Medpace Holdings (MEDP)

The CRO Anomaly?

Welcome to yet another in-depth report. It’s Medpace Holdings’ MEDP 0.00%↑ turn today. Medpace is a CRO (Contract Research Organization) that has compounded at a 30% CAGR since its IPO in 2017. The stock is currently in a 30%+ drawdown:

This report goes over…

The development of outsourcing in the pharma industry

The CRO industry

Why Medpace is unique

Financials and growth drivers

Competition, moat, and risks

Management, capital allocation, and valuation

Concluding remarks

The full in-depth report is available exclusively to paid subscribers, although the first two sections are free to read. If you are a paid subscriber you can find a link to the PDF with the full report in the section that discusses the uniqueness if Medpace.

If you want to have access to this in-depth report as well as historical reports, feel free to join Best Anchor Stocks:

Without further ado, let’s jump right into the report.

Pharmaceutical companies (from now on: ‘pharmas’) are no longer what they used to be, period. While I’ll leave it to you to judge whether this is good or bad, it’s undeniable that the pharma industry has undergone significant changes throughout the last 40-45 years. This evolution has led to a new industry structure and the emergence of several high-quality niches exposed to numerous long-term tailwinds. The protagonist of today’s in-depth report would not exist today if not for the most relevant trend impacting the pharma industry since the 1980s: outsourcing.

Pharmas have transitioned from being fully integrated players afraid of outsourcing even the most mundane tasks, to relying on a myriad of external providers to conduct even what were historically believed to be “core” competencies. Many pharmas claim that the change was self-induced to improve the business model (gain flexibility and unlock funds to invest in innovation), but the truth is that it originated out of necessity, a necessity that had cost and complexity as its main drivers.

The history of outsourcing in the pharma industry

The 1980s were a prosperous decade for the pharmaceutical industry. Competition was moderate, blockbusters were on the rise, pricing was hot, and profit margins were fat. Pharmas were fully vertically integrated back then, and the benevolent environment was not conducive to a change in strategy (“why change what is working?”). Outsourcing did exist, but it was primarily viewed as a “lender of last resort” type of arrangement. If a pharma had a demand peak that could not be satisfied with the existing capacity, it would exceptionally outsource some tasks to external providers.

You would’ve been called crazy if you were thinking about outsourcing in the 1980s. Just like “real men had fabs” (famous quote by AMD's CEO Jerry Sanders, in 1993 when asked about the IDM model) in the semiconductor industry, “real men in the pharma industry were vertically integrated!” Back in the 1980s, the pharmaceutical industry believed that they were so good at what they did that no external operator could do better. They were soon going to find out that reality was much different.

The 1990s were a more difficult decade, although the 2000s would demonstrate that it could get worse. The Hatch-Waxman Act of 1984 was a double-edged sword for pharma. On the one hand, it encouraged innovation by improving blockbuster protection, while on the other hand, it facilitated the introduction of generics to the market as a cost-containment measure. Unfortunately for pharma, the legislation was somewhat successful, and the rise of generics put pressure on pricing. The same pharma companies that believed nobody could do better started looking at their cost structure and began to moderately outsource some tasks.

Outsourcing carried several advantages, especially during tough periods. It would basically allow pharmas to remain flexible and swiftly react to changes in the demand environment. It was precisely during this decade that contract research organizations (CROs) began to emerge. Quintiles (now IQVIA) and Covance (acquired by Labcorp) were founded at the end of the 1980s and the beginning of the 1990s (Medpace itself was founded in 1992), and the CRO industry grew at a 35% compound annual growth rate (CAGR) throughout the decade. Despite this rapid growth, the industry was still nascent, as pharmaceutical companies still believed in-sourcing was a competitive advantage and therefore only outsourced certain tasks on a case-by-case basis.

It was in the 2000s that the outsourcing trend began to gain momentum. The 2000s added several headwinds to the price pressures of the 90s. The most relevant one was patent cliffs. Several large blockbusters (at the time, small molecules) began to face loss of exclusivity (LOEs). This led to an increased focus on costs, and consequently, to more outsourcing. It was at this time that pharma companies started to view outsourcing not as a “lender of last resort” but as a strategy that would enable them to focus on their core competencies (mainly R&D). The strategic shift proved successful: pharma companies were able to lower their break-even point and survive the patent cliff.

While these patent cliff headwinds eventually abated in the 2010s, they are now more palpable than ever. The industry is eyeing a significant patent cliff over the next decade. While the outsourcing trend never stopped, one can only wonder what a new round of patent cliffs can do to bolster it:

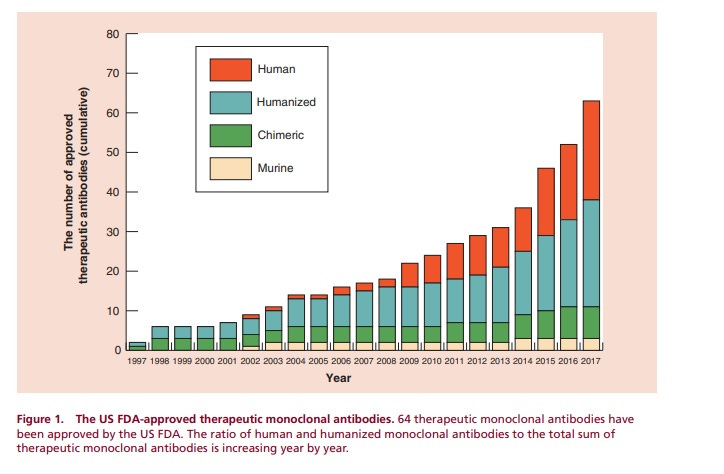

There was yet another headwind during the 2000s: complexity. Small molecules were increasingly getting displaced by what we know today as large molecules or biologics (the most predominant being Mabs or monoclonal antibodies):

This higher molecular complexity was also met with more regulatory scrutiny. This meant that costs were no longer the sole driver of outsourcing; complexity was another valid reason. Costs and complexity remained top of mind for pharma executives through the following two decades, transforming these companies into IP and innovation hubs surrounded by a myriad of strategic partners. The model of strategic partnerships was well underway throughout the 2000s, but Lilly ensured that there would be no looking back. The company signed a 10-year strategic partnership worth $1.6 billion with Covance in 2008. It was the first of its kind.

Pharmas managed to increase flexibility thanks to outsourcing, but they also “armed the rebels” and now rely to a greater or lesser extent on a handful of players to take their innovations to market. The good news for pharma is that the structure of many of these niches tends to be oligopolistic, and, therefore, competition is kept in check even though there are only a handful of credible suppliers in each.

The graph below summarizes the lifecycle of a drug (not in great depth). In the 1980s, most of this workflow was insourced by pharmaceutical companies, something that’s not remotely true today:

Most of these “strategic partners” share several commonalities, of which I would highlight their significant switching costs. Switching costs arise from pharmaceuticals being eventually delivered into human bodies. This means that the tolerance for errors is pretty small, which has two implications. First, some of these products enjoy regulatory capture, which imposes a significant entry barrier. This happens in two ways:

The product gets spec’d into regulatory documents, and pharma must file a resubmission if they are willing to make a modification to such document. After the COVID “supply shock”, in most cases, several supplies get spec’d into a regulatory document, but they always tend to be incumbents.

Capacity must be certified by a regulatory body, putting barriers on new capacity

To this, we must add pharma’s historical risk aversion. Pharmas tend to be adverse to taking risks post drug discovery for two main reasons. First, there’s a lot of money on the line. Once a drug has been discovered, a significant amount of money is at stake in commercializing it as quickly as possible. This makes pharma companies rely on proven suppliers. Secondly, the risk of something going wrong is extremely high. A contaminant included in a glass vial that is later administered to a patient can lead to a myriad of lawsuits, costing millions and potentially leading to bankruptcy. There are many examples of this throughout history. Take NECC. A contamination in its injectable steroid for back pain led to a nationwide meningitis outbreak that killed at least 64 people and led to its bankruptcy.

Unlike popular belief, the patent period begins much earlier than commercialization, so anything that speeds up this process or diminishes its risk is likely to justify almost any level of investment (thereby significantly increasing switching costs and giving pricing power to the incumbents).

While I have discussed (and am exposed to) two of these profitable niches before (bioprocessing equipment and fill-and-finish), I will discuss the CRO industry in this report.

Section 0: The CRO Industry

After a pharmaceutical or biotech company has identified a drug candidate, it must undergo extensive testing before the FDA approves its commercialization. This extensive testing phase is typically referred to as a clinical trial. An E2E (end-to-end) clinical trial consists of several sub-phases that must be understood before looking into any CRO. Here they are:

The first thing that should stand out is that clinical trials are a lengthy process that can last for upwards of a decade (without considering Phase IV). It all starts with pre-clinical, where a sponsor (this is how CRO customers are called) must demonstrate through several methods (primarily animal testing) that the drug is safe to be administered to humans (efficacy of the drug is not much of a consideration here). The output of the pre-clinical stage is an Investigational New Drug (IND) application. Once the IND is reviewed and approved by the FDA (USA) or the EMA (Europe), the drug enters clinical trials in which it will be gradually administered to humans.

The FDA recently released new information regarding pre-clinical trials: it will work to simplify these through the use of AI and other methods. This news sent the stock of Charles River (a CRO heavily exposed to the pre-clinical phase) crashing down 30% in a day, but it might be good news for the remaining participants (I’ll discuss AI later on in the article). The CROs I listed in the chart above (IQVIA, ICON, and Medpace) are focused on the clinical stage, rather than the pre-clinical stage.

Having a broad idea of the size and composition of clinical trials is also important. I must say that the data about the number of clinical trials doesn’t seem entirely trustworthy because different sources provide different estimates, but Jefferies estimated using clinicaltrials.gov that there are just under 15,000 active clinical trials in the US:

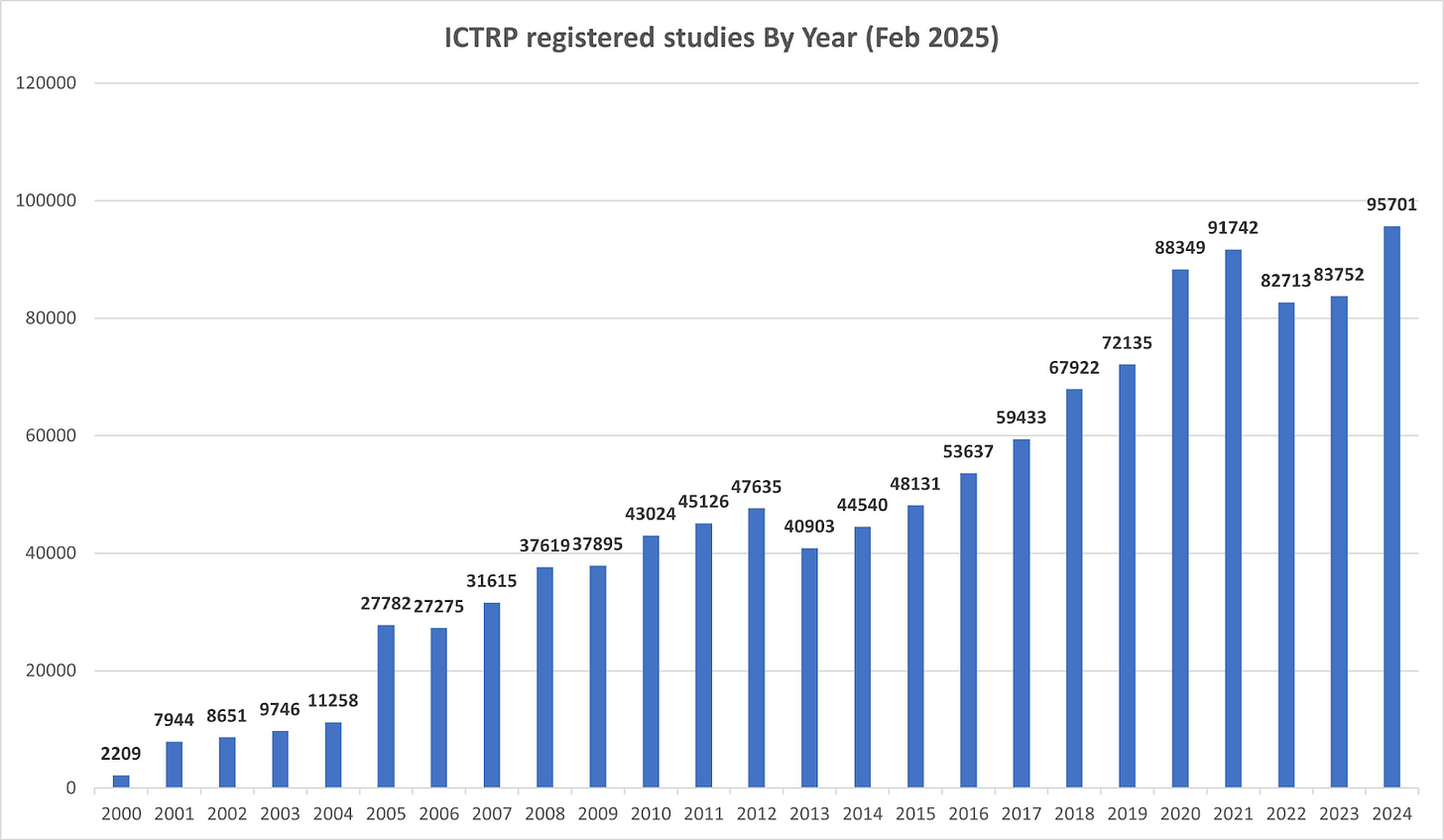

Clinicaltrials.gov is not updated in real time, but if I look up the number of active trials today I get to around 28,000. Other sources like the WHO (World Health Organization) take into account global clinical trials and point to around 95,000 active clinical trials worldwide, albeit this number seems a tad high considering where the US stands:

Regardless of data accuracy, what seems pretty obvious is that there are thousands of clinical trials active at any given moment and that the number of active clinical trials has increased over time (mirroring the rise in R&D investments from the pharma industry).

The composition is also important here: oncology is the most prevalent therapy type by a substantial margin:

The clinical trial process is divided into four main phases:

Phase I involves a limited number of patients, with the goal of determining how humans react to the drug and the dosage that will be used in subsequent phases.

Phase II: the drug is administered to more patients to understand the safety profile of the drug in a larger population and start measuring its effectiveness

Phase III: the most significant phase of all by far. Typically involves hundreds of patients and measures side effects and the effectiveness of the drug compared to existing treatments and a placebo.

Phase IV: after the drug has been approved, it is monitored to understand its long-term impacts (if any)

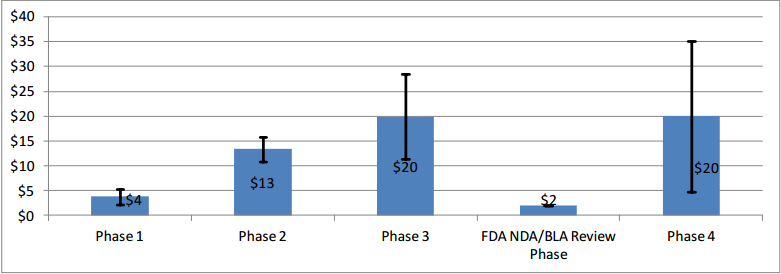

The number of patients is the main driver of cost/investment. Clinical trials come in all shapes and forms, but some sources estimate the cost per patient for a complex clinical trial upwards of $100,000. This means that a complex trial made up of 300 patients can cost up to $30 million (and this would be only for phase III). In simple terms: the more patients required, the higher the investment required by sponsors, and the more money the CROs can potentially make.

Most of the investment happens in Phase II and Phase III (especially the latter). The number of patients is typically decided jointly between the sponsor and the regulator and it’s based on statistical formulas. The sponsor comes up with a number of patients that will result in a statistically significant finding, and the regulator has to approve said protocol before it’s implemented.

Cost will vary significantly depending on the drug in question, but here’s how the investment distribution across the different phases might look like for a typical clinical trial:

Phases II and III are where CROs can potentially generate the most revenue by conducting tasks like…

Organizing the trial

Sourcing the patients

Gathering the data (in some cases CROs will have their own labs)

Monitoring the trial

Preparing a regulatory submission

…

These tasks bring a different set of challenges. For example, sourcing thousands of patients is a feat that few can achieve and is typically accomplished through an extensive network of sites and hospitals/clinics that, in most cases, source these patients on behalf of the CROs. These large trials also require significant labor capacity from the CROs (it’s a labor-intensive business and this is one of the main reasons why it was eventually outsourced). Both the complexity in sourcing patients and the raw number of CRAs (Clinical Research Associates) required to run large trials mean that scale is a significant advantage in the industry.

The reason is that not many CROs have the sheer manpower required to conduct these large, global trials. Small CROs can be successful, but to do so they must focus on a given niche (like a very complex therapy) and realize that the end state is that they’ll probably end up getting acquired by a larger CRO. Consolidation has been an ongoing topic in the industry although the market remains somewhat fragmented, with the “top 6” accounting for 44% of global CRO revenue in 2024 (IQVIA estimates). I believe the top 6 are made up of IQVIA, ICON, PPD (acquired by TMO), Fortrea, Syneos, and Medpace:

Despite the industry possessing significant barriers to scale, there is little differentiation once players are scaled. Running clinical trials is a fairly commoditized service, and winning contracts tends to be a competitive process. The process works as follows: sponsors issue an RFP (Request for Proposal), to which several CROs submit bids. While price is definitely a consideration in determining the winner of the contract, it is not the only factor. The relationship between the CRO and the sponsor (which can even become somewhat politicized in the case of large pharma), the CRO's experience in the same therapy type, and other factors also play a role. All this said, it’s undeniably a competitive process that limits pricing and therefore isolates margin expansion opportunities to the cost side of the equation.

CRO contracts have other particularities. They tend to be lengthy (due to the length inherent to clinical trials) and can be canceled at any time by the sponsor. They can also be pretty sticky in the sense that conducting phase II gives you a pretty high chance of conducting the phase III (for simplicity reasons), although this is not always the case.

A CRO also chooses what contracts to bid on. Manpower is the limiting factor for these businesses, so CROs tend to pursue those contracts they believe have the highest chances of being more profitable. Medpace is known for only pursuing FSO-type contracts (you’ll understand what I mean by this in a bit) and being very stringent in what characteristics a contract must meet before bidding for it. From a Tegus expert call:

If the medical team did not think it was promising, chances were that you would not have a proposal sent out. You would respectfully decline to propose.

Segregating the industry by sponsor is also key to understanding the mix and quality of the different CROs. Exposure to different sponsors brings a unique mix of opportunities and challenges. There are three distinct sponsors in the industry (albeit 2 and 3 are typically bundled together):

Large pharmaceutical companies

Mid-sized biotech companies

Small biotech companies

Most of the industry’s innovation takes place in small and mid-sized biotech, so CROs exposed to these sponsors (like Medpace) tend to grow faster (just due to R&D dollars at these firms growing faster). The caveat here is that SMID biotech is more exposed to venture capital (VC) funding and therefore can be more volatile. SMID biotech can also sometimes be “cash-strapped”, so they may come with potential credit issues. For example, a CRO might be working with a small biotech in Phase II, but this sponsor may run out of money and therefore have to cancel the trial. As in most things in life, there’s a tradeoff here: growth vs. risk (or volatility).

The growth algorithm for most CROs is pretty straightforward and is a mix of the following:

R&D growth: typically 2-3% for large pharma and around high-single digits for biotech

Increased outsourcing of clinical trials: several players claim that this adds around 1-2% of growth per year

Increases in market share: this varies widely, but the tendency is for the large CROs to continue taking share of the small CROs just due to scale advantages

M&A: can add around 1-2% per year for large CROs (although it doesn’t apply to companies like Medpace)

This growth algorithm suggests that, for large CROs exposed to large pharma (such as IQVIA and ICON), a growth rate of around MSD to HSD is a good benchmark. For companies heavily exposed to biotech sponsors, expected growth is likely to be higher, albeit more volatile due to fluctuations in funding. Growth, at the end of the day, tends to be lumpy regardless of the sponsor due to cancellations and failures. Most sponsors can cancel their clinical trials at any time with no penalty and few drugs make it all the way to Phase III.

SMID biotech and large pharma also differ in the services they demand. Two models coexist in the CRO industry: FSP (Functional Service Provider) and FSO (Full Service Outsourcing). In FSP, the sponsor only outsources certain tasks of the clinical trial to the CRO. In FSO, the sponsor hands over all tasks of the clinical trial to the CRO. The difference is important because FSO is a much better business than FSP due to the CRO's ability to add and capture more value, resulting in higher margins. Large pharma lends more to FSP because they have more expertise/scale to conduct certain tasks in-house. This is important because the FSP/FSO mix is worse at the large CROs than at Medpace. For example, FSP currently accounts for around 20% of IQVIA’s backlog whereas it’s negligible at Medpace.

SMID biotech lends itself to FSO because they lack the internal expertise or scale to run a large clinical trial. This slide from IQVIA’s investor day is pretty illustrative:

Having this in mind is key when thinking about market sizes and outsourcing trends. While large pharma does spend more on R&D than SMID biotech (albeit growing slower), the fact that the latter lends itself more to full outsourcing makes both CRO markets somewhat comparable in size:

Some estimates point to around 75% of clinical development spend coming from large pharma and large biotech. This means that these companies spend 3x more on clinical R&D than SMID biotech, but due to the nature of the FSP/FSO mix, the target market for CROs exposed to large pharma is “only” 30% larger than that of SMID biotech. This also has potential implications for the growth algorithm (which will be discussed later on).

AI in the context of the CRO industry: risk, opportunity, or both?

A while ago I wrote an article outlining why the healthcare industry was an asymmetric bet on AI. CROs in particular seem like a segment of the industry that can potentially benefit massively from AI, but no opportunity comes free of risk.

The potential tailwinds are straightforward and can be divided into two buckets. First, AI can potentially accelerate drug discovery, leading to a higher volume of clinical trials. The FDA-related news from a couple of weeks ago is a good indication of how this might play out. Substituting a portion of animal testing in pre-clinical trials with AI (while terrible news for pre-clinical CROs like Charles River) promises to increase the pipeline of drugs that make it to clinical trials. Cheaper and faster is always good for the steps that come after. Increasing the chances of success of a candidate is also a potential tailwind. If AI can help differentiate the successful projects from the unsuccessful early on, more R&D dollars should be funneled into projects that have a higher probability of making it through to Phase III (where CROs make most of their money).

The second way AI can be a tailwind for CROs is by making them more efficient. CROs are labor-intensive businesses, so anything that improves labor productivity will result in significant operating leverage. This is especially true for the large incumbents who own massive amounts of data from running thousands of clinical trials and therefore can potentially utilize AI better.

Up to here, it all seems positive, but there’s also another side of the coin. While AI can potentially make CROs more efficient, it can also reduce the number of patients required to run clinical trials. This would, theoretically, reduce the profit pool for CROs. Less patients required to run large trials would also lower the barriers to scale, thereby increasing the competitiveness of the industry. Now, it’s tough to know at this point if the larger pipeline would compensate entirely for fewer patients (or even if fewer patients will become a reality), but it’s definitely something worth keeping an eye on. Medpace was asked about this in its most recent earnings call, to what its CEO replied something logical (Jevons Paradox anyone?):

That’s pretty hypothetical, you make drugs easier to develop and you tend to get more development.

I would agree with his POV here, to be honest. It seems pretty clear that AI will have an impact on the CROs, and if you ask me today, I’d say the impact seems net positive despite the potential risks. That said, it’s undeniable that there are other companies in the life sciences’ supply chain for which my confidence level is much higher. If more drugs get developed, companies that are involved in their manufacturing and containment will benefit with minimal exposure to AI risks. It seems that life sciences in general is positively skewed to AI , but the degree of the skewness matters.