Wow Medpace

Q2 earnings digest

Medpace reported outstanding earnings on Monday, and the market’s reaction was quite something (put mildly):

Due to my investment style and the kind of companies I look for, I never thought it was possible to experience a 40%+ appreciation in one day, but this is why one should never say never (I guess). Now, while earnings were exceptional, another element of the story likely added fuel to the fire and enabled this performance: shorts. Medpace had been heavily shorted coming into earnings (10%-12% short interest), so at least a portion of this pop seems to be caused by shorts covering their positions:

Note how short interest has little predictive power over the long term. The only period when short interest was as high as coming into Q2 earnings was in February 2019, and Medpace is up around 360% (excluding the post-earnings pop) since then. When considering someone’s long/short investment thesis, I always recommend having in mind that investment horizons matter greatly in this business. Of course, the fact that this pop was to an extent caused by short covering means that we might give some of it back over the coming days (who knows).

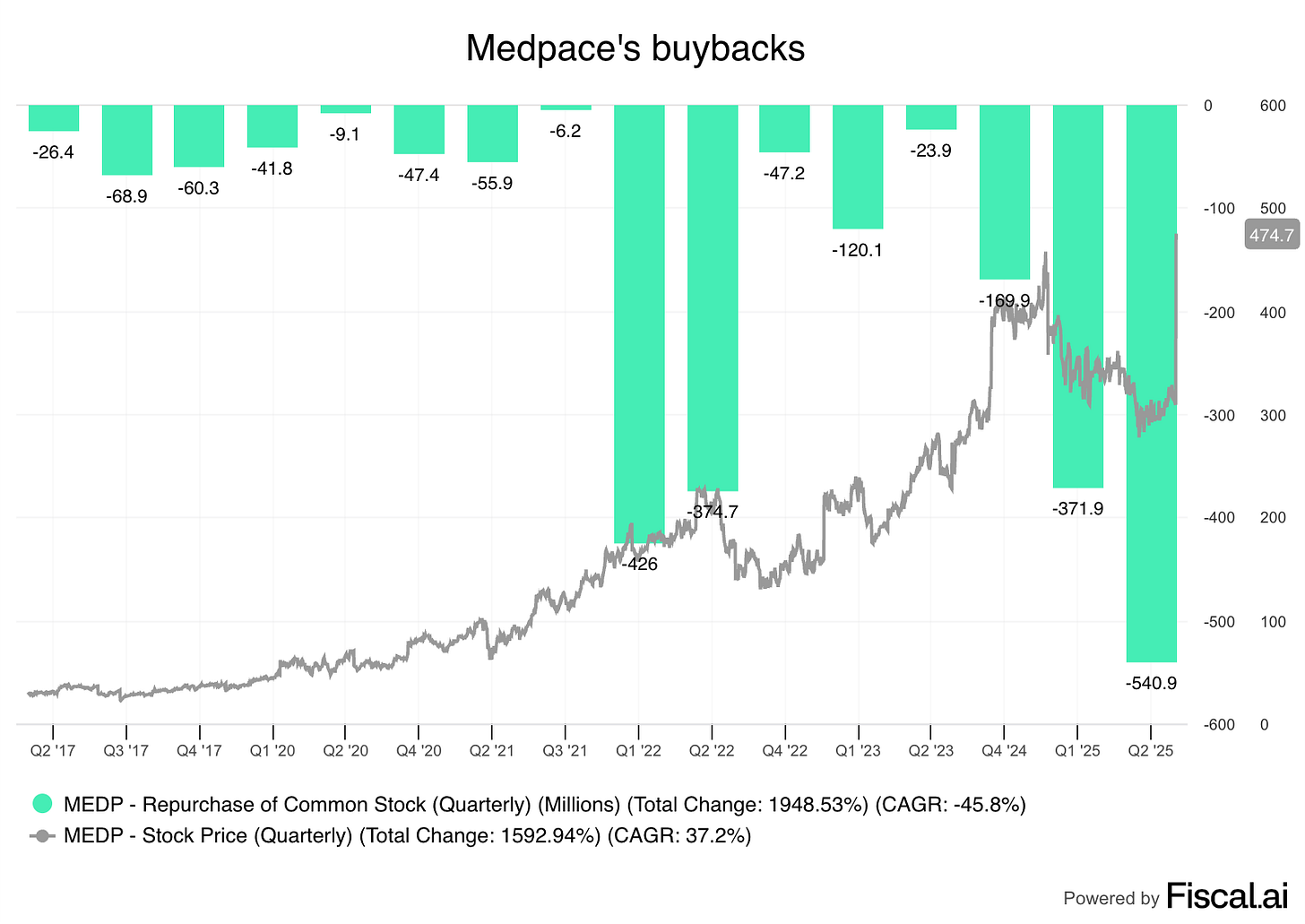

Medpace’s management managed once again expectations beautifully and took advantage of the pessimism baked into the stock coming into earnings. The company repurchased approximately 10% of its outstanding shares in Q1/Q2, before delivering strong earnings. Management utilized the entire cash position, along with Q1/Q2 cash flows, to repurchase approximately $900 million worth of stock. While skeptics will say this was luck, I believe the track record of opportunistic buybacks is evident:

While seeing a management team do buybacks opportunistically might be raise some eyebrows, what should really raise eyebrows is the fact that not the majority of management teams are good at repurchasing stock. Medpace has basically…

Managed low expectations

Bought 10% of the shares outstanding at an attractive valuation

Raised expectations once the buybacks were completed

While it would be impossible for an individual investor to buy the stock with the same information management has, it’s honestly surprising not to see more CFOs/management teams being good at repurchasing shares when they basically know the two variables that matter:

The market’s expectations

The numbers they will report

In short: management teams should be able to play “God” in the expectations game. On the other hand, individual investors can do their best to calculate #2, but they will only know #1 for sure. When a good (but not outstanding due to CRO not being the best industry) business like Medpace allocates capital in such a counter-cyclical way, it becomes an extremely interesting company. Capital allocation decisions add up dearly over long periods, and it’s definitely easier to sleep well owning a company where you know that management has got your back.

I would also like to add that even though August Troendle (Medpace’s CEO) receives his fair share of criticism (probably due to being an outsider), he stands out as a very honest manager, and I’d say that anyone who’s read/listened to Medpace’s calls would agree. He is not afraid to discuss the business's problems, and it doesn’t seem as though he intends to hide any issues.

All this said, let’s take a look at earnings.

Medpace’s earnings

As I mentioned earlier, earnings were exceptional, not only on an absolute basis but also relative to market expectations. Let’s take a look at some of the numbers…

Revenue came in at $603.3 million (up 14.2%) compared to market expectations of $538.8 million—a 12% beat.

EBITDA of $130.5 million (up 16.2%) compared to market expectations of $117.3 million—an 11% beat.

Guidance for 2025 was raised to $2.47 billion from a prior guidance of $2.19 billion. That’s a guidance raise of 13%. Growth at the midpoint of FY 2025 guidance has gone from 3.9% to 17.1%

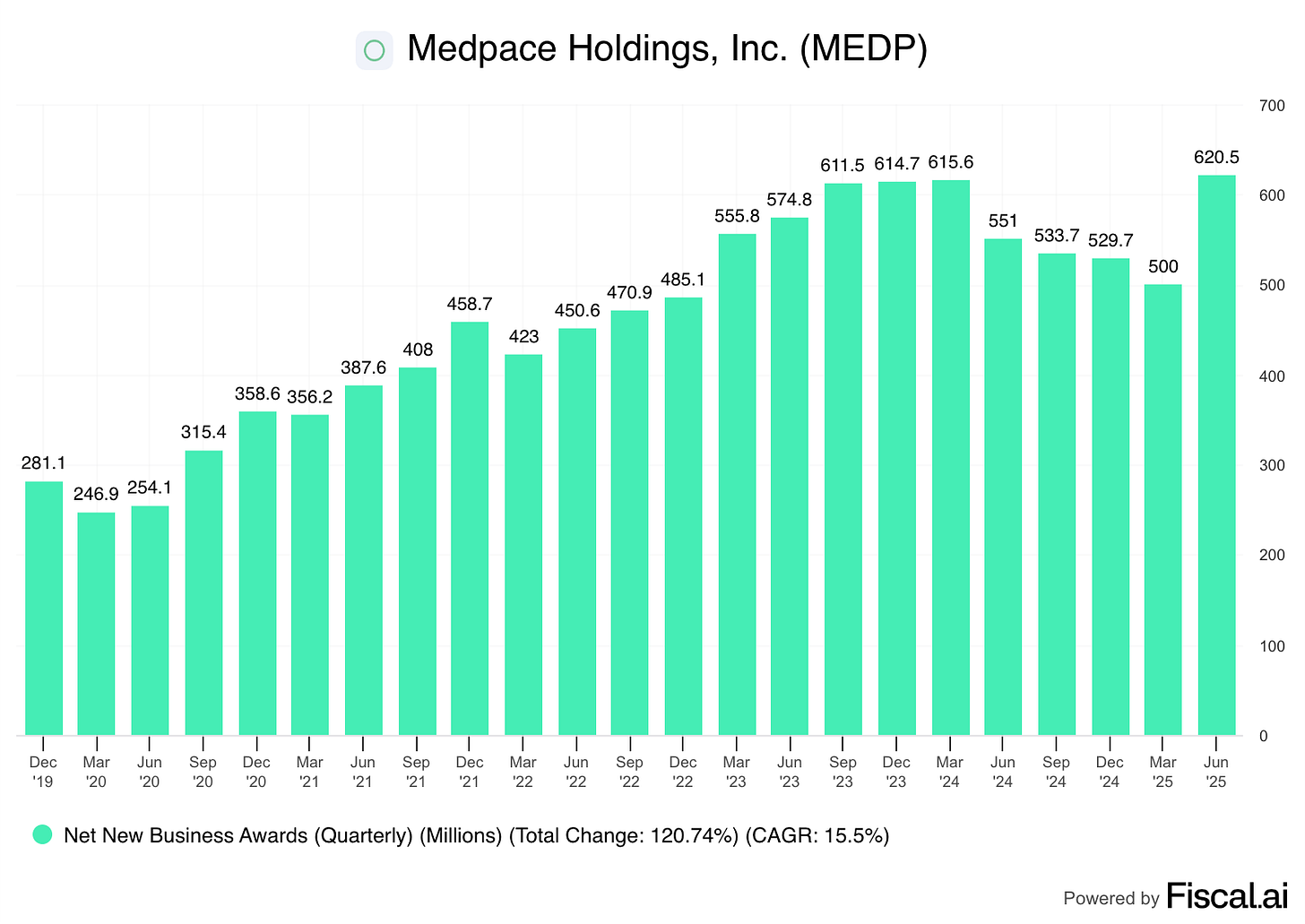

While these numbers surely portray that earnings were exceptional, I believe it’s also essential to understand where the strength came from. The highlight of the call was that this outstanding performance took everyone (including management) by surprise for several reasons. The first one was cancellations. Medpace mentioned in Q1 (last quarter) that the RFP (request for proposal) activity was not the problem because activity remained high, but that the level of cancellations was above average. This is precisely what reversed in the quarter: cancellations came in lower than expected in Q2, which, together with an accelerated decision making by customers, allowed strong growth in net new awards and a book to bill ratio above 1:

Net new awards were strong even in the face of a lower-than-usual win rate. RFP activity was high and compensated for the lower win rate, so RFP volume won was still at a good level. Management also explained how investors should contextualize the win rate. It’s a dollar-based metric and therefore it’s dependent on the win rate of large projects versus small projects (i.e., not winning a large project is significantly detrimental to the win rate). Medpace does not compete as favorably in large projects, so losing a couple of those can impact the win rate without this necessarily being bad for the business. This is what happened in Q2.

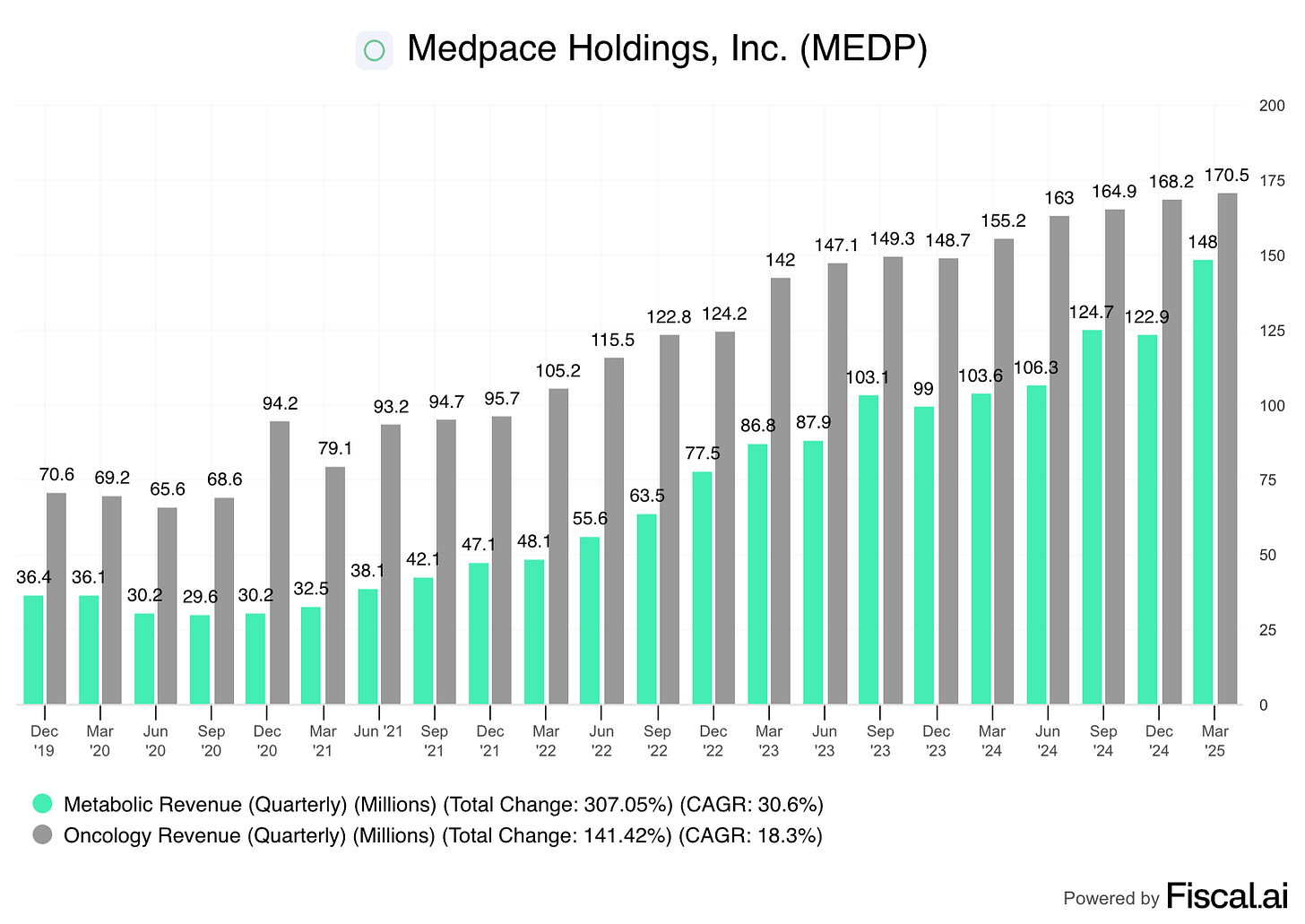

Another reason for the outperformance was the accelerated backlog burn. Medpace burned through more than 21% of its backlog in Q2, an unusually high percentage compared to its typical 17% in most quarters. The reason was two-fold. First, the company recognized higher pass-through revenue. This was also a tailwind for margins because this type of revenue doesn’t require significantly higher labor. This resulted in higher labor productivity, which nobody had expected (neither management nor analysts) and, consequently, higher margins. In my in-depth report, I mentioned that Medpace’s labor productivity was close to a peak and that it would be challenging to see it increase further (i.e., I wasn’t expecting it either).

Secondly, the company’s revenue and backlog became more heavily weighted toward metabolic clinical trials, which burn at a faster rate than oncology trials. Metabolic revenue has been growing faster than oncology revenue for a while and is catching up:

Management expects this to persist into the second half of the year, so they were evidently asked about the sustainability of the current revenue growth. The rationale here is that, if Medpace is burning backlog faster than usual and this backlog is slightly decreasing (it was down 2% year over year in Q2), then revenue growth might look great this year, but this situation might create an air pocket next year. August Troendle argued that they expect to achieve a book-to-bill ratio of 1.15 in the second half of the year, which should support future growth even as backlog burn accelerates temporarily. A 1.15 book-to-bill ratio would mean that net new awards are up 40% year over year, a target that management believes is achievable as long as cancellations remain low.

One thing that has become clear this quarter is that Medpace’s business is pretty unpredictable, even for its management team. Almost everyone believed that R&D spending (which includes clinical trials) would be extremely weak, particularly in SMID biotech due to funding issues. Well, it turns out that quite the opposite ended up happening:

RFP flow in Q2 continued to be strong, and we saw an increase in rate of decisions. Total pending RFP dollars were down on the quarter, and our award notifications were strong. Cancellations were down across the pipeline, and awards recognized into backlog were the highest in the past five quarters. With a book-to-bill of 1.03 in the second quarter of 2025. We continue to see a strong potential for book-to-bills returning to above 1.15 in Q3. Although funding challenges remain acute for many of our clients, the large majority of those clients with ongoing studies were able to obtain sufficient funding to keep the trials running. The funding environment has been stable to improved.

Source: August Troendle during the Q2 earnings call

What the guidance implies and updating my valuation

I’ve already discussed above that the new guidance implies significantly faster growth in 2025 than previously envisioned. To reach the midpoint of its annual guidance, Medpace must accelerate its H2 revenue growth to 22% from 11.8% in the first half. For several reasons, August Troendle believes it's achievable:

Due to several factors, including better funding than anticipated, fewer cancellations, accelerated client decisions, rapid project startup, shifting mix away from oncology and toward faster burning therapeutic areas, and significantly higher investigator costs. We now anticipate accelerating revenue in the second half of the year. As a result, our revenue guidance has been raised by $280,000,000 at the midpoint.

A significant portion of the raised revenue guide comes from pass-through costs, rather than direct service revenue, but it’s still a substantial increase. In terms of margins, the full-year guide implies an EBITDA margin of 21.5%, a decrease of 130 bps compared to 2024. While margins have benefited from higher productivity this quarter due to higher pass-through costs, management did mention they expect to see more hiring in the back half of the year.

What to do after the 50% pop?

Two things have changed significantly since I discussed Medpace’s valuation in my in-depth report (published May this year): the stock price and the growth expectations.