Riding the innovation wave

Keysight's Q4 2025

Keysight reported outstanding earnings on Monday. The stock rose significantly the following day, and although it did not break its ATH, it is pretty close!

I could discuss all the highlights of the quarterly release in a lengthy article, but I thought it was a better idea to focus on the several topics that matter:

The key numbers and the Keysight thesis

The valuation

Keysight was one of the companies severely punished in April during the tariff tantrum. One could argue it was punished for good reason because (a) it has indeed suffered tariff costs (Keysight decided to honor its pre-tariff orders without raising prices) and (b) the company is exposed to the Capex of its customers, and we all know how muted Capex has been with all the uncertainty. Regardless of whether you think the tariff drop was warranted or not, the company has demonstrated that tariffs were a nothing-burger.

Without further ado, let’s start with the numbers and what makes Keysight “special.”

The key numbers and the Keysight thesis

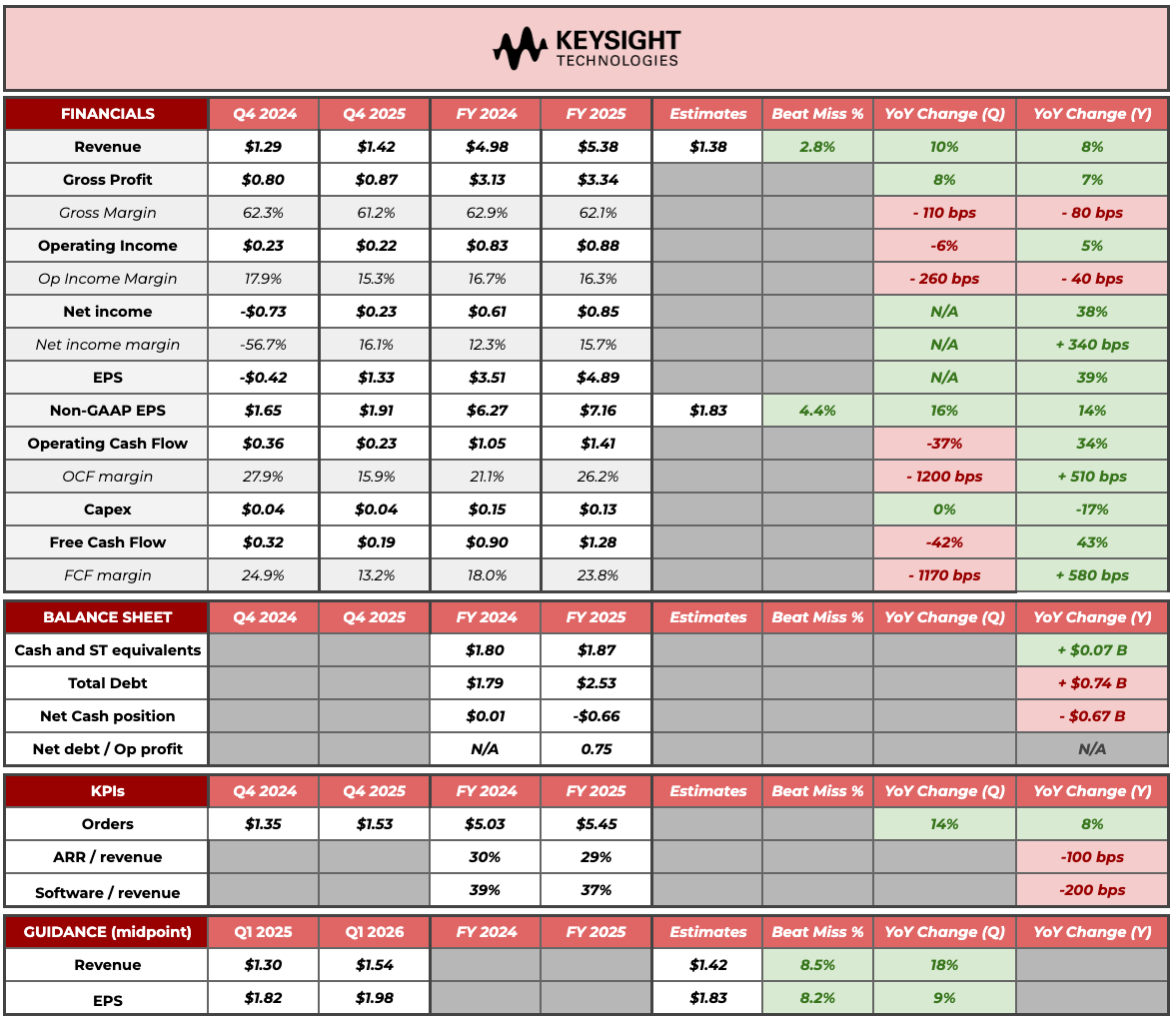

Here’s the summary table for Keysight:

Several things are worth highlighting from this table. Let’s start with the most obvious one: Keysight is now firmly out of the downcycle. Revenue growth actually decelerated from last quarter, but we must not forget that there was a pull-forward in Q3 due to tariffs. The leading indicator (orders) is growing significantly ahead of revenue, which means that Keysight is again building its backlog.

This is great in and of itself, but it’s even more impressive when we consider that 6G is still not “a thing.” Keysight has historically been understood as a 5G/6G company (i.e., a one-trick pony). This meant that its growth was unequivocally linked to the “G” cycles. Well, here we are: orders growing in the mid-teens and still no meaningful 6G business (which will eventually come, as the industry is already in pre-standard design). This simply stresses that Keysight has evolved through the years and is much more than a 6G company today. In fact, Keysight expects growth in Wireless in FY 2026, despite the bulk of the 6G investment cycle being expected somewhere around 2028/2029.

This is also interesting because it seems that the investment cycles might have “decoupled,” allowing Keysight to generate smoother earnings. Even though Wireless is “weak” due to the absence of 6G, Wireline is standing up as the growth driver. We don’t know what will happen in the future, but we might end up in a scenario in 2028/2029 in which Wireline is a bit weaker while Wireless is picking up.

Probably the thing that makes Keysight interesting is that it’s pretty much exposed to every technological revolution. No matter what tech “revolution” you are thinking about, it’s likely that Keysight has some kind of exposure to it. Here’s a non-comprehensive list:

AI buildout (CSG, Wireline)

6G development and deployment (CSG, Wireless)

Non-terrestrial networks like ASTS, Starlink, and Kuiper (CSG, Wireless)

Quantum Computing (EISG)

Autonomous driving (EISG)

Semiconductors (EISG)

Defense (EISG and CSG)

…

In some way, we could think of Keysight as the picks and shovels of human curiosity, which doesn’t seem like a bad place to be! For example, have you heard about “optics” being the next big thing in AI? Well, Keysight is also poised to benefit from it (more so after the acquisitions of Synopsys’ Optical Solutions Group):

Optical speed refresh cycles are also gaining momentum, moving from the 400 GB to 800 GB to 1.6 tera.

When people think about the picks and shovels of AI, they think about Nvidia or ASML. They rarely think about Keysight, even though the company is involved pretty much in every step of the AI buildout, from the very first stages to optimization post-deployment:

Keysight is actively involved with industry leaders and a growing number of consortia shaping the future of AI infrastructure.

The “downside” to Keysight’s model is that it’s somewhat exposed to customers’ Capex and, therefore, to investment cycles (i.e., it’s cyclical). The good news is that the company has made efforts to diversify away from this dynamic by growing its software and services segment. Software and services accounted for 37% of total revenue in FY 2025, slightly down from FY 2024, which is normal given that equipment sales are picking up. Still, a very respectable number that is expected to rise to 40% in FY 2026, aided by recent acquisitions. Management does not believe that 40% of total sales is the limit for software and services.

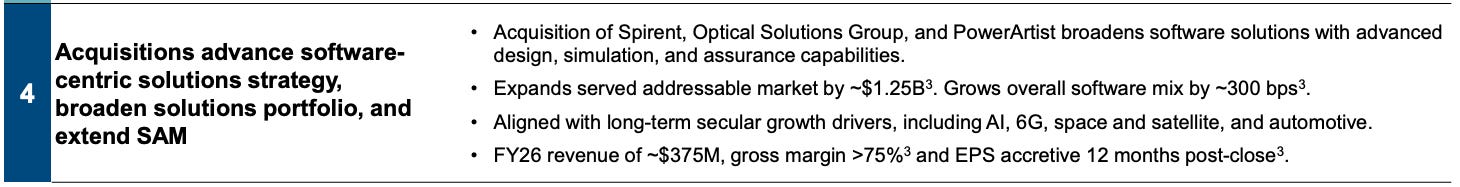

Speaking of acquisitions…Keysight mentioned that the acquisitions of…

Spirent

Optical Solutions Group from Synopsys

PowerArtist from Ansys

…contributed around $11 million of revenue in Q4 (so, not meaningful). What’s more interesting is what Keysight expects of these for next year. On top of expectations of core business growth (i.e., organic growth) “at or above” the high end of the LT guidance (4-7%), Keysight expects these acquisitions to add around $375 million in revenue in FY 2026. This means that, should Keysight’s organic business grow 8% next year, total revenue growth will be around 15% YoY in FY 2026.

The profitability situation is not the same, as Spirent specifically had very poor operating margins (Synopsys’ and Ansys’ businesses are likely higher margin, as they were a forced divestiture, but they are smaller than Spirent). Keysight expects to deliver significant synergies ($100 million) as it integrates these acquisitions, but doesn’t expect much in terms of synergies next year. This means margins will likely come under some pressure next year. What’s interesting is that, despite the significant negative impact of acquisitions on profitability, management still expects to grow EPS at or above 10% next year. Note that this is before repurchases, and Keysight also announced a new $1.5 billion repurchase program.

Should synergies get realized in 2027/2028, we should see profitability in those years ramp up considerably. The word “synergies” might give you shivers, but they make sense for Keysight. Right now, Spirent and Keysight have two workforces that can ultimately transform into one workforce that sells both products. Note that the acquisitions are gross-margin accretive, so it’s a matter of Opex (not product), and Keysight has an excellent track record of streamlining Opex.

My updated valuation model

There are several reasons why we must update our Keysight model. The first is that the stock is now close to its ATHs, so things have changed somewhat. The second one (and most important) is that we have to include all the new information we have from the acquisitions. Here’s my updated Keysight model: