Healthcare Working Again (?) & What Intel Earnings mean for ASML (NOTW#53)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Both indices rose again this week, continuing their non-stop pursuit of all-time highs. We are in the midst of earnings season, so I share all the earnings digests I have published this week and also discuss (for paid subscribers) what Intel earnings meant for ASML.

Without further ado, let’s get on with it.

Articles of the week

I published four articles this week, all of which were earnings analyses. It was a hectic week in terms of earnings, but luckily, next week should be a bit calmer. I first published an article on Atlas Copco’s Q2 results, which saw the stock drop significantly after the report. I explained what caused the drop and discussed the current valuation. I also share some relevant news about the company in the company-specific news section.

Time to add?

Atlas Copco reported its Q2 earnings last Friday, and the market did not like them at all. The good performance of the stock coming into earnings might have made some believe that the market knew earnings would be good (certainly seemed so!), but the stock dropped like a rock as soon as the report was released:

The second article of the week was Medpace’s earnings digest. The company reported a very strong quarter, catching the market entirely by surprise. The stock rose 50% the following day and although it has corrected somewhat, one can’t deny that a good portion of the stock price boost was warranted.

Wow Medpace

Medpace reported outstanding earnings on Monday, and the market’s reaction was quite something (put mildly):

The third article of the week was Texas Instruments’ Q2 earnings digest. The company reported good earnings but disappointed on guidance. The worst part of the release was probably how management managed expectations poorly, but I believe this overshadowed some really good news they shared during the call.

Some bad news...but some excellent news

Texas Instruments reported strong Q2 earnings on Tuesday, but the guidance for Q3 was somewhat disappointing. This took the market by surprise because many investors were anchored to the positive tone management had exhibited over the last few months. Both the guidance and management’s tone signalled caution ahead, which is simply something one can’t “afford” when the stock is trading at all-time highs. Not unexpectedly, the stock dropped significantly the following day:

Finally, the fourth article of the week was Judges’ trading update analysis. The company reported pretty bad earnings despite showing growth (due to very easy 2024 comps). It does seem this one has taken management by surprise.

The Good, The Bad, (but primarily) the Ugly

Judges published its H1 2025 trading update this week, and it was pretty terrible. The stock dropped significantly post-release, and even though sometimes we might say that such sharp drops are market inefficiencies or whatnot, I must say that it was a pretty deserved market reaction this time:

Market Overview

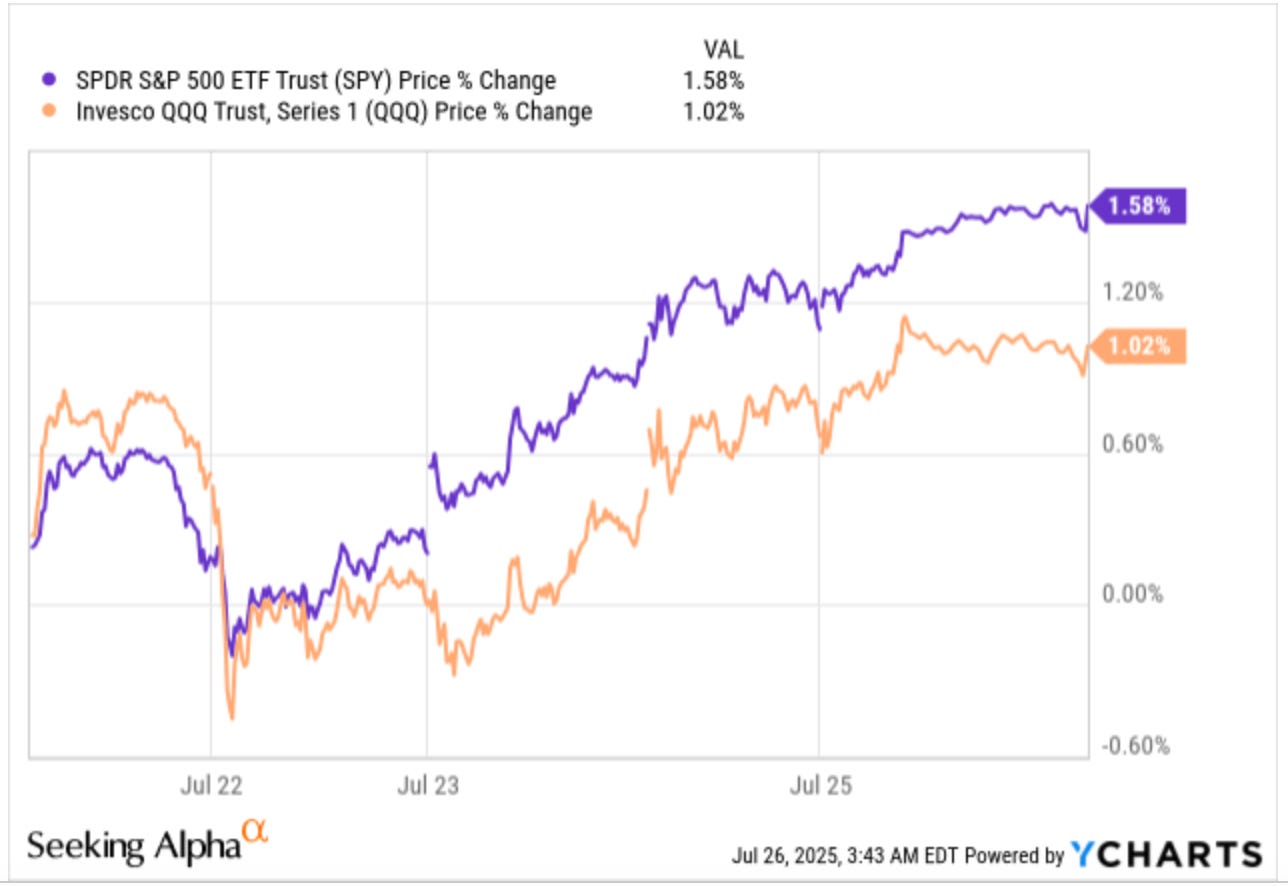

Both indices rose again this week, and this time by a substantial amount. Both the Nasdaq and the S&P 500 were up more than 1%:

This brings the YTD performance of the indices to 17.8% for the S&P 500 and 21% for the Nasdaq. If we zoom out, we can see that the indices have had a spectacular 3 and 5-year period. Over the past 5 years, the S&P 500 has CAGRd at a 16.2% clip, whereas the Nasdaq has done so at a 17.6% CAGR. Over the past 3 years, the numbers are even better, with the S&P 500 growing at a 19% CAGR and the Nasdaq at a whopping 25% CAGR:

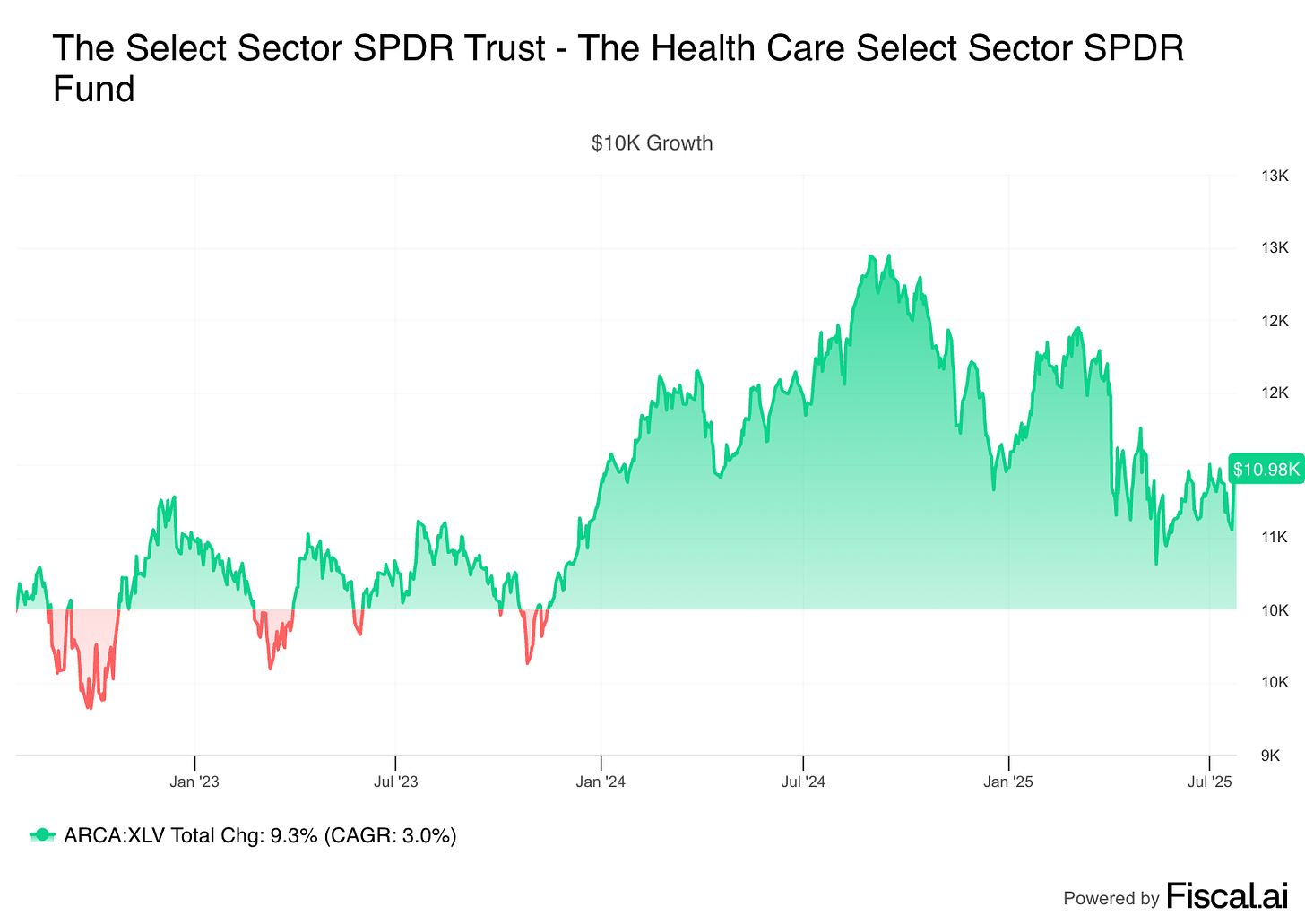

I don’t want to spoil the party, but this definitely doesn’t seem sustainable if history is any guide. This performance has also been driven to a great extent by the technology sector (evident by the fact that the Nasdaq has CAGRd at a materially faster rate than the S&P 500). While a rising tide lifts all boats, it seems like healthcare/biotech has not boarded any ship. Over the last 3 years, the healthcare index (XLV) has CAGRd at a 3% clip, way below the indices:

Now, this doesn’t mean that the underperformance is totally unwarranted. The industry has gone through a boom and bust cycle caused by the pandemic and subsequent destocking, so the numbers have surely justified the underperformance to some extent. However, there’s no denying that the sector has been left for dead for too long, with valuations now looking much more attractive as the industry recovers from the downcycle. What’s interesting about the sector is that it’s typically regarded as a defensive sector, even though there are companies that can sustainably grow earnings at a double-digit clip. Not what I would call a defensive.

The question here is: Is the sentiment shifting? Thus far, the earnings season for healthcare has been generally positive. Several earnings have significantly outperformed analyst estimates, which, combined with the negative sentiment prevailing in the sector, has resulted in substantial share price increases. Several notable examples are Medpace (up 54% after reporting earnings), TMO (up double digits after reporting earnings), and West Pharma (up 20% after reporting earnings):

While there’s no denying that at least a part of said performance seems to have been caused by shorts getting burned (i.e., a short squeeze), I do think that the tide seems to be starting to change. Truth be told, me saying this might be your most obvious sign that the tide is, in fact, not changing! Should the sector start “working” now, I anticipate some good years ahead. Fundamentally, the industry is very attractive (not all parts of the value chain) due to the secular tailwinds it has at its back, the durability of these businesses, and the mission-criticality of its products. An additional tailwind I would add is that of AI. While AI promises to disrupt most industries, it appears to be a significant tailwind for healthcare, with relatively low disruption risk (again, depending on the part of the value chain).

In a relatively recent NOTW, I outlined why I like the industry, this is what I wrote:

Many investors (and therefore the algos) seem to be playing it extremely safe here. One would think they are waiting for a confirmation of the inflection, but we already had that, and there was still no reaction. Just for context, Stevanato grew revenue by 1% in 2024 and will probably grow HSD this year while expanding margins significantly. Danaher’s bioprocessing business shrank 4.5% in 2024, but management is guiding for HSD growth this year. When will sentiment flip? I have absolutely no clue, but I do believe some things make the setup appealing:

Accelerating top lines

The resilience of the industry due to the mission-criticality of its products

The fact that it’s a very hated sector right now

The positive skew the industry has to AI

I have been holding some healthcare/bioprocessing stocks for a while, and it’s undeniable that they “have not worked.” I am sure that when they start working, there will be something else in the portfolio that stops working, and this is why investing can be so frustrating. I tend to compare it to golf: it’s tough to have every part of your game working at the same time. We’ll see what happens here going forward, but this is the first time in a while that the top 3 weekly performers in my portfolio are my 3 healthcare stocks (up 45%, 10% and 9%).

The industry map also reflected what I discussed above: healthcare was pretty strong:

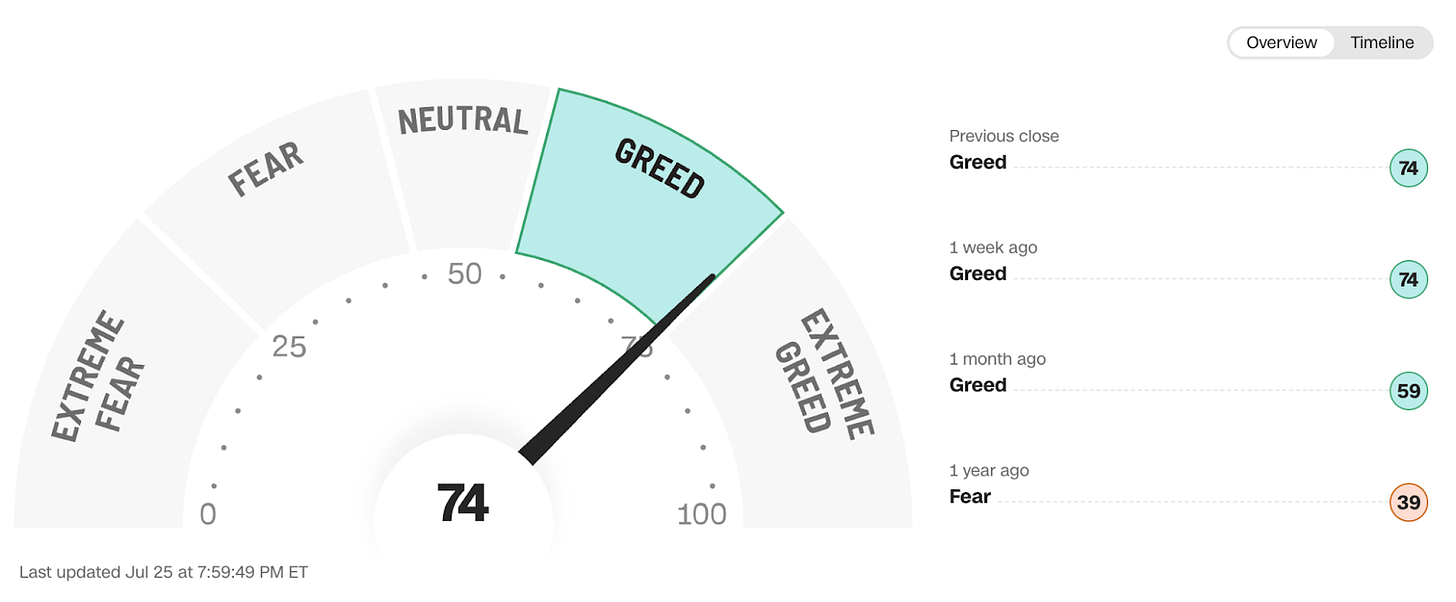

The fear and greed index remained close to extreme greed:

The rest of the content where I share what I bought this week and the news of the week (including what Intel’s earnings meant for ASML) is reserved for paid subscribers.

What I bought this week

I added to several positions this week: