Thanksgiving weekend and Nvidia's "battle" against Google (NOTW#70)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

It was a short week in the market due to Thanksgiving, but there were several relevant events/news of portfolio companies regardless.

Without further ado, let’s get on with it.

Articles of the week

I published two articles this week, both earnings digests. The first one was Keysight’s Q4 earnings digest.

Riding the innovation wave

Keysight reported outstanding earnings on Monday. The stock rose significantly the following day, and although it did not break its ATH, it is pretty close!

The company reported excellent earnings this week and demonstrated once again that it’s probably (together with semis) as close as you can get to riding the wave of future innovation. You can read my Keysight in-depth report here.

The second article of the week was Deere’s earnings digest.

Deere’s Q4 2025: Will it be worth the wait?

Deere reported Q4 and FY 2025 earnings on Wednesday (before market open). Results were “meh,” and the commentary around FY 2026 wasn’t inspiring either. The market did not like the results, and the stock dropped almost 6%. Before earnings, Deere was trading close to its ATHs (all-time highs), so the

The company didn’t report great earnings, but all eyes remain on the recovery of the cycle. I discuss the three most important topics of the release, including the valuation. You can read my Deere in-depth report (for free) here.

Without further ado, let’s see what the markets did this week.

Market Overview

It was a relatively calm week in financial markets due to Thanksgiving. The markets were closed on Thursday, but both indices took a breather and rose significantly this week:

I don’t have much to comment on this week, but I found this post fascinating:

Constellation Software is a $50 billion+ market cap company that traded little to no meaningful volume when the US markets were closed. Constellation/Topicus/Lumine don’t typically have the highest volume, which might indicate there’s basically no appetite for these types of businesses right now (we know where the appetite and attention are). This should also help contextualize the daily movements of these stocks. Given such thin volume, any of these companies can go up or down significantly on no news. Judges Scientific is in a similar position, but the market reacted very strangely to a relevant piece of news we received this week (more about this in the company-specific news section).

The relative weakness of Nvidia compared to the indices was also interesting:

The counterparty appears to be Alphabet. Why? Because a narrative is now forming claiming that TPUs are “better” than GPUs and that Nvidia’s “monopoly” is coming to an end. The company thought it was a good idea to respond to said narrative by posting the following on X:

I am not claiming whether Nvidia’s claims in said post are valid, but it does seem like a somewhat desperate measure to post this on X. Note that the stock is down only slightly from its highs, and the post directly goes “against” one of Nvidia’s main GPU customers. This, together with rumours that Jensen Huang told employees that the “market depended on Nvidia” and that he had seen memes on social media, would make me a bit worried as an Nvidia shareholder (or at least I don’t share things being done this way). All this said, Nvidia is a phenomenal company, and Jensen Huang is an outstanding CEO (one whom I would never bet against).

It does seem like the writing is on the wall over the long term: Nvidia’s main customers have every incentive in the world to develop proprietary solutions to displace the company’s GPUs (Amazon with Trainium, Google with TPUs…). They also have the capital to do it, and in the paraphrased words of Jeff Bezos: “Nvidia’s margin is their opportunity.” Maybe Nvidia never gets displaced, but this doesn’t mean it will not face increased margin pressure as customers transition to hybrid workloads. We’ll see.

The industry map is a bit misleading this week because it takes the last 5 days, so Friday of the previous week is also included due to the Thanksgiving weekend:

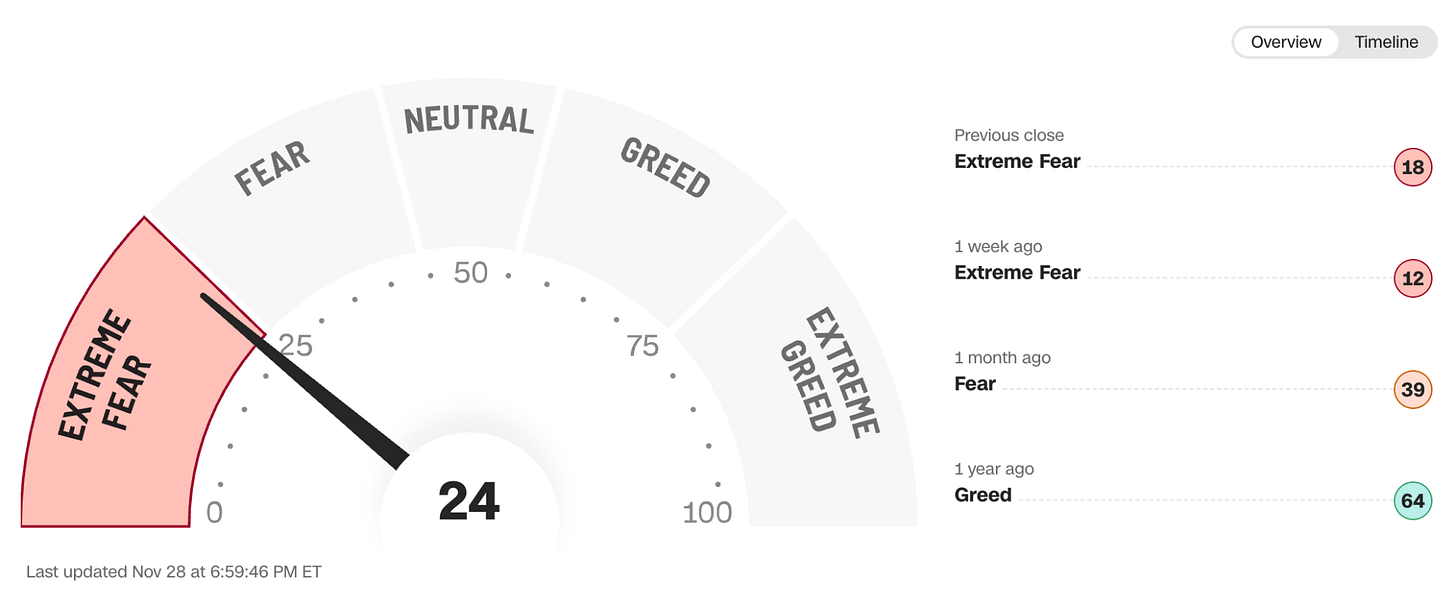

The fear and greed index improved considerably and is now close to fear territory. Just for context, this was at 6 a couple of weeks ago (oh, how fast does sentiment change in the market!):