Diageo: An Unprecedented Boom and Bust

Hi reader and welcome to yet another Best Anchor Stocks deep dive,

If you have not read the prior deep dives, I just want to let you know that they are accessible through the “Deep Dives” tab in bestanchorstocks.com, but I’ll leave them below too:

Deere: Cultivating Technology (shared for free as a model deep dive)

In this month’s deep dive I’ll profile Diageo, the leader of the global TBA (Total Beverage Alcohol) industry. The spirits industry is interesting due to its attractive unit economics and because it has gone through a pandemic boom-bust cycle which might provide some interesting entry opportunities. If you want to read about the industry before starting this deep dive, feel free to do so here.

Diageo has also suffered some company-specific headwinds that have made the stock suffer quite materially. The stock is down 12% year to date, down 26% over the last year, and is almost in a 40% drawdown. Needless to say, sentiment has not been as negative as it is today for a very long time…

I’ll cover the following topics in the deep dive:

Section 1: History and What the company does

Section 2: The Financials and Growth Drivers

Section 3: Competition, the Moat, and Risks

Section 4: Management & Incentives, and Capital Allocation

Section 5: How the company complies with the Best Anchor Stock traits

Section 6: Current status and valuation

Section 7: Concluding remarks

The history section will be shared for everyone, whereas the rest of the deep dive is reserved for paid subscribers. If you want to have access to all the content, the deep dive archives, and the remaining deep dives I will upload going forward, don’t hesitate to subscribe:

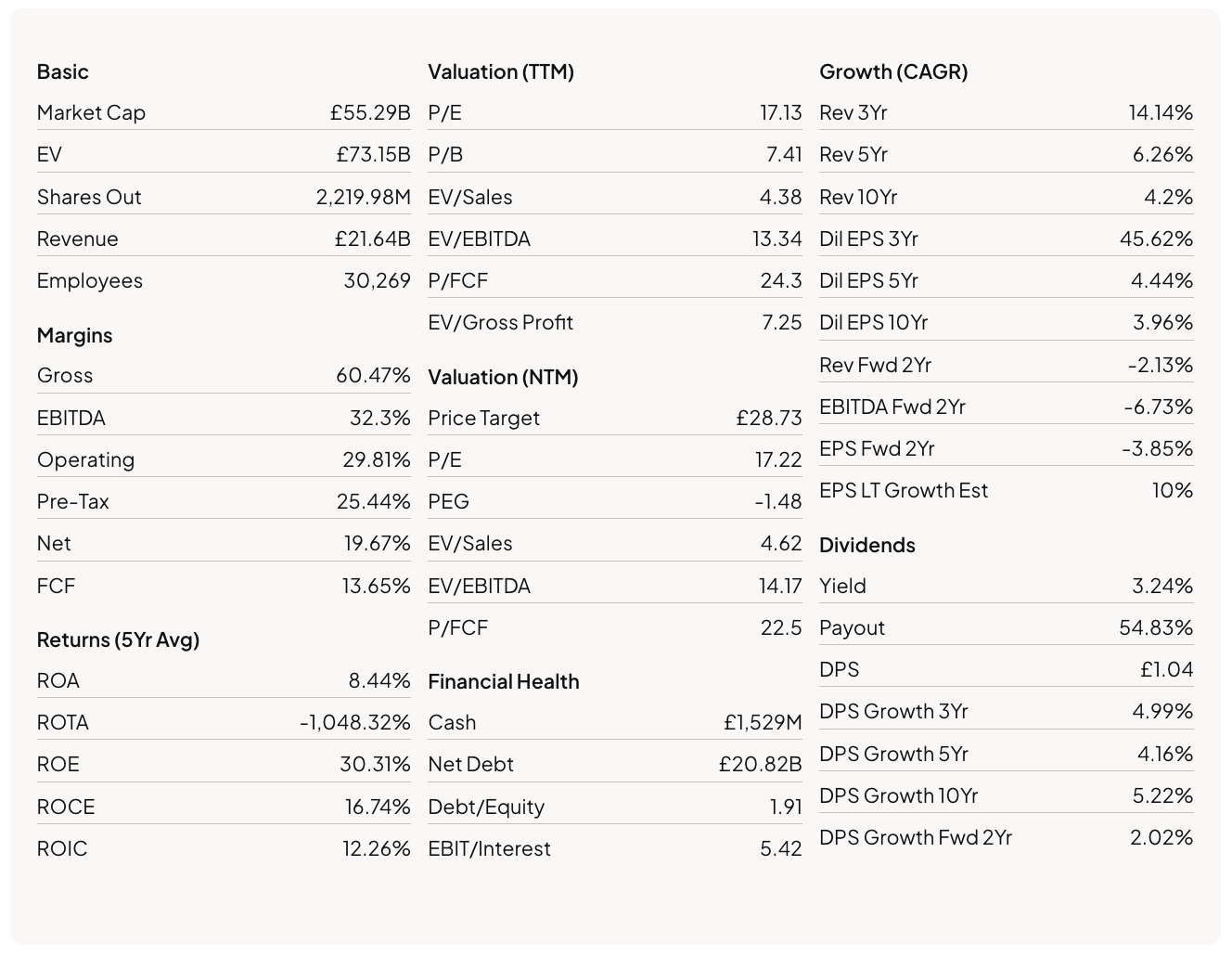

Before jumping directly to the company’s story and what it does, let me share a snapshot (courtesy of Finchat):

Section 1: Diageo’s story and What It Does

Explaining Diageo’s story is complex due to the diverging history of the company itself and the brands it owns. Diageo was founded in 1997 from the merger of Grand Metropolitan and Guinness.

The merged company would originally be known as GMG Brands and united several global brands such as Burger King, Haagen-Dazs, Old El Paso, and Johnnie Walker. Not a bad lineup if you ask me.

The rationale behind the merger was twofold. For starters, both companies had a strong position in liquor, beer, and wine, which were united into an operating segment called ‘United Distillers & Vintners.’ This combination would make GMG Brands three times as large in terms of profits as its closest peers in the spirits industry.

The second reason behind the merger came from a broad-based push into emerging markets that was underway back then. Guinness had a good presence in these markets, and Grand Metropolitan believed that a merger would be a good way to enter these markets with the help of its peer:

Our strengths in developing markets will be one of the biggest attractions of these two companies coming together.

Source: Tony Greener, Guinness Chairman in 1997, at the time of the merger

Both companies were historic rivals, but the deal was enabled by the friendship of their leaders. Despite all the backlash large mergers face nowadays, back in the day the merger was seen as a positive move for both companies. There were only two votes against the merger. These came from the current CEO of LVMH, Bernard Arnault, and another of the company’s directors. Bernard Arnault was a significant Guiness shareholder because Guinness and LVMH had a partnership through which the former distributed the spirits, champagnes, and Cognacs of the latter. With a 30% stake in Guinness, his vote was essential for the merger to go through.

To “unblock” the merger, Bernard Arnault asked for 250 million pounds, which both companies reluctantly paid. I think this shows what kind of shark mentality Bernard Arnault has always had, which has probably been a critical factor in LVMH’s rise to the top. The relationship between LVMH and Diageo still exists today despite friction at the time of the merger.

The newly constituted company was soon renamed ‘Diageo,’ an amalgamation of the Greek words ‘dia’ (day) and ‘geo’ (global). According to management, this name portrayed that the company’s brands would be bought by many consumers every day worldwide. Even after the name change, the company was still very diversified, owning not only alcohol brands but also the aforementioned food brands. This would change quickly.

Shortly after the company was born, a terrible crisis struck Asia, where the company generated around 12% of its profits. Diageo took advantage of this bump and consolidated its operations. Burger King and Pillsbury (owner of Haagen Dazs and Old El Paso, among others) were sold for $2.5 billion and $10.5 billion in the early 2000s, respectively. The company's story of becoming a specialised giant in the TBA industry had just begun.

From then on, the company started an acquisition spree to build the most diverse portfolio in the TBA (Total Beverage Alcohol) industry, counting more than 20 significant acquisitions since 1997. Many of these have occurred in the last few years, including the likes of Don Papa (Rum), Don Julio and Casamigos (Tequila), and Aviation Gin (the name is self-explanatory). The company has not only acquired businesses and brands but has also divested them, actively managing the portfolio to favourably position itself to take advantage of the industry’s trends.

The story of Diageo is not the whole story

The above might make Diageo appear as a relatively young company. After my sale of Five Below (discussed here), Diageo is now the youngest company in my portfolio. As you might already know, I put a lot of emphasis on company age because I look to invest in companies that have already won and that I believe will continue to do so in the foreseeable future.

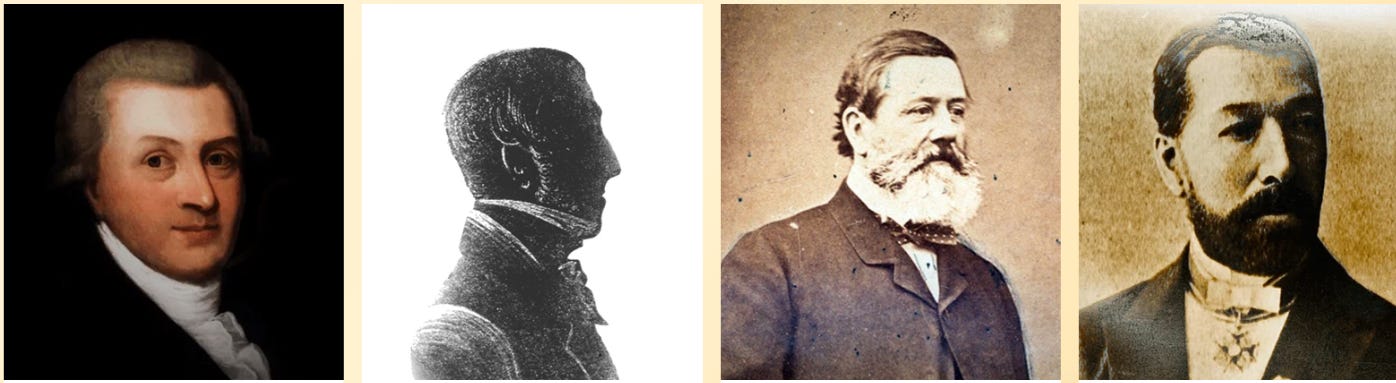

Despite Diageo being born in 1997, many of the company’s brands are centenary and go back as much as 300 years! Arthur Guinness started brewing ale in 1759, whereas John Walker and Charles Tanqueray began their businesses in the 1820s. Smirnoff, another of the company’s brands, started operations in 1864.

These brands have survived several economic crises, two world wars, and a constantly evolving regulatory landscape around alcohol. Diageo, as the consolidating company, might only be 26 years old. Still, its brands have endured the test of time, not for several decades, but for several centuries, portraying their and the industry’s resiliency. Talking about each brand's rich history is out of this article's scope, but you can read about it on Diageo’s webpage.