"A transition year."

FRP Holdings Earnings Digest

Some context before jumping into the article: FRP Holdings is a $550 market cap company that operates in the real estate and aggregates industry. The Baker family owns 30% of the business and its origins date back more than 100 years.

If you are interested in reading more about the company you can read my in-depth report here (reserved for paid subscribers):

This said, the earnings digest below is shared for free.

FRP Holdings ($FRPH) reported Q4 and 2024 earnings last week. Since this company does not see significant quarterly changes, I’ll keep this earnings digest short and focus on the highlights. I’ll also focus on the yearly numbers as quarterly numbers don’t matter much.

FRP Holdings enjoyed a good 2024, with Net Operating Income growing significantly across all segments…

+17% YoY NOI growth in Industrial and Commercial

+23% YoY NOI growth in Mining and Royalty Lands

+34% YoY NOI growth in Multifamily

The above resulted in 26% NOI growth in 2024 and a 29.5% CAGR over the last three years. However, this strong growth has created an “air pocket” for 2025. Management claimed they “expect 2025 NOI to be flat if not slightly less than 2024.” Several factors have created this “transition year” scenario for all segments. Let’s start with Multifamily.

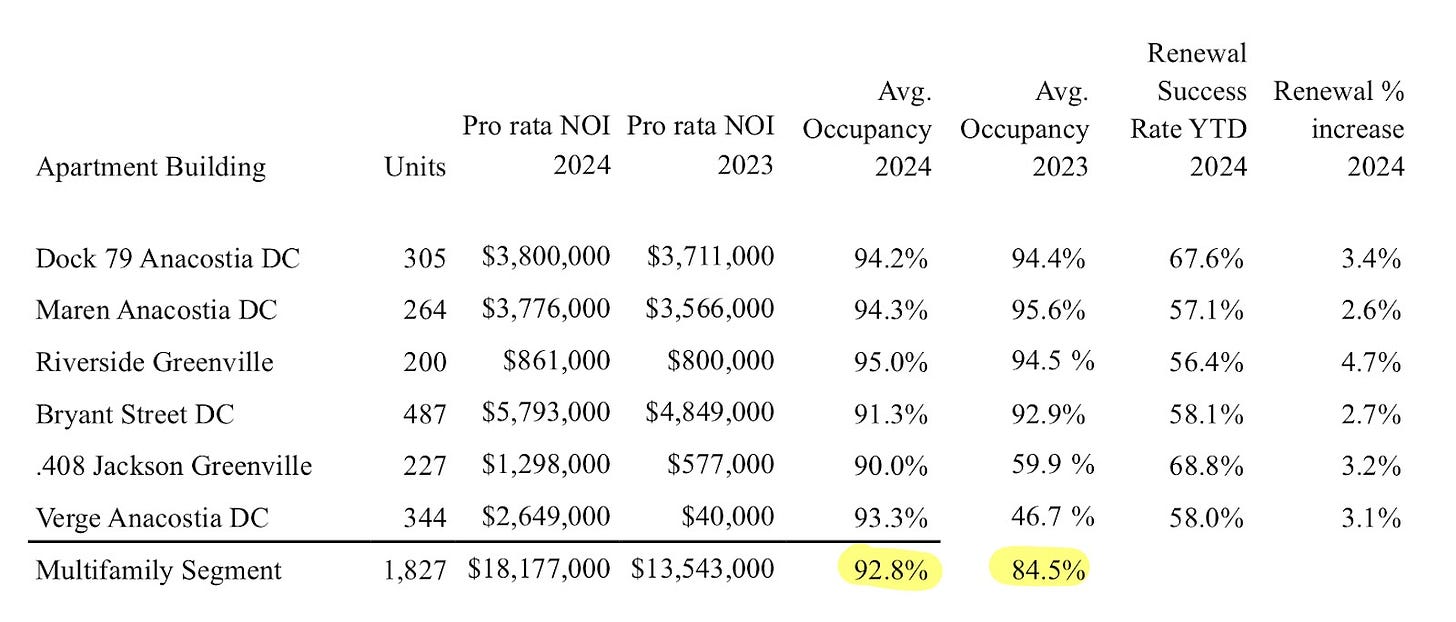

Multifamily posted good numbers across the board. Average Occupancy was almost 93%, renewal success rates and increases were healthy:

Considering what’s going on with DOGE in the DC area, it might be a better idea to look at quarterly numbers here (they were also healthy). The only problem with this is that Trump got into office in 2025 and we only have Q4 numbers, so before any DOGE-related impact.

Multifamily will suffer certain headwinds in 2025. First, management believes there will be an influx of supply to the DC market this year, which is what made them focus on Industrial and Commercial rather than on developing its DC multifamily assets (i.e., this is not news). To this we have to add that pretty much all of its multifamily assets are already stabilized and therefore growth will purely be organic (which is relatively low for real estate assets). This was not the case in 2024 when .408 Jackson and the Verge will still being leased up and therefore contributed significantly to growth.

Despite the focus on industrial, management shared they would develop two multifamily assets in South Carolina and southwest Florida in 2025. Upon stabilization, these assets are expected to add 810 units and $6 million in pro rata NOI (which is significant considering 2024 NOI was $18 million). While these assets will be developed through 2025, they will unlikely add meaningful (or any) NOI this year.

The weakness in the DC area related to DOGE policies doesn’t help multifamily either, nor do tariffs. Regarding the latter, management believes that tariffs on lumber could make multifamily investment less appealing (as they would rise construction costs). Regarding the former, in November, I asked FRPH’s CFO if they expected cuts to federal spending to impact their DC assets significantly. He told me they did not, but I have asked this question again now that the impact is likely more tangible (I’ll share the reply once I get one).

Jumping to industrial and commercial, management noted they have vacancies at Cranberry and the Chelsea building, which they expect will take some time to re-lease. A 50,000-square-foot tenant (10% of the business) defaulted on its lease obligations, and management expects to gain control of the building in Q2 2025 (this means it will remain vacant at least 3 months this year). To this we must add that they also expect several tenants to leave once their lease contracts expire. This will significantly lower the occupancy rate at Cranberry in particular, but there is good news (even though it seems impossible!)

Firstly, industrial and commercial supply seems to be retracing to pre-pandemic norms.

With new construction starts and deliveries falling to pre-pandemic norms, we expect market vacancies to top out in 2025, which should go well for demand and rent growth as we deliver our new industrial projects.

Less supply means that FRP Holdings can re-lease its vacant properties at higher rates. Management expects to re-lease these properties at a rate around 7% higher:

The average rental rate of the expiring industrial leases was $6.55 and we are hopeful most of our new rental rates start in the $7s or greater.

These vacancies will evidently weigh on growth over the short term, but will help the leased assets bring in more money down the road thanks to higher rents.

The second good news is that this reduced supply environment is also great news for future development and industrial and commercial opportunity remains significant. Management’s goal for the next three years is to develop and lease Perryman, Lakeland, Fort Lauderdale, and a building in Hartford County. Developing these assets will require an investment of around $146 million and will result in…

850,000 additional square feet

$8.55 million of NOI upon stabilization

These projects should theoretically be delivered in a reduced-supply environment, which management attributes to competitors going “too fast:”

I think that a lot of our competition went really, really fast, and right now, they just they can’t take that jump, whether it’s their risk appetite of their balance sheet or I can’t answer for them. We see a great opportunity in the market that we have targeted to build in 2025 when a lot of people just aren’t and being able to deliver in 2026 and be one of the only games in town.

In short: FRPH can ramp up investments when few can.

Some weeks ago I shared that John Baker had purchased $10 million worth of stock in the open market. If I had to guess, I’d say this was the reason for that purchase. John Baker is unlikely to care about what the business does next year and is probably focused on the long-term, which seems bright for the company. This said, the reality is that vacancies will put some downward pressure on 2025 NOI. Management sees 2025 as a year to plant the seed of future growth:

The flip side of this coin is that while we anticipate our NOI growth to stall in 2025, the driver of most of our future NOI growth will also come in 2025 through an estimated $71 million in equity capital investment. In 2025, we will begin construction on our two industrial joint ventures in Florida, continue to entitle our existing pipeline in Maryland and look to augment our existing pipeline through a land purchase, industrial joint venture, or possibly both.

What’s interesting about the $71 million is that, despite management claiming that investments will be focused on industrial and commercial assets, around half of this investment will be made in multifamily assets (those outside the DC area). FRPH expects to invest $35 million in these assets in 2025, compared to $21 million in the two industrial buildings (the remaining amount is Capex for the existing portfolio).

Lastly, the mining and royalty lands segment is expected to do well in 2025 but will face tough comps from a one-time payment received in 2024. So, all in all, while 2025 seems to be a transition year, it’s not stopping management from developing its rich pipeline in multifamily and industrial. The ability of FRPH to not slow down its reinvestment stems from its ability to diversify:

We will always try to exploit our competitive advantage in the asset class we have the most experience in, but real estate is cyclical and there will almost certainly come a day where the state of the industrial market will make us glad we continued to pursue multifamily development.

This diversification ability is one of FRPH’s strengths. Multifamily in DC is expected to be challenged over the next few years, but the company can shift reinvestment towards industrial in the meantime. Even inside multifamily, the company can pursue development outside the DC area while waiting for the supply environment to stabilize. This ability to shift reinvestment is not an advantage all competitors enjoy, which makes them more likely to pursue low-return investments just to reinvest their excess cash. This ultimately means that FRPH can grow more profitably.

I must say that what’s currently happening in DC regarding DOGE and the Federal government and this increase in supply is not something that I particularly like, but I also acknowledge that FRP Holdings owns unique assets in the DC area and that the way they value these might already incorporate some conservatism. Let’s look at that.

Valuation and the topic of a catalyst

Management shared again their NAV (Net Asset Value) estimate, which showed $37 at the midpoint:

The NAV estimate is up 6% from Q2 but basically unchanged since the 2023 investor day. Not great, but FRPH is still very early in its development phase and can add significant value through their pipeline development (they have a track record of doing so). The other thing we can see is that management’s estimate is 32% above the current stock price (around $28), so FRP Holdings seems to be trading at a significant discount of NAV. A discount to NAV is warranted for real estate businesses because assets are not liquid and management doesn’t plan to sell them (in this particular case), but it seems a tad too much considering that management is arguably being pretty conservative with their estimate.

According to Bill Chen (a long-time FRP shareholder), cap rates used to derive the NAV are too conservative because actual market cap rates are lower. Bill Chen argues cap rates used on the company’s multifamily assets should be in the high 4s or low 5s, rather than the mid 5s management is using. Should FRPH use these cap rates, the NAV estimate of its multifamily assets would be considerably higher.

I would be wary of being too optimistic with cap rates, though. First, it’s not a “realistic” metric because management doesn’t plan to sell any of its assets. Secondly, I believe we can introduce certain degree of conservatism in cap rates considering the DOGE-related environment. Bill Chen argued that updating cap rates would help new investors gauge the company's true value. Rather than seeing a 32% discount to NAV, new investors would see a 40% to 50% discount to NAV, which might make them look further into the opportunity. Management answered they would look into this but that they don’t plan to be overly aggressive.

Bill Chen also asked management for another catalyst to increase the stock price: a dividend. While I believe that implementing a dividend (however small) might automatically increase the stock price (I don’t make the rules), it’s tough to see how this would be the best capital allocation decision considering all the reinvestment opportunities at management’s disposal.

If you’ve been following my work for a while, you’d know that I don’t tend to obsess over catalysts, but I must say that I do think about them for FRPH. The stock has been flat for four years, and while management continues to add value through their development, there seems to be no visible catalyst to make the stock price go up (which is how shareholders make money). The reasons are varied…

2025 will be a transition year

Management doesn’t plan to sell any of its assets

Real estate development is slow

Fears of a DC slowdown don’t help…

This said, such periods have not been rare for FRPH. For example, the stock was flat from 2013 to 2016 but shot up 80% over the next three years. The reason was most likely the sale of its industrial warehouse portfolio to Blackstone. That was a catalyst, and while investors are most likely buying $1 for 60 cents with FRP Holdings, it’s challenging to see a catalyst that makes the market realize that this is the case.

In my valuation exercise, I claimed that we don’t need the discount to NAV to close to make this an appealing investment because the underlying business is growing at a good pace (NOI has CAGR’d at a 30% clip over the past three years). That said, with no NOI growth in 2025 and no evident catalyst to close the discount to NAV, it seems like investors will probably need to be a bit more patient than they have already been. Returns rarely come in a straight line, and FRPH has proven to be a great example of this through history.

Have a great day,

Leandro