Deere’s Q4 2025: Will it be worth the wait?

Deere reported Q4 and FY 2025 earnings on Wednesday (before market open). Results were “meh,” and the commentary around FY 2026 wasn’t inspiring either. The market did not like the results, and the stock dropped almost 6%. Before earnings, Deere was trading close to its ATHs (all-time highs), so the stock is barely down 10% from its highs even after the post-earnings drop:

I am going to briefly go over the numbers before focusing on what (imho) are the three most relevant topics:

Profitability and tariffs

The environment in FY 2026 and the sources of upside

The current valuation

Without further ado, let’s start with the numbers.

The numbers

Here is Deere’s summary table:

Two things seem clear from the table above. The first is that growth continues to improve somewhat/normalize (especially outside of PPA in North America). Deere’s growth across all segments continued on an upward trajectory, and Q4 was the first quarter since Q3 2023 in which the company grew!

This might lead one to believe that 2025 marked the trough for the company and that FY 2026 will be much better. There’s some truth to this, but we also need some context to understand why we shouldn’t get too excited (more on this later).

The clear lowlight of the quarter and the year was profitability. The full-year profitability drop was expected because Deere is a fixed-cost business that suffers operating deleverage (and sales were down), but it might stand out that profitability dropped so sharply in Q4, even amid strong growth. Let’s dig a little bit deeper into this.

Tariffs and profitability

I’d say there were highlights and lowlights in terms of profitability. Let’s start with the lowlight to help contextualize the highlight. The lowlight was tariffs. Tariffs impacted Deere this year both directly and indirectly. The direct impact was felt in the P&L, with $600 million in tariff-related costs in FY 2025. These lowered the consolidated profitability and had an especially strong impact on Construction & Forestry. The indirect impact, of course, is that tariffs have introduced uncertainty and may have delayed the upcycle.

The highlight could be found in Deere’s structural profitability improvement. Despite significant headwinds from tariffs, the company’s margins are considerably higher than they were at the same point of the cycle in 2016. If you’ve read my past articles on Deere, you’ll know that this is a pretty relevant part of the thesis: Deere’s structural profitability will improve significantly thanks to technology and a better-run business overall:

Even with the North American large agricultural industry declining by around 30% this year, we delivered margins over 450 basis points better than in 2016, the last time we were at this point in the cycle. Excluding tariff headwinds, that improvement would have exceeded 600 basis points.

There were some technology-related highlights during the quarter. I’ll list some of these below:

Technology developments are increasingly being used outside PPA, for example, in Small Ag & Turf and Roadbuilding. There are a lot of R&D synergies that are yet to be realized

Some of the company’s autonomous offerings (row crop tillage solution) have already covered around 200,000 acres

Precision Essentials has had orders for 24,000 units since its launch 2 years ago. In Q3, management shared that there were 21,000 orders, so this number is up 14% sequentially

Engaged acres in the John Deere Operations Center were up 10%, with highly engaged acres up 17% (i.e., technology is winning “acre” share from existing customers)

Harvest setting automations enjoyed a whopping 90% take rate on North American combines in the first year

See & Spray covered 5 million acres compared to 1 million in 2024 and showed pretty outstanding savings: “The average herbicide savings from the technology in 2025 was around 50%.”

No matter how you look at it, farmers are increasingly adopting technology. This is great for Deere because it’s significantly accretive to its margins and will help smooth out the cycles (as Deere is increasingly monetizing production rather than investment). If I could ask management one thing, that would be to standardize the KPIs shared around technology. Deere is hosting an Investor Day in December to discuss its Smart Industrial strategy, so we might get our wishes granted.

You might have also noticed that cash flow generation was very strong despite the downcycle. As much as I like to focus on cash flow rather than on accounting profits, we shouldn’t do this with Deere. The main reason is that industrial businesses have “countercyclical” cash generation as they drain inventory during downcycles. This inventory needs to be replaced eventually, and therefore, cash conversion will be impacted during the upcycle. Still, I believe this is one of the features that make industrial businesses quite appealing.

The environment in FY 2026 and the sources of upside

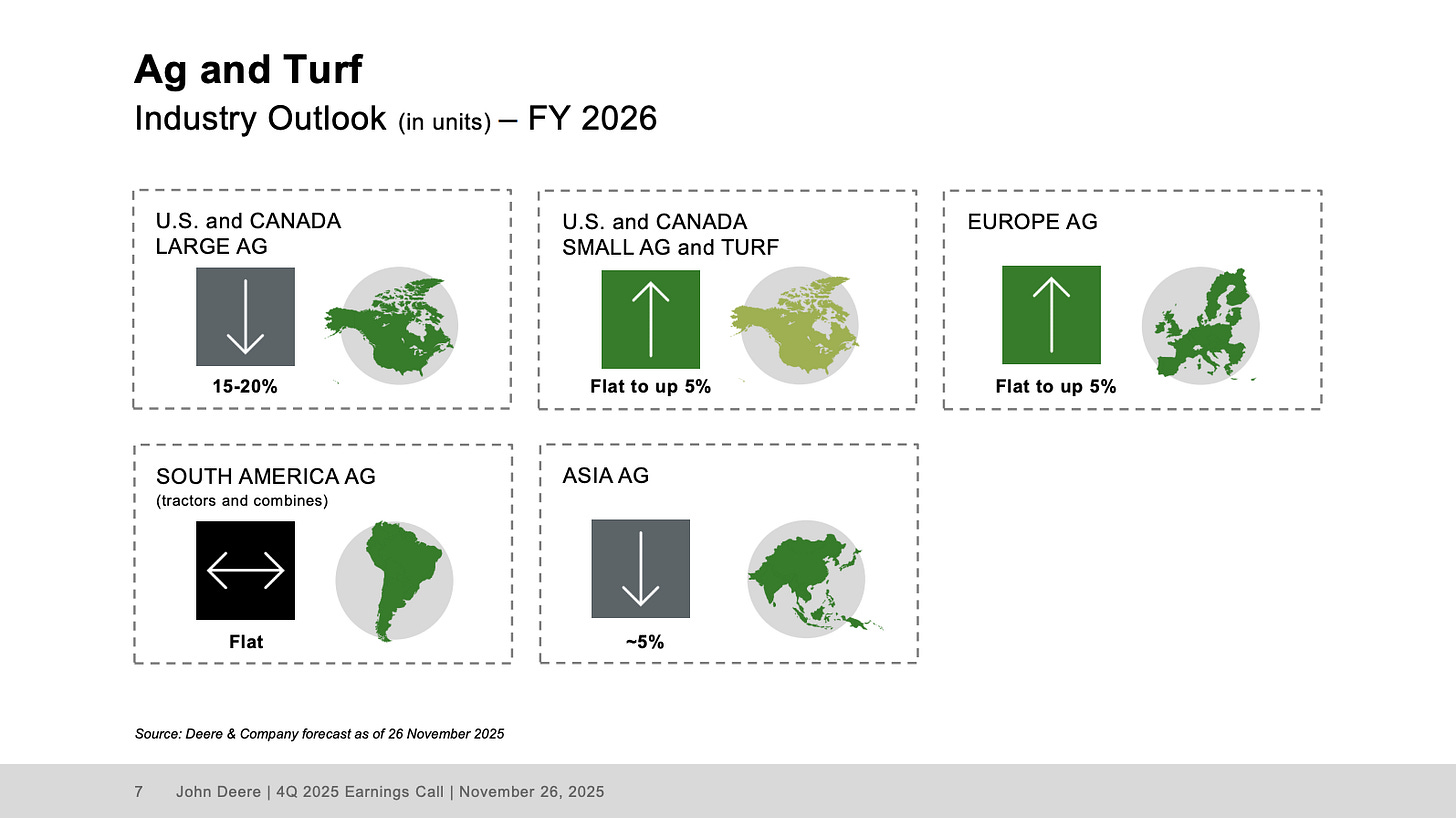

Even though the numbers above might suggest that 2025 was the trough, management believes that North America Large Ag will see the trough in 2026 after another 20% decline:

Deere expects to outperform the industry in PPA for the very simple reason that they’ve managed inventory very carefully:

To put in perspective how low absolute inventory levels are, new field inventory for Deere 220 horsepower and above tractors ended fiscal 2025 at the lowest unit level we’ve seen in over 17 years.

This inventory situation is also a source of upside when the cycle recovers, as Deere can benefit from stronger end-demand and some potential stocking as inventory normalizes. Despite further headwinds expected across the industry, Deere expects PPA sales to be down 5-10% in FY 2026. The good news is that the expected performance in the two other segments will be significantly better:

Small Ag & Turf outlook: +10%

Construction & Forestry outlook: +10%

Deere’s bread and butter is Large Agriculture (we also know this is the segment with the highest margin potential, thanks to the applicability of technology), but thanks to its diversification, Deere expects FY 2026 equipment operation revenue to increase 2% at the midpoint. All this despite the ongoing downcycle in its most important segment.

Just like this quarter/year, things are considerably different when it comes to profitability. Small Ag & Turf’s and Construction and Forestry’s margins are going to remain resilient, but PPA will experience further deleverage (and it’s the segment with the highest margins). This is one reason why the net income guide calls for a 13% drop despite equipment operations sales being slightly up, but there are two more. Another one is taxes. Deere will face higher taxes as it expects to generate more revenue from outside the US. The other one (and arguably the most relevant one) is tariffs. The company expects $1.2 billion in pre-tax costs from tariffs, which obviously pressure profitability.

All of the above translates into expectations of $16 of EPS in FY 2026 (excluding further buybacks), which management believes is the trough year, with PPA below 80% of mid-cycle. Being completely honest, I expected 2025 to be the trough when I started a position in Deere, but geopolitics and tariffs surely didn’t help. All this said, management believes there are certain sources of upside to 2026 NA large ag numbers, which they did not assume in the guide. Let’s go over these.

Management highlighted strong crop use and consumption, coming primarily from two sources. First, new trade agreements. You might have seen in the news that China is back to buying soybeans from North American farmers. This is net positive for Deere, but it also negatively impacts the environment in Brazil (since they were selling soybeans to China). The second source is the growing demand for biofuels. As the world struggles to transition to renewable energy completely, the middle step lies in biofuels, which require both corn and soybeans:

The amount of US corn going to ethanol is approaching record levels. Meanwhile, Brazil is also allocating significantly more of its corn production for domestic ethanol use. Similarly, US soybean oil use is also projected to reach record levels, primarily fueled by rising demand for biomass-based diesel.

This is being driven to a great extent by regulation:

The EPA’s proposed renewable fuel standards for 2026 and 2027 include substantially higher targets for biomass-based diesel, while the Clean Fuel Production Tax Credit was extended via the One Big Beautiful Bill, incentivizing the domestic production of biofuels.

I’m not particularly fond of investing in companies exposed to energy, but with Deere we have some kind of “artisanal” exposure. Management also sees other potential sources of upside, such as supportive government payments (though they are not counting on them). They did mention that some of this upside might be starting to play out…

The demand picture for grains feels incrementally better compared to a quarter ago.

All this said, I wouldn’t count on any upside materializing in FY 2026 for two main reasons. First, the geopolitical environment remains volatile, so I’d imagine farmers are not yet comfortable making significant investments. Secondly, I highly doubt things can change quickly in an industry like Deere’s, even if the demand environment improves significantly. Management mentioned that they’ve been working to satisfy demand in H2, should demand improve suddenly. We’ll see.