The Boy That Cries Wolf and The Healthcare Industry (NOTW#44)

Best Anchor Stocks has a partnership with Finchat (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

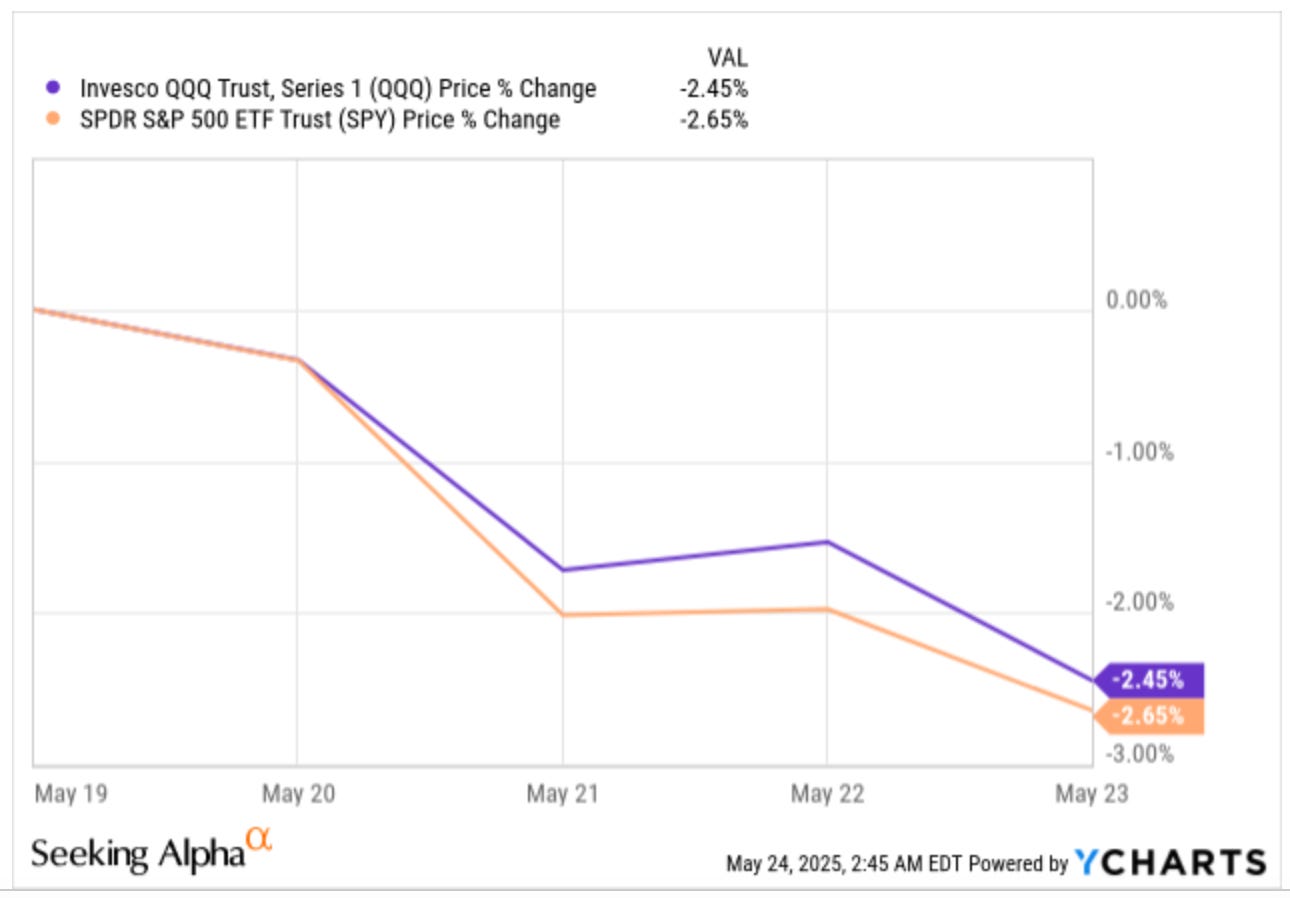

Both indices were down this week, and the tariff topic was front and center again after a few weeks of relative calmness. I also briefly discuss the opportunity I see in healthcare and what might be keeping the sector pressured (for now).

Without further ado, let’s get on with it.

Articles of the week

I published two articles this week, both earnings digests. The first one was Deere’s Q2 earnings analysis. The company reported excellent earnings and is slowly (but steadily) becoming the farm’s operating system. Remember you can read my in-depth report on Deere for free here.

Becoming the farm's operating system

Deere reported great earnings last week, and the market recognized these as such despite the slightly lowered guidance. The stock is now solidly above $500 and has breached a new all-time high:

The second article of the week was Keysight’s Q2 earnings analysis. The company delivered outstanding results, beating revenue and EPS estimates (despite tariff headwinds) and raising guidance. The market initially reacted positively to these results, but Keysight is now trading at a slightly lower price than before reporting these (which is interesting).

Full Steam Ahead

Keysight reported great earnings this week. The company delivered a beat, beat, raise quarter despite being exposed to the Capex cycle of its customers in a turbulent macro environment. Capex is, in …

Next week, I plan to publish an article on 5 investment mistakes I have made and several earnings articles (Intuit and Copart). I will also publish an in-depth report (hopefully in two weeks) on Trupanion (TRUP). Trupanion is a very interesting company in the growing space of pet insurance, although the company has always attracted controversy:

This is just an appetizer of what’s expected for Best Anchor Stocks over the coming months.

Market Overview

Both indices dropped this week, and both did so by a similar amount:

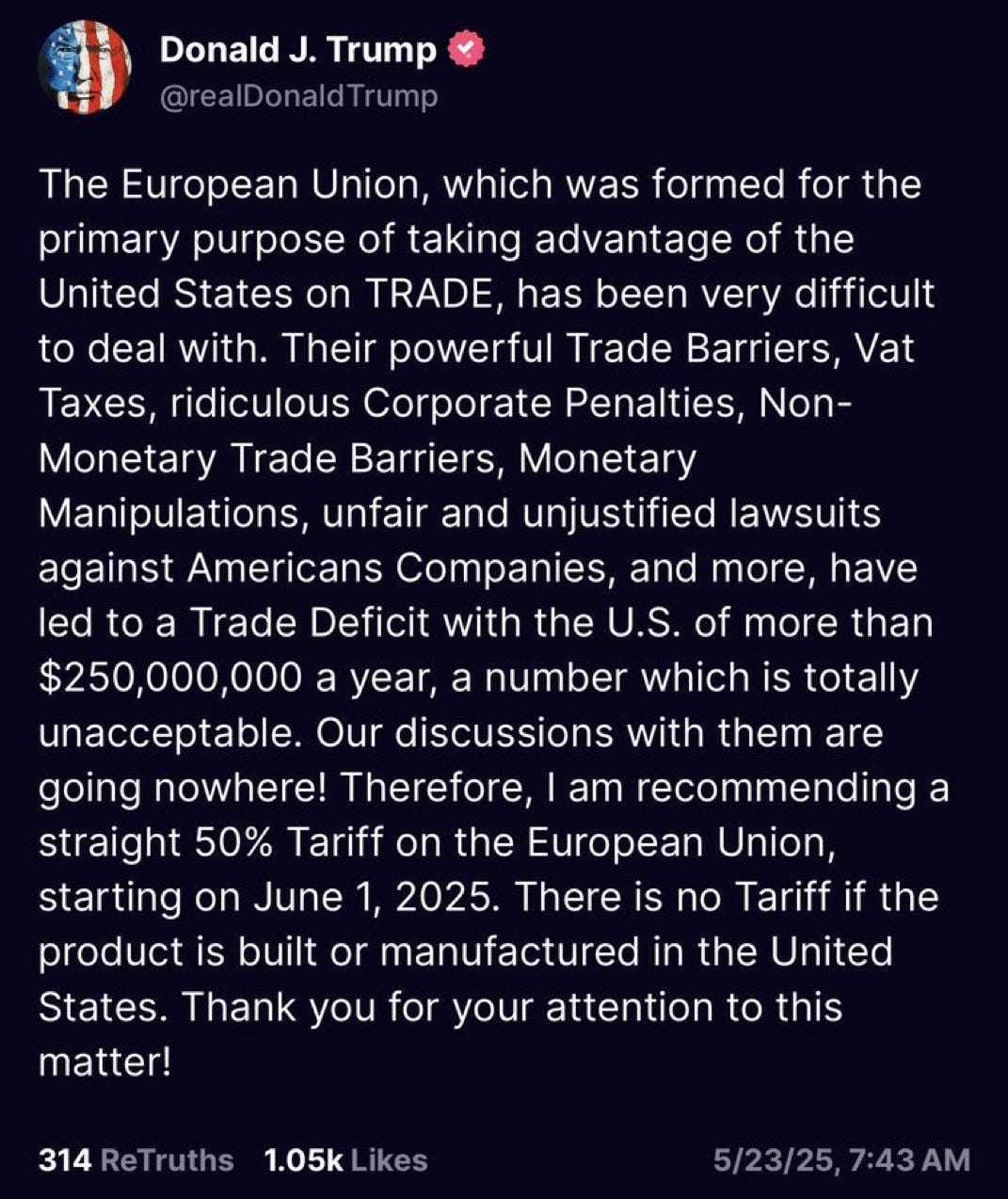

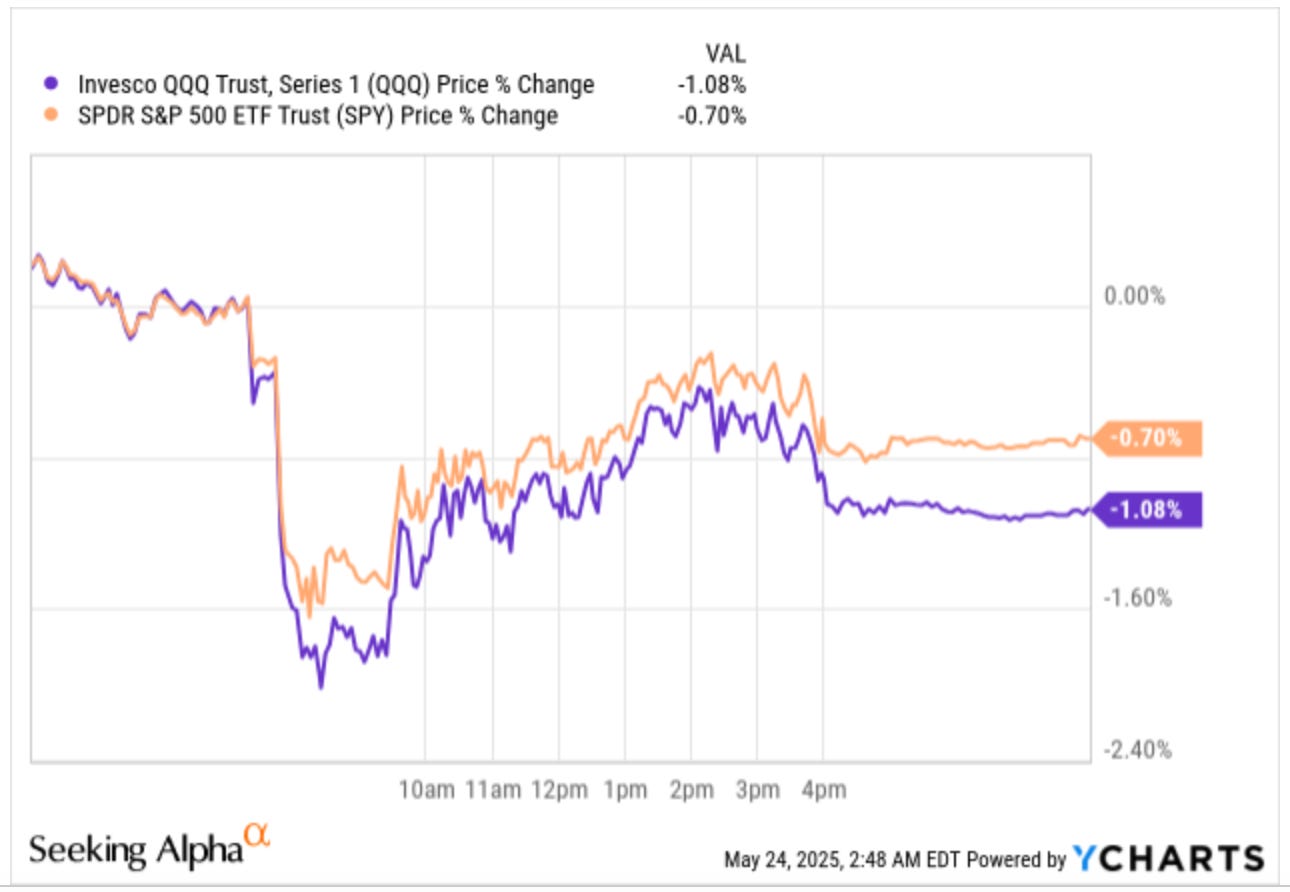

Indices were already falling before Friday, but Trump “tried” to accelerate this drop by posting on Truth Social that he recommended a 50% tariff on the EU starting June 1st:

Just when we thought things were calm, Trump struck markets again. Unfortunately for him (assuming he intended to tank markets and rates), markets seem to have grown accustomed to his rants. While, if true, this news should’ve made markets drop considerably more (let’s not forget they are close to ATHs), the Nasdaq and the S&P 500 were barely down 1% on Friday:

This resembles the story of “The boy who cried wolf” (I hope this is how it’s called in English). In this case, Trump is the boy who, instead of crying wolf, cries tariffs. While these threats were at first taken seriously by the market, all the pauses and false threats have made the markets shrug off any news related to this topic. The only problem is that if the threats eventually become true, the market is unlikely to be prepared for it (just like the wolf ended up coming and nobody was prepared). I honestly think that 50% tariffs are unlikely to be implemented, but if I have demonstrated anything to myself over the past few years is that my macro forecasting ability is abysmal. There are only two types of people in financial markets: those who know their forecasting ability is terrible, and those who have yet to find out.

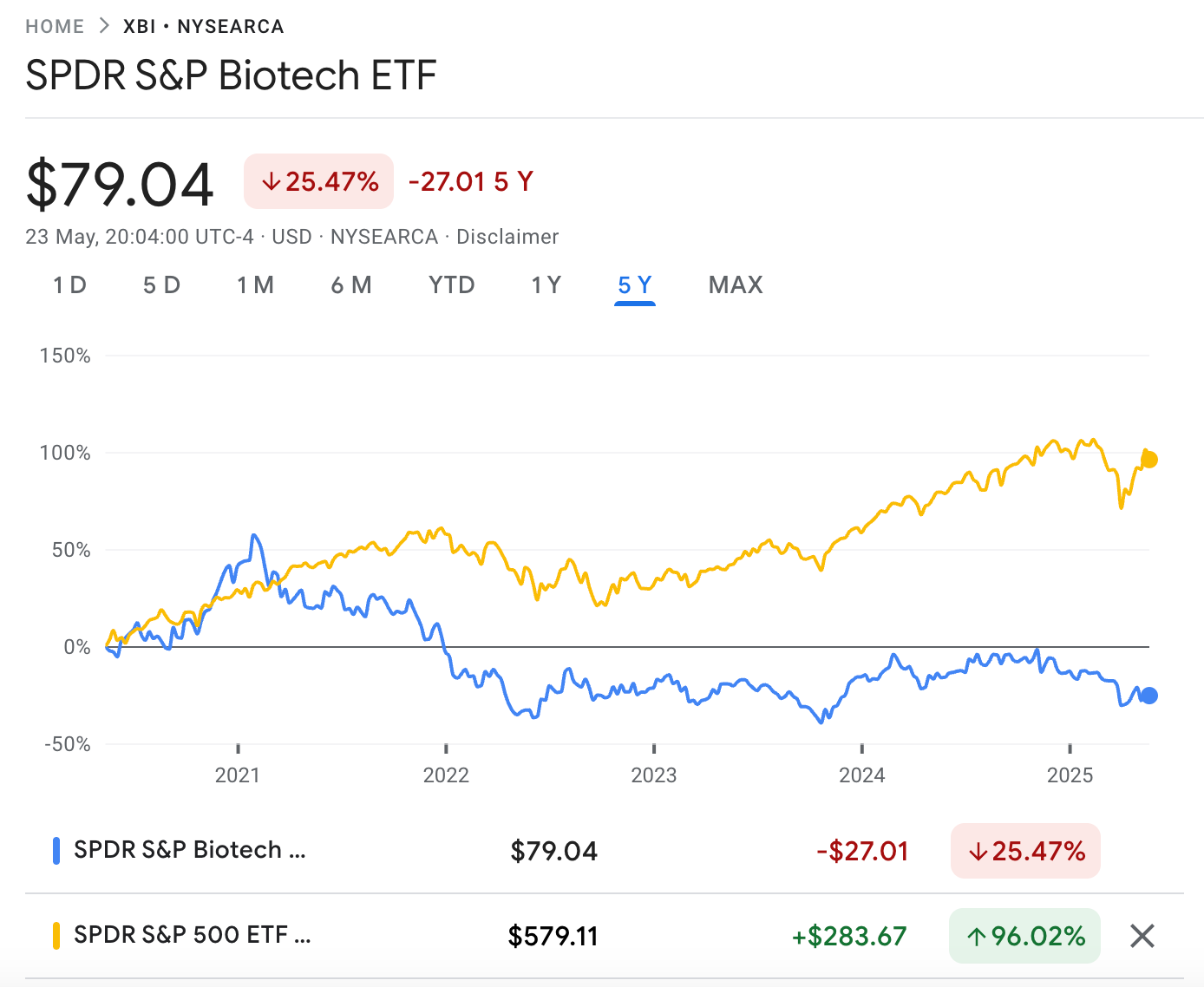

Even though this might be a topic for another article, I wanted to talk a bit about the situation in the healthcare industry. If you’ve been paying attention to the healthcare/biotech industry, you’ll know it has been in a bear market for quite some time. For context, the biotech ETF (XBI) is down 20% over the past 5 years despite the market being up 96%! Quite the differential:

The bear market was caused primarily by two things. First, a pull forward during the pandemic resulted in one of the steepest destocking cycles in the industry's history. Stocks ran as if there had been no pull forward, but eventually crashed when the market realized what had happened. This destocking took quite a bit more time to sort itself out than many expected (myself included). With the destocking issue mostly resolved today, we have two additional problems. First, interest rates. Much of the industry's innovation comes from SMID biotech companies, which rely on funding to conduct R&D. As interest rates rose in the post-pandemic environment (and remain high today), funding has been under pressure. Secondly, the new administration. It’s no secret that Trump and his government are a tad skeptical of pharma and have openly declared “war” on large pharma. This, evidently, doesn’t help with sentiment (which was already bad due to destocking).

Despite all these headwinds, one thing remains true: these companies provide innovation that can quite literally change people’s lives. Whether Trump is in the Government or another president, it seems clear that the products these companies research/manufacture will be needed by society. Healthcare costs have indeed spun out of control, and therefore, not all business models in the supply chain are sustainable. What’s interesting is how many people believe that this high cost is almost entirely attributable to large pharma. The reality is that there are lots of intermediaries taking a lot of money into their coffers with little value added to show. In an ideal world (maybe utopic), these intermediaries will get “cut off” and the money will be redirected into R&D to advance the cure of more diseases.

So, if the sector has been on a 5-year-long bear market, continues to provide essential products regardless of the administration, and is already experiencing a growth inflection post-destocking…why are stocks still performing so poorly? I don’t have the exact answer for this, but it seems pretty obvious it has to do with positioning. In short, not many investors are willing to “pile into” healthcare/biotech with all the uncertainty regarding the new administration and after the post-pandemic destocking.

Many investors (and therefore the algos) seem to be playing it extremely safe here. One would think they are waiting for a confirmation of the inflection, but we already had that, and there was still no reaction. Just for context, Stevanato grew revenue by 1% in 2024 and will probably grow HSD this year while expanding margins significantly. Danaher’s bioprocessing business shrank 4.5% in 2024, but management is guiding for HSD growth this year. When will sentiment flip? I have absolutely no clue, but I do believe some things make the setup appealing:

Accelerating top lines

The resilience of the industry due to the mission-criticality of its products

The fact that it’s a very hated sector right now

The positive skew the industry has to AI (talked about this here)

We’ll see what happens from here on out.

The industry map was mostly red this week, with a few exceptions:

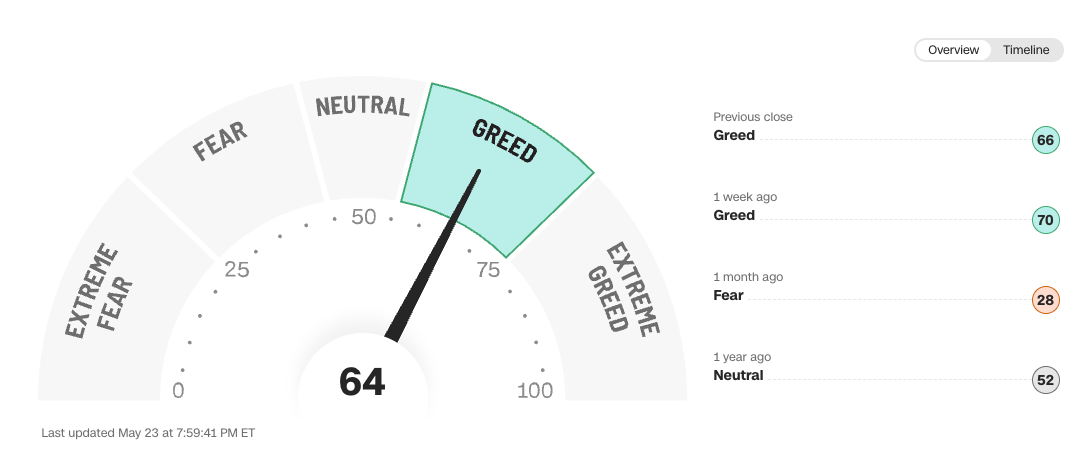

The fear and greed index retraced slightly, although it remained in greed territory:

The rest of the article where I discuss my transactions and the news of the week is reserved for paid subscribers.