believe there’s upside opportunity for profits here (will delve into sales later), for two reasons. First, Nintendo has a history of being conservative with software sales. This means that software might become a larger portion of the pie even at launch (TBD).

The second reason is that management assumes tariffs stay where they are. This basically means that any positive developments between Vietnam/China and the US could potentially result in the tariff amount accruing to Nintendo (we already saw positive developments this week regarding China). Worth noting that Nintendo is not currently suffering the retaliatory tariffs (there was a pause in these), but it is facing the 10% flat rate. I don’t think tariffs are ultimately as relevant for Nintendo due to most profits coming from the software side, but it’s definitely a potential upside opportunity.

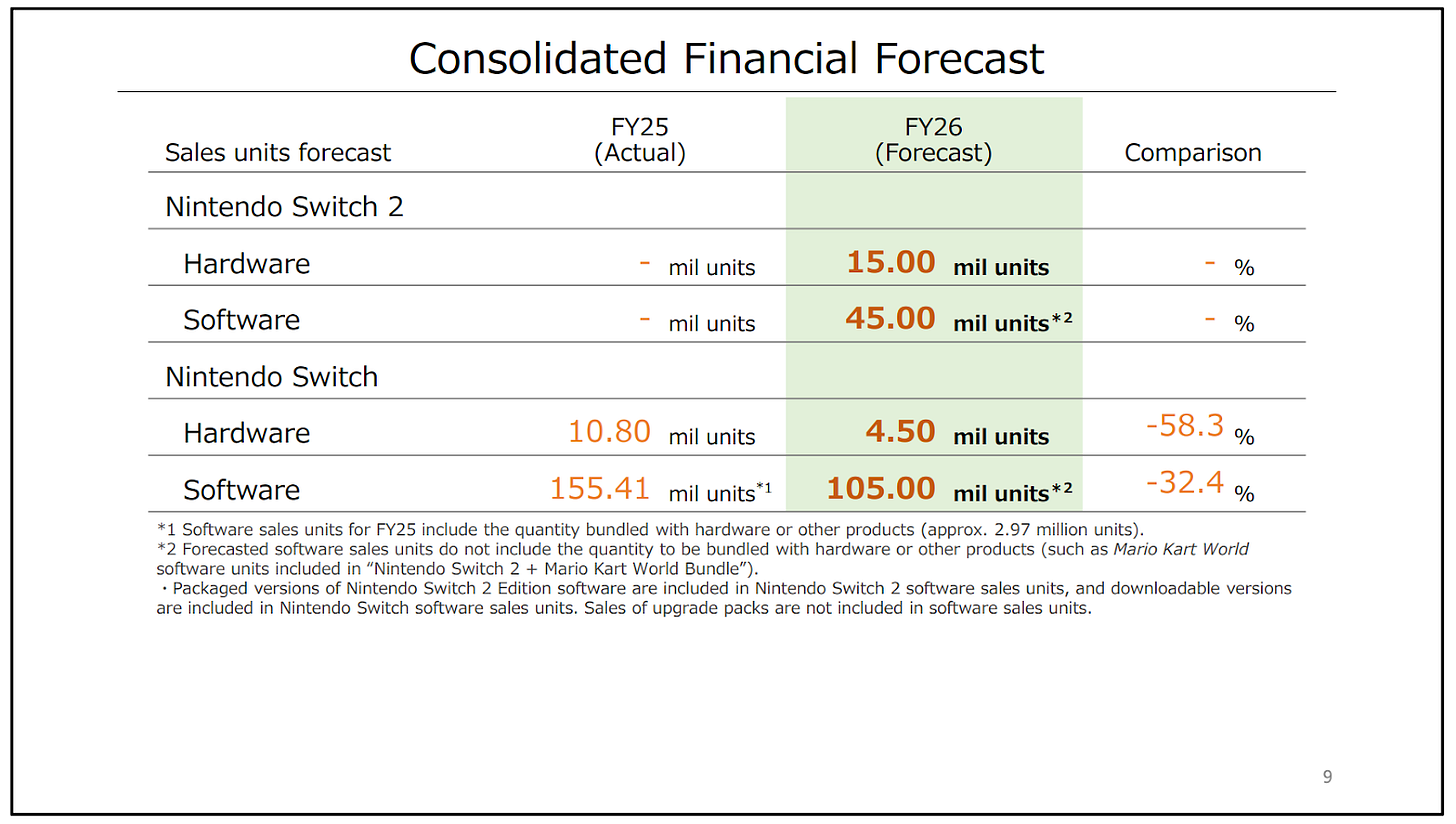

Nintendo expects to sell 15 million SW2 in FY 2026 (10 months of sales due to the system being launched two months into the year) and 45 million software units:

The software units don’t include the bundled software sold with the hardware, so if we assume that 50% of hardware units will be sold with Mario Kart World (which will arguably be higher), this means that software sales would be somewhere around 52 million for a 3.46 tie ratio. Management argued this was a good benchmark to think about.

This seems a tad conservative when considering that the tie ratio for the SW1 was higher (3.57) despite having significantly less support from third-party publishers. As discussed above, Nintendo tends to be quite conservative with software sales, and this calculation seems to support this belief somewhat.

Hardware also seems conservative if we consider several things. First, management also tends to be conservative with hardware sales at launch. They projected around 10 million in sales for the SW1 at launch and sold close to 18 million over the first 12 months. Management openly shared that the current figure assumes that the SW2 doesn’t sell faster than the SW1 (something I assumed in my valuation exercise), but I would say there’s upside to this stemming from two things:

The SW platform is proven now and people know what to expect

Pre-order demand is significantly outpacing that of the SW1 and also management’s expectations

There were a lot of doubts regarding Nintendo’s capacity to supply demand. A supply constraint could theoretically limit the upside if demand ends up being higher than expected. Management quickly put this fear to rest, claiming that the forecast was based on demand and not supply:

The limits of our hardware production capacity were not a factor in setting our sales volume forecast.

This is consistent with the fact that they managed to manufacture 18 million SW1 in their first year and that they prepared for a bigger launch. I struggle to see 15 million as the peak supply for Nintendo. What seems evident is that Nintendo can’t sell 30 million SW2 in its first year, even if there’s demand for it. The good news is that this shouldn’t matter much. Whether Nintendo sells in its first or second year doesn’t change much of the investment thesis.

Comparing the guidance to my estimates

I published a valuation article not long ago explaining why I was still adding to Nintendo. Now that we have management’s guidance for the first year, I thought it would be interesting to see how it’s aging (still a long way to go, though).