Annual Recap 2024

Hi reader,

Another year and another annual recap (you can find last year’s annual recap here). I’ve already been doing investment research full-time for over two years, and with the benefit of hindsight, I can confidently claim that I made a good decision leaving the safety of my previous job to embark on this uncertain (but thus far rewarding) journey.

Best Anchor Stocks has always been about high-quality research and content, so before going into the recap as such, I thought it would be a good idea to share the most popular articles of the year (I recommend reading this annual recap before reading these). I published 134 articles in 2024, from which these 5 can be highlighted (in order of popularity):

The feedback based on these results is clear: you enjoy industry and company deep dives more than anything. This makes sense, but I have also found that many also find value in general investment articles, so I plan on writing those in 2025 as well.

I also published 8 deep dives in 2024 (Diageo, Hermes, Atlas Copco, Deere, Keysight, Stevanato Group…and several that were not disclosed). If you are interested in Copart (CPRT), I also went rather deep into the company with my good friend Clay Finck: ‘Copart Stock Deep Dive w/ Leandro from Best Anchor Stocks'.

I’ve also recorded several podcasts this year. I’ve not been as active as I would’ve liked on the podcast front, but I plan to publish episodes more recurrently in 2025 (already 3 guests lined up). The top three episodes of the year were the following:

Investing in High-Quality Companies w/ Barry Schwartz and Ernest Wong from Baskin Wealth

The Picks & Shovels of the Healthcare Industry w/Peter Mantas

Best Anchor Stocks (the investment research service) has had a good year, going from $0 in ARR (Annual Recurring Revenue) on Substack to becoming a respectable business. It has performed better than I imagined when I launched the paid offering in the summer, but I am not satisfied. It has also brought an important benefit by allowing me to widen my network. Sharing content online has far more benefits than I had ever imagined, and I plan to do this for a long time.

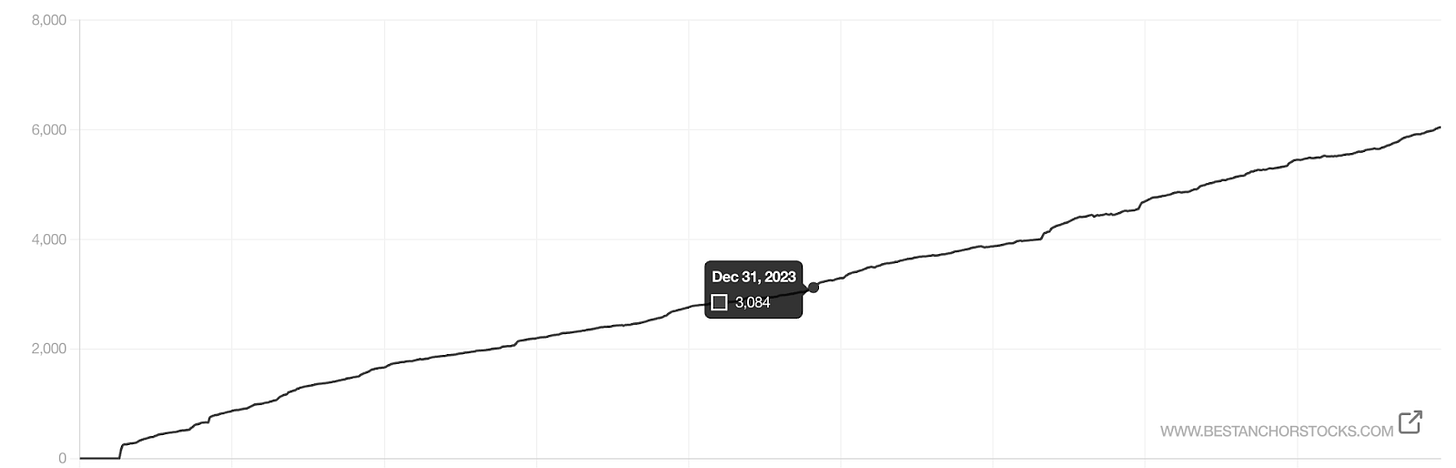

The free portion of Best Anchor Stocks has also performed great. Free subscribers doubled in 2024, and growth has recently accelerated:

I am very grateful to all the people who have made this possible. Of course, Best Anchor Stocks is much more than Substack, as I also share my content in Spanish (Invirtiendo en Calidad) and Seeking Alpha. All in all, it has been a good year, but I will work hard to make 2025 even better.

Reflecting on Lessons Learned

2024 has also been a good year from the POV (point of view) of lessons learned. One of the things I like the most about investing is that there’s always something to learn regardless of one’s experience level. It’s when one thinks that there’s nothing more to learn that things start to go south. I understand why some people would like to portray an image of superiority in this industry, but I tend to be wary of people who believe they don’t have anything else to learn. This stands true in any career, but probably more so in investing.

Anyways, earlier this year, I shared on X some lessons I had learned through these years. These are the ones I laid out in the original thread:

Demand determines growth, supply determines profitability. Focus on the latter: many people focus on how large a market will be (I used to be one of them), but what ultimately determines a market’s attractiveness is this growth and size coupled with significant entry barriers that limit new supply. It’s not about how big the market is but to which companies the growth accrues.

Track record of shareholder value creation matters. If a company is perceived as high-quality, but its stock has failed to perform well over the past 5-10 years, then something is “wrong.” In short, if a management team is vocal about how high quality their business is but the stock has gone nowhere for a while, maybe there’s a problem, which can come from two sources: (a) the business is not as high quality as its valuation portrays, (b) management does a bad job at communicating company quality to the market.

Research that leads to no action is very important to cultivate pattern recognition (some call it “intuition.”). The goal should be to increase the productivity of the research process: many people tend to act on all their research because they fear having wasted their time. The truth is that research that leads to no action is also an invaluable source of knowledge.

The unimaginable can happen in the stock market (both upside/downside), so being patient and not falling prey to recency bias are key traits: recency bias is THE driving force in the market, especially since daily trading is dominated by algos which typically chase momentum. Being aware that the future might look very different from the past is key (albeit very tough) when immersed in the daily market commentary.

Learning to say "no" and knowing when to sell is arguably a much more challenging skill to master than buying and holding. This is somewhat related to lesson #3, but most humans are geared to say “yes,” so being able to say “no” is a superpower in this industry. Selling is also very tough if you are a long-term investor because you need to find another idea to deploy those dollars (which can already be in the portfolio), and ideas come rarely.

Positions that weigh the most should be those where the downside is somewhat protected: most search for spectacular gains by overweighing the companies that offer the most upside, but these also tend to be those with the highest risk.

The past matters quite a bit. Trying to understand how sustainable the past is is a better investment time-wise than trying to project the future, ignoring the past (which is what many do). I believe the past is a pretty good proxy for the future, although judging its sustainability is key. Mean reversion is real, but what’s also real is the ability of some companies to defer this mean reversion for longer than the market expects.

EMH has many flaws and opportunities can be found in any market cap range. More information doesn't make markets more efficient; if anything, it makes them more inefficient. This is a belief that’s not widely held. Many people believe AI will make markets more efficient, but I believe the opposite will happen.

There are hundreds of portfolio combinations that will yield good results over the long term; no need to "win them all." It’s better to focus on one’s portfolio rather than overobssess with what other people own. Many people will only share the winners either way!

I’d add a couple more that I’ve learned over the past few months…

Cyclicality is not entirely bad so long as one is aware of it and doesn’t disregard it. I used to be afraid of cyclicality, but now I actually believe that it’s where opportunities are present because few people are willing to hold companies that are going through downturns. The reason is two-fold: fundamentals are not going in a good direction, and multiples (almost) always appear optically elevated.

Returns say little if one doesn’t understand risk. A 10% return might be better than a 30% return if the investor who achieved the 30% return was not adequately compensated for the added risk. The tough part is understanding how much risk one is assuming. The goal of any investor is to understand if they are being adequately compensated for the risk they are taking. In short, the goal of any investor should be to maximize risk-adjusted returns. One side of this ratio is easily measurable (returns), whereas the other can be highly subjective (risk).

A look at the portfolio in 2024

I also share my personal portfolio with full transparency with paid subscribers, and while I will not share all the positions here, I thought it would be a good idea to look at the portfolio’s general numbers for the year.

I’ve been reading about a lot of outstanding performances over the last couple of weeks, but I don’t know if this is the result of everyone doing spectacularly well or of one of the following…

Only people who have done spectacularly well sharing their returns

The social media algorithm pushes these performances forward

Probably a bit of both! Two things seem clear, though. First, 2024 seems to be a very positive year for many people and can be considered one of those years where it was “easy” to make money. Historically, there have been many years like these in the stock market, but going through those where making money can be conceived as a miracle will always remain tough.

Secondly, we must be aware that most returns being shared are gross, meaning that they can’t be compared across strategies (I discussed why in this article). You might be expecting a similar spectacular performance from my portfolio, but it didn’t perform spectacularly well. In fact, it underperformed quite materially the S&P 500 and the MSCI World (which is mostly exposed to the US either way).

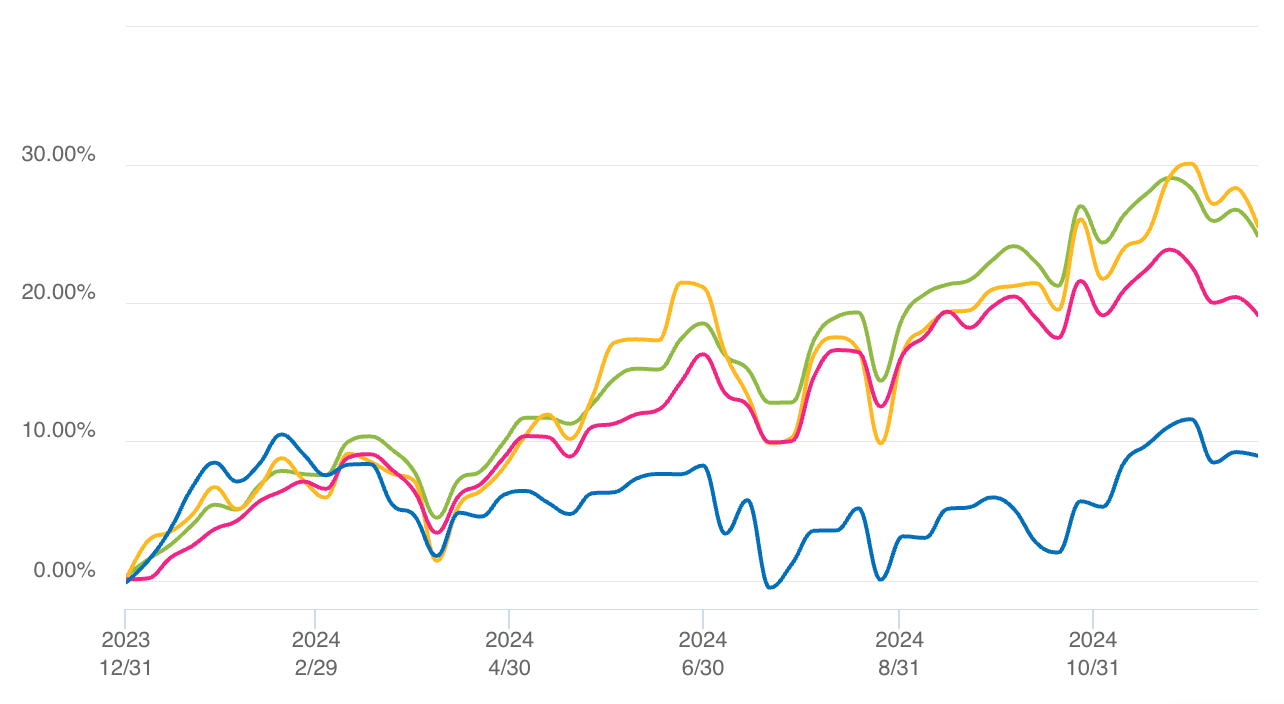

My portfolio’s return (blue) this year was 9.72% (MWR) and 8.98% (TWR) against strong performance from the indices:

While this is evidently disappointing, there’s a reason why I don’t like to share short-term returns: they blur the big picture, which is what ultimately matters. I’ve heard the argument that if you are a fund manager, then mid-term returns should also matter. The reason is that if all of your outperformance has been created at the beginning, then a lot of investors in your fund that have invested after that will probably be underperforming. I understand this argument and think it makes sense, but as I manage my own money from the start, I feel that inception to date is always a better measure.

Anyways, since inception (01/2022), the portfolio has significantly beaten the indices, delivering a 15% CAGR (MWR) compared to a 10% CAGR for the US indices and an 8% CAGR for the MSCI World. I have always measured my returns against the S&P, but I feel the MSCI World might be a better benchmark as I have significant exposure to Japan, Europe, and Canada as well:

These are the returns that matter to me and is the reason why I only share inception-to-date returns. I have been doing this when things have gone well and when they have gone bad. For example, the portfolio delivered returns of 38% last year against 26% for the S&P 500. Something similar happened in 2022 when the portfolio “only” dropped 5.4% compared to the S&P 500’s drop of 18%. So the returns over these years compared to the S&P 500 stand something like this:

2022: -5% (my portfolio) vs -18% (S&P 500)

2023: 38% (my portfolio) vs 26% (S&P 500)

2022: 9.72% (my portfolio) vs 23% (S&P 500)

The reason why I have always shared inception-to-date returns is that all the yearly numbers are a distraction from long-term investing, which doesn’t mean that they do not matter because the LT performance is evidently made of a series of short-term returns. Needless to say, the above is also not a long enough track record to differentiate between luck and skill.

That said, I don’t think it’s a bad idea to focus on “what has gone wrong,” or probably better said, why the portfolio has lagged the indices so much this year. Many year-end letters claim that some companies in the indices have done so well that a lack of exposure to these made it tough to outperform this year. This is evidently true, and my lack of exposure to Big Tech (I only own one company) has definitely played a role in this year’s result. While this might sound like an excuse, it’s actually an admission of a mistake: I should’ve looked closer into several components of the Mag 7 which are high-quality companies and fit my investment criteria (in most cases).

I’ve also made a (double?) mistake with Five Below, but this time one of commission (rather than omission). Five Below’s drop cost me around 3% of annual returns, and I also sold it close to the bottom (at least, thus far) because the thesis had changed. Since I sold it, the stock has recovered 22%, although I will only know if it was a mistake in hindsight.

I believe there might be two other reasons that explain this year’s returns. The first one is that the past two years have been unusually strong, which probably led to some valuations getting ahead of where they should be. Several of my positions enjoyed an outstanding 2023 but were mostly flat this year. Of course, the best course of action in hindsight would’ve been to sell these companies coming into 2023 (and maybe pour these proceeds into Nvidia), but timing these things is quite tough, and the underlying businesses have been performing just fine. It’s normal to see some breathers from time to time. I would also have had to find a place to invest this money in, and good ideas come rarely.

Another reason, which is entirely self-inflicted, is that I have been positioning my portfolio into several businesses that are in a downturn or close to/at an inflection point. I believe not many investors (mainly professionals) are willing to hold these companies because they fear that something like what happened to me this year can happen to them: owning stocks that are currently treading water. This lack of excitement revolving around such companies tends to bring reasonable valuations, which is what I care about over the long term.

I acknowledge that investing in these positions not only might bring somewhat flat returns through a period of time but also significant opportunity costs. I’m fine with taking on this opportunity cost so long as my downside is protected and these companies will eventually do well (in short, I don’t care when these returns are realized so long as they are realized over a reasonable period). I believe this is the case for the companies of this type that I hold so I am willing to hold them so long as the thesis has not changed. I own 7 companies of this type (out of 16), and that has evidently put downward pressure on my returns. Only 2 of these 7 companies enjoyed a positive performance in 2024, and their performances were below those of the indices. I expect this will change once their downcycle ends or their inflection point arrives, but I honestly don’t know when exactly that will happen (hopefully in 2025).

I am not using this as an excuse, as I am perfectly cognizant that it’s an autoinflected wound: I believe there are many opportunities in such businesses and I am willing to expose myself to the opportunity cost. Luckily enough, I am not exposed to the incentive structure of the industry, so I can wait these periods out.

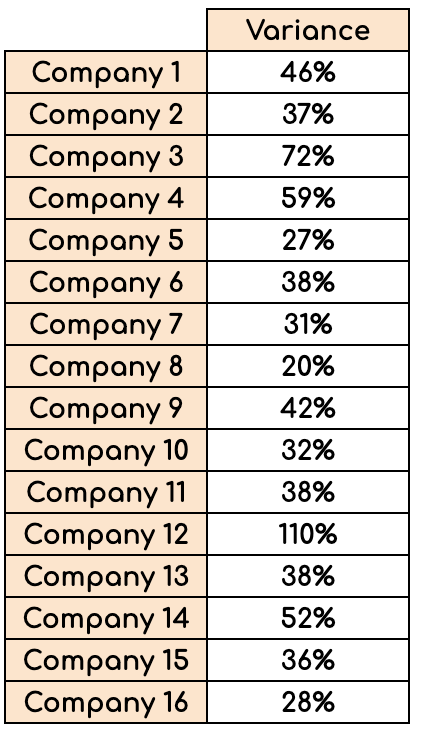

Something that will always surprise me is how the value the market ascribes to any given company throughout the course of any year fluctuates. I’ve crunched some numbers for my portfolio. The average variance (calculated as “High/Low - 1”) over the last year between their high and low for the companies in my portfolio has been a whopping 44% (and I don’t invest in precisely small or underfollowed companies), with the highest variance being 110% and the lowest 20%:

Meanwhile, the intrinsic value change in these companies has probably been significantly lower. What does this mean? That throughout a given year, a company is likely to go through the three valuation scenarios: overvalued, undervalued, and fairly valued. Not always though, as a company can stay in overvalued/undervalued territory while seeing significant swings To take the subjectivity out of my purchases, I came up with a spreadsheet that compares the current price with my estimate of intrinsic value (I shared it with subscribers).

Something I believe I must improve is upping my quality benchmark. I believe my portfolio will have at most 20 companies because it feels like a number I can follow relatively closely and hold conviction in. A universe of high-quality companies is probably in the hundreds, meaning that I should be saying “no” much more often than “yes.” I think this is already the case today but I need to be even stricter because some companies might have made it into the portfolio without meeting the quality I strive for (Five Below is a good example).

It’s obviously not great to deliver these returns during a year when many are posting spectacular returns, and it definitely feels lonely. However, I believe it’s through such periods when one has to remain true to their strategy and I plan on doing just that in 2025 and beyond. One of the toughest things about investing is that the feedback loop is extremely long, so I will only know if this strategy is the right one when at least 5 to 10 years have passed. In other instances of life, the feedback loop is extremely short, and humans are geared to this immediacy. Investing is built differently, which makes it much tougher.

Podium of errors

I have been reading Giverny Capital’s letters for quite some time and was lucky enough to interview François Rochon for the podcast. One of the sections of those letters that I enjoy the most is the podium of errors, where François Rochon shares his biggest mistakes. While this is intended with the same goal, there are some peculiarities. The main one is that I don’t really know if they are yet mistakes because the feedback loop is long (as discussed earlier). This leads to there being errors of commission in this year’s podium, as errors of omission are much more palpable (and costly) over longer time frames.

So, here they are.

Gold Medal: TSM (TSMC)

This has not been a mistake because “it has gone up a lot” but because it has “gone up a lot” and I was closely following the company. I regularly read TSMC’s, Samsung’s, and Intel’s earnings calls as part of my ASML research, and it was pretty evident what was going on under the hood. TSMC did not trade cheaply due to competitive fears but more due to the China/Taiwan risk. This is a risk that I probably overemphasized, as the company already had plans to diversify to other geographies, and it was arguably a global risk (rather than one specific to TSMC).

It’s also true that the AI ramp was also an “unknown” at the beginning of the year, but even without it, TSMC would’ve probably fared pretty well. There goes a 100% return (so far)!

Silver medal: Five Below (FIVE)

Five Below had always been a company that, although attractive, I believed did not fit my investment criteria entirely. Retail can be a great business if done right, but it relies primarily on execution and my thesis revolved around Joel Anderson being able to execute going forward. The company faced some macroeconomic pressures (or so they claimed), and Joel Anderson finally left the company, leading me to sell my position at a 44% loss. Painful, but it brings an important lesson: be careful with retail.

Bronze Medal: Interactive Brokers (IBKR)

Interactive Brokers has been a double mistake for me. I first came across the stock (superficially) when I was at an investment conference, and someone was pitching DeGiro (a European broker). I had been a user of Degiro but had switched to IBKR and knew how superior IBKR was both in cost and coverage. I ran a quick checklist on the company and found…

A growing company

Founder still involved with a significant stake

Good incentive structure

A total focus on the customer (something that I could corroborate as I was one)

This was in November 2023, when IBKR was trading at around $80. The P/E seemed pretty low at 10x, which honestly made me think there was something that didn’t add up. This was a big mistake because I decided to pass on it.

Then, when the company had run up already I decided to look at it in-depth. I found a high quality company that was growing nicely and had a clear cost (and coverage) advantage compared to peers. IBKR had historically been focused on professionals, but its foray into the “retail” sphere was proving quite successful. It’s also a company that doesn’t do PFOF (Payment For Order Flow), which honestly is something that most brokers do and that goes against their customers' interests (even if they are not aware of it).

The only doubt I had back then was interest rates. Very summarized…IBKR makes money through commissions and through the interest it makes on the funds of its customers. The company returns some of this interest income back to its customers, but it keeps all the income generated over the first $10k of any account. This means that when interest rates decrease, IBKR should make less interest income (although it’s not a 1-1 relationship). I thought that this made the business unpredictable and decided to pass on it. I don’t know if it was a mistake or not (we’ll only know in hindsight), but there’s a lot to like about IBKR:

Natural hedge against volatility and high interest rates

A growing business with competitive advantages

Very well run

Incentives clearly aligned

…

I missed the stock at $80, and I missed it again at $120. The stock is currently trading at $190+ and a P/E of nearly 30x. I have done all my research, so I might consider writing a short piece on the company sometime this year.

What to expect in 2025 (not a market forecast)

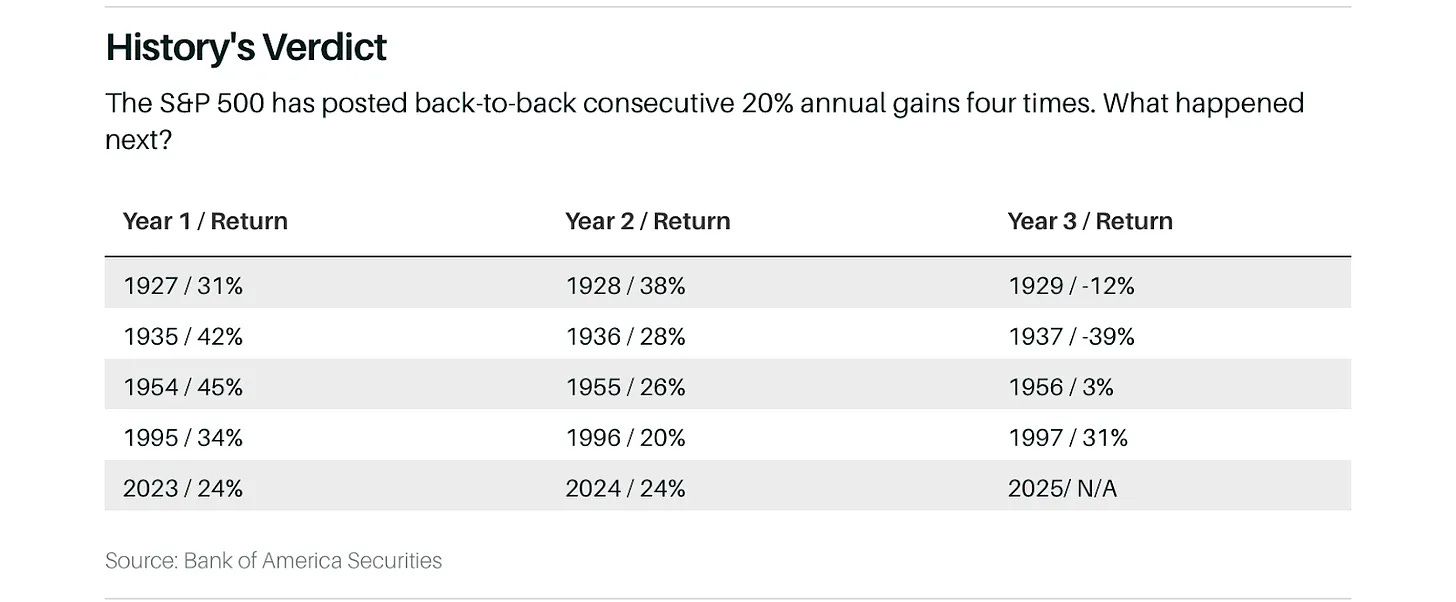

If you are here to find out what I think markets will do in 2025…you are in the wrong place. I do think that having three spectacular years in a row is very unlikely…or is it? If we look back at the past we can see that history is of little help in forecasting what comes after back-to-back 20%+ years:

Despite the lack of historical basis to claim that the third year after back-to-back strong gains will almost surely be bad, many people believe that this outcome is 100% certain. If I had to guess, I’d say that 2025 leans more into a bad year than a good year, but what do I know? I can, however, focus on what I can control. The first thing I can control is the companies I hold in my portfolio, and I am happy with where it stands now, regardless of where the market stands. The second thing I can control is the content I publish at Best Anchor Stocks, and I want to change some things there.

The first thing I’ve done this year is to launch a community on WhatsApp (you can click that link to join). Investing is a solitary endeavor, but it can be very rewarding to make good connections. The goal of the community is precisely this.

The second thing I want to do is improve the research. As investors, we are constantly immersed in a learning process, and I want to make 2025 a year of improvement. The goal is to look back at my research in 2026 and think it’s terrible (which will mean I have improved quite a bit). I believe I have to do a better job at asking (and answering) the important questions rather than just focusing on the information that’s in front of me. I plan to work on this in 2025.

I also believe I have to be able to say more with less words. Many people claim that an investment thesis can be laid out in a few sentences, and while I agree with this, conviction can’t be built in such a short space. Conviction requires significant knowledge (even if the thesis can be summarized), which is why I tend to write long reports. That said, I can definitely do a better job of saying more with fewer words, and that’s something that I plan on doing in 2025. In short: the goal is to increase the insights/words ratio.

Finally, as a rather personal goal, I also plan on significantly expanding my contact network. One of the best things about sharing my content publicly is that I have met outstanding individuals, but I acknowledge that I could’ve done a better job of meeting such individuals earlier. That, together with growing Best Anchor Stocks, is my personal goal for 2025. If you want to be part of this journey, feel free to join Best Anchor Stocks!

Here’s to a great 2025!

Leandro

Lovely ready Leandro! I feel you on TSMC. I wrote up a fairly lengthy deep dive in Jan 2023 when it was close to $90 per share and did not buy the stock, even though I was so impressed by the company. Live and learn.

Brave and insightful! Grande Leandro