The market is a huge rotation machine (NOTW#36)

Best Anchor Stocks has a partnership with Finchat (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

The indices were down again this week, although they are far from “worrying” levels. The market is a huge rotation machine over the short and medium term, but fundamentals should prevail over the long term regardless of factor exposure. I explain what I mean by this in the market overview.

Without further ado, let’s get on with it.

Articles of the week

I have published four articles since my last news of the week (two weeks ago). The first one is probably one of the best articles I’ve ever written (in my opinion), or at least one I enjoyed writing. In it, I unpacked the drivers of value creation. I recommend reading this article to understand what an investor should focus on when analyzing a company.

Unpacking the drivers of value creation

I’ve increasingly been discussing topics like cash on cash returns and reinvestment rate in my in-depth reports and other related articles, so some of you have asked me to write an article explaining…

The second article was FRP Holdings earnings digest. The market did not like the results much because 2025 will be a transition year, but the company is doing pretty well, and there hasn’t been a significant impact from DOGE thus far (I share more details about this in the NOTW).

"A transition year."

Some context before jumping into the article: FRP Holdings is a $550 market cap company that operates in the real estate and aggregates industry. The Baker family owns 30% of the business and its ori…

The third article was Adobe’s earnings digest. Again, the market did not like the earnings report, and Adobe is now trading at levels that are “suspiciously cheap.” I explain what I mean by this in the article.

Are We Witnessing Adobe’s Funeral?

Sometimes, a stock keeps going down despite the company reporting good earnings, getting to a level where it’s “suspiciously” cheap. It’s normal to doubt whether it’s the market that’s getting it wrong or us when this happens...

Lastly, I published part 1 of a two-part miniseries in which I explain how my portfolio companies would fare in a recessionary and tariff-driven world. The primary objective of the portfolio is not to remain resilient during a recession, but part 1 shows that the companies in the portfolio would do just fine during one (all while growing double digits in a normal economic environment).

A Recessionary and Tariff-driven World

If you’ve followed my work for some time, you’ll know I don’t make macro or geopolitic calls/forecasts (even though I reserve the right to have an opinion). This is not based on the belief that macro or geopolitics don’t matter (they do) but on the belief that

Market Overview

The two leading indices had yet another negative week. Both were down around 50 basis points:

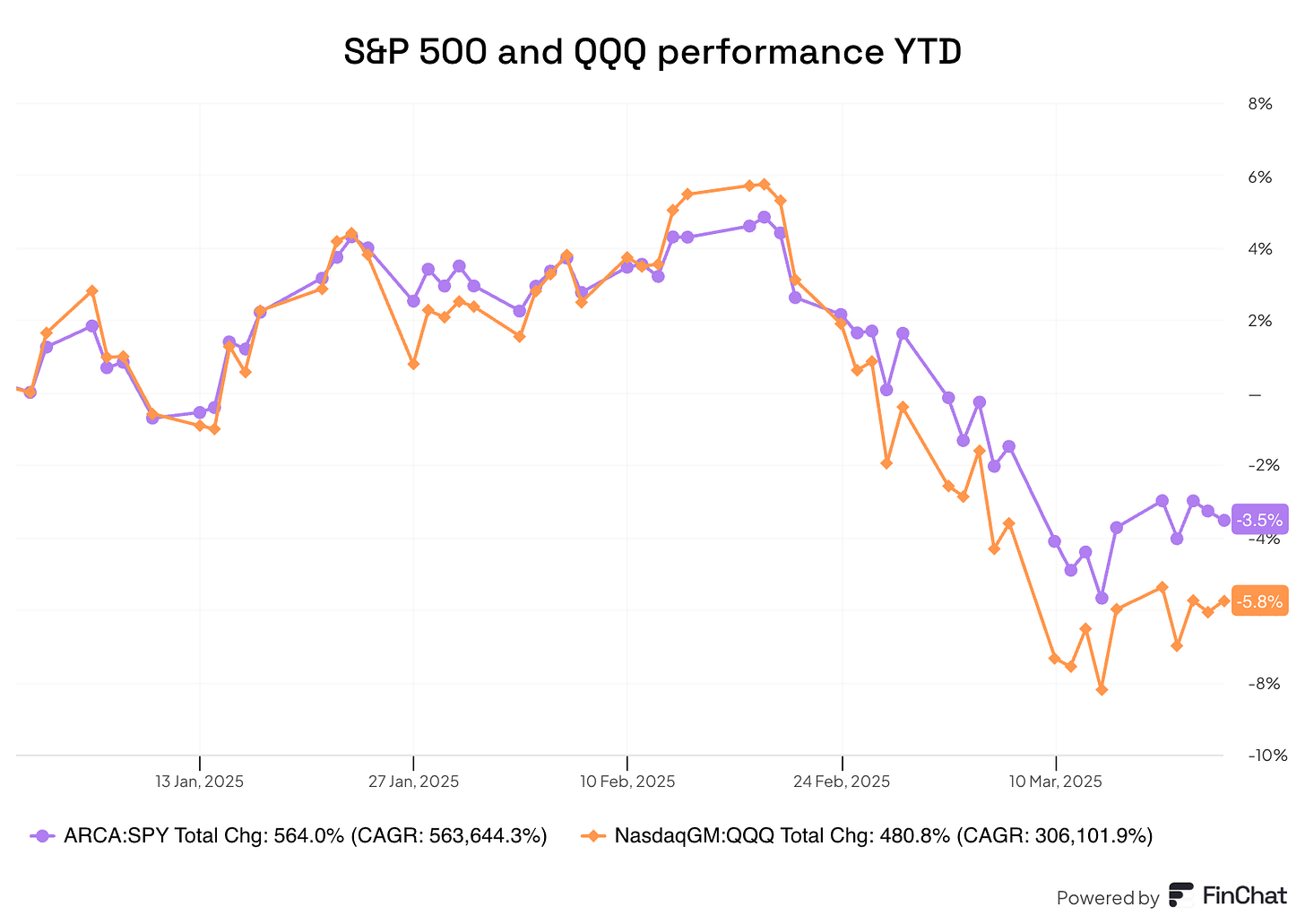

It has been a “turbulent” start to a year filled with uncertainty. The leading indices in the US are down year-to-date, although maybe much less than sentiment would suggest:

Before believing that we are undergoing a “rough patch,” let’s not forget that the Nasdaq is marginally in correction territory whereas the S&P 500 is not even in one yet! It’s interesting to see how both indices suffered similar drops mid-year in 2024 and nobody even remembers it now:

The reality is that the average stock is probably down more than the index, which makes the drop more painful to many stock-pickers. However, one can only ask themselves what would happen with individual stocks if the leading indices fell 30% to 40% (spoiler: it’s not going to be nice!). This is something that can happen, although I am not claiming it will happen this time around.

The topic of rotation is interesting. I firmly believe that the market is simply a huge rotation machine over the short to medium term. News come out, and algos and short-term oriented investors react swiftly by repositioning their portfolios. A good example is Europe. Investors have seen that there’s quite a bit of uncertainty in the US, so Europe has “caught a bid” (finally, some would say). Indices which exclude US-based stocks have performed significantly better than US-based stocks so far this year:

While it feels excellent to correctly reposition one's portfolio to be in what the market will favor at any given time, I believe it’s a strategy destined to fail over the long term because it can’t be repeated accurately. The market might be a rotation machine over the short and medium term, but fundamentals will prevail over the long term regardless of where the company is based or what “factor” it’s exposed to. I always struggle to understand why some people see investing as black or white, in the sense that “Europe is bad, invest in the US” or the opposite. There are great and terrible companies in the US, and there are great and terrible companies in Europe. The same goes for many other countries (with the only requisite that business must be friendly in such countries). It’s definitely tough to resist the urge to try and reposition the portfolio to the “winning” formula at any given moment, but I anticipate that not many people will make it work over the long term.

The industry map was mixed this week with no clear identifiable trend:

The fear and greed index remained in extreme fear:

The rest of the content is reserved for paid subscribers. I share my transactions of the news of the companies in my portfolio.

My additions this week

I added to several positions this week.