Tariffs, Markets Dropping, & Investing Psychology (NOTW#54)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

It was a different week than the markets have accustomed us to lately. Both indices were down, and uncertainty quickly rose again. Markets don’t love uncertainty, so it’s normal to see some sort of selloff as they sit close to ATHs.

Without further ado, let’s get on with it.

Articles of the week

I published three articles this week. The first one was Danaher’s earnings digest. The company (like the bioprocessing space in general) outperformed earnings estimates again, but declined to raise the full year guide (I explain why this might have been the case). The market remains uncertain about underwriting the return of bioprocessing, but it seems to be happening as we speak.

Everything up and to the right…except the guide

Danaher reported again a beat-beat-raise (sort of) quarter, and its stock initially did what it usually does: it dropped. Although it was a good quarter, it was likely not the kind of quarter that ch…

The second article of the week was my AAON in-depth report. AAON is an exciting company that has managed to compound at a 24% CAGR over more than 30 years and is today exposed to one of the fastest segments in the economy. With the stock down 40% from all-time highs, I decided to dig deeper.

AAON (AAON)

This story starts with my quest for a non-obvious way to expose my portfolio to the massive data center buildout expected over the coming years (the semiconductor industry and hyperscalers would be the “obvious” way). McKinsey estimates that

AAON is the 13th deep dive I’ve published (the library keeps growing). Paid subscribers have access to all previous deep dives here (Stevanato and Deere are shared for free as a sample):

The third article of the week was Hermes’ earnings digest. The company reported solid earnings when looked at in the context of the broad luxury industry. I explain what makes Hermes different from the rest and why I thought they were pretty good earnings.

A Rare Opportunity in Hermes?

Hermes reported pretty good earnings this week, although context is needed to understand them fully. I’ll quickly go over the numbers, the highlights from the call, and will lastly look at the valuation. The stock is

Market Overview

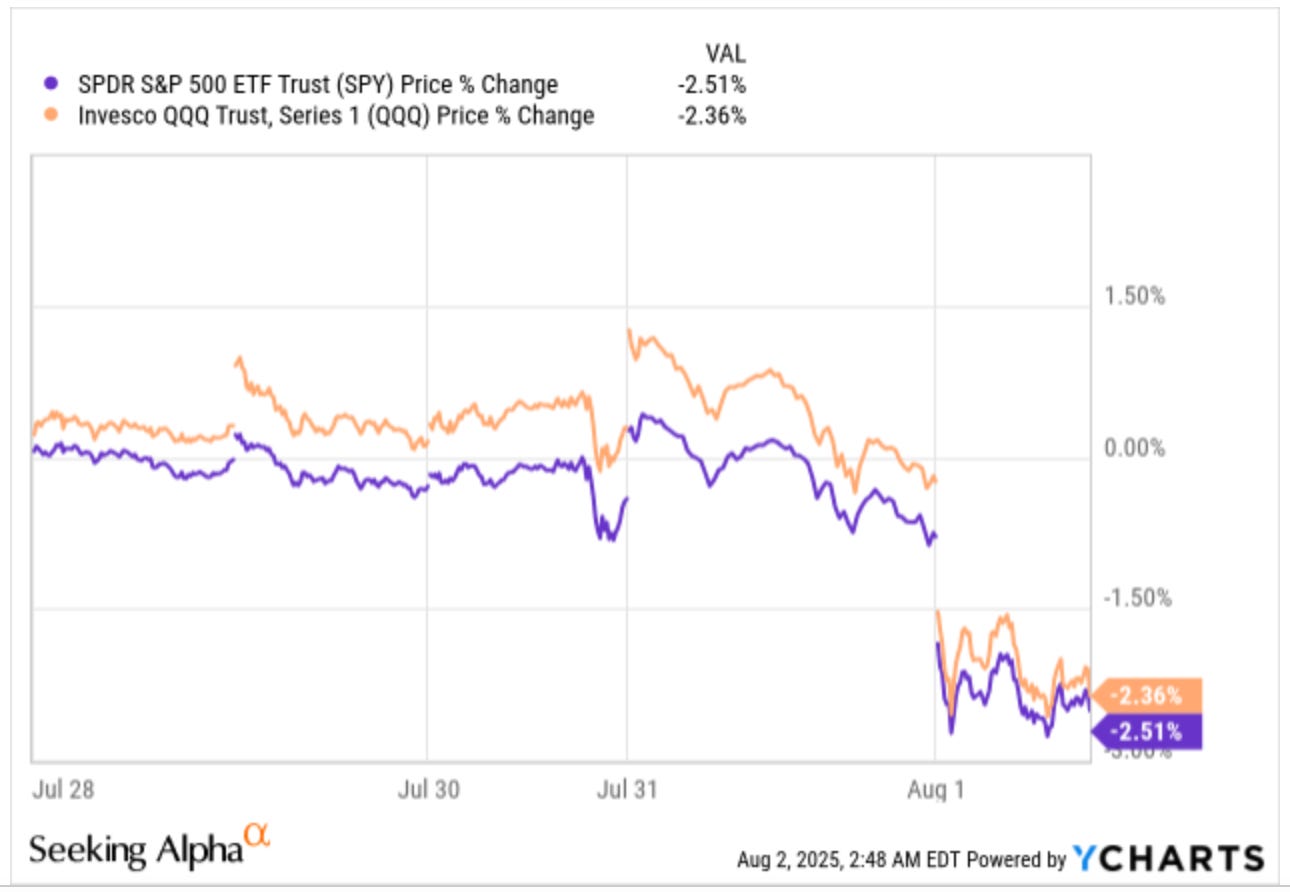

This will sound like a rarity based on what has happened over the past few years, but indices were down substantially this week:

I was surprised to see the kind of panic such a movement can bring to markets. Many investors started to “panic” or worry about what would happen going forward, despite indices standing close to ATHs. Many now believe this is the start of the next crash, which might definitely be the case! Note that algorithms (both in social media and those algos that trade markets) can magnify the sentiment shifts. When markets drop, many people start to post “why” they are dropping (the explanation always seems to come after the fact, for whatever reason), and those posts get quite a bit of engagement. Why? Because we can’t stand not knowing why markets are moving. Now, the reality is that nobody knows why they are moving, but uncoincidentally, the reason that’s making them drop today is (in a lot of people’s opinion) the reason why they are going to continue falling for a long time (i.e., recency bias).

It’s also worth remembering what happened at the April lows: everybody thought markets would continue dropping because there was no reason to think otherwise. What many people miss is that markets bottom when there’s no reason to be optimistic (i.e., when most imaginable bad news have been discounted). All this said, we are barely off ATHs, so I don’t really think we should consider this a panic scenario by any means. We’ve grown accustomed to seeing green every week, but we should never forget that the laws of probability demonstrate that markets don’t go up in a straight line. The stock market is likely to see…

A 10%-20% drop every 2-3 years

A 20% drop (bear market) every 5 years

30%+ drops every decade or so

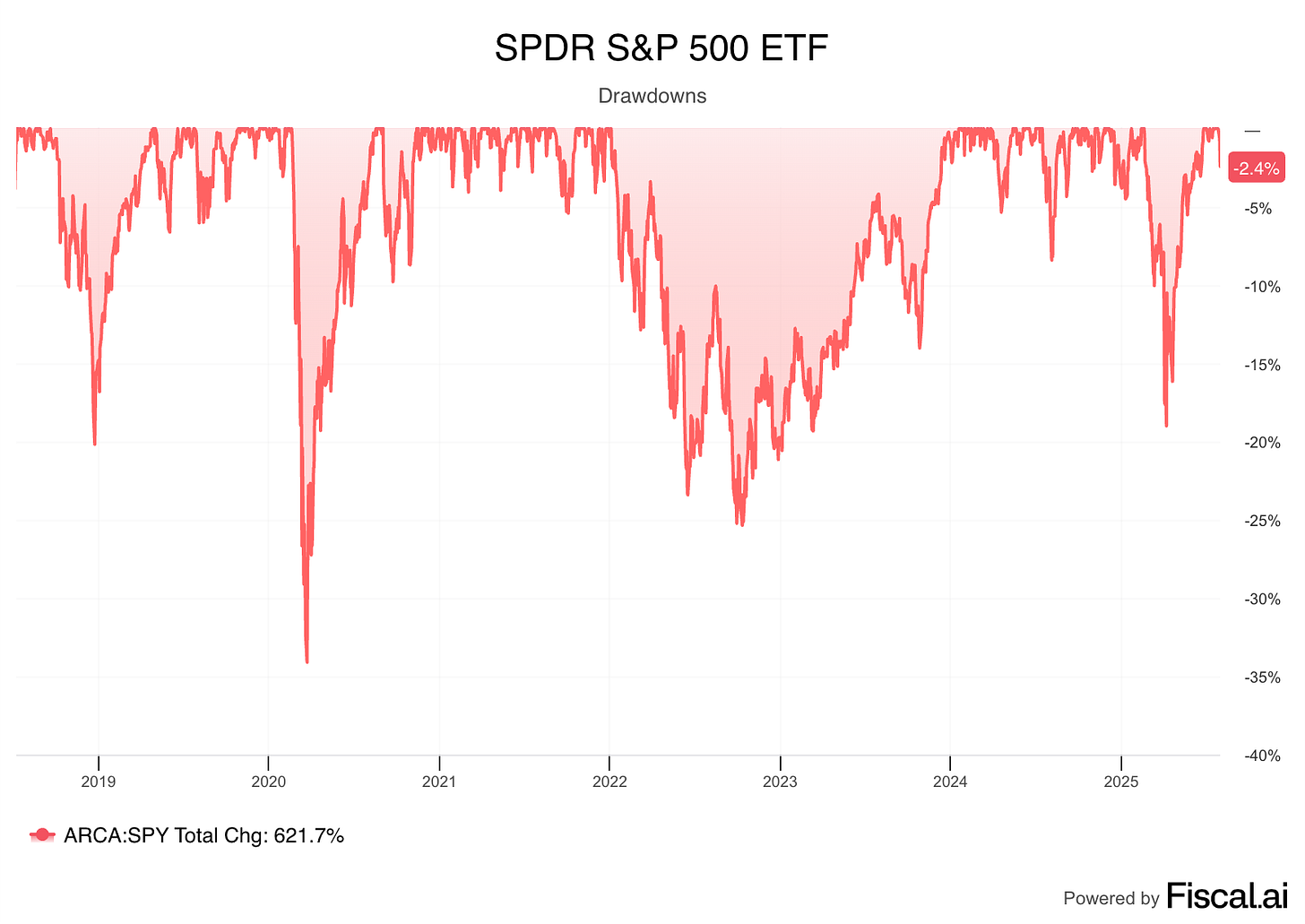

This means that drawdowns are likely to be an integral part of any investor’s career, and if you’ve been investing since 2019 you’ll probably be aware of this! Since 2019, the S&P 500 has seen two bear markets (COVID and 2022) and two additional drops of between 15%-20%:

There has been one common behaviour in all of these instances: many people were saying at the lows that we were going much lower. This is the perfect illustration of recency bias. When things are rough, many will expect them to get worse. When things are good, many can only think about how much better they can get. This is why you get bubbles on the way up and depressions on the way down, and illustrates the opportunity for the patient investor.

The other type of behaviour one can see when things get rough is that a lot of people freeze at the lows. Many spend their time waiting for a crash, only to freeze at the lows. I don’t know if this is more a function of panic or greed. Humans want to time the exact bottom, so many end up waiting for a slightly better price, until it’s too late. It doesn’t feel great buying something and seeing it drop 10-20% more, but that’s likely going to be irrelevant over the long term if it was bought at a reasonable valuation. Buying when seas get rough is not an enjoyable experience, but this is how you know that the purchase is likely going to work out well over the long term.

As for the reasons why the market dropped…I have no clue, but it might have had something to do with a re-adjustment of the jobs report, which came in significantly lower than expectations. Even though the unemployment rate has barely budged, many believe it’s related to a weak economy and might signal that the Fed has been too slow lowering rates. It’s funny how we’ve gone from praising Powell for not lowering rates to criticizing him for the same thing literally one week later.

The “official” implementation of tariffs probably also had something to do with the drop. The 1st of August tariff deadline was on Friday, so the US implemented (for example) a 20% tariff on Taiwan, which is the source of many leading-edge semis that the US needs. In this case, I am pretty sure that the price will be paid by the end consumer or borne by the tech companies that use said chips, as the entire semi supply chain can raise prices without suffering a significant dent in demand (due to their competitive positions).

The industry map this week was something we’ve not seen in a while: a sea of red!

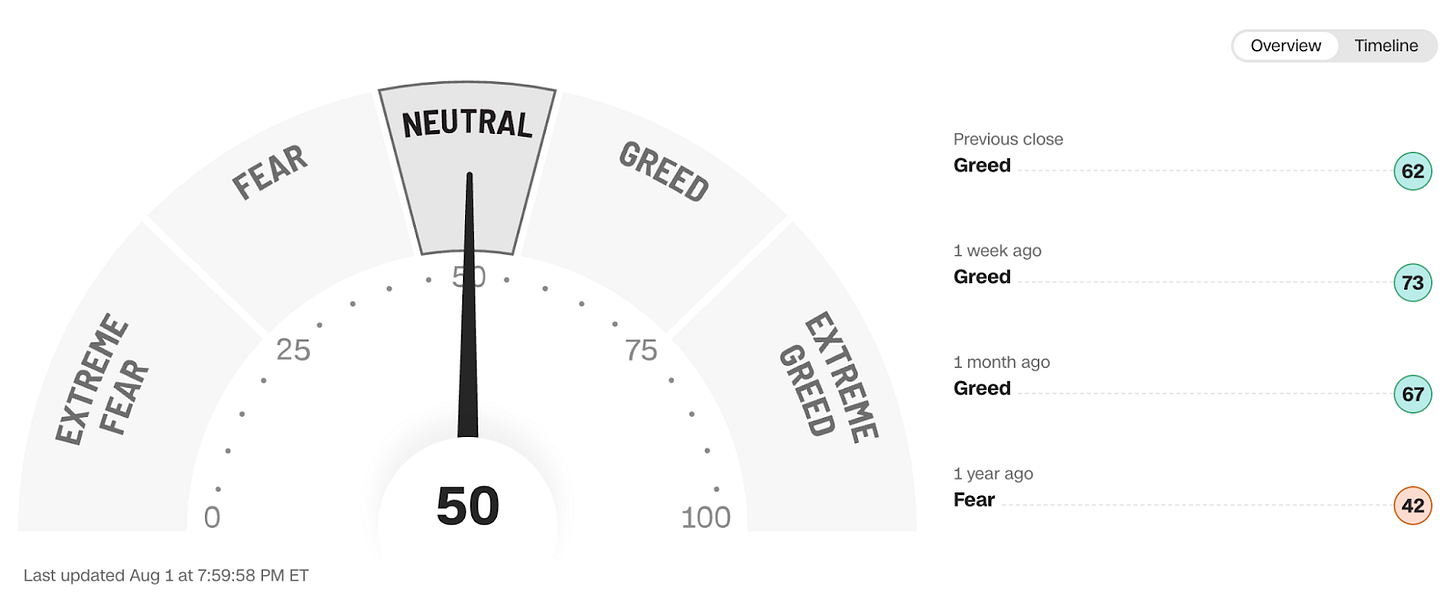

The fear and greed index decreased materially, going from almost extreme fear to neutral in just one week:

Note that this exemplifies why there’s so much volatility in the stock market over the short to medium term. Even though fundamentals don’t budge much over short periods, the perception of investors and what they are willing to pay for those fundamentals does change rather quickly. I recall reading in a book (don’t remember which one) that one should always bet against investors being able to stay in extreme fear, as humans end up wanting stability and can’t remain at emotional extremes for long. This is something that we’ve definitely seen over time in the stock market.