Time to add?

Atlas Copco's Q2

Atlas Copco reported its Q2 earnings last Friday, and the market did not like them at all. The good performance of the stock coming into earnings might have made some believe that the market knew earnings would be good (certainly seemed so!), but the stock dropped like a rock as soon as the report was released:

Truth is the stock has recovered somewhat from the Friday lows, something that in my view makes sense and I expect to explain why in this article.

It has not been the best start to this earnings season for my portfolio. Two portfolio companies have reported earnings so far (ASML and Atlas Copco), and both dropped significantly after their reports. The interesting thing is that both dropped due to a similar reason, despite operating in somewhat unrelated industries (Atlas Copco’s Vacuum Technique and ASML’s business are somewhat related): the indirect impact of tariffs.

In addition to the aforementioned headwind, Atlas Copco also faced a significant currency headwind. The company reports in Swedish Krona but generates its revenue all over the world. A softer dollar is also detrimental to margins, as a significant portion of costs are incurred in Swedish Krona/euro. The opposite is also true: a strong dollar would be great news for Atlas Copco. That being said, I have absolutely no idea what currencies will do going forward, acknowledging that they do matter in this particular case.

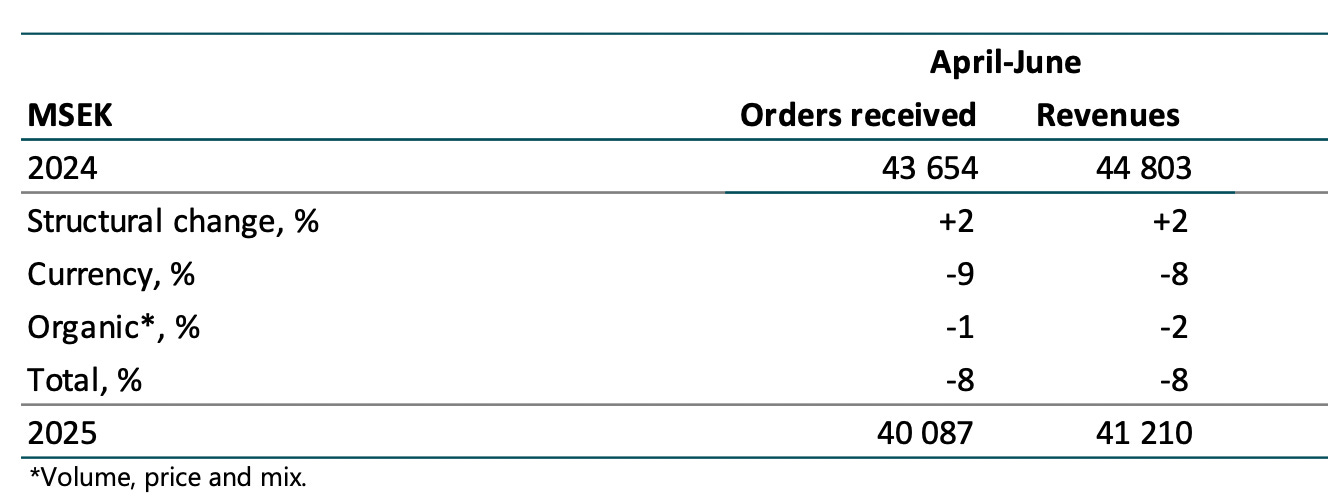

Let’s first look at the results, and I’ll later talk about the source of weakness and some green shoots. Atlas Copco suffered slight organic declines in both revenue and orders. These organic declines were augmented by currency headwinds and slightly offset by growth from acquisitions:

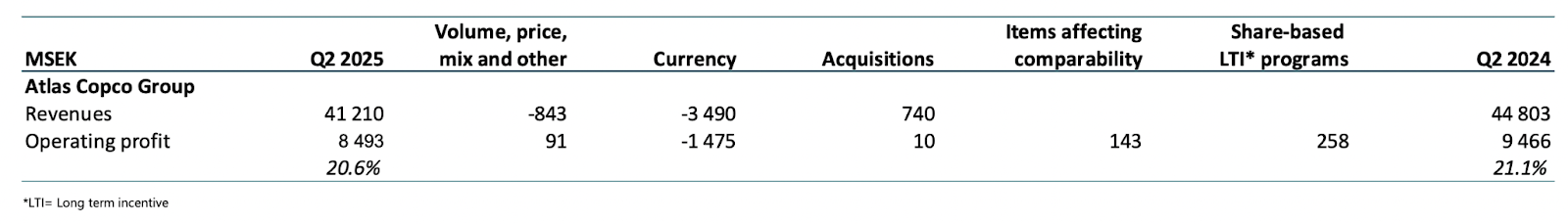

Margins did not perform well either, as the operating profit margin contracted by 50 basis points. This is evidently not great, but understanding the context is essential. Atlas Copco is an industrial business that should theoretically experience substantial operating leverage/deleverage when growth accelerates/slows. However, its margins tend to be relatively stable for several reasons. First, service revenue makes up around a third of total revenue, and it’s more recurring than equipment sales. One could argue that they even go in opposite directions, as customers might end up requiring more service when they defer capital expenditures. Management shared that service revenue was strong again. Secondly, Atlas Copco outsources most of the parts used to assemble its equipment, meaning that COGS are somewhat flexible (unlike in your classic manufacturing business).

Now, the news are significantly better than what the numbers might portray when we take a look at the underlying margins. Currency was a significant headwind to operating profit (a 42% decremental impact), but Atlas Copco managed to increase its underlying operating profit through volume, price, and mix, even in the face of revenue declines. Acquisitions, as usual, were margin dilutive (2% margin), albeit not significant enough to make a difference.

Management attributed this encouraging drop-through to several factors, although they did not quantify them. They talked about mix being favorable and about cost-containment measures starting to show up in the numbers. The mix impact might be short-lived because the company also experienced significant decrementals in the past for the same reason. Still, I’d say it’s pretty positive to see such a drop through even in the face of revenue declines because this means operating margin expansion might be pretty good when growth resumes.

Understanding the source of the weakness

Similarly to ASML, Atlas Copco flagged tariffs/geopolitical uncertainty as the source of the organic weakness. They mentioned that direct tariffs were not really a problem (recall they stood at 10% at the date of the report), but that customers were being hesitant to commit orders (especially large) in the face of tariff uncertainty.

Most of the problems originated from Compressor Technique, specifically from gas and process compressors, where the order size tends to be larger than for industrial compressors. To illustrate the significant drop in orders for gas and process compressors, management noted that these products account for around 10% of the Compressor Business but were responsible for nearly half of the 7% organic decline in orders. This means that gas and process compressor orders dropped by around 35% year over year.

While larger orders are going to be inherently lumpier, management did share some green shoots:

The level of activity remains high in terms of bidding

There have been no above-usual cancellations

So, what appears to be happening here is that customers are waiting to get some clarity on tariffs before confirming their orders. As this weighs more in large orders, it’s creating a situation where numbers are significantly weaker than the underlying activity of the industry portrays:

What we see now, it’s quite a lot of hesitation from our customers to place orders. Like I mentioned during the presentation we do have some large orders. And then if you have two or three customers hesitating or further analyzing, asking more questions, so then you can have a quarter where orders can be weak.

Source: Wagner Rego, Atlas Copco’s CEO, during the Q2 earnings call

We could compare Atlas Copco’s customers’ situation to that of TSMC. Management is implying here that capacity is tight at its customers and that the willingness to invest is high despite the deferral, similar to what TSMC said this week. Capacity at TSMC is pretty tight, but they are hesitant to invest in further capacity due to the tariff uncertainty. In TSMC’s case, it’s ASML that is suffering what Atlas Copco is suffering with large gas and process compressors. Management is confident that the orders will eventually come, claiming even that they’ve received letters of intent from customers but that they don’t count those as orders:

The projects are there, they are alive. It’s a matter of time now till the customers decide. We are quite active quoting, but customers are not deciding. There are LOI (Letters of Intent) in place, but those are not firm orders.

Source: Wagner Rego, Atlas Copco’s CEO, during the Q2 earnings call

While not the ideal situation for Atlas Copco, I am fairly certain that these orders will eventually come, as customers can only defer them for so long. Unlike for ASML, where lead times are significantly longer, if said orders were to come soon, then we’ll most likely see a faster rebound at Atlas Copco. Note that TSMC’s deferral of decision-making also impacts Atlas Copco, although the company did point out that the weakness in Vacuum Technique was more related to the poor performance of Intel/Samsung:

And then in the US, there is a major account that doesn’t have a Capex budget as before.

Source: Wagner Rego, Atlas Copco’s CEO, during the Q2 earnings call

So, even though the quarter was not what I would’ve liked, there’s little to do when customers are deferring orders due to geopolitical uncertainty. This might sound like an excuse from Atlas Copco, but having read the calls of companies like ASML and TSMC and having both POVs from customer and supplier, I do think it seems like a pretty credible explanation. We’ll have to wait and see what Ingersoll Rand (Atlas Copco’s compressor technique peer) reports on August 1st. In the meantime, Atlas Copco’s management appears to be focused on what they can control, which is to keep costs under control and continue innovating while they wait for demand that will eventually materialize.

Atlas Copco can continue investing because, despite the softness in growth, the company remains very profitable and cash generative. Cash flow from operations was healthy and the company has a net debt to EBITDA ratio close to 0.