The Good, The Bad, (but primarily) the Ugly

Judges’ H1 2025

Judges published its H1 2025 trading update this week, and it was pretty terrible. The stock dropped significantly post-release, and even though sometimes we might say that such sharp drops are market inefficiencies or whatnot, I must say that it was a pretty deserved market reaction this time:

Even though the title of the article is “the good, the bad, but primarily the ugly,” I will review these in the inverse order. Let’s start with the ugly: the funding issues in the US. Judges reported a 20% organic drop in the US in H1, which (although I haven’t checked) is likely the most significant drop in the company’s history in that geography. The reason the management team cited was funding issues in academia, which put pressure on capital expenditures. This makes sense and was not entirely unexpected, judging by the headlines we’ve been seeing. It did, however, seem to catch management by surprise. Several signs indicate that the impact of this risk accelerated in Q2. For example, management hosted the H2 2024 call in March (end of Q1) and outlined this risk but downplayed it significantly. This is what management said during that call:

We expect a good start to 2025.

Of course, this year, ROTIC has declined as a consequence of the weaker performance. So we ended the year at 16 and a half percent, which is absolutely not where we expect it to be, and we expect to return promptly to over 20%. And certainly, I’d like to see that even by the half year.

Organic order intake is slightly ahead of 24 year to date.

But there’s also budget cuts in American research that could have an influence on our business. But generally, we feel we should have a much better year than last year. And we believe we are happy with the market expectations as they are now.

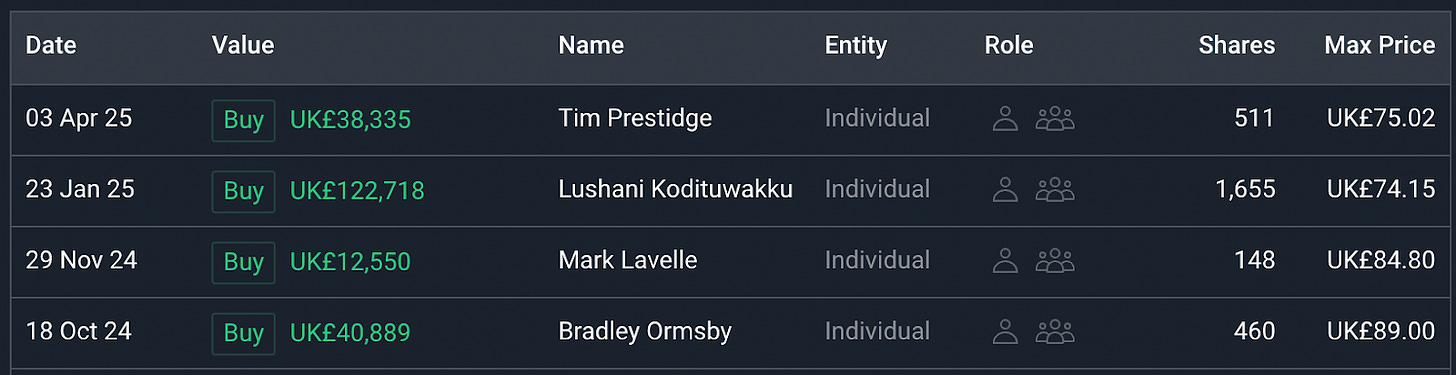

The fact that insiders had been buying in the open market in Q1 at higher prices, but that significant insider buys stopped suddenly in Q2, is also a sign that this took Judges completely by surprise in Q2:

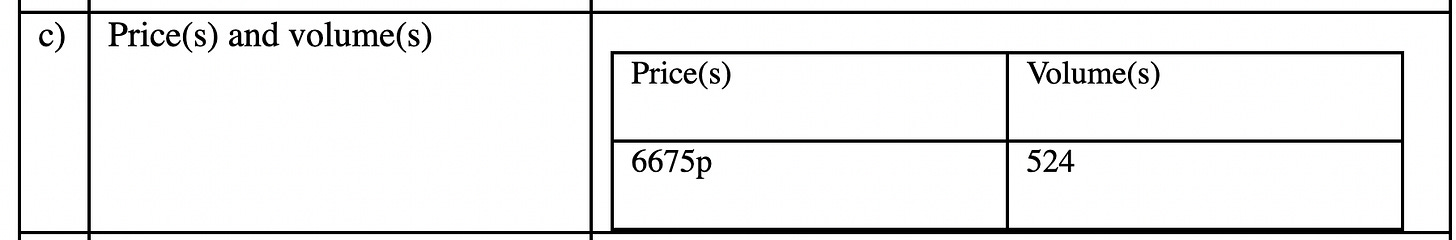

Some insider purchases are starting to roll in at Judges after the drop. Charles Holroyd has acquired today 540 shares of Judges at roughly 67 pounds, for a total purchase price of 35,000 pounds.

Now, while this is evidently better than not seeing insider buys after said trading update, I must say that if this trading update demonstrates something is that management doesn’t possess the visibility as to insider purchases being a strong signal. So, while not downplaying that seeing insider purchases after a significant drop is good, one could’ve said the same thing in Q1!

Some of you may be aware that the Trump administration has been threatening universities with funding cuts, using them as a political weapon to “force” these universities to comply with the Administration’s agenda. These cuts and pressures are already becoming a reality, exacerbating the funding situation that universities were already facing before said cuts. Even though some of this will go to court (universities are fighting back), one of the first things universities have done in the face of uncertainty is to cut Capex. This, of course, has been a significant headwind to Judges’ business, and honestly, something that I should have given more importance to (albeit we’ll see later how I was indirectly taking it into account in my valuation).

Given that this is Trump’s second term, we can look back to see what happened during his first. His intentions were similar at the time, but many of his proposals failed to pass through Congress, and therefore, funding ended up growing instead of shrinking. Then came COVID and universities saw another bump to their funding, which evidently benefited Judges. From 2017 to 2023, Judges’ organic growth rate averaged 7% despite organic growth being down 12% in the pandemic year. Now we are seeing reality kick in with a normalization of growth coupled with the additional headwind of the funding issues.

The question here is: Is the situation temporary or structural? Saying first that I have no clue what will happen, I’d say the answer to this question depends on one’s time horizon. It seems more likely that funding cuts will be implemented this time around than in Trump’s first term, but it may also be a matter of headline risk, as it was last time. Regardless of what ultimately happens, it seems pretty apparent that uncertainty is prompting Judges’ customers to reconsider their investments. Note that 50% of Judges’ revenue is exposed to universities, but not all of this is located in the US. The US accounts for around 25% of turnover. If we assume that the distribution of university revenue tilts more towards the US (say 40%), then we are talking here around a 20% exposure of total revenue to this issue. Note that the real exposure is arguably lower because there was no Coring contract last year. In short: it’s not insignificant, especially when it’s plunging 20% year over year.

The worst-case scenario here would be that Trump goes through with all of his threats, in which case it will be a tough market for Judges until the end of his mandate. This, to be fair, is largely the scenario we are currently witnessing, although it could deteriorate further. It’s unclear how things will evolve, but it’s not the ideal scenario by any means. The non-worst-case scenarios are likely similar to what happened during Trump's first mandate, where it was headline risk more than anything else.

Then came “the bad.” Outside of funding issues in the US, the company is also experiencing some organic growth challenges across certain businesses. This was maybe more surprising than the funding issues, considering that management had already “owned” said problems in March and said they were working towards remediating them.

Management again owned this underperformance and claimed that they are working on resolving the issues, but I would say it was not a pleasant surprise to see organic order growth in the UK drop 7%. As this was a trading update and there was no follow-up call, we don’t really have many details about this. The funding issues in the US, together with the drop in the UK, resulted in a profit warning for the year:

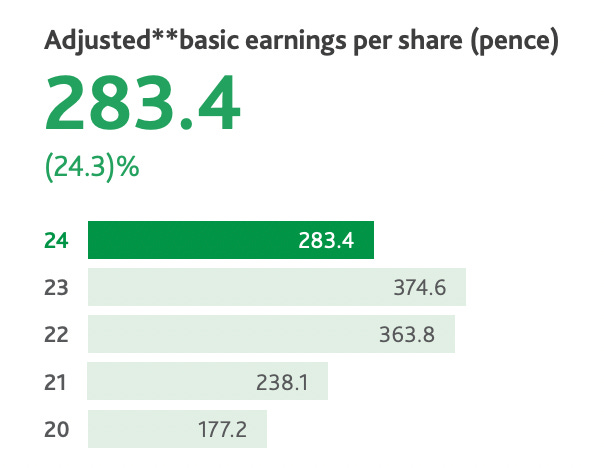

As a result of these headwinds coupled with the aforementioned business-specific issues, the Board now anticipates delivering Adjusted basic earnings per share of between 285p and 330p per ordinary share in FY25 which is below market expectations.

The market’s expectations were around 367p, so Judges’ midpoint guidance is around 16% below these (perhaps not a coincidence that the stock was down by that much yesterday). Now, this trading update also highlights how non-normalized the 2024 numbers were and how anyone relying on them to form an opinion would’ve been misled. At the midpoint of the revised guidance, adjusted EPS are set to grow 8.5% this year. At the high end of the guide, EPS is projected to increase by 16%. The range is quite wide, which is consistent with a very uncertain environment. Even though Judges will grow in 2025, adjusted EPS will remain significantly below the 2023 peak:

But why is Judges being able to grow even in the face of all the headwinds I have discussed? Let’s take a look at “the good.” I would start this section by saying that what I am about to say here should not hide the fact that earnings were pretty terrible. I consider myself a pretty positive person, so I always think there’s a good side to everything, even in this trading update!

A couple of things were positive during the first half. First, Judges recognized the revenue from the Geotek Coring contract, which is taking place in Japan. There was no Geotek contract in 2024, which created very easy comps for this year. Organic growth in H1 2025 was 7% when including Geotek, but down 7% when excluding it. Judges is also a business that suffers from operating leverage/deleverage, so when excluding the profitability improvement of Geotek, EBIT dropped around 30% organically.

The UK and the US made 38% of total revenue in 2024 and were probably responsible for a good chunk of the drop, as Judges mentioned that the environment in other geographies was good in terms of orders:

Across the Group, Organic* order intake was up 4% when compared with H1 2024. Organic orders were up in all regions except North America (down 18%) and the UK (down 7%).

To this, we must also add that Judges did not discuss inorganic growth. The company made three acquisitions last year (Luciol, Rockwash, and Teer Coatings) but did not provide details on how these acquisitions contributed to overall growth. Luciol was acquired quite early in 2024, so I’d imagine most of the contribution (or the opposite) was organic, whereas the company did not own either Rockwash or Teer Coatings in a significant part of H1 2024.

It’s also worth noting that this is not a sector where one can make countercyclical acquisitions. The reason is that the owners of the businesses that Judges is after are not typically willing to sell when the sea gets temporarily rough (similar to Constellation Software’s case). The good news here is that if there are no countercyclical investments, it probably means that the owners of those businesses think that what the industry is going through is, in fact, temporary.

Now, the best news amidst all the bad news might be the valuation.