Keysight Technologies (KEYS)

Enabling Innovation

Hi reader,

Welcome to yet another Best Anchor Stocks deep dive, this time on Keysight Technologies (KEYS). In this report I’ll go over everything there’s to know about the company:

Keysight’s story and what it does

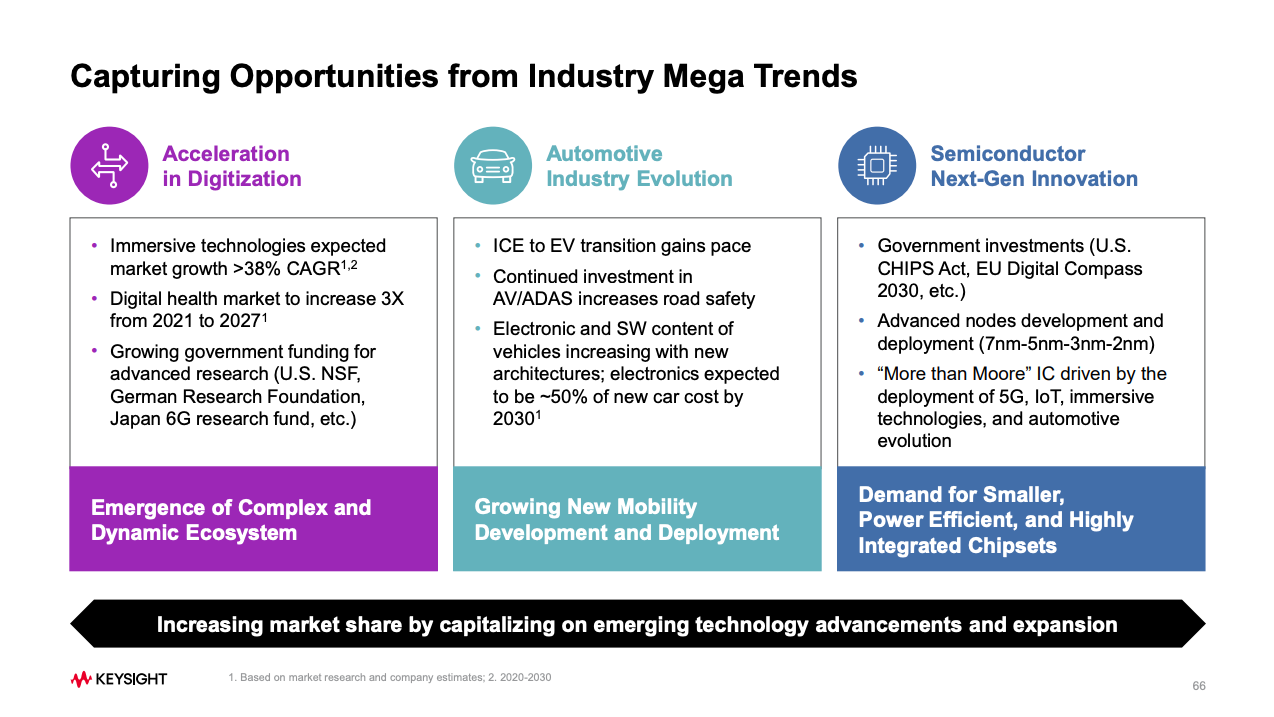

Financials and growth drivers

Competition, moat, and risks

Management & Incentives, Capital Allocation, and Valuation

The first section of the report will be free to read, with the rest (including the valuation model) being reserved for paid subscribers. If you want to have access to the full report, all past reports, my portfolio etc you can become a paid subscriber and join hundreds of paid subscribers:

I have also decided to start a community on WhatsApp where I’ll share interesting content and we can talk about any investment related topic without the constraints that X can have. You can join the community using this link or scanning this QR:

Also just as a heads up, I’ll be sharing a Zoetis (ZTS) deep dive later this month.

Without further ado, let’s get on with the report.

Section 1: Keysight’s story and what it does

Keysight might appear to be a relatively young company (it is), but its origins date back much farther than 2014. The company was spun out from Agilent that year, being Agilent the result of yet another spin-off, this time from the well-known Hewlett Packard (aka. HP). Thus, Keysight’s roots actually trace back to 1939, when HP was founded.

This made me think about something…when looking at great enterprises, it's (almost) always the case that we’ll most likely miss all the actual value creation due to spin-offs getting lost in their story. The total return of any company will incorporate the value of the shares at the spin-off date, but not all the value created (or destroyed) after that. While most managers in corporate America now strive to make their businesses larger, much shareholder value creation has been achieved by doing precisely the opposite: making businesses smaller. Incentives are critical here because they should help management strive to improve the business, not to make it larger.

Anyway, going back to our story. The tech industry was buzzing and competition was rising fast in the late 1990s so, to remain focused and competitive, HP decided to spin off several businesses into a newly formed corporation called Agilent.

Agilent would be comprised of the following legacy HP businesses:

Test and measurement

Chemical analysis

Medical businesses

Computing and imaging

These four business lines generated a combined $8 billion in revenue in 1999, making Agilent the largest IPO in Silicon Valley at the time. Agilent was, of course, subject to the frenzy financial markets were experiencing back then, and it was this frenzy that probably pushed HP to spin-off the business (they were getting a good deal in financial markets). Its stock rose more than 200% in a couple of months, only to collapse almost 90% once the dot-com bubble burst:

This is also a good example of how dangerous it can be to buy a bubble, especially if one doesn’t DCA after that. Since reaching its peak in 2000, Agilent’s stock has increased 71%, or what’s the same, has compounded at a paltry 2.2% CAGR.

Despite the volatility in its stock price, Agilent’s management continued executing HP’s playbook and looked forward to becoming a more focused company. The company sold its Healthcare Solutions Group to Philips in 2001 and continued building two relatively independent segments throughout the 2000s: lifesciences and diagnostics and test and measurement.

Agilent went further in 2014, deciding to spin out its test and measurement division (known as ‘Electronic Measurement’ at the time) as an independent publicly traded entity called Keysight Technologies.

This division was generating around $2.9 billion in revenue at the time, and the goal of the spin-out was precisely the same that HP had pursued when it spun out Agilent:

The completion of this separation and the creation of Keysight Technologies will provide excellent shareholder value by sharpening the focus of each company and allowing Agilent and Keysight to pursue their individual growth strategies.

According to Agilent, the name “Keysight” comes from the ability to “see what others can’t see” and the ability to provide “key insights.”

From that moment on, Keysight continued what Agilent had already been doing: investing organically and inorganically to lead the test and measurement industry.

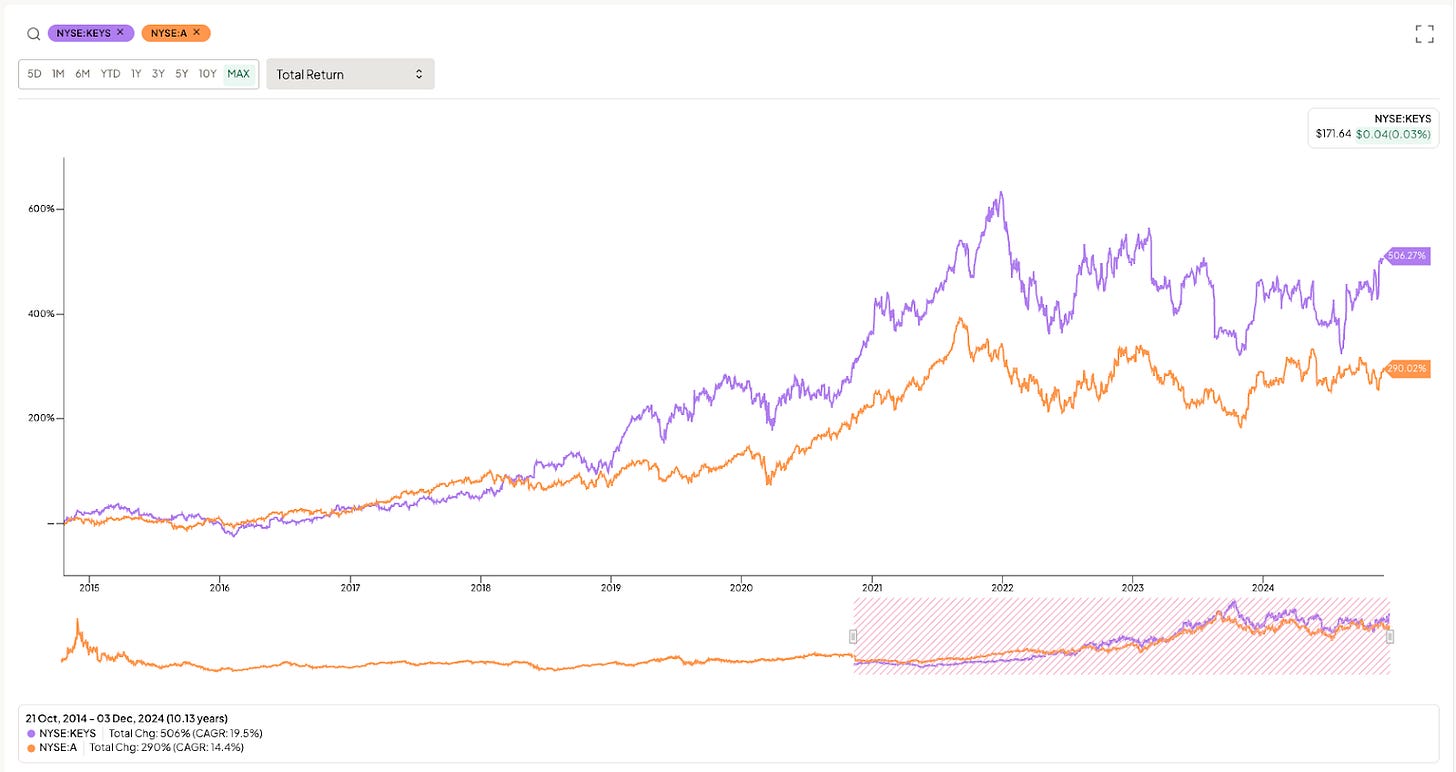

What’s interesting is that Agilent might have spun out the better business, as Keysight’s total return has far outpaced that of Agilent since spin-off (I know that Lifesciences is not going through its best moment today, but neither is Keysight):

Keysight might be a relatively new company to financial markets, but its business dates back more than 80 years, and it’s very tough to envision a future without its products and services. Since the spin-off, the company has invested significant amounts into R&D and M&A, making over 20 acquisitions. Keysight operates in a boring industry (test and measurement), but its products and future prospects appear far from boring.

What Keysight does

Understanding what Keysight does is challenging, mainly because it operates in a sector that (unless you are an engineer) you are unlikely to be familiar with: test and validation/measurement. As you might know, I always start my analysis by reading the 10K, and I must be honest: I did not understand much when I read Keysight’s annual report. However, as I continued reading, I understood what Keysight does and hope to do a better job than the 10K in explaining it in this section.

In plain English, Keysight provides the tools (hardware and software) so that its customers can test their tech-related products before launching them to market. The most straightforward example here (and where Keysight has historically been strong) is telecommunications. When telecom providers want to launch something like 5G, they need to test it in a lab environment to understand how it works well before launching it to the mass population. Keysight provides telcos with the tools to do so. For example, Keysight sells software that allows these companies to test cyber attacks to a network:

Keysight also provides tools for Telcos that allow them to emulate a network with thousands of devices active at the same time.

Another example here is AV (Autonomous Driving) technology. Keysight provides car manufacturers and AV-tech developers with the necessary tools to test Autonomous Technology in a controlled environment. One example of a product here is Keysight’s Radar Scene Emulation, which allows AV companies to emulate up to 512 objects as close as 1.5 metres:

The two examples above evidently refer to technologies that can’t be iterated in the real world; they must work before being deployed to the general population. This is the niche (critical, complex, and tough to test in the real world) where Keysight excels.

There are many more examples (some of which I’ll discuss later), but the bottom line (a rather philosophical one) is that Keysight enables innovation. Any innovation that you can think of requires pre-testing before getting to market:

Test and measurement is what enables the advancement of technology. The test and measurement industry is influencing how these technologies are advancing.

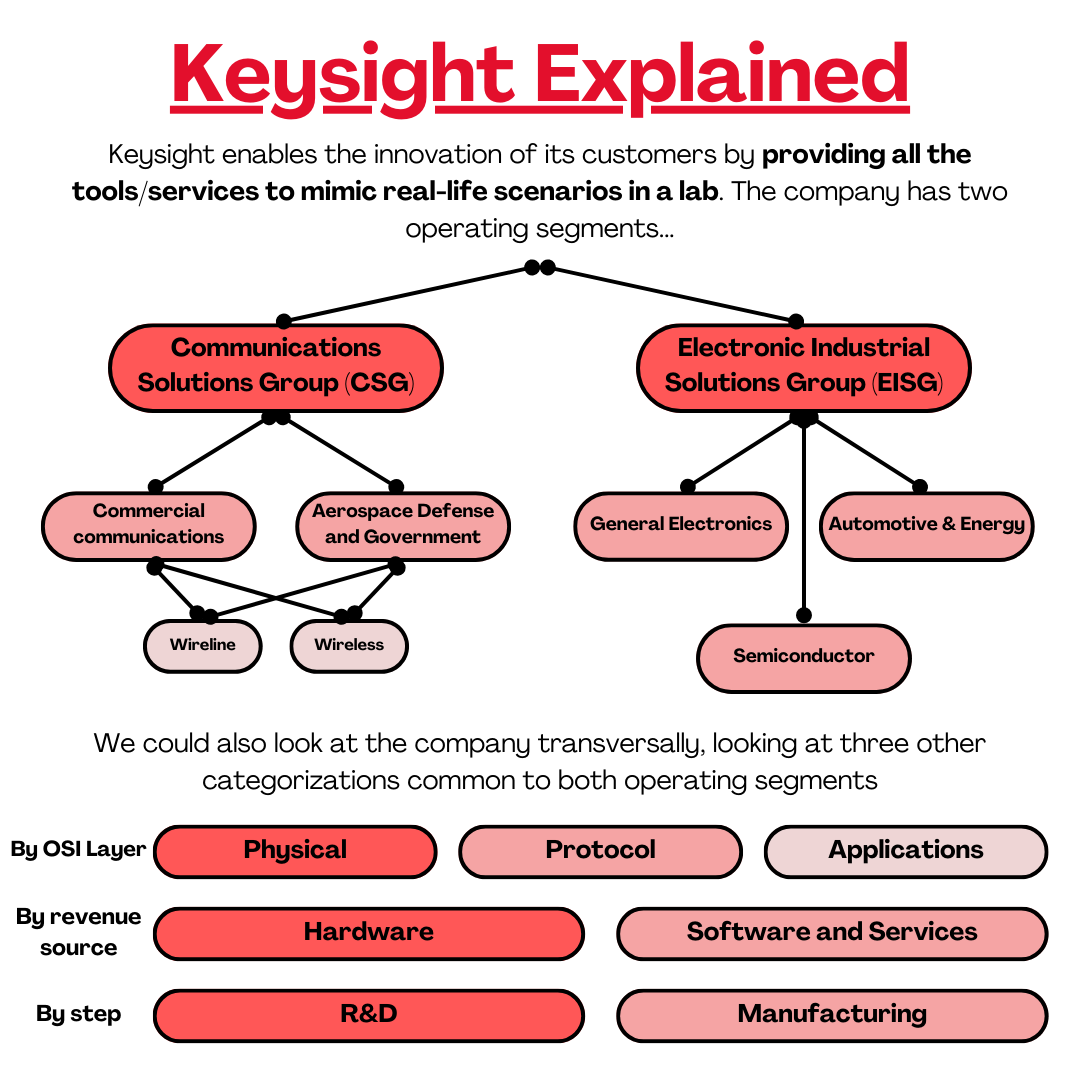

Keysight’s business can be subdivided in many ways. Let’s start with the types of services the company provides. The company provides four main products/services across the entire customer workflow (design, manufacturing, deployment, optimization…):

Hardware

Software

Support services

Global consultative sales organization

The largest of these revenue sources is currently hardware, although Keysight has been leaning heavily into software and services since its IPO (2014), both organically and through M&A. There’s an additional component in software and services: ARR (Annual Recurring Revenue). Keysight used to sell software but not on a recurring basis, so management is now pursuing the recurring route to improve resilience during downcycles. Software and services currently make up around 39% of total revenue, with around 25% of total revenue being pure software. ARR currently makes up 30% of Keysight’s revenue, so it’s safe to say the company is successfully transitioning from its more cyclical hardware component to its more resilient software and services component.

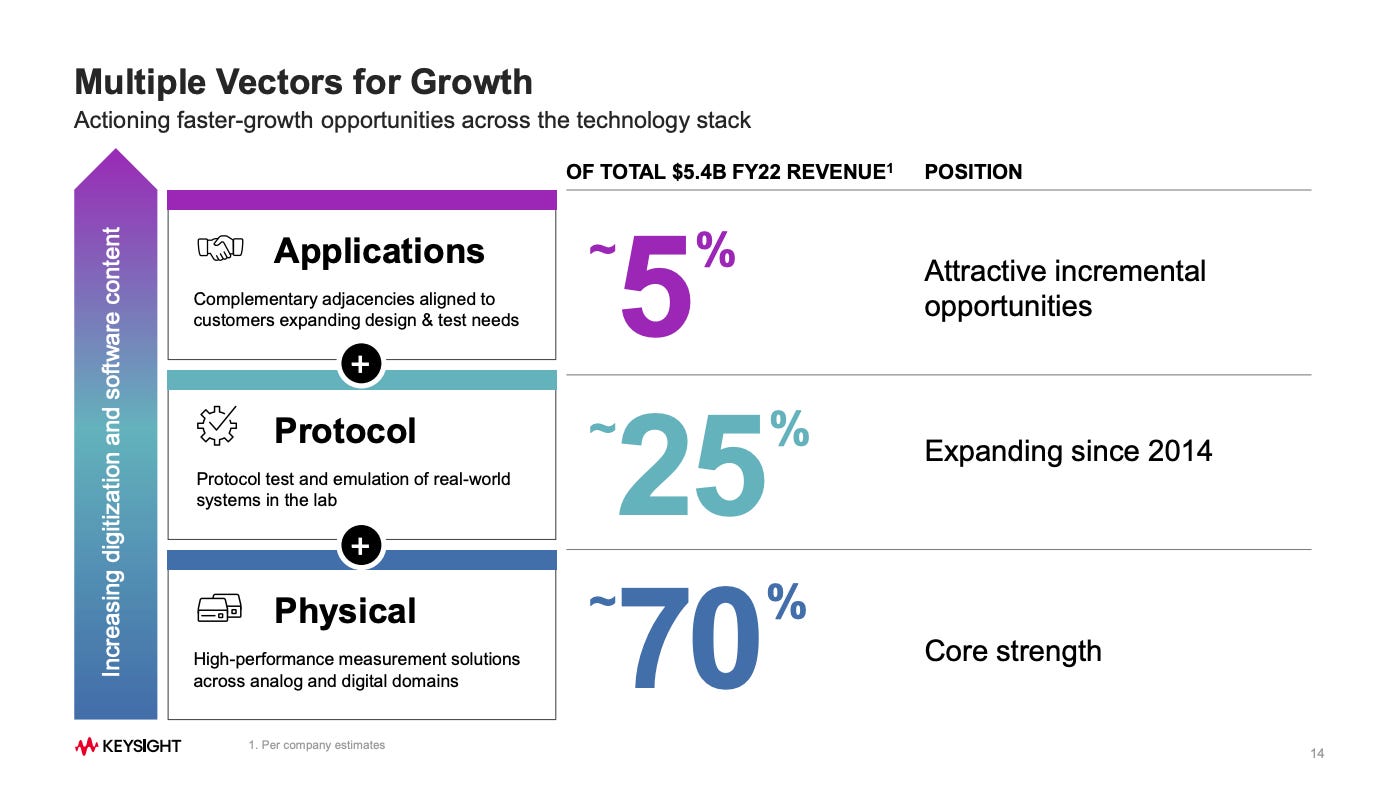

This transition has been enabled by Keysight’s foray into different layers of the Open System Interconnection (‘OSI’) model. You’ll probably be wondering what the hell the OSI model is. Don’t worry, I’ll explain it briefly. The OSI model is a conceptual model that divides a networking system into 7 distinct layers, although Keysight simplifies them into three: physical, protocol, and applications.

The physical layer refers to how the different hardware (transmitters, receivers, antennas) communicates raw data. This currently makes up 70% of the business and is what Keysight inherited from Agilent.

The protocol layer is related to how data is transmitted and interpreted between devices, so it basically allows customers to test real-world systems in a lab. This layer currently makes up around 25% of the business.

The application layer is where the network and the user communicate and is a nascent opportunity for Keysight. Only 5% of the company’s revenue comes from this layer.

The protocol and application layers have a higher software component, so it was Keysight’s way of diversifying toward a more recurring business:

When we spun out of Agilent, we were largely a tools company. 100% of our business was in the physical layer tools category. And most of our expansion efforts since then have been in the emulation space and more recently into the simulation arena with the application layer pivot that we have.

Source: Satish Dhanasekaran, Keysight’s CEO

Another way we can divide the business is by operating segment. Keysight currently has two reportable segments:

Communications Solutions Group (CSG)

Electronic Industrial Solutions Group (EISG).

CSG focuses on network communications testing and can be further subdivided into two subsegments:

Commercial communications: the main customers here are large telcos that test their networks before deploying them to consumers

Aerospace, Defense, and Government: basically the same as the above, but focused on applications for defense, space, and the government

As you might have imagined, the customer base in CSG is pretty concentrated, but Keysight is the clear dominant player with an installed base of over 1,600 and 125 solutions.

CSG can be further subdivided into Wireline and Wireless. Wireline refers to communications through wires, whereas wireless refers to communications without wires. So, 5G would be included in wireless, and data center applications would be included in wireline. Wireline, for example, has benefited strongly from recent hyperscaler investments:

We’re enabling our customers to emulate AI workloads in the lab because trying to emulate it on expensive GPUs is astronomically expensive and takes a long time.

This is just another example of Keysight’s ability to help customers emulate the real world in a controlled lab environment.

EISG, on the other hand, is a much more diverse segment comprised of several end markets such as general electronics, semiconductors, automotive, and energy. Just to give some examples here…Keysight’s equipment helps customers test semiconductor manufacturing control processes, develop AV (autonomous) and EV (electric) technology for carmakers…

You’d think this would be enough categorizations for Keysight (product, layer, operating segment…), but there’s one more: R&D and manufacturing.

Keysight’s products and solutions are present in the entire lifecycle of a project, from R&D (in the very early stages) to manufacturing and optimization (in the late stages when a product is already marketed). Keysight has been increasingly leaning into the R&D phase of its customers because it’s much more profitable due to reduced competition. As you might have imagined, reduced competition comes from the fact that tackling the R&D phase is much tougher than tackling the manufacturing phase. The main reason is that you need foresight for the former, but hindsight is enough for the latter.

Being present in the R&D phase means that, while we (as end users) might not see 6G until the year 2029 or so, Keysight is already working on it with customers and generating some revenue.

If I were to build a visual with what Keysight does, it would look something like this: