Stevanato Group (STVN) (Pt. 5)

The Best Anchor Stock traits

Hi reader,

This is the last article related to the research on Stevanato Group (STVN). I’ll review how the company complies with all the Best Anchor Stock traits:

Before reading this article, I highly recommend you read all the articles I’ve published on the company up to now (if you have read all the articles then you can jump directly to the first trait).

In the first article, I explained the company’s history and what it does. Stevanato is relatively new to financial markets but has been operating for many decades.

The second article discussed the financials and growth drivers. There’s a limited financial history for Stevanato, but what’s undeniable is that current financials and growth rates are not normalized. I explain why in that article.

The third article discussed three key topics: competition, moat, and risks. Much of the attractiveness of Stevanato as an investment comes from the industry's competitive environment, but there are also several company-specific characteristics to point out.

Finally, the fourth article discussed management & incentives, capital allocation, and valuation. Just as was the case in the article with the financials, Stevanato does not have a long track record through which we can judge these topics, but I give it a shot.

Without further ado, let’s directly jump into the first trait.

1. Experienced and aligned management

Stevanato does not have, on average, a very experienced management team. The average tenure across Stevanato’s management team is 8 years and heavily skewed to two managers: Franco Stevanato (CEO) and Mauro Stocchi (Chief Business Officer):

This is nothing to write home about, but it needs context. This relatively low tenure is not a result of high rotation across the management team but rather the result of a newly constituted management team for public markets. Of the 7 managers, 2 run “newly” created positions (COO and IR), and the CFO came as a result of the company’s IPO. In short, there is no need to read too much into this relatively low tenure. The managers in charge of probably two of the most critical positions have an average tenure of 23 years.

Something worth highlighting is the company’s board of directors. The board is composed of 12 members. They are all very experienced in the industry, but I would highlight four:

Sergio Stevanato: the founder’s son who ran the business for decades

Don Morel: former CEO of West Pharmaceuticals during a period when the company significantly outperformed the indices

William Federici: former CFO of West Pharmaceuticals

Karen Flynn: former Chief Commercial Officer of West Pharmaceuticals

The Stevanato family is likely well aware of West Pharmaceuticals’ track record of shareholder value creation in public markets and wants to put similar ingredients in place. Another place where they try to mimic West is in incentives. Management’s compensation is based on two metrics:

Total revenue growth

ROIC

The first of these metrics might incentivize a “growth at all costs” mentality, but ROIC is there to control for that. The only “problem” with these metrics is that Stevanato is not transparent with the thresholds. We don’t know what ROIC or total revenue growth the compensation structure targets, but this should not be worrying considering the high insider ownership.

The Stevanato family owns more than 80% of the business, so it’s safe to say that they care dearly about the stock price over the long term. As discussed in my Hermes analysis, when insider ownership is so high, the compensation structure is not AS important (it’s important nonetheless). Stevanato is a good example of these dynamics.

If you want more detail on these topics, please read part 4 of the series.

2. Proven track record of outperformance

Things get tricky here: Stevanato does not have a proven track record of outperformance. The company has only been publicly listed for 3 years, years through which its industry has suffered considerable destocking dynamics and a significant drop in COVID revenue.

This might sound counterintuitive, but the fact that Stevanato’s stock is down since its IPO is good news. I say this because it signals good capital allocation from management: they chose an ideal moment to IPO.

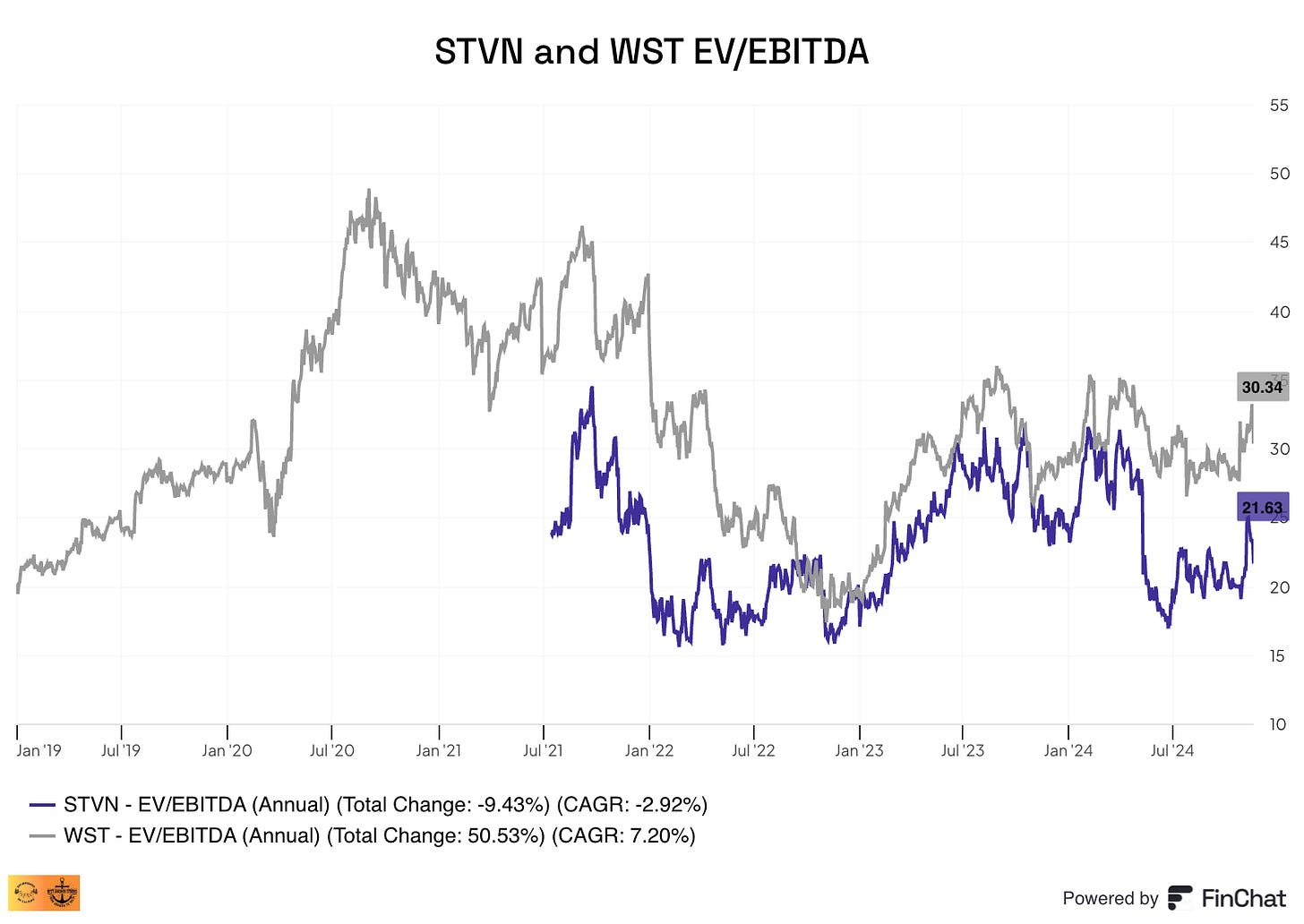

The goal of any IPO is to gather the most funds possible, and Stevanato IPOed when EV/EBITDA multiples in the sector were hovering around 40 (likely on inflated earnings):

The company chose an ideal moment to IPO because multiples started to contract soon after. One might claim this was luck or not; we’ll never know. What’s evident is that the company is paying for the current capacity expansion plan by selling overvalued shares, and that’s always a positive thing.

The other thing I would highlight is that the industry has a track record of shareholder value creation. When looking at a given industry, I always come back to this graph by Michael Mauboussin which portrays that it’s easier to add shareholder value in certain industries than in others (albeit there’s always room for shareholder value creation in any industry):

Stevanato might not have a proven track record of shareholder value creation yet, but one company (the only pure play publicly listed for so long) in the industry has managed to create significant shareholder value: West Pharmaceuticals (WST). We should (evidently) avoid extrapolating what West has done to what Stevanato might do in the future. Still, there are reasons to believe that the same ingredients for value creation that have existed in West are also present at Stevanato:

The industry is still attractive as it enjoys significant entry barriers and secular growth drivers

Stevanato is earlier than West in its transition to high-value products, which should improve the quality of the business

The executives who unlocked value at West (Don Morel and William Federici) are now directors at Stevanato

Stevanato has no proven track record of shareholder value creation due to its short history in financial markets, the pandemic’s boom and bust, and management’s good capital allocation decision to IPO at “the top.” This said, it does seem that Stevanato has all the ingredients to build such a track record going forward.

3. Strong moat

There are several pillars to Stevanato’s moat. Most of these pillars are industry-specific, but Stevanato also possesses certain “proprietary” competitive advantages that separate it from its peers. I won’t go into detail into each pillar because I already did that in part 3, but all these pillars together end up giving Stevanato’s products the following characteristics:

Mission critical due to regulatory capture

High switching costs due to regulatory and reputational barriers

Both create a fertile ground for value creation over the long term.

4. Enjoying long-term secular tailwinds

This is something I touched on in part 2, but I’ll bring a summary here. Stevanato is exposed to several secular tailwinds across its segments, and interestingly, there’s significant visibility into these tailwinds due to the length of the regulatory (i.e., what we see in the pipeline today is what we’ll see in the market over the next decade or so).

Stevanato is not exposed to the rise of biologics (like Danaher) but to the rise of injectable medicines. Luckily for the company, both are related. Biologics are increasingly taking over small molecules due to their effectiveness in treating certain diseases, and due to their sensitivity, these tend to be injectables. A more significant presence of such therapies in the pipeline should eventually translate into more injectable volume going forward, especially when we consider biosimilars' arrival. Biosimilars are expected to lower the value of biologics due to the increased affordability, but this increased affordability should be very positive for volumes.

That said, there’s also an underlying shift that should act as a growth driver for Stevanato going forward: the shift to high-value solutions. Stevanato is increasingly “taking on” tasks on behalf of its customers (namely washing and sterilization) and calls these high-value solutions. This shift should bring higher revenue (ASPs of HVP are up to 10x higher than bulk products) and higher margins (gross margins of HVP are typically double those of bulk) but comes at the expense of somewhat higher Capex. What I want to illustrate here is that it’s not all about volume growth; growth will come from incremental volume, but also replacement demand as new injectables make it to the market and customers opt for high-value solutions.

All in all, Stevanato can take advantage of several secular tailwinds to grow its business. By the way, in part 4 I wrote the following when discussing the valuation:

I believe management is pretty conservative here, and something doesn’t add up. Recall that I mentioned before that they expect €1 euro of Capex to result in 1€ of revenue, and we found out that the current differential between incremental sales and Capex euros spent is around €700 million. This would mean that the current capacity expansion plan can support up to €1.7 billion in sales. This has two potential implications:

Management is being conservative with their growth expectations (i.e., they’ll grow faster)

Management is being conservative with the required Capex going forward (i.e., they’ll need less Capex to sustain growth)

The third option is that (A) they are being misleading, or (B) I misunderstood something. Option (B) is unlikely here, as management confirmed to me that I am not misunderstanding anything:

It is one euro of capex will generate one euro of revenue – when the production is at full capacity. So for example in Fishers, we expect to invest roughly 500M. The site will achieve full productivity in mid to late 2028 approximately. In this case, we would anticipate hitting the 500M in revenue in that 2028 time frame.

I still have some doubts about this, so I’ll keep you posted with what I find out.

I contacted management, and they told me that I understood it correctly and that all the Capex that has been spent up to now that still needs to be met with incremental sales should translate into future revenue if the company operates at full capacity. This means that Stevanato should, in theory, be able to support €700 million in incremental revenue without spending a dime on incremental Capex. Management told me that this is true but that they will keep investing according to the growth opportunities they see.

5. Optionality

Stevanato is not a business that has optionality due to its ability to go into new markets (like an Amazon might), but due to the company being part of the picks and shovels of a very innovative industry: the pharmaceutical industry.

It’s highly likely that when we analyze Stevanato in 10 years, the company will probably be doing the same thing: containment solutions for the pharmaceutical industry. What we can’t answer (and this is where optionality comes from) is what therapies those containment solutions will be used on in 10 years (either in type or number).

This means there’s optionality in volumes, which can also be positively impacted by the use of AI during the discovery and approval processes. I discussed this in more detail in this article, but I view Stevanato (and Danaher) as potentially an asymmetric bet on AI.

6. Double-digit growth

Understanding Stevanato’s growth path is not an easy task, primarily because we don’t have a long financial history to look at. There’s an additional roadblock: the track record of growth we can look at includes plenty of noise due to the pandemic boom and bust.

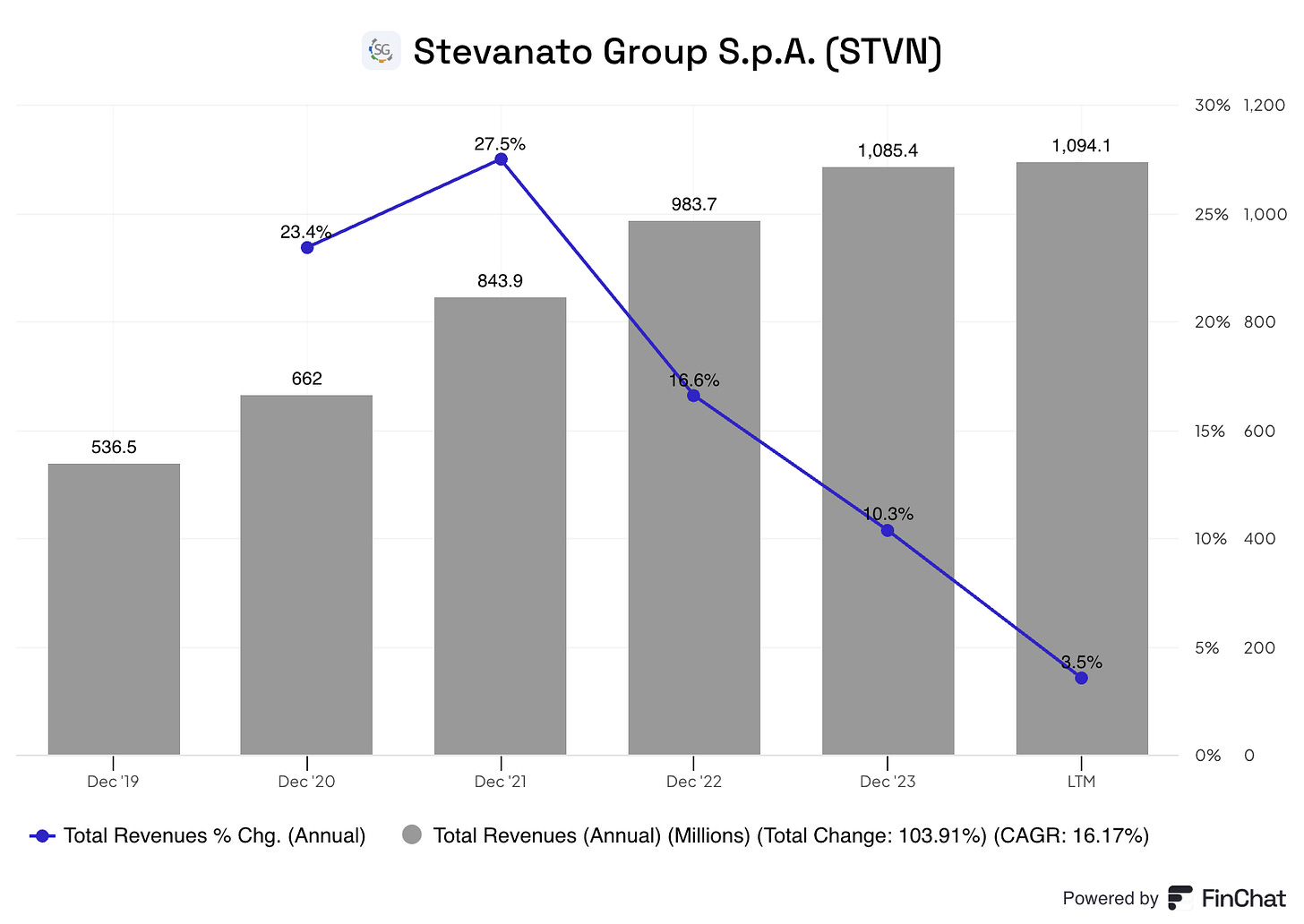

Stevanato’s growth has been pretty volatile since 2020 and has decreased considerably since peaking (the growth rate, not revenue) in 2021. The 16% revenue CAGR through this period was probably also influenced by the pandemic, which is probably a tad higher than we should expect going forward. It does show us, though, that Stevanato can grow its top line at a double-digit clip:

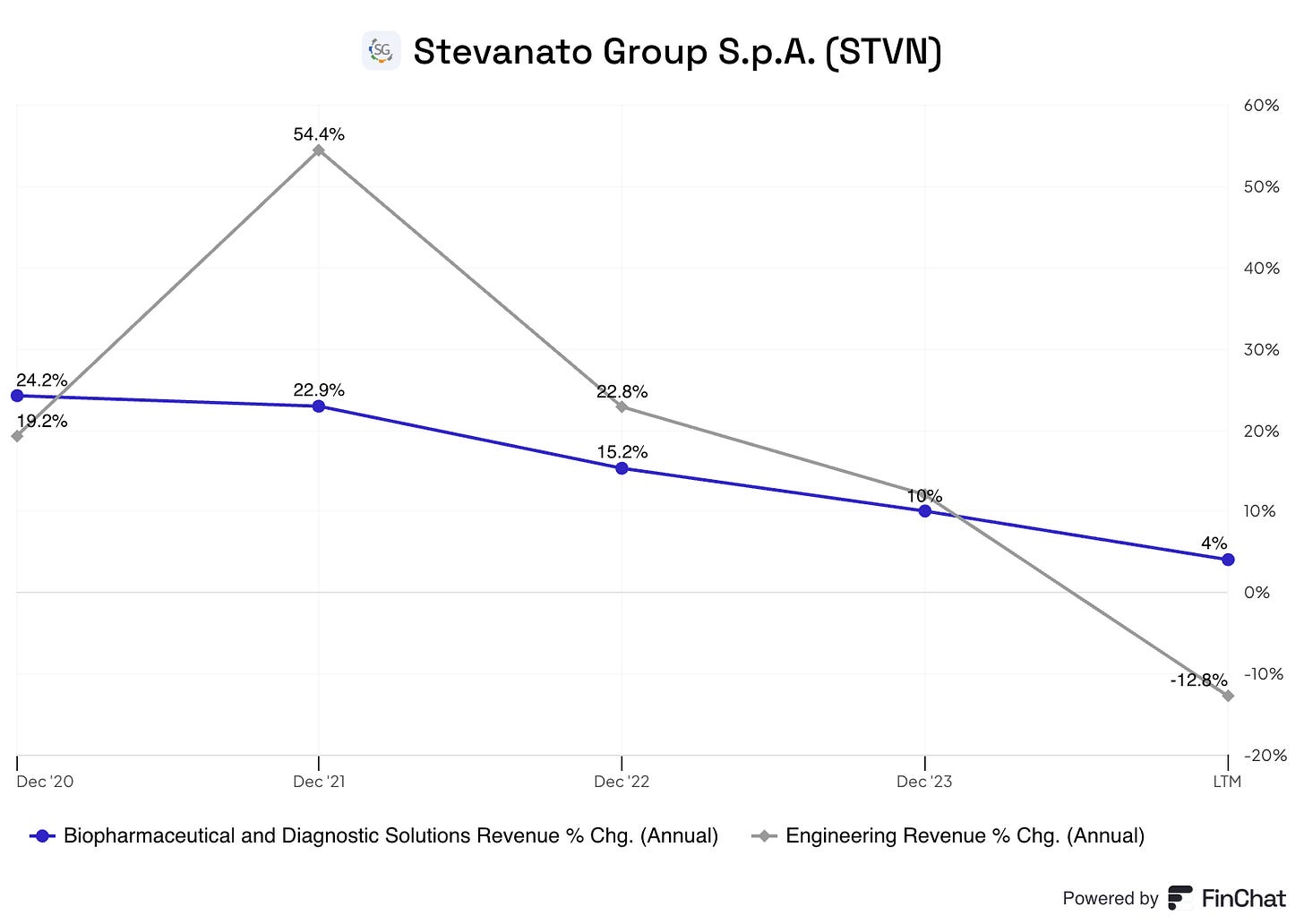

Stevanato is the perfect representation of the pandemic boom and bust, albeit it has been resilient through the bust despite growth rates coming down considerably. Both BDS and Engineering enjoyed significant growth during the pandemic as customers ordered ahead of demand to bypass supply constraints (in a process called “stocking”). This stocking eventually came biting back in the form of destocking, and growth decelerated to the point that Stevanato does not expect to grow this year.

If we look across segments, we can see that there’s a stark difference between BDS and Engineering. It’s pretty evident that Engineering is more volatile than BDS, and the reason is that it’s tied to the Capex of its customers. BDS, on the other hand, is mostly consumables revenue that tends to be more stable as it’s directly linked to end demand and the Opex of its customers.

Growth rates have declined in both, but much more in Engineering (for reasons discussed in other articles):

With this volatile and strange period behind us, what should we expect of Stevanato’s growth going forward? Management believes this is a double-digit revenue growth business at steady state (i.e., once noise is behind us). The company has grown significantly faster than 10% in some years since management issued these expectations (2021), but it “uncoincidentally” has delivered a 10% revenue CAGR from those levels. It seems that management has not taken these growth expectations out of a magic hat.

One of the best things about management’s “guidance” is that visibility is pretty high, thanks to ongoing customer conversations. Customers must tell Stevanato what demand they expect over the coming years so that Stevanato can build the capacity to satisfy it. It’s definitely true, though, that customers can turn out to be too optimistic.

Due to expectations of significant demand in the coming years, management undertook a considerable capacity expansion plan of around €1.5 billion (to date), claiming that each euro spent in Capex should eventually translate into €1 of revenue. In another article, I calculated how many excess sales there are still to be realized based on this Capex plan, and I found out the number was around €700 million:

This basically means that, when Latina and Fishers (the facilities that are responsible for most of this Capex) are operating at full capacity around 2028, Stevanato will be able to support around €1.7 billion in revenue. This assumes that the company is operating at full capacity by then. As discussed, management builds capacity based on long-term commitments with customers, so even if Stevanato achieves this goal by 2030 (and not 2028), the revenue CAGR supported by this capacity expansion plan should land pretty close to 10% (9.3%). If the company were to be operating at full capacity in 2028 (as expected if customers satisfy their commitments), revenue CAGR should come in around 14%.

More than the growth rate per se, I would highlight two things. The first one is that, as discussed, there’s high visibility due to this expected growth being based on customer’s long-term commitments. Recall, though, that commitments are not necessarily noncancelable orders.

The second thing that should give us confidence in these growth rates (besides all the volume drivers in injectables expected over the coming years) is that a good portion of this growth will be “replacement” demand. The industry is transitioning from bulk to high-value products, which carry up to 10x larger ASPs (Average Selling Prices). This means that if Stevanato replaces a bulk order with a high-value solutions order, revenue should automatically go up without a corresponding volume increase.

West Pharmaceuticals (WST) is further along in this transition to high-value products and has achieved a 9% CAGR in proprietary product revenue (akin to Stevanato’s HVS category) over the past decade:

With biologics making an increasing portion of approvals, tailwinds for high-value solutions should, in theory, be stronger over the coming decade than they were in the past.

This said, and despite revenue growth for Stevanato probably landing in the HSD to LDD range, the best thing about the business lies in the bottom line. As a significant portion of expected revenue growth will come from the industry’s transition to high-value products, margins are expected to expand significantly.

According to Stevanato’s management, HVS carry around double the gross margins of bulk products, on average. This means that any growth in the top line will most likely be magnified on the bottom line as margins expand. Stevanato’s growth is not “just growth,” it’s very profitable growth.

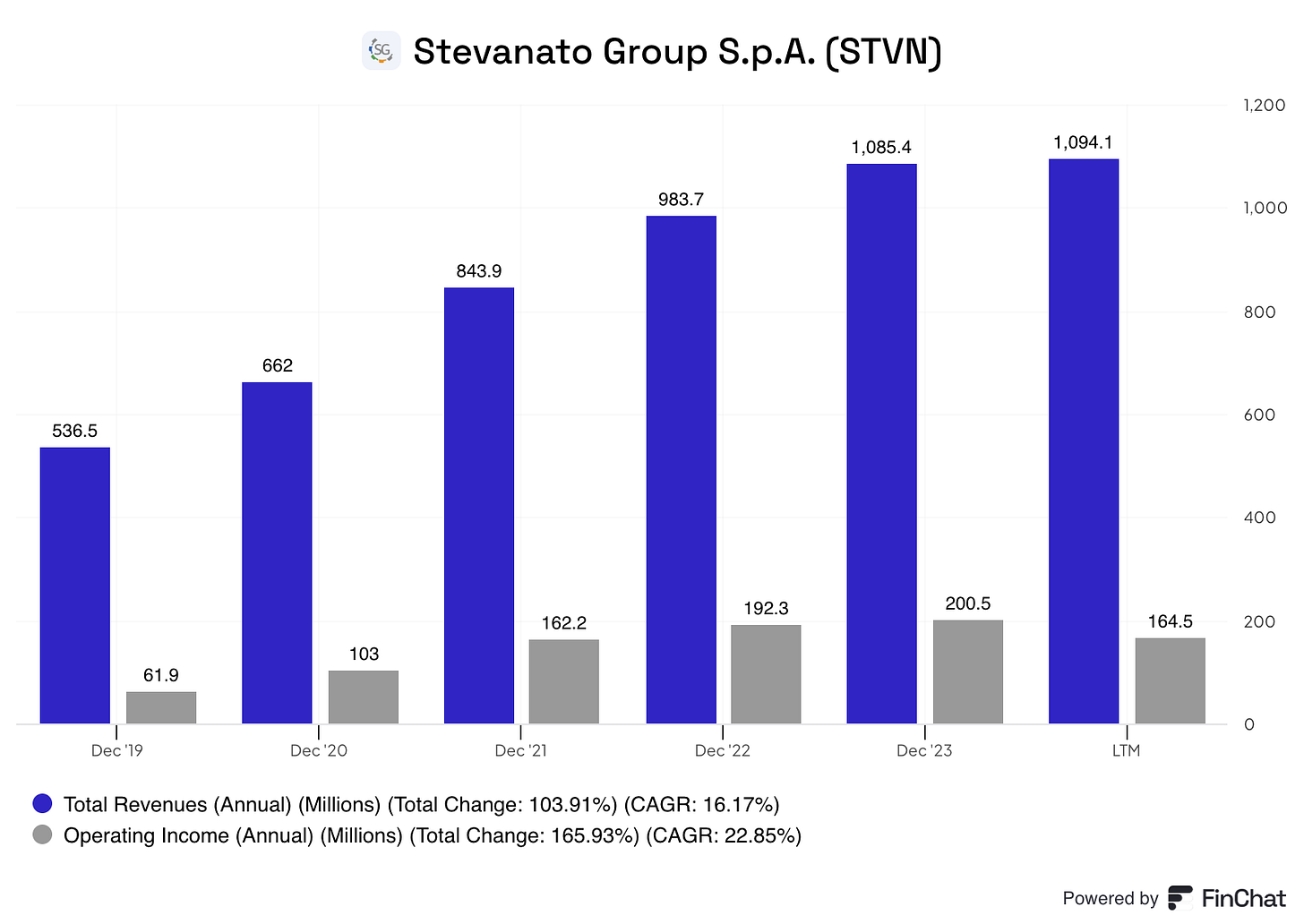

This has been the case in Stevanato’s short history. Despite all the inefficiencies the company is currently facing, operating income has grown significantly faster than revenue:

Operating leverage in this business is significant, so I expect to see Stevanato grow its operating income at around mid-teens over the coming years.

There’s little doubt that Stevanato complies with this Best Anchor Stock trait, and it does so in both revenue and earnings. Sometimes, a company will not meet the revenue growth threshold (or this trait altogether), but it can still make a good investment. It’s not growth alone that matters, but growth in the context of the current valuation. Stevanato is evidently priced to grow faster than Deere (for example), which doesn’t necessarily make it a better investment (I believe both will work out just fine).

7. Strong financial position

Stevanato IPOed to gather funds to invest in capacity. However, the funds the company gathered were insufficient to fund the capacity expansion plan as growth expectations came in higher than expected. To meet the growing need for funds, the company did two things:

Issue more shares

Issue debt

Stevanato continues to suffer a Free Cash Outflow, and cash is not plentiful on the balance sheet, but the company has a solid financial position. Stevanato currently carries a net debt position of €286 million. While this might appear relatively high, Stevanato is a very profitable business even during the current “downcycle,” so its net debt/EBITDA ratio is currently just over 1x despite the “surge” in debt and the depressed EBITDA figure. The company operates in a pretty stable industry based on consumables (akin to recurring revenue) and, therefore, could potentially take on higher leverage levels.

I believe this is unlikely to happen for two reasons. The first and most evident one is that this is a family business where the family members are unlikely to take the risk of running on high leverage. The third generation is running the firm, so it’s safe to think that they think about durability rather than optimizing its capital structure.

The second reason is that Stevanato carries a 1.2x leverage ratio when capacity expansion is at its peak and EBITDA is at its (likely) trough; in short, when both variables are working against the company. If the business environment improves from here (which seems likely) and Capex starts to come down, we should see Stevanato’s leverage levels naturally come down as EBITDA grows and the needs for debt become nonexistent.

All in all, despite everything working against it, the company is still running with low leverage levels. To this, we must add that the family still owns 80% of the outstanding shares, and it’s unlikely they’ll ever expose the company to the terminal risk that high levels of leverage always bring.

8. Lower than usual volatility

I have to make a slight workaround around this trait with Stevanato. As you might have noticed, Stevanato’s stock is pretty volatile. Significant (and fast) drawdowns and runups are the norm for the stock. Since I have owned Stevanato (barely a couple of months), its stock has gone up 20%, given back all of these gains, and gone slightly back up. Just in the last 6 months the stock has suffered several 15%-20% drawdowns:

I’ve discussed the reasons behind this volatility several times throughout the article series. The main reason is that the stock is thinly traded because the family still owns around 80% of the outstanding shares. Only around 530,000 shares (out of around 270 million) trade daily. With management owning most of the business and their reluctance to sell (at least for now), it’s unlikely that supply will get any better over the short term. This lack of supply obviously creates more violent moves (both up and down). The low float also diminishes the presence of large funds, which tend to be more long-term holders than the average trader.

The other reason behind the volatility is that Stevanato is currently undergoing a tough period, and there are shorts in its float.

As a workaround around this trait I could say that, while the stock is volatile, the business has not been volatile. This, however, would also be slightly misleading. Stevanato’s business has been pretty volatile through this pandemic boom and bust, but that’s precisely why there are opportunities in financial markets. It’s “easy” to value a business when numbers are somewhat normalized, but when these are all over the place, many will not even give the stock an opportunity. I believe this is what’s happening with Stevanato, added to the fact that many funds can’t even purchase the company due to its low float and, therefore, don’t even care about looking at it.

I believe that Stevanato’s business will not be very volatile going forward, mainly because it’s exposed to healthcare, enjoys secular growth drivers, and sells consumables. This said, there’s no denying that its business depends to an extent on blockbuster drugs (like GLP-1s today), so we might see some kind of volatility on the revenue line from time to time.

9. Resilient during recessions

What I’ve just discussed about the volatility of the business going forward also stands for its resiliency during recessions. Stevanato was not publicly traded during the last financial crisis, so there’s no way of knowing how the company performed back then. The good news is that West Pharmaceuticals was publicly traded back then, so we can see how it performed.

West was growing pretty fast coming into the global financial crisis, and revenue decelerated significantly. It did remain in positive territory, showing its resilience. As this industry is a manufacturing industry, when revenue slows, operating income tends to fall more, and that’s what happened at West:

Something similar might likely happen to Stevanato if we go into an economic downturn. Revenue growth would probably slow significantly (not from today’s levels but from a normalized state) and margins would probably fall due to underutilization across its manufacturing capacity. In short: Stevanato does not seem immune to a recession (there are few, if any, businesses that are immune to recessions).

This said, we could argue that Stevanato’s business is resilient to downturns for several reasons. First, it’s exposed to the healthcare industry, which is viewed as a defensive industry. Healthcare is viewed as defensive because, no matter what the economy does, the population still needs to get treated, and Stevanato’s products play a key role in administering drugs to patients.

Let’s not forget that Stevanato sells primarily consumables, which means it's tied to volumes required by the patients more than the Capex investments of any of its customers. Capex tends to be cut much earlier than Opex when the situation worsens, and even though the Engineering segment is exposed to its customer’s Capex, it doesn’t even make up 20% of Stevanato’s business.

We could argue, though, that Stevanato might be more exposed today to an economic recession than in years past; why? Due to GLP-1s. GLP-1s (commonly known now as the “obesity drugs”) have been a tailwind for the industry. While they are evidently necessary for the patient’s health, they are inherently a bit more discretionary. These drugs are expensive, and we might see patients delay their intake if economic conditions worsen as delaying their intake will probably not put their life at risk (at least not immediately). A counterpoint here would be that lower intake of these drugs and, therefore, higher obesity could lead to higher comorbidities in the future which should translate into higher volumes for Stevanato (just thinking out loud here).

This said, recent headlines claim that these drugs might end up included in the Medicare and Medicaid programs which would significantly increase their affordability. The only caveat here is that this is a Biden proposal, and with Trump soon coming to office we don’t know how it’ll play out.

Another thing we could argue is that Stevanato might see downtrading from high-value solutions to bulk if an economic recession hits. I view this as unlikely for two reasons:

HVS carry certain services (like washing and sterilization) that customers have chosen to outsource. These capabilities can’t be insourced in a short period because they rely on capacity additions which are unlikely to be undertaken during a downturn (and if they do then that benefits Stevanato’s engineering segment)

Regulations are getting stricter, and therefore, the impact of relaxing quality standards in containment solutions can be much costlier today than it was in the past

All in all, healthcare is one of the so-called defensive industries. While no industry is immune from an economic recession, some are more than others, and I think Stevanato will prove to be resilient through any upcoming recession. The main reason is that many patients need Stevanato’s products to carry on with their lives regardless of the current economic situation.

10. Reasonable valuation

I will not discuss the valuation here in detail, as I already did that in one of the articles of the series.

In the meantime, keep growing!

Thanks for making this write up free. I work in healthcare and have not given much thought to injectable drugs and who makes the containers.

Am new to your Substack, impressed by the quality and clarity of your writing. Will work my way through your past posts. Do you publish an intrinsic value/ fair value for the companies you analyse, 1 year and 3 year price targets?

Thanks for your hard work!