Everything up and to the right…except the guide

Danaher's Q2

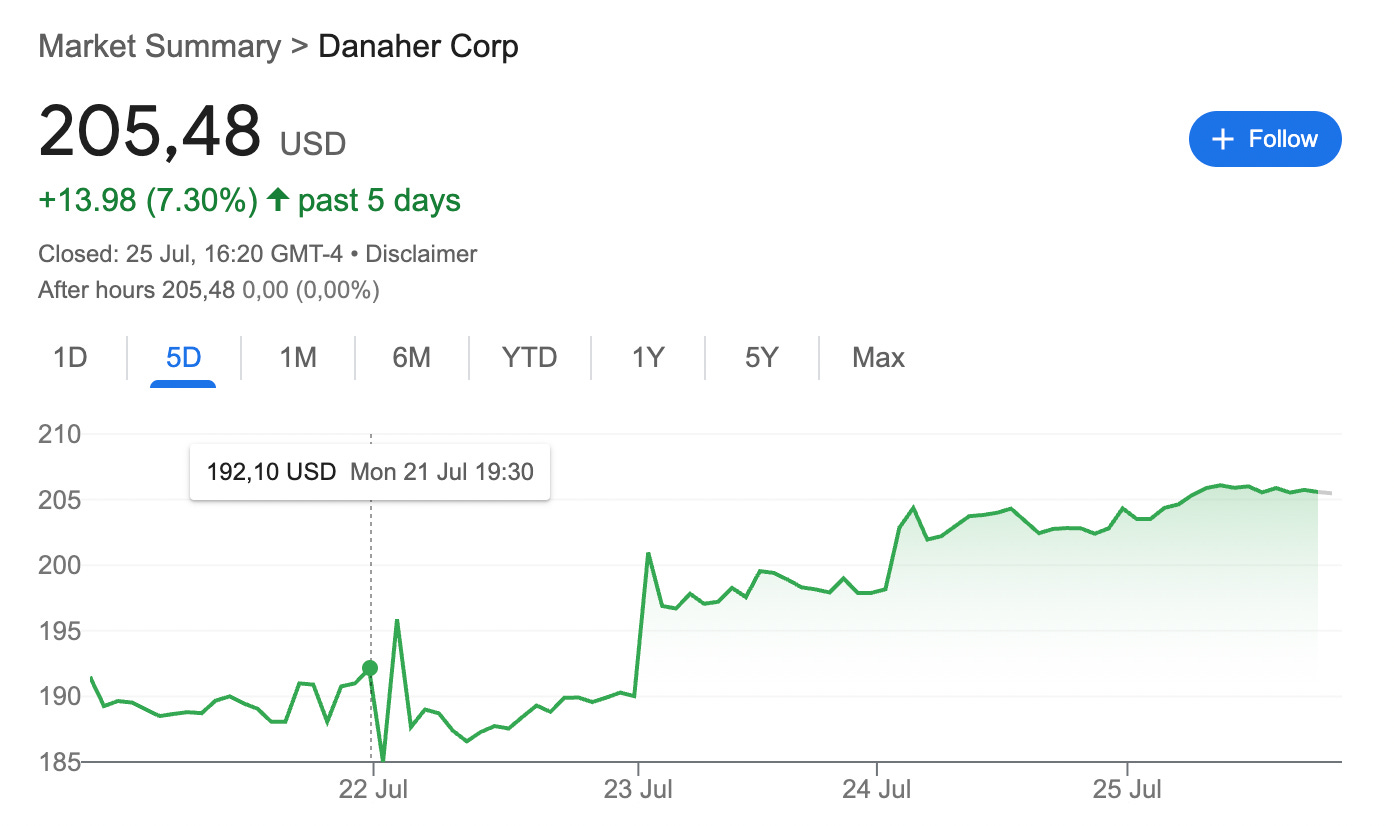

Danaher reported again a beat-beat-raise (sort of) quarter, and its stock initially did what it usually does: it dropped. Although it was a good quarter, it was likely not the kind of quarter that changes market sentiment. Other companies, such as Medpace and Thermo Fisher (one of Danaher’s peers), did somewhat “shift” the sentiment of the industry, causing Danaher’s stock to rise in tandem. Since reporting earnings, Danaher’s stock is up around 7%:

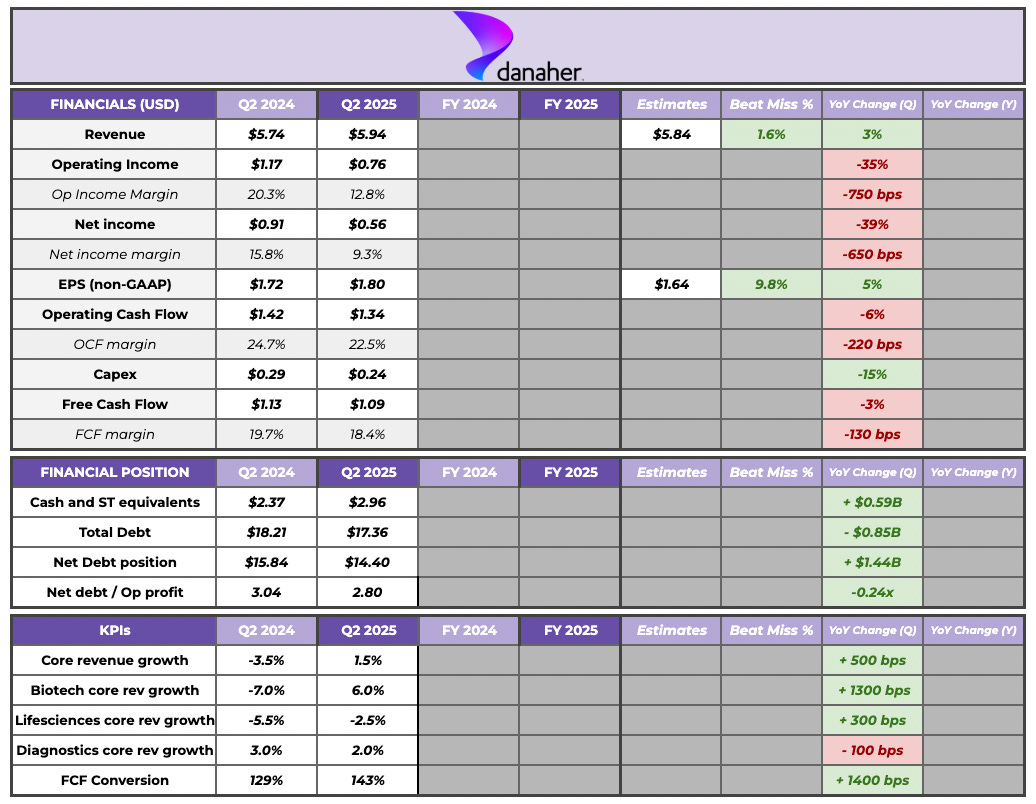

Growth rates are not yet where one would expect them to be, but it’s undeniable that the company (and the industry in general) is firmly recovering from the destocking period and all the noise the pandemic created. Before digging deeper into the numbers, here’s Danaher’s summary table:

To gauge the recovery of the cycle, we must focus on the KPI section. Except for diagnostics, the growth of all of Danaher’s segments improved year over year. The most significant improvement has come from biotechnology, where recovery is well underway. The reason why biotechnology is performing significantly better than the other segments is probably closely related to its mix of consumables and equipment. The part of the industry that remains weak is equipment, which is exposed to customer CapEx. Although biotechnology derives revenue from equipment, most of the revenue comes from consumables, which are tied to customer operating expenses (Opex). The mix of equipment is considerably higher for Diagnostics and Life Sciences.

This equipment side of the business is also subject to tariff uncertainty (which should sound familiar if you’ve read my ASML and Atlas Copco earnings analysis). Management believes that this side of the business should recover over the next 6 to 12 months as customers can’t defer their capacity expansion forever:

Consumables continued to lead the way globally with low double-digit growth in consumables really driven by commercial demand in large pharma CDMO customers.

Now, the equipment remains below those historical trends. With funnels improving. So we're seeing better funnel activity but we continue to see order delays with trade policy creating some incremental noise here probably slowing some decision making.

Source: Rainer Blair during the Q2 earnings call

Management also mentioned that large customers drove bioprocessing’s performance, with small customers remaining somewhat weak. This is somewhat consistent with the industry’s expectations of a weak biotech sector, which is precisely why Medpace’s numbers shocked the market. The good news is that they did mention that, although down from its peak, the biotech sector remains stable.

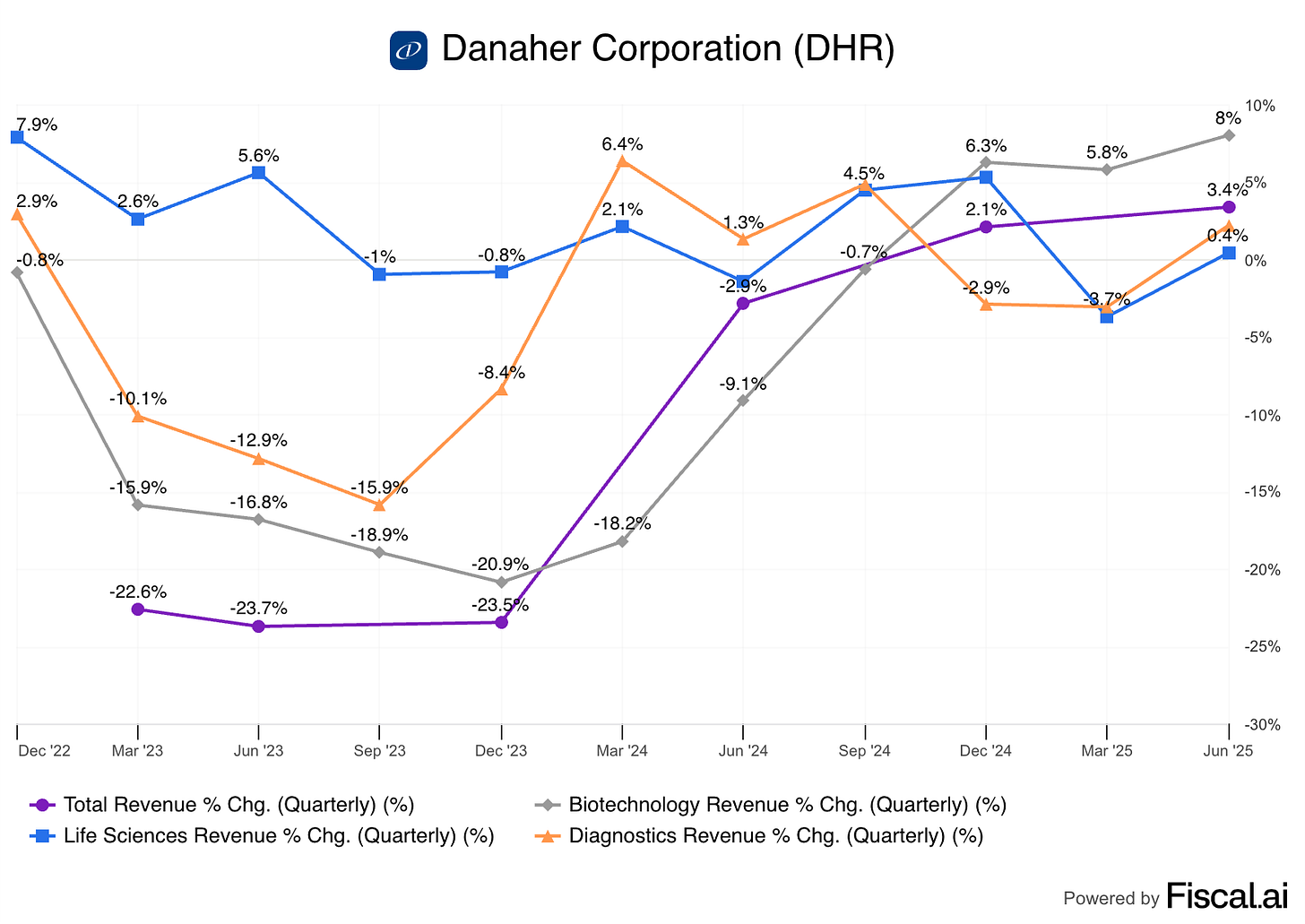

The bottom line is that, after many quarters of weak sales growth numbers, things seem to be pointing in the right direction (finally):

The most encouraging aspect of the graph above is that biotechnology continues to accelerate, reinforcing management’s confidence in the long-term growth profile of the business. This is important because I believe it’s what many investors don’t really believe:

The strength of the development pipeline paired with consistent growth in commercial production also reinforces our conviction in the high single-digit long-term growth outlook for our leading bioprocessing franchise.

Management also mentioned (consistent with what I wrote in this article) that they expect AI tailwinds for the biotechnology franchise going forward. As they see it, AI in the industry is not only a question of faster discovery but of better allocation of resources to the most successful drugs, which eventually end up faster in significant manufacturing volumes:

Now as it relates to AI, we really see that ultimately as a tailwind because we see then less money being spent on getting to compound ideas, if you will, and more money being spent taking great ideas, which have been validated in silico, as they say, through the development pipeline, ultimately, driving more manufactured and commercialized therapies.

Now, notice from the table above how GAAP operating income and net income dropped significantly, whereas non-GAAP EPS and FCF conversion improved substantially. The reason was an impairment in the Life Sciences segment. This is a non-cash expense and should not recur; however, it suggests that management may have been caught off guard by the current downcycle and the valuations they were willing to pay for certain businesses.

The good news is that, ignoring the impairment and some tax-related changes, the company's underlying margins are improving, which is something we should expect as growth recovers. One of the things that many people miss is that even though Danaher seemed to be overearning during the pandemic, its normalized margins are likely to be significantly higher than where they are today.

In terms of geography, management mentioned that aside from how VBP (value-based procurement) is impacting the diagnostics segment, the business China is slowly recovering:

So our China business outside of diagnostics has been firming up. The bioprocessing business has shown slight growth here in the quarter. And we see the biotech and pharma market there some more solid activity levels. So we do see that in bioprocessing. As we think of life science tools, we did see more stimulus activity and that's flowing through not just to orders, and the revenues. It's still not at normal activity levels, but we do see it firming up.

So we're encouraged by what we see here. For those two businesses. And that's reflected here in our second-half view.

Management’s conservativeness

Now, despite everything pointing in the right direction and continuous outperformance, there’s one thing that puzzles investors: the guide and management’s conservatism. Danaher slightly raised its EPS expectations for 2025 by 1% but maintained its expectations for 3% top-line growth.

The thing is that management openly admitted that they were outright ignoring several tailwinds to EPS in the guide:

So maybe I'm kind of sort of thinking about the guide like this. So we got off to a pretty good start in the first half. Both on the cost actions like I said to Scott earlier, I feel very comfortable where we are on those. We had a little bit better FX as well, probably FX was maybe a nickel better for us. And like I said, I we get the full cost actions, which is probably 15¢ or so. And so I kind of look at that, say $0.20 and that's what we flowed through to the full year. So all the cost actions and the better first half FX So we started in January, we'd call it $7.60 as sort of the range, put the $0.20 on top of that and that's how you get kind of the high end of the range now at $7.80. But there are two other things here that I think you're right, we have not flowed through fully.

I think maybe the easiest way to think about it is one, we had a good start in respiratory in Q1 and Q2. And two, FX. In the second half, that's going to be much more favorable than we thought in January. And so I think the combination of those two, maybe probably another $0.15 $0.20 that has not flowed through. And the reason we haven't floated through is one, we're going to maintain the full year respiratory guide at $170,000,000 to see how that plays out in Q3, Q4, you know, that is a variable number. And that affects is the same, right? That could fluctuate and come back. That has made a significant movement since January, and that could very well come back. So we've decided now to hold back on Respiratory, hold back on the second half FX, and just kind of see what happens, especially in a pretty dynamic policy and operating environment. Just felt like we'll sit and see how things play out before we commit to that final $0.15 $0.20.

Thank you. And just a clarification question for Matt McGrew Matt, did I hear you correctly that at current foreign foreign exchange rates that your guide would be point $15 higher?

With both the respiratory and the current FX. Probably $0.15 $0.20 I'm not sure I'd say that the guide's higher, but that's what the math would imply. That we have not, if you would, not flowed through.

So, summarizing: if Danaher had taken all things into consideration, the high-end of its new EPS guide would’ve been around $7.95-$8 (consensus is at $7.79), which would be a 3% rise and arguably would’ve also risen core revenue growth expectations for the year. The question here is: what is Danaher’s incentive to sandbag? In prior quarterly digests, I’ve mentioned that Danaher might have had a reason to sandbag in the past: its repurchase program. However, the company did not repurchase any stock this quarter despite the stock being at a significantly lower price than in prior quarters. There’s one potential reason why management might have decided not to repurchase shares: something is advancing in the M&A pipeline. This is pure speculation, and nothing was mentioned during the call, but it’s a potential reason.

This ultimately means that repurchases are no longer a “reason” to sandbag, so what’s going on? Danaher also announced this quarter that the current CFO is retiring and will be replaced by the CFO at LifeSciences. Being new to his role, I can see why he would not like to set the bar high. Danaher also claimed that they would provide early commentary on how 2026 is shaping up in the Q3 earnings call (October). This might also be related to the new CFO coming on board because sharing thoughts on the next year is not something that Danaher typically does in Q3.

Just as a brief note, my valuation for Danaher has not changed, and I discussed it in more detail in my August article ‘Is Danaher’s Buyback Good Capital Allocation?’. The stock is considerably cheaper today, but I still hold the price under which I would be willing to buy (shared in the Decision Spreadsheet). As I have a considerable allocation to the company, I don’t expect to add significantly to my position over the coming weeks.

Have a great day,

Leandro