Some bad news...but some excellent news

Texas Instruments' Q2 Earnings Digest

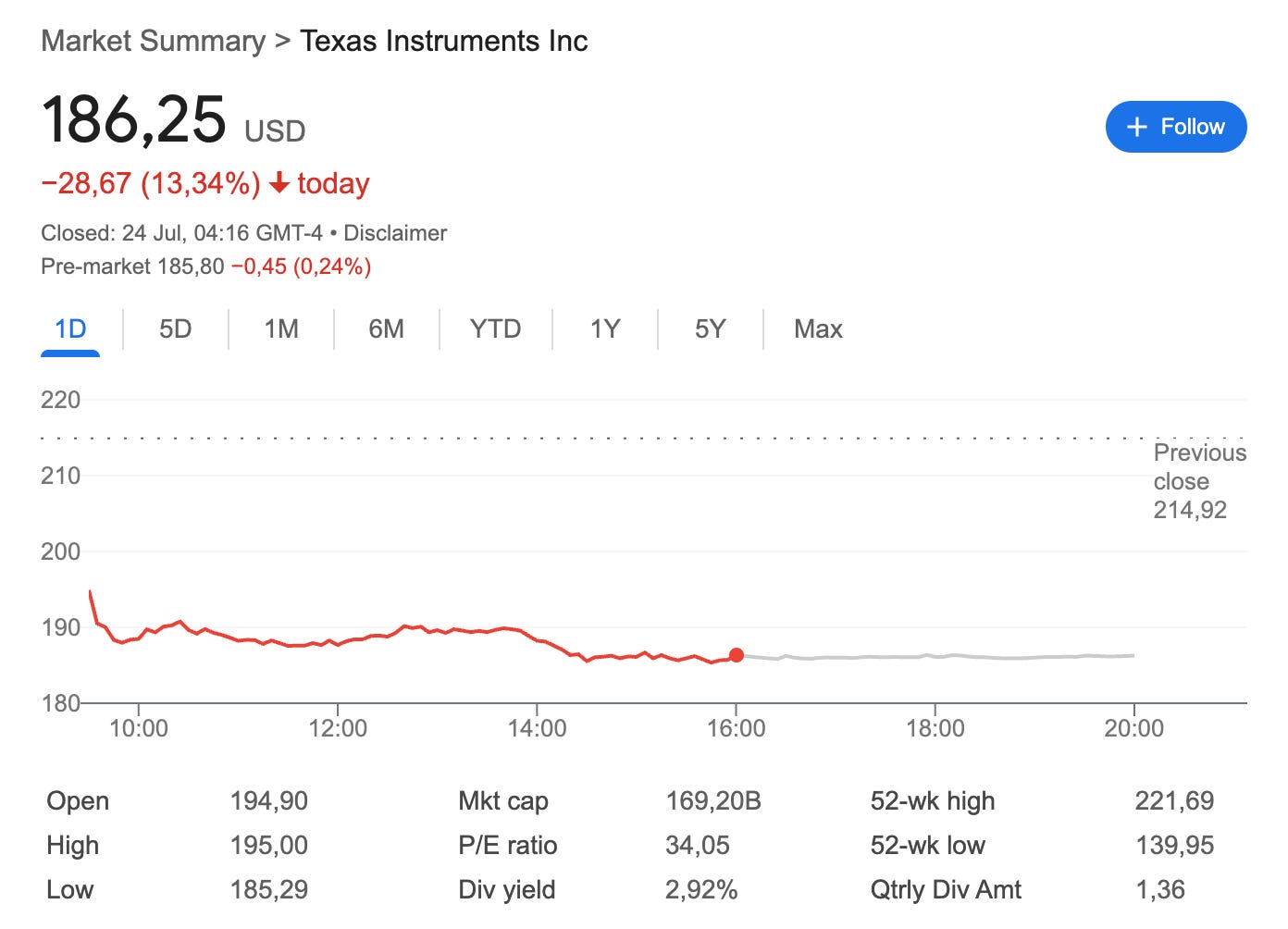

Texas Instruments reported strong Q2 earnings on Tuesday, but the guidance for Q3 was somewhat disappointing. This took the market by surprise because many investors were anchored to the positive tone management had exhibited over the last few months. Both the guidance and management’s tone signalled caution ahead, which is simply something one can’t “afford” when the stock is trading at all-time highs. Not unexpectedly, the stock dropped significantly the following day:

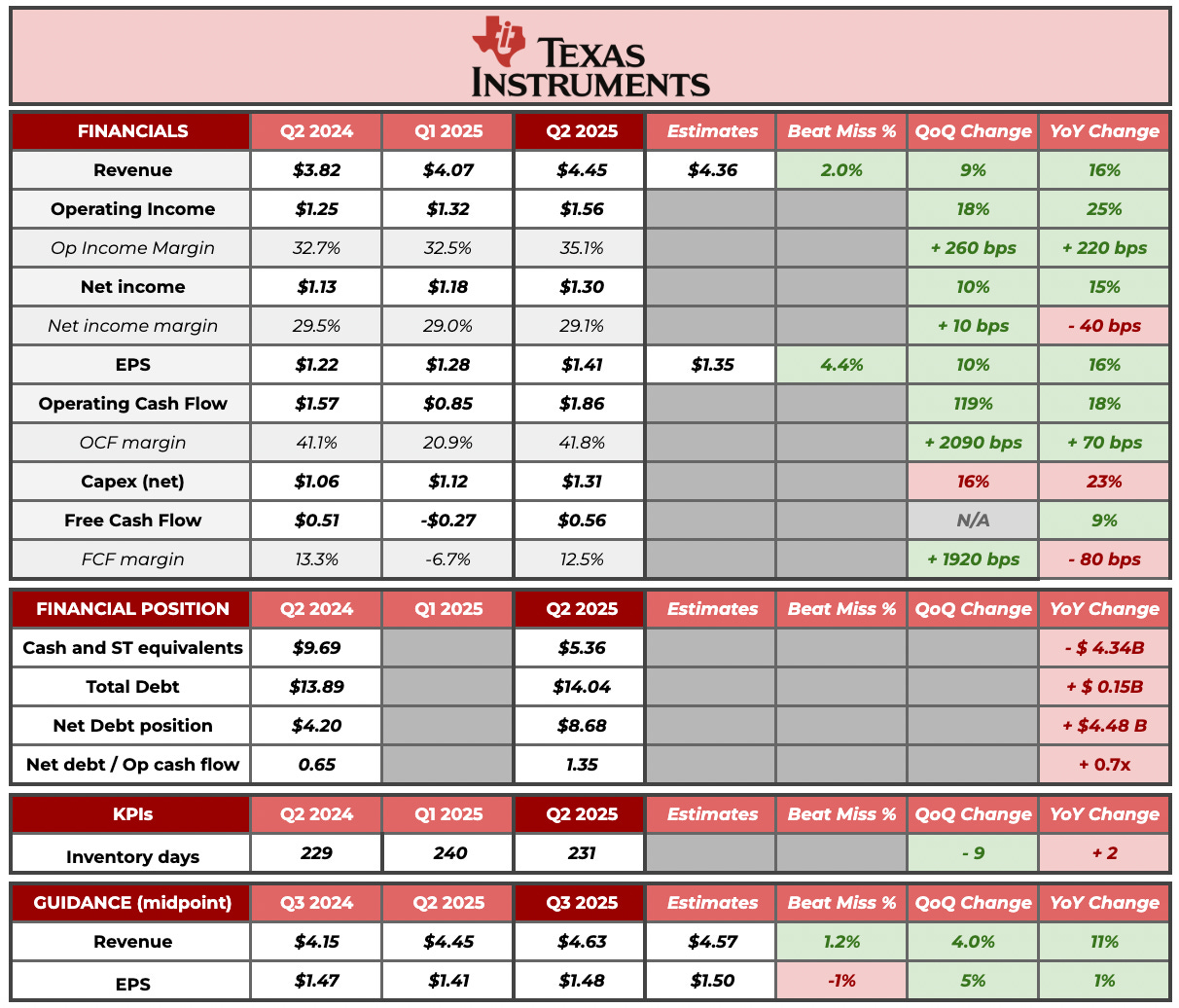

Although it may not seem like it, Texas Instruments beat both Q2 revenue and earnings estimates. Revenue came in at $4.45 billion compared to estimates of $4.36 billion (a 2% beat), while EPS came in at $1.41 compared to estimates of $1.35 (a 4% beat). The company also enjoyed strong operating leverage as revenue grew both sequentially and year over year:

While a lot of headlines scream that guidance disappointed significantly (probably exacerbated by management’s tone), the midpoint of management’s guidance ($4.625 billion) was 1% ahead of the market’s expectation of $4.57 billion. The guidance range was pretty wide, though. At the low end of its guidance ($4.45 billion), TI would be -2.6% below expectations, but it would be 5% above if we assume the high end ($4.8 billion).

The company’s Q2 guidance last quarter took many analysts by surprise, who inquired about a potential pull forward created by tariff uncertainty. Management claimed last quarter that they did not think it was related to a pull forward but rather to the normal cyclical recovery. With Q2 earnings coming in above guidance and Q3 guidance disappointing, it feels as though there was indeed a pull forward.

Now, there seems to be something that many people are overlooking in terms of cash taxes that, in my view, is significantly more positive than anything negative one can find in management’s inability to manage expectations properly. I’ll discuss more about this topic later on in the article.

Digging deeper into the numbers

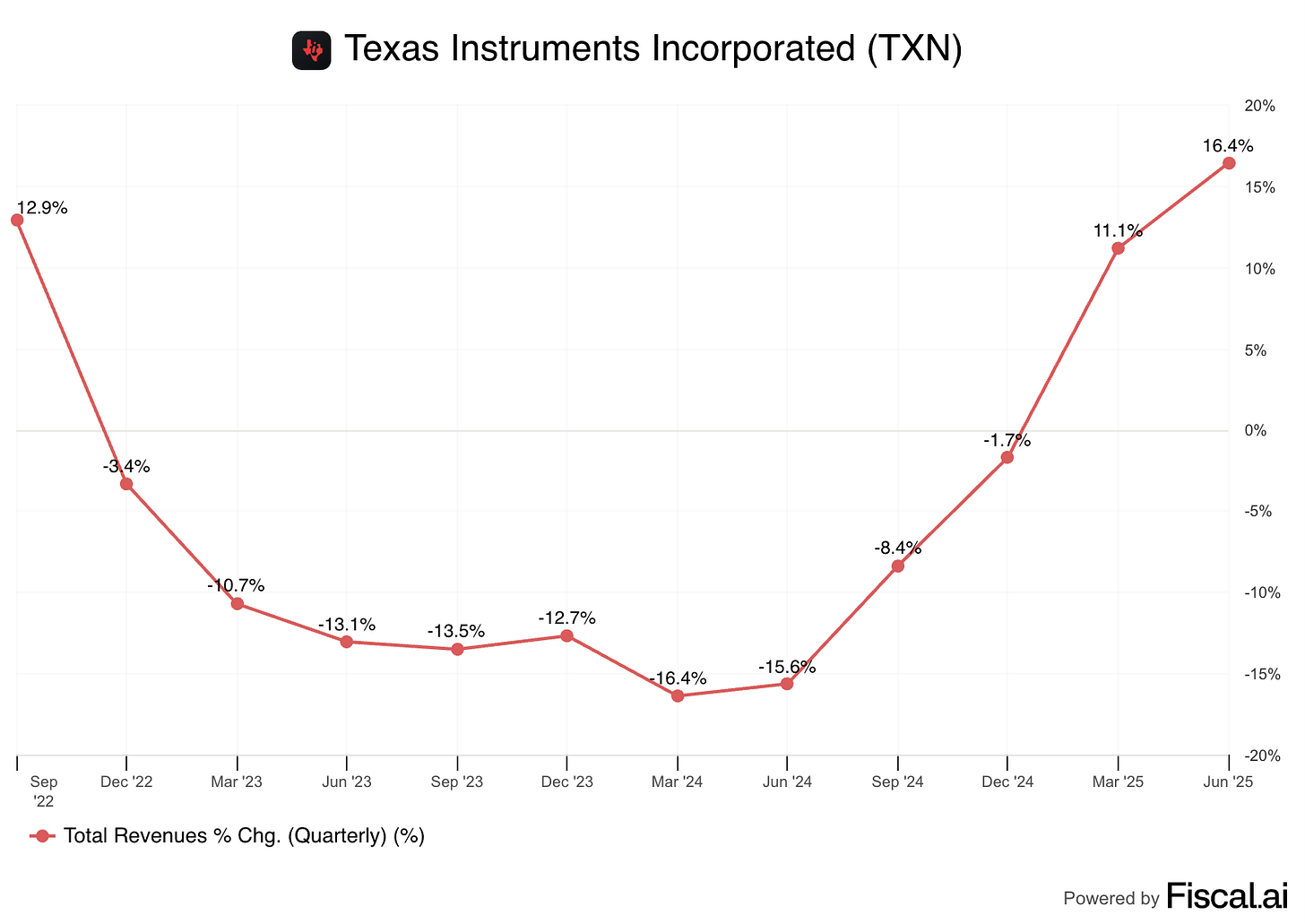

So, even though guidance disappointed, TI remains firm in its cyclical recovery. Revenue has continued to grow both sequentially and year over year, although comps are getting tougher and Q3 is a slight setback at the midpoint of the guide (at the high end, year over year growth would be 16% as well despite the higher comps):

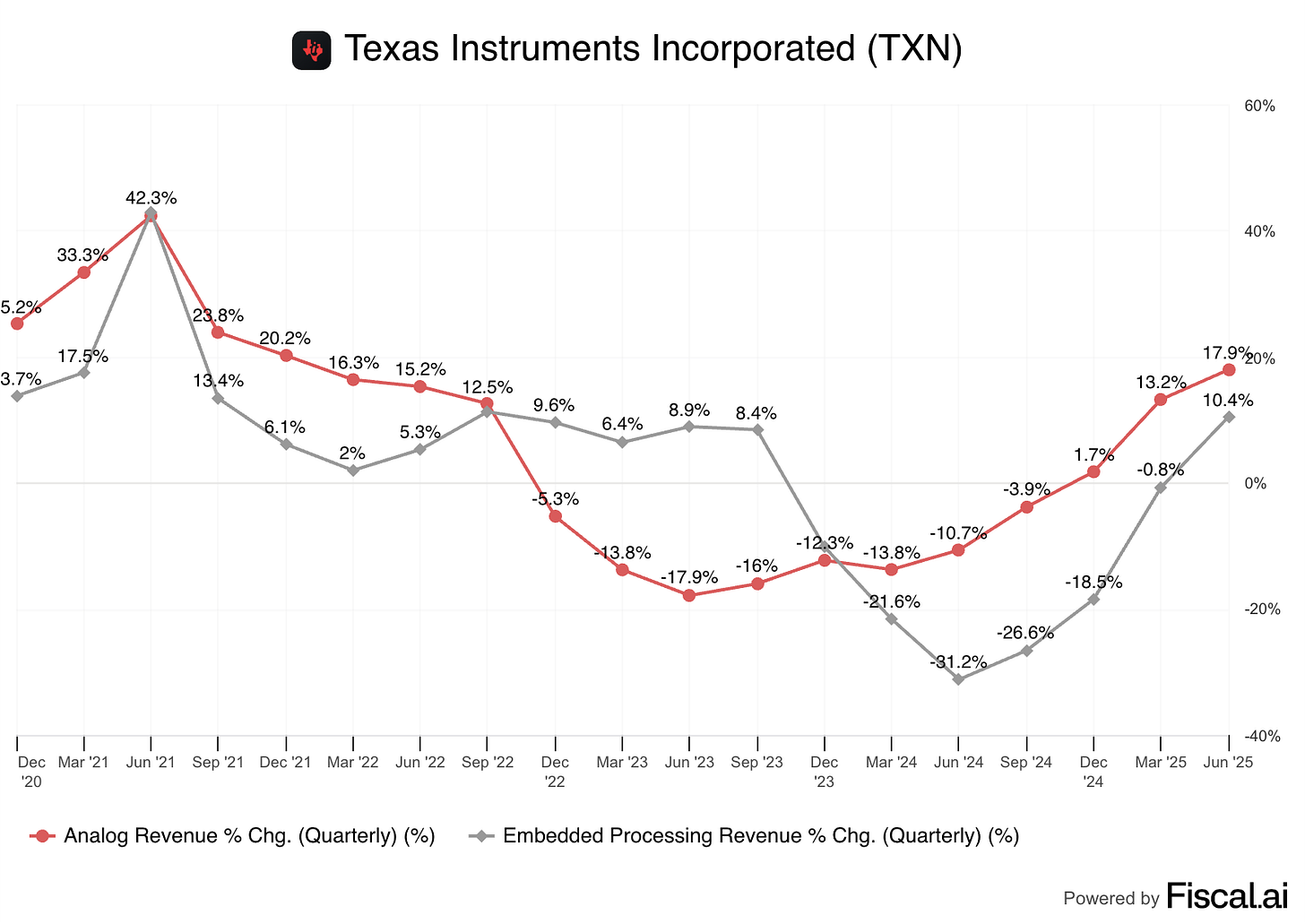

For the first time in a while, both analog and embedded grew double digits. Analog has been growing at a good pace for some quarters, but it was the first time in a since Q3 2022 that both Analog and Embedded grew in the double-digit range:

As for end markets, management mentioned that the cyclical recovery is well underway in four out of five markets. The lone “star” here is automotive, which remains in a downcycle. Management, however, believes that the downcycle will be less pronounced than it has been in other end markets due to secular tailwinds:

I will say that automotive had not recovered yet, but because of content growth, we think the cycle here is going to be less pronounced and more shallow.

We’ll see what happens, but it’s undeniable that the cycle is well underway despite the hiccups. To the extent that the cycle will play out is a different matter, but one can’t deny that the cycle is indeed unfolding.

Note that operating leverage drops significantly in Q3, with the company experiencing only 1% year-over-year EPS growth despite an 11% increase in revenue. Management alluded to several reasons here. First, the financial position is in worse shape now, with less cash available to be invested in interest-rate-yielding debt, and the coupon rate of debt has increased somewhat (currently stands at 4%). To this we must add that gross margins are expected to be flat sequentially due to higher depreciation. Another interesting point is that these EPS growth estimates might even be a tad too high, as management noted that they did not take into account the newly enacted US tax legislation when setting guidance. I’ll discuss this topic in more detail later.

The reasons behind the caution

Management flagged that, due to lead times being relatively low, they don’t have much visibility into the future. Additionally, their fragmented customer base means they don’t have a clear understanding of why customers are ordering. While this explanation makes sense, they should’ve thought about it before claiming last quarter that the outperformance was not due to a pullforward. This would’ve definitely helped manage expectations and avoided a 52% rise from the April lows to ATHs and a post-earnings drop of 12%.

The source of cautiousness could be found in the industrial market in China. Management now believes that there might have been a pull-forward effect, as Industrial Activity in China was running hot in Q2, but that it normalized towards the end of the quarter. They shouldn’t have sounded confident last quarter if they lacked visibility, but they now seem to be protecting themselves just in case; the Q3 guide implies that there was indeed a pull forward even though they do not know for sure.

It’s true, though, that despite the volatility in expectations, not much has changed in terms of where TI will end up YTD after Q3. Let’s crunch some numbers. Expectations for Q2 and Q3 were $4.36 billion and $4.57 billion, respectively. If we add these up, we reach expectations of $8.93 billion in revenue across both quarters. Let’s also add the Q1 expectation to get to the YTD expected number. Expectations for Q1 were $3.91 billion, bringing what the market expected YTD (Q1+Q2+Q3) to $12.84 billion. If TI reaches the midpoint of its Q3 guidance, the company would have delivered $13.15 billion YTD at the end of Q3, or roughly 2% above what the market expected at the beginning of the year (and this is with Q2 and Q3 expectations probably having risen significantly since the start of the year). There’s no denying that expectations were not managed as they should, but the outcome is what matters unless you want to play the sell-side game. Of course, TI’s lack of visibility might also mean that the sell-side might expect Q4 numbers will be lower than anticipated.

I know what you might be thinking: it’s not estimates that are important, but how the company performs against said estimates and its valuation at any given time. Well, TI’s stock was trading at roughly the same price as today in January, but revenue YTD is 2% above estimates despite the upcycle being well underway and the company announcing a significant cash benefit from newly enacted tax legislation:

I think during the last call, everybody was pushing back, how could it be that TI will grow 7% sequentially and I think we’ve upsided there, right? So I think right now maybe the expectations were higher, but we are just calling the forecast the way we see it.

Something that many people seem to have missed/ignored is that there was also great news regarding cash flows. This is not an excuse, though. Management did not manage expectations as they should’ve, and that’s on them! Management did say that they are still running well below the trend line, meaning that we’ve not even reached mid-cycle:

We are still running double digits percentage-wise on units below trend line.

Capital allocation and the great news

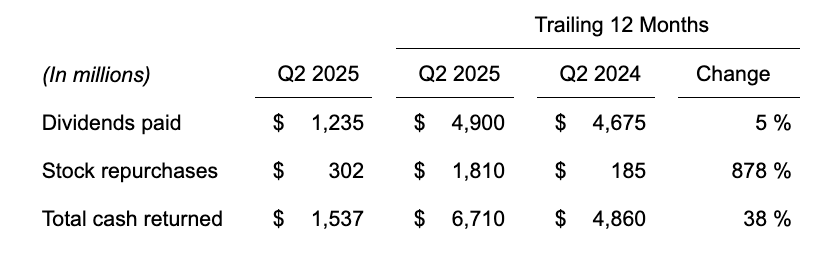

TI surprised some investors with a $300 million buyback, primarily because the company is investing a lot of its cash flow into Capex as part of its capacity expansion plan and the stock was trading close to ATHs at quarter end. Some are even flagging that the company is not generating sufficient cash flow to cover its dividend and the buyback, something that is evidently true:

TI has generated $1.7 billion in cash flow over the past 12 months but has returned $6.7 billion to shareholders over the same period. What investors are also puzzled about is that TI decided to do a buyback while sitting at ATHs despite the management team having a history of countercyclical buybacks. Now, this needs context. The reason is that Liberation Day took place in Q2, and TI might have repurchased shares at $140 while pessimism was at its highest. I guess we’ll have to wait and see when the 10-Q is filed, but the fact that they conducted a buyback in Q2 doesn’t mean they did so at the price the stock closed Q2 at.

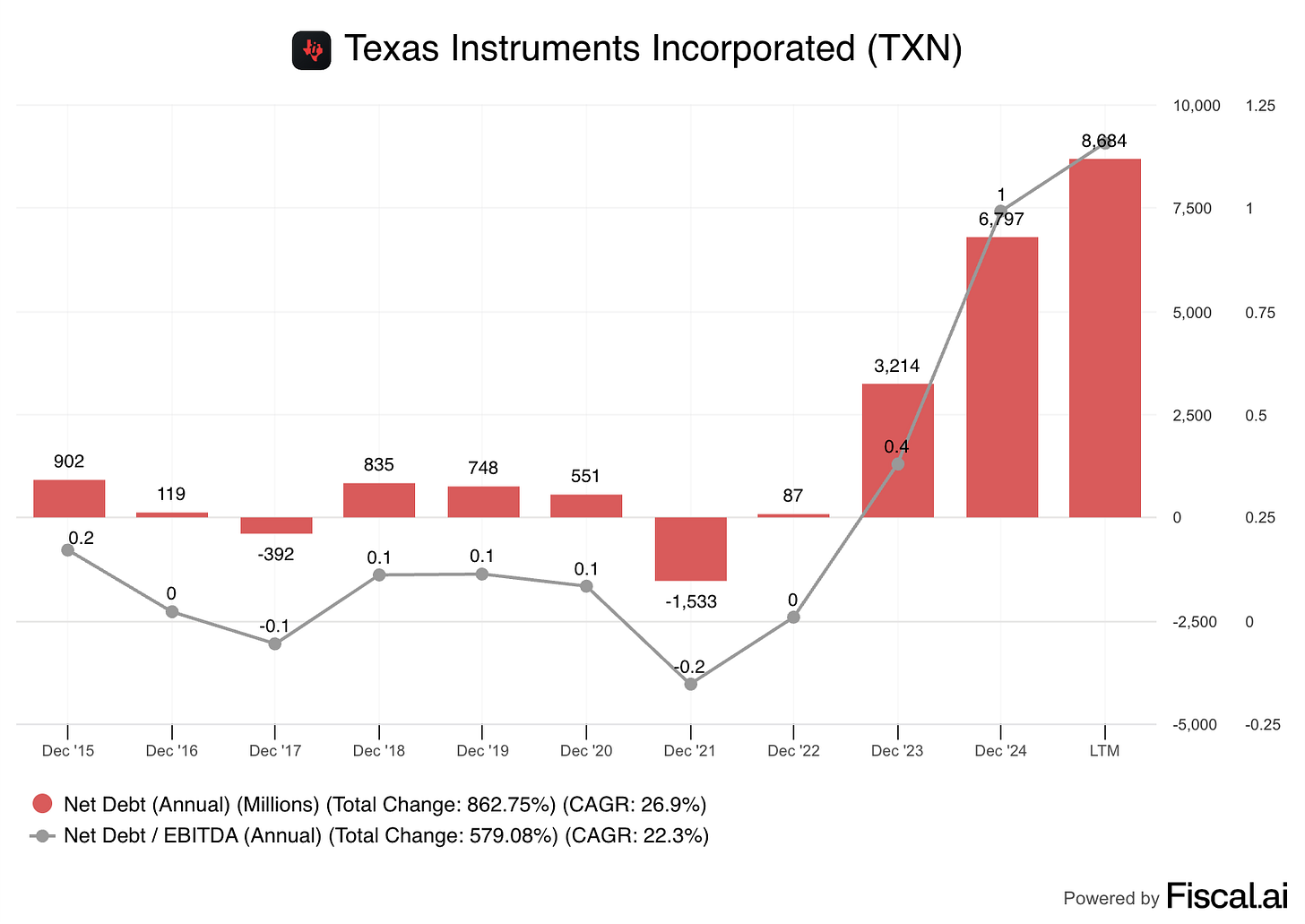

TI initiated its Capex expansion plan with a significant cash position, which it has since drawn down. The company has also issued debt to return money to shareholders. The net debt position is up substantially, and the net/debt to EBITDA ratio also increased proportionately, albeit it’s still at a lowish level considering the resilience of this business:

While this might sound worrying, we must not forget that several things took place at the same time:

TI was going through a downcycle

TI was going through a significant capacity expansion plan

The ITC money came in with a lag

With a net debt-to-EBITDA ratio only slightly above 1 and these three cash flow headwinds reversing at the same time, I honestly don’t think TI’s financial position is worrisome.

Cash flow is a particularly interesting topic in light of the recently enacted US tax legislation. Management claimed that the GAAP tax rate might increase in Q3 2025 and for the whole year, but that they expect the new legislation to result in “significantly lower cash taxes for many years.” Let’s take a look at what has changed, as it brings important implications when considering the estimates shared by management during the last Capital Management Update.

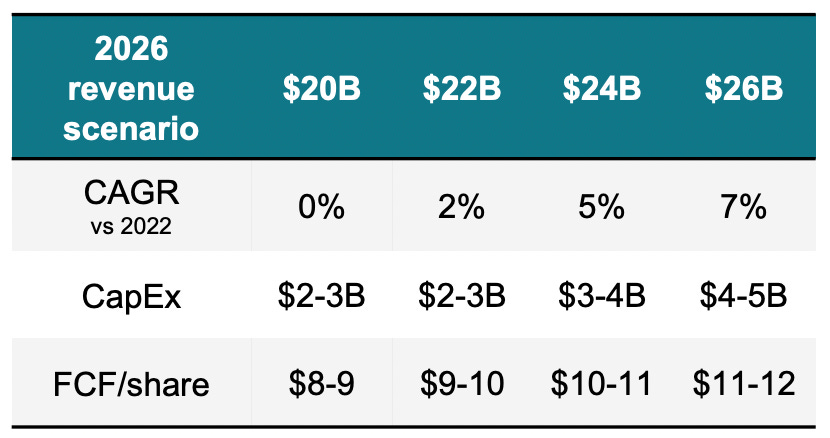

The most straightforward change is that the ITC (Investment Tax Credit) will increase from 25% to 35% starting in 2026. This means that if TI invests $2 billion in Capex in the US in 2026, the company will receive an additional $200 million in tax credits, which will flow directly into Free Cash Flow. If the company plans to spend $5 billion, then the flow through to free cash flow is $500 million. Again, these estimates are in addition to the ITC credits management expects to achieve at a 25% rate (already included in management’s estimates shared during the Capital Management Update).

There were additional changes. For example, companies will now be able to expense 100% of US R&D and “eligible capital expenditures” in the first year, rather than the usual 5-year amortization. The math here is more complicated because we don’t really know precisely what portion of TI’s R&D expenditures are domestic. Still, if we assume that TI spends $2 billion on R&D in the US in 2025 and 2026, at a 15% tax rate, the cash benefit from this new law change is approximately $300 million in each of those years. Now, this law also establishes that companies can make a catch-up of R&D spend from 2022 to 2024. The unamortized R&D balance is approximately $3.6 billion, which, at a 15% tax rate, would result in additional cash tax savings of $540 million in 2025. This catch-up creates an increase in the GAAP tax rate because it cancels the existing deferred tax asset and is the reason why Rafael Lizardi said the following:

We are currently evaluating the changes in the legislation are going to have on future financial statements. That's why in the guide that we gave, we did not incorporate it. We need additional time to do a full evaluation. However, I would tell you that based on our initial assessment, what we expect, what would likely happen is our GAAP tax rate will increase in third quarter in 2025; however, it will decrease in 2026 and beyond.

More importantly, from a cash flow standpoint, we expect significantly lower cash tax rates for the next several years. So again, we're very pleased with that legislation.

Then comes the new legislation related to bonus depreciation, which would allow TI to deduct a more substantial amount of its Capex invested in year 1. Up to today, TI was allowed to adhere to the following depreciation schedule for its equipment:

80% in year 1

20% in year 2

Starting January 2025, TI will be allowed to expense the full 100% in year 1, meaning that the incremental deduction for 2025 increases by $1 billion (20%*$5 billion in Capex spent this year) and by $1.6 billion in 2026 at the low end and $4 billion at the high end. Assuming a 15% tax rate, this results in $150 million lower cash taxes in 2025 and $420 million lower cash taxes in 2026 (midpoint of Capex guide).

So, if my numbers are ballpark correct (big IF), this is the cash tax benefit TI can get from the newly enacted tax legislation:

2025: $990 million

2026 (assuming midpoint of Capex $3.5 billion): $1.07 billion

At the current share count (911 million), this would equate to approximately $1.08 in additional free cash flow per share in 2025 and $1.17 in 2026. This seems pretty significant if we take into account how it bumps management’s FCF per share estimates shared in the latest capital management update:

At the low end, it bumps free cash flow per share by 14%. At the high end, it bumps FCF per share by 10% (this calculation is not exact because cash savings increase with Capex, but it’s a quick approximation). Now, a quick disclaimer: I am not a tax expert, and although I have done my fair share of research to arrive at my estimates, they may be incorrect. They will most likely not be precise, but what does seem evident is that the improvement in Free Cash Flow per share coming from said tax changes is significant (management’s tone also seems to point this way). What does seem likely is that TI’s EPS will come in lower than expected in 2025, but with a higher cash conversion due to lower cash taxes that will directly drop through the FCF figures.

The drop in the current share price coupled with the “updated” FCF figures begs the question…