Why Healthcare offers an asymmetric bet on AI

Hi reader,

I will not be the one to tell you that AI is (and has been for a while) the buzzword of financial markets, but here I am writing about the topic yet again. This time, instead of understanding AI's impact on several software businesses I own, I want to discuss its potential impact on an entire industry: healthcare. Healthcare is a vast industry, and the implications of AI vary widely across its subcomponents, so I’ll focus on those that could potentially offer an asymmetric bet on AI. Needless to say, I am not well versed in all the subcategories within healthcare, so consider this list non-exhaustive.

There’s little denying by now that AI potentially brings substantial growth opportunities to many industries. However, as investors in individual companies, we must also strive to understand how and why this growth will accrue to incumbents or, conversely, where it comes with significant disruption risks.

There’s (almost) always a tradeoff in investing; for AI, this tradeoff seems to be one of growth opportunities vs. disruption risks. I think, however, this tradeoff is favorably skewed in some subsegments of the healthcare industry.

Before jumping into these segments and why they might offer an asymmetric bet on AI, I want to briefly explain a drug’s lifecycle.

How the drug workflow works

Humans have been searching for solutions to the numerous diseases humanity faces for centuries. This research process encompasses several steps, the first of which is called the drug discovery process. In the modern drug discovery process, a pharma or biotech company searches for two things…

The protein that needs to be targeted to cure or mitigate the disease

The compound that will be most effective in targeting this protein

While the end objective of a drug will always be to cure the disease, this is not possible in many cases, so pharma companies have to conform themselves to finding a solution that helps mitigate its impacts. Even though not the best end result, it’s still significantly better than having to face the disease without treatment. Take, for example, AIDS. People used to die from AIDs, but they are now able to die from age even though there’s no cure for AIDs. Despite significant advancements over the past decades, there are still many unmet needs regarding diseases, either because there’s yet no cure or because there’s no treatment whatsoever for some diseases.

The industry should strive to find therapies for such unmet needs, but there are certain roadblocks. The first roadblock is that it’s an extremely complex and expensive task. It is estimated that discovering and developing a drug can cost north of $2.8 billion and takes, on average, 15 years. Discovering the protein to be targeted takes more time than money (in the grand scheme of things), but clinical trials are both expensive in time and money.

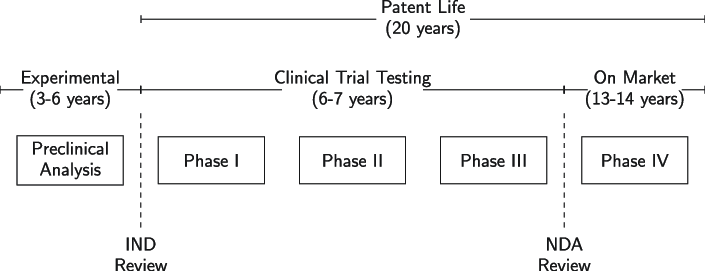

The second roadblock (tightly related to the first one) is regulation. As these drugs are ultimately going to make their way into a human organism, regulatory bodies (the FDA in the US and the EMA in the EU) have set stringent regulatory requirements for a drug to be commercialized. These barriers can be summarized into three steps: "Phase I, II, & III.” These three phases, together with phase IV, could be bundled into the drug approval process:

As you can see above, getting to commercialization takes anywhere between 9 to 13 years. Note that a drug developer is incentivized to take the drug fast to market because the patent life starts after the IND review. This means that when a drug is commercialized, the remaining patent life tends to be significantly shorter than 20 years. IND stands for Investigational New Drug Application and is a regulatory requirement to start administering the proposed drug to humans. First at a very small scale (Phase I) and subsequently to larger populations (Phase II and III).

This is something obvious, but the goal of the drug approval process is to ensure that the drug is safe to be administered to a large population. We could divide the drug “workflow” into three steps: drug discovery (aka., pre-clinical), approval (aka., clinical), and commercialization:

So the question is…where is AI expected to have the most significant impact in this workflow? The logical answer is drug discovery. AI should, in theory, help accelerate the drug discovery process because as algorithms improve, they should be able to help researchers become more productive when looking for the protein to target and a compound to “attack” it. Algorithms have historically been used for the former and are increasingly being used for the latter. However, several challenges remain until it becomes fully applicable.

The main challenge comes from fragmented and inconsistent databases (i.e., the absence of high-quality data). The problem is not the amount of data but rather how reliable it is to be used in a model and how scattered it is. The industry is taking several steps to remedy this, but it’ll probably take some time until it comes up with some workable data set. There’s no denying, though, that over the LT, it’s highly likely that AI will help accelerate the drug discovery process; to what extent is anybody’s guess.

What I find more interesting, however, is AI's role in the drug approval process. At first, one might think that there’s not much AI can do in clinical trials. However, several researchers believe AI will come in quite handy in saving costs and time through the process; how? By reducing failure rates. According to this study, “just decreasing the failure rate by 20% (from 30% to 24%) in each step of the discovery process would mean halving the total cost of any single project.” These are no small numbers, more so considering how expensive the process is and that this money would be able to be used elsewhere and would enjoy a faster turnover:

There’s also an additional benefit. Due to the high cost inherent in drug development, rare diseases or those that impact smaller populations are typically left unmet because it’s simply “not worth the cost.” If AI helps decrease the average cost of developing a drug, then this might also change going forward because it might make economic sense to focus on more niche populations.

There’s, however, a pretty significant roadblock to this applicability. Most AI models function as a black box in which the outcome is not entirely explainable. This is a roadblock here because researchers need to know why a potential drug is expected to fail or has failed. They need to know this so that they can tweak the compound and continue with the process.

In short, AI should theoretically enable a faster drug discovery process and higher success rates in the drug approval process. This, in turn, should lead to more and less expensive drugs being approved yearly. The current success rate from the start of a clinical trial to commercialization stands around 10-20% and has remained stable for several decades. Will AI change this? It’s still soon to know, but there’s definitely a chance to do so despite the aforementioned roadblocks. More drugs coming into clinical trials (due to a faster discovery process), and more drugs making it to the commercialization phase should lead to higher (and potentially cheaper) volumes going forward.

What healthcare subsegments can benefit from this?

Considering most of the AI benefits should potentially translate into increased volumes, I believe two industries stand to benefit quite materially while remaining isolated from disruption risks: bioprocessing tools and fill & finish.

The bioprocessing tools companies sell the equipment and consumables necessary to manufacture biologic drugs (also known as large molecules, these are drugs made from living organisms). I’ll not explain this entire workflow here, but I’ll share it below. Remember you can also listen to my podcast with Peter Mantas on the topic:

The fill & finish companies sell containment solutions that “store” these biologics before being administered to patients. The growth drivers for both subindustries are somewhat similar because they participate in the same value chain (at different stages), but there are some differences.

Biologics are expected to remain the fastest-growing category in the industry, aided by their effectiveness in treating various diseases and the arrival of biosimilars (generic biologics). With the current pipeline and approvals increasingly being skewed toward biologic drugs, it’s natural to think that any benefit of AI should result in a faster rollout of these products to market:

Biosimilars will probably create headwinds on overall category growth (value-wise) by depressing prices, but they should theoretically increase volumes by increasing affordability. While bioprocessing companies will benefit from any kind of increase in biologic volumes, fill & finish companies “only” benefit from those that are injectables. Most biologics are currently injectables because of their sensitivity (the digestion process would likely reduce their effectiveness quite materially in some cases). Below you can find some examples of both types of companies…

Bioprocessing: Danaher (DHR), Thermo Fisher (TMO), Sartorius…

Fill & Finish: West Pharmaceuticals (WST), Gerresheimer, Schott Pharma, Stevanato (STVN)…

Now, while the potential benefit from AI seems straightforward (increased volumes), why are these companies protected from potential disruption risks? A good portion of their “defense” can be summarized in a couple of bullet points:

Regulatory entry barriers: both the bioprocessing and fill & finish companies are protected by regulatory barriers because their products get spec’d into the drug. A company must undergo a certain regulatory process again if it wants to switch to a different solution. This process takes time, and time is money in this industry, so customers tend to be reluctant to waste time re-filing. Biosimilars also tend to take the specifications of the biologic because they know it will get approved, and they care dearly about getting soon to market.

Mission criticality and reputation: the tools, consumables, and containment solutions are all critical in the drug development and commercialization steps; they are must-haves for pharma companies. Pharma companies tend to be reluctant to change to newcomers due to reputational reasons. Switching to a new and unproven supplier could cost billions in lost sales or reputational damage if something were to go wrong.

Low portion of the overall budget: while more applicable to fill & finish than bioprocessing tools and consumables, considering that it takes more than $2 billion (on average) to take a drug to market, these products make up a low portion of the overall budget. This further increases switching costs, considering how much money is at stake during the patent life period.

All of the above result in high switching costs, which eventually should lead to a low risk of disruption from AI. In both cases, it’s not as much about the product but about having something one can trust to take a drug to market (as the most expensive part of the process can be considered sunk costs).

All in all, I believe companies focused on bioprocessing and fill & finish can potentially enjoy the benefit of AI without suffering too much of the disruption risk, meaning that they would offer an asymmetric bet to AI. The potential impact AI can have on the drug development process is still TBD due to certain roadblocks, but it definitely constitutes positive optionality for these companies if it ever gets solved.

In the meantime, keep growing!

Hi Leandro, as someone who works in healthcare, I agree. Also, it has uses in administrative tasks. The administrative burden of HCPs is ever growing with time, and AI offers a huge value add in de-burdening providers (so they can focus on clinical duties).

Something similar is playing out in policing with AXON, where they are using AI to help law enforcement complete their paper work.