Are We Witnessing Adobe’s Funeral?

Q1 Earnings Digest

Sometimes, a stock keeps going down despite the company reporting good earnings, getting to a level where it’s “suspiciously” cheap. It’s normal to doubt whether it’s the market that’s getting it wrong or us when this happens. It’s rare for the market to get things very wrong, but many examples of extreme dislocations proved to be opportunities for long-term holders (there’s survivorship bias here, though). Meta is a good example. When the stock was down 70% off highs in 2022, many believed the company was doomed, but reality turned out differently (many would argue that Kodak is the flipside of Meta, something I would agree with). Conviction comes in handy in these situations because it’s when the noise is the loudest and the bear case seems most palpable (if not a certainty). Will Adobe be an opportunity akin to Meta, or will it be one akin to Kodak?

The truth is that we’ll only know the answer to this question in hindsight, but I want to share why I believe the market might be getting it wrong here. In all honesty, the bear case for Adobe seems quite lazy and many people who constantly parrot it have most likely not done much work on the company (some have, but the loudest tend to be those that have not).

Just like last quarter, Adobe’s stock dropped significantly after reporting earnings. The company’s stock was down almost 14% on Thursday:

The stock is now in a 44% drawdown, its second largest in the last 5 years. The only (but significant) difference is that the current drawdown is significantly detached from the broad market and this was not the case in the 2022 drawdown. This can only mean one thing: the market believes there’s something fundamentally wrong with Adobe this time around.

The stock is currently trading at an SBC-adjusted FCF yield of 4.5% despite Free Cash Flow growing at a 14% CAGR over the last 5 years and despite revenue continuing to grow double-digits, without signs of a meaningful slowdown. It seems pretty clear that the market is worried about Adobe’s future in an AI-driven world.

It never ceases to amaze me how a $200 billion business can drop 14% twice after reporting earnings. Maybe the market is not as efficient as people believe. The most puzzling thing of all is that Adobe reported a good quarter. Revenue grew 11% in constant currency and non-GAAP EPS grew 13% in Q1 2025. Even though it seems unimaginable looking at the market’s reaction, both of these metrics topped the market’s expectations:

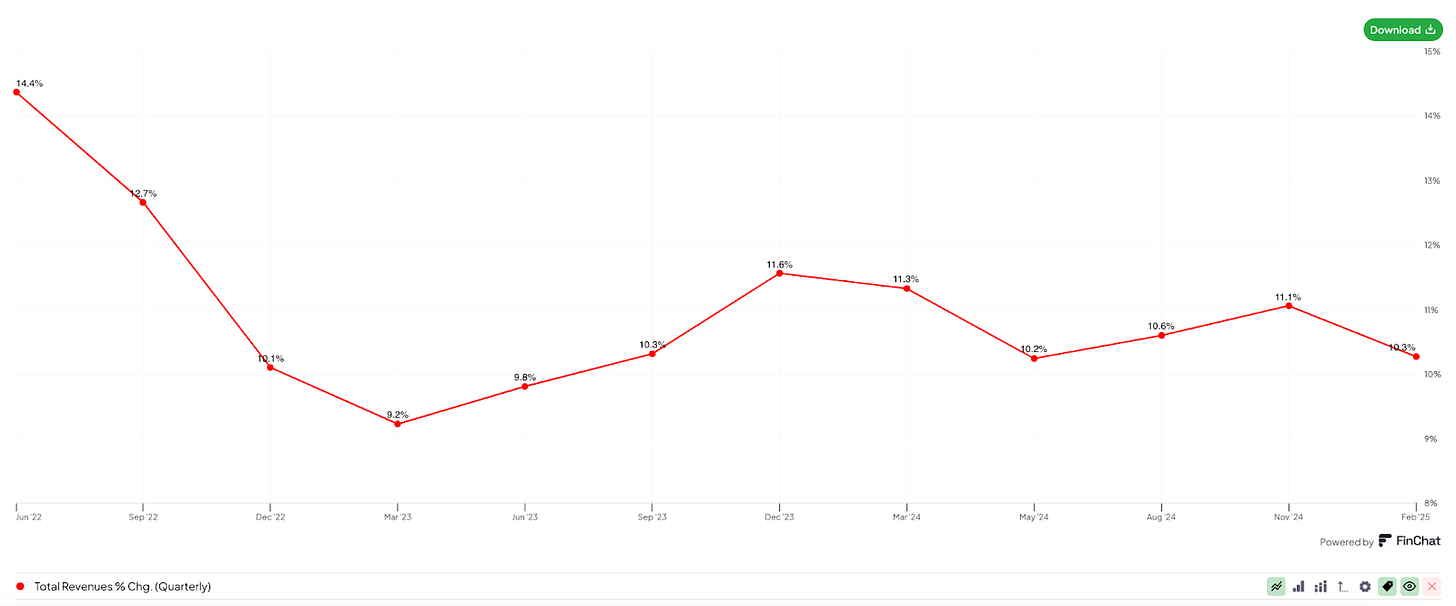

There are also no signs of a meaningful slowdown over the short term. Both total RPOs (remaining performance obligations) and current RPOs outpaced revenue and grew 11% and 12%, respectively, to $19.7 billion. Adobe’s revenue growth remains impressive all things considered. The company is at a +$20 billion run rate and has grown double digits in 10 out of the last 12 quarters:

To contextualize this feat, note that only 5 companies in the US with market caps above $100 billion have managed to grow revenue at a 10% CAGR over the last 5 years while enjoying an operating margin above 35%. Adobe is the cheapest among all these by a significant margin:

This says nothing about the forward returns of these companies, but it sure shows that either Adobe is doomed or it’s a great opportunity right now. Although the market seems to think differently, I believe predictability at this scale is worth quite a bit.

One place where the company slightly missed expectations was Q2 guidance, although management reaffirmed 2025 guidance. This, in theory, should’ve calmed down some fears regarding AI disruption, but it seems like the market will need one of two things to look through this AI “risk”:

A significant beat in the company’s numbers in any given quarter

A prolonged period of the AI risk not playing out

Due to Adobe’s predictability, I believe #1 is unlikely. #2 will take time but I think it’s the most likely scenario here. The company suffered a similar scenario when it transitioned to a SaaS model over a decade ago. The market believed this transition would be a net negative for Adobe as it would lower switching costs without a significant TAM expansion to compensate for it. The stock price was flat from 2010 to 2012 as revenue decelerated following the transition, while the S&P 500 was up around 20% during that time-frame.

The only difference between that situation and the current one is that revenue continues to grow at a double-digit clip today as Adobe pivots to AI. Both scenarios are evidently not the same, but they have one thing in common: the market doubting that Adobe will be able to adapt to a new environment and that this environment will be a net negative for the company. We will only know if this is true in hindsight, but there doesn’t seem to be much proof of this happening currently (it’s more speculation at this point).

The new metrics and what we can learn from them

I usually discuss Creative, Document, and Experience Cloud KPIs, but management shared several new metrics this quarter that will play an increasingly important role as Adobe implements its new cross-cloud strategy. Management started disclosing three new metrics in an effort to be more transparent with shareholders. These metrics “completely” change the company’s KPIs:

We believe Adobe’s success will be driven by innovation in service of both Business Professionals and Consumers and Creative and Marketing Professionals. Reporting insights and the financial performance across these customer groups will provide a clear view of Adobe’s execution against our strategy. We will therefore provide overall Adobe revenue, Digital Media and Digital Experience segment revenue, Digital Experience Subscription revenue and Digital Media ending ARR in aggregate rather than by cloud, as well as subscription revenue for Business Professionals and Consumers and Creative and Marketing Professionals.

This means investors are getting two new segments: Business Professionals and Consumers, and Creative and Marketing Professionals. Business Professionals and Consumers includes…

All subscription revenue from Document Cloud

Acrobat subscription revenue in Creative Cloud

Adobe Express subscription revenue in Creative Cloud

Creative and Marketing Professionals includes…

All subscription revenue from Digital Experience

All remaining subscription revenue from Creative Cloud

One way to understand these new segments is to think of Business Professionals and Consumers (‘BPC’ from now on) as “individuals and SMBs” and Creative and Marketing Professionals (‘CMP’ from now on) as “enterprises.” Although I must say that this distinction is not so clear-cut, we can glean some relevant insights from these new metrics (albeit we don’t have historical numbers).

Management shared that BPC grew 15% in Q1 and represented 28% of total subscription revenue. On the flipside, CMP grew 10% in Q1 and represented the remaining 72% of total subscription revenue. Two things stood out for me here. First, seeing BPC growing ahead of overall subscription revenue growth should “tame the fears” of AI disruption. Sales cycles in BPC are probably shorter than those for CMP, so this segment might mirror the current environment more closely. We don’t have the historical numbers to know if BPC revenue has accelerated after the arrival of AI, but the fact that it’s growing faster than overall subscription revenue probably portrays what management has been saying for a while: AI might indeed be a net positive for Adobe.

The other thing I’d highlight is that seeing CMP make up such a considerable portion of subscription revenue is positive. The reason is that Adobe’s strength has always relied on its ability to offer an E2E solution for Enterprises. This E2E solution now comprises generation (Firefly), editing (suite of apps), distribution (Experience Cloud), and an iteration of this process. Note that Adobe has not historically monetized generation, so anything the company can add from generation would be incremental to its business. I believe the large proportion of CMP revenue (although not a clear cut segment) makes Adobe’s position in the AI era more defensible, primarily because it’s the only company capable of offering the E2E solution to enterprises. There were several interesting comments regarding Adobe’s new comprehensive sales strategy:

We talked about increasingly driving cross-cloud offerings. We are already doing it today. We’re going to be doing more of it going forward. We have accelerated One Adobe deals by increasingly integrating our creative and marketing products into a single enterprise solution.

Adobe’s management seems to know that this is their strength and plans to capitalize on it. Enterprises seem to make up a more significant part of the company’s business than I had previously imagined, which is good because I believe the AI opportunity is likely much more incremental for the Enterprise segment than for individuals or SMBs.

All this said, the market only seems to care about direct AI revenue. Management also shared how much revenue Adobe was directly (this word is important) generating from AI: $125 million. They expect this number to double by year-end. $250 million in direct AI-revenue would mean that Adobe would end the year with just over 1% of revenue coming directly from AI. This might be underwhelming for some people, but management also shared that this only includes revenue from AI-only offerings (like Acrobat AI assistant, the new Firefly App and Services, and Gen Studio for Performance Marketing) and does not capture the benefits that Adobe has enjoyed by deploying AI across its tools. This means that even though we don’t know how much revenue is directly and indirectly derived from AI, we do know that it will be likely higher than 1% of total revenue by year end. Worth pointing out that this metric will be shared sporadically, not every quarter.

Another thing that I’d like to discuss is how the lines are blurring between the different clouds. We already knew this was the case for Creative and Experience (two steps of the same workflow), but I was surprised to see how the line between the Document and Creative Clouds is blurring too:

A significant number of all documents created in Acrobat are visual documents, things like marketing content, sales pitches, presentations, infographics and cover pages. We’re making good progress in addressing this need by embedding Express capabilities as a native experience in Acrobat. We see numerous indicators of user demand as express usage through Acrobat has grown 10x year over year.

Express also seems to be picking up pace:

Express onboarded nearly 6,000 new businesses in Q1, representing approximately 50% quarter over quarter growth.

Note that Express is Adobe’s way of entering a space where Canva has historically dominated and seems to be doing so pretty effectively. I believe the likelihood of Canva disrupting Adobe’s enterprise segment is lower as Canva can’t offer an E2E solution today (they don’t have an Experience Cloud, for example).