Constellation’s Q1, AGM, and Valuation

Constellation Software reported Q1 earnings and held its Annual General Meeting this week. Recall that the company does not host earnings calls; therefore, the AGM is pretty much the only moment when shareholders get a chance to hear from the management team. The objective of this article is threefold. I’ll first briefly discuss the Q1 earnings and the main points of concern, share my highlights from the AGM, and share some thoughts around the valuation.

Without further ado, let’s start with the quarter.

Constellation’s Q1

Constellation’s quarter was underwhelming to many, and for good reason. There were (imho) three main points of concern.

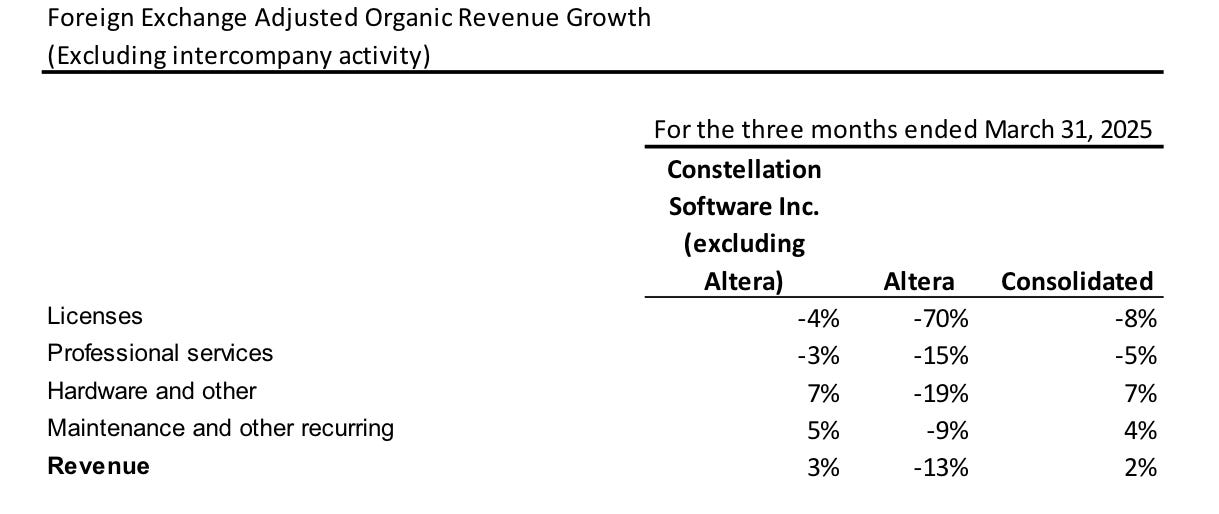

The first one was revenue growth. Revenue “only” grew 13% year over year, with organic revenue (FX adjusted) coming in at +2%. Many thought of this as very low because the reported organic growth number was 0%, but it’s not abnormal if we ignore the post-pandemic inflationary period. Management shared in the AGM that they still target GDP-like organic growth rates:

What stood out to me is that this was Constellation’s first quarter of sequential revenue decline in a very long time:

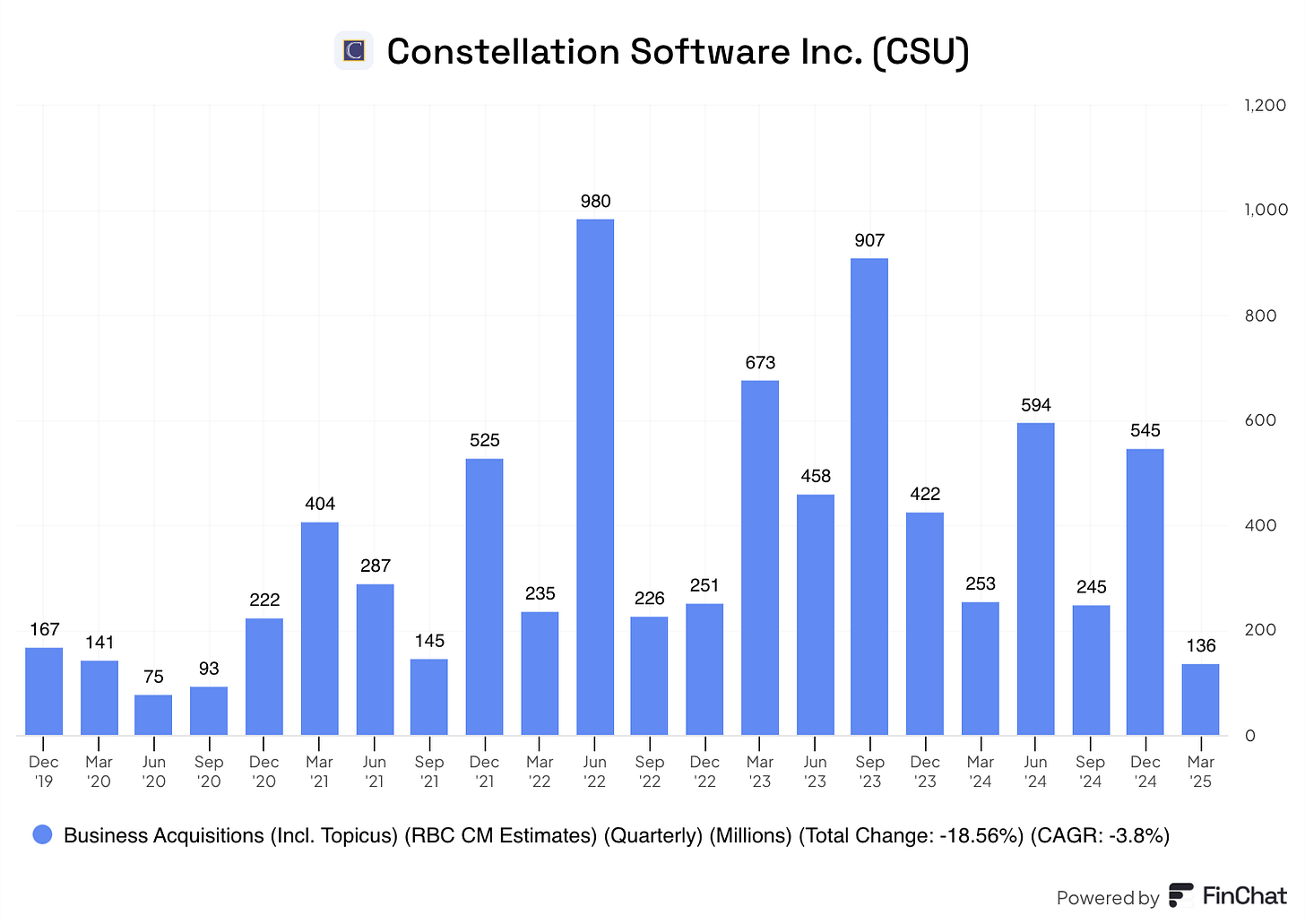

Capital deployment was the second (and arguably more worrying) point of concern. Constellation’s capital deployed into acquisitions was pretty light in Q1. Management deployed $133 million into acquisitions in Q1, or roughly $67 million excluding Topicus. Q2 is expected to be a considerably better quarter in this regard, with commitments for $427 million in acquisitions and still half a quarter to go.

It’s always the case for Constellation or Topicus that when capital deployment is light in any given quarter, people start to worry about the runway. While natural (because runways don’t last forever), plotting out quarterly cash deployed into acquisitions should help us see that it’s lumpy and that a weak quarter is not necessarily a good proxy of future capital deployment:

The TDLR (too long didn’t read) here is that one could have had similar concerns regarding capital deployment in Q3 and Q4 of 2020 or Q3 2021, and these concerns would’ve been quickly put to rest some quarters later. Experiencing lumpiness in capital deployment is normal and a characteristic that emerges when done right (opportunistically and in a disciplined manner). We don’t have to go far away to see a good example.

A few quarters ago, Topicus paid a special dividend to shareholders due to the absence of capital deployment opportunities. I vividly remember how many people started to claim that Topicus’ runway seemed over, arguing that Europe was a much more challenging market in which to conduct Constellation’s strategy than the US. Fast forward to today, and Topicus is setting records regarding capital deployment, and few remember the special dividend. While the runway inevitably gets shorter over time and it gets incrementally harder to deploy higher amounts of capital at high rates of return, one quarter is unlikely to break the thesis (if history and common sense are any guides).

The third and last point of concern was Altera. Organic growth significantly decelerated in Q1 and came in at -13%:

Jeff Bender mentioned in the AGM that they had visibility into the attrition that Altera is now suffering and that it was taken into account at the time of acquisition. The good news is that Altera saw yet another quarter of positive free cash flow. Constellation has collected $266 million in Free Cash Flow from Altera after paying an EV of $892 million less than 3 years ago. Jeff Bender also mentioned that if they had the chance to acquire Altera again, they would do so (and it would be more profitable due to what they have learned from the acquisition).

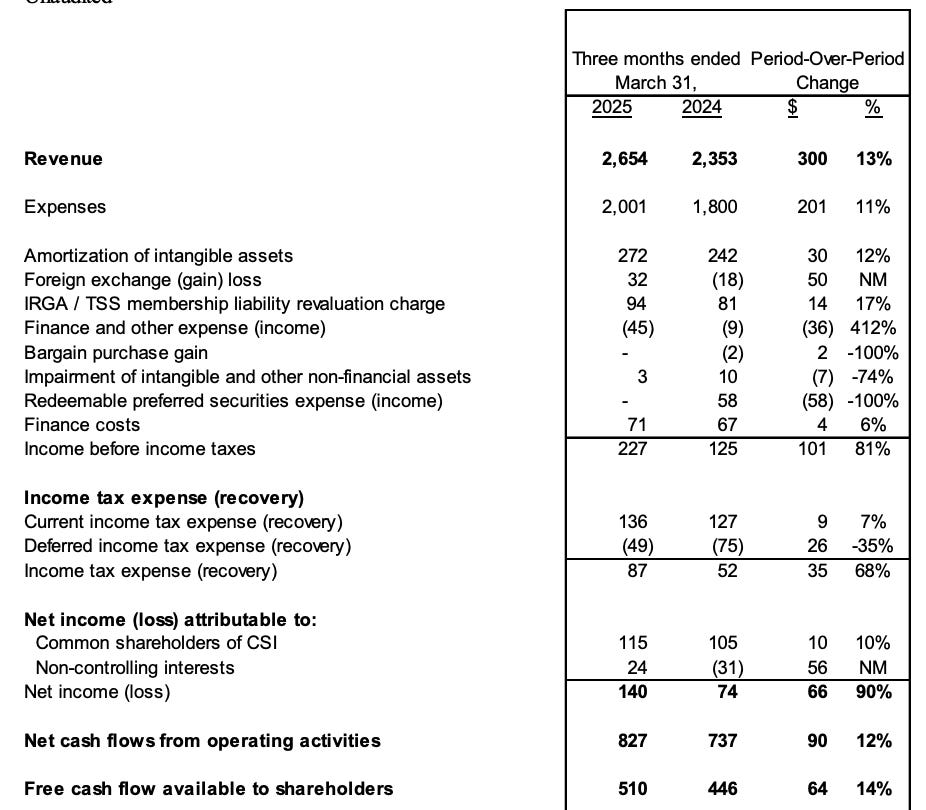

As it tends to happen when inorganic growth is “meh,” margins were a highlight. Expenses grew more slowly than revenue, and cash flows grew double digits:

So, while there’s no denying that the quarter was not great and below what Constellation has accustomed its shareholders to, history shows that rushing to conclusions based on one quarter might not be the best idea, more so when management’s tone in the AGM regarding capital deployment sounded quite positive (not what I would’ve expected).

The AGM highlights

I would group the AGM highlights into three buckets: M&A, AI, and compensation. Let’s start with the first one. Management said numerous interesting things about capital deployment, of which I would highlight three:

They remain confident in deploying 100% of the company’s free cash flow

They are experimenting outside of core VMS

They believe the Q1 numbers have more to do with timing than anything else (I’ve already sort of explained this when discussing the quarter, but thought it was a good idea to point out that management confirmed it)

Management sounded much more positive on the first point than they’ve been in a while. They pointed out that the quality of the pipeline is deteriorating (normal as one advances through the pipeline), but that they are confident in their involvement in large acquisitions and their competitiveness in SMID acquisitions.

Large acquisitions were discussed in depth. First, management mentioned that relationships with brokers are improving. Unlike in the SMID (small and mid) space, where Constellation is in direct contact with the founders/employees of the target company, large acquisitions run through the investment bankers. It’s a more competitive space because Private Equity is willing to offer higher prices but (important “but”), management claimed that despite SMID acquisitions enjoying higher ROICs than large acquisitions, the gap is reduced once you take into account all the administrative work needed to fill the pipeline of SMID acquisitions (probably the reason why there’s significantly less competition in these). They gave the example of Asseco. They have been cultivating the relationship with Asseco for over a decade, and this ongoing relationship doesn’t come free of charge.

There were also questions regarding countercyclicality in capital deployment. Management argued that countercylicality is not really a thing in SMID acquisitions due to something that David Cicurel (Judges’ CEO) has discussed before: founders/owners of resilient businesses are unwilling to sell their business in challenging times (a good indication of this is Constellation’s low capital deployment through the pandemic). They did say, though, that large acquisitions do potentially bring countercyclicality into play.

It was point number 2 that probably took many by surprise. While Mark Leonard did not mention that the opportunity is over in core VMS (think this is what many are making out of it), he did say that to deploy 100% of Constellation’s FCF, the company will most likely need to “look elsewhere.” It’s not the first time management has said this, but I do believe it was the first time they discussed the places outside of core VMS where they are deploying capital:

HMS (Horizontal Market Software)

Hardware/software hybrids

Software/data hybrids

Payments

They are already experimenting in these, and results thus far seem to be good. However, it’s undeniable that the quality across these is probably lower than for core VMS (or else they would’ve been explored earlier on). Mark Leonard termed this as “style drift.” In short, if you believed that the Constellation thesis relied on VMS, you face a decision between these two:

Acknowledging your thesis has been broken and sell

Suffer from thesis creep

If, on the contrary, you believed that the thesis relied on a decentralized organizational structure to deploy capital at high rates of return, then your thesis should be pretty much intact. Note that style drift was already evident in 2021 when Mark Leonard shared in his President Letter that Constellation would lower its hurdle rates to lean more into large acquisitions. Many thought this broke the thesis, but large acquisitions have done well and the stock is up 180% since (not counting spinoff or dividends). As expected, management argued that competitive intensity is higher in these new sectors than in the historical core VMS SMID space, but that they are still happy with their win rates and the opportunities available.

What’s undeniable is that ROIC has steadily declined since CSU started to deploy capital into large acquisitions (i.e., since it started to leave its comfort zone to deploy increasing amounts of capital). The good news is that it has remained above 20%, a return level few Constellation shareholders are likely to be able to achieve. This means that the preferred choice for any shareholder should be for CSU to deploy all the cash flows it can at current ROICs (evidently, the higher the better):

It’s evident that ROICs are better in SMID acquisitions, but if this doesn’t allow the deployment of 100% of the company’s FCF, then the best option is for management to look elsewhere, so long as returns don’t drop below 20%. Deploying 100% of Free Cash Flow at 20% ROICs basically means the company can comfortably grow at double-digit rates for the foreseeable future. I’ll talk about this in more detail later on when I touch on valuation.

Management has no intention of lowering hurdle rates, and they plan to deploy 100% of free cash flow at current rates. This, imho, is much better news than many are giving it credit for. Sure, ROICs are not what they used to be, but they are still attractive and allowing Constellation to deploy increasing amounts of capital. Deploying 50% of FCF at 30% ROICs and giving the remaining 50% back to shareholders would result in a worse outcome than deploying 100% of its free cash flow at 20% ROICs. The calculations here are straightforward: 50% reinvestment rate at a 30% ROIC yields a 15% earnings growth. A shareholder would have to pay taxes on dividends received. Assuming said taxes are 20%, then the amount the shareholder would have to reinvest would be 40%. Reinvested at an 8% rate, this would leave the shareholder with growth in intrinsic value of 18% (inferior to the 20% achieved by the company deploying 100% of its free cash flow and it would also be much more time-consuming). It’s also worth mentioning that Constellation has never hidden the concept of diminishing marginal returns. Mark Leonard has repeated for a while that it would get incrementally harder to maintain high ROICs, but that he would try to defer mean reversion as much as possible. Safe to say he has done a good job thus far.

Another relevant topic touched upon in the AGM was AI. There were a lot of comments around this and whether it is a significant risk to Constellation, but most of it can be summarized in one sentence: Constellation doesn’t see itself as a software vendor but as an IT partner selling both software and services. This means that, if anything, they expect to benefit from customers wanting to deploy AI across their organization. This is honestly a TBD, but the explanation made sense. In many cases, Constellation’s software is very niche and heavily customized. AI is arguably more of a risk to a non-customized large market. Management did mention that it’s something they deeply care about.

Finally, some words on compensation. One of the things that makes Constellation unique is its compensation structure. Managers are “forced” to reinvest 75% of their bonuses buying shares in the open market, but I found out in this AGM that every 5 years they can take their bonus in cash (probably a method to avoid selling their shares for liquidity). Constellation is undertaking two changes to the compensation structure:

It’s trying to allow managers to invest in individual businesses within the global corporation (say, a Harris employee wants to invest in Harris, not CSU as a whole). Mark Leonard mentioned that this is pretty complex, but that they will do it

Some operating groups are including organic growth as part of their compensation schemes

All in all, it was an interesting AGM, especially regarding the capital allocation topic and the now-famous style drift. I recommend watching it if you are a shareholder.

The valuation

Mark Leonard mentioned during the AGM that the stock should be at a quarter of the current price to justify 20-25% returns and that it’s currently priced to achieve market-like returns at most. While this definitely sounds worrying, we must not forget that Mark Leonard tends to be pretty conservative with his estimates (both in terms of valuation and growth runway ahead, both topics related). What we should do is try to understand what might need to happen to achieve decent returns in Constellation from here on out.

For this exercise, I decided to exclude the IRGA liability from FCFA2S (Free Cash Flow Available to Shareholders). Constellation has generated $1.6 billion in FCFA2S over the last twelve months. The company has a current market cap (in US dollars) of around $75 billion, meaning that it’s currently trading at 46x FCFA2S. Assuming the company can deploy 100% of its Free Cash Flow at a 20% ROIC over the next 5 years and that the multiple contracts to its 8-year average (24% contraction) by the end of the 5Y period, CSU would end up with FCFA2S of around $4 billion, which at a 30x FCFA2S multiple would imply a market cap of $120 billion or a 10% CAGR. Not too bad, but we must not forget these are “hefty” assumptions.

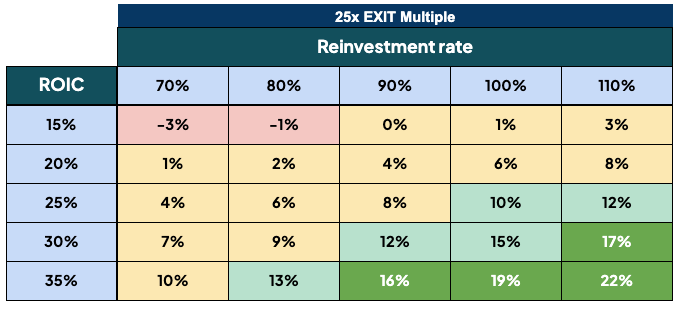

The best thing to do here is to sensitize our ROIC and capital deployment variables. I’ll build two IRR tables, one assuming an exit FCFA2S multiple of 30x and one assuming an exit multiple of 25x. The truth is that Constellation’s justified multiple is significantly higher than what the current numbers portray, as the stock has beaten the market by a significant margin. This means it was mispriced throughout this period.

Assuming multiple contraction is 100% realistic as the runway gets shorter and the quality of the acquired businesses diminishes. If it doesn’t contract, then great, but I don’t think it’s a good idea to bet on this. Worth noting that for those cases where I assume that capital deployed is below 100%, I am not considering that this capital gets returned to shareholders (which would be added returns on top of the ones you see in the table).

This is the IRR table assuming a 30x exit multiple on FCFA2S (a 35% contraction from current levels):

And this is the IRR table assuming a 25x exit multiple on FCFA2S (a 46% contraction from current levels):

Judging by management’s commentary, I’d say that the most likely scenario is that Constellation deploys 100% of its free cash flow at a 20% ROIC. This would mean that, from this price and assuming the exit multiples above, Constellation can potentially achieve returns between 6% and 10%. Not outstanding, but probably not something that justifies selling it either, due to the optionality inherent to the business. One never knows when large acquisitions might show up (Altera and Optimal Blue are a good example), and if Constellation can potentially achieve…

A higher reinvestment rate than 100% (using leverage)

A higher ROIC (the current ROIC is closer to 25% than 20%

While I would not add to Constellation here, selling it would mean paying 21% tax on my capital gains. I currently have a 140% unrealized gain on Constellation, so my capital to deploy in other opportunities would be 12% lower just due to tax. This means that the other opportunity should at least deliver returns that compensate for this loss of reinvestment capital. There can be opportunities to redeploy this capital, but for now, I will keep my position and will continue adding to other companies that are more attractively valued.

I hope you have a great weekend,

Leandro

Luv those plant volumne bars. Very creative!

Nice table charts. Thanks for sharing!