AAON (AAON)

A Cool Way to Play AI?

This story starts with my quest for a non-obvious way to expose my portfolio to the massive data center buildout expected over the coming years (the semiconductor industry and hyperscalers would be the “obvious” way). McKinsey estimates that somewhere between $1 trillion and $2.6 trillion will be invested in data center infrastructure (without counting IT equipment) over the next 5 years. Just for context, the midpoint of said estimate is around the same size as the GDP of Spain:

Even though estimates should always be taken with a grain of salt due to the unpredictability of the future, it does seem fairly obvious that there’s a lot of money at stake here. I came across AAON’s stock in my quest and decided to dig deeper because it satisfied some key criteria:

High insider ownership

Good top line growth and exposed to a high growth industry

Stock significantly off highs

Great track record of shareholder value creation

…

Even though AAON’s business is somewhat boring (more on this later), its stock was not long ago a hedge-fund and Wall Street Bets favorite, and no wonder why. The stock remains a 100-bagger even after its current 40% drawdown, delivering a total return CAGR (Compounded Annual Growth Rate) of over 24% over a 33-year period. An investment of $10,000 in AAON’s stock 33 years ago would be worth more than $1.5M today:

While it shouldn’t be shocking to come against a 100 bagger (AAON is not the only one), what’s probably most surprising about AAON is that it has become a 100 bagger as an HVAC manufacturer. HVAC equipment is not the typical industry where one would expect to find 100 baggers, and the data seems to confirm this: AAON is the only company in its industry that has achieved 100-bagger status, delivering around 10x the return of its closest peer. While underlying business performance is not the only thing that matters here (the size at which a company IPOed is also key in attaining 100-bagger status), everything seems to point to AAON being one of a kind.

Like many other exciting stories that became 100 baggers, AAON’s story has its roots in a charismatic and long-term owner: Norman “Norm” Asbjornson (my objective is to spell his surname correctly all throughout the report). Entrepreneur since he was a kid, Mr. Asbjornson was born in 1935 in a humble family with no access to running water, electricity, or central heating. We take many of these things for granted today, but these were not necessarily the norm (no pun intended) 80 years ago.

After graduating from Montana University in 1960, he declined a job offer from Boeing (the usual route for most graduates) and accepted an offer from American Standard. American Standard would send Norm to Detroit to customize HVAC equipment. He was an exceptional salesman, so he quickly rose within the company.

The “AAON story” as such really began in 1987 when Norm joined Alleghany Industries and was tasked with restructuring John Zink Co.’s commercial heating and air conditioning division. He was instructed to do what he did best: sell. However, this time it was the business that he was selling, not HVAC equipment. He would once again do an exceptional job, only this time he would be both the seller and the buyer. He ended up making the high bid in 1988 for $8 million after gathering money from a few investors and remains the largest shareholder today.

Soon after the purchase, he set his eyes on one objective: to make AAON’s equipment the best value in the HVAC industry (“value” being the key word in this mission statement). He would pursue a rather unconventional path to achieve this, but it’s an extraordinary example of how David can beat Goliath even when everything is against him.

This in-depth report will have a somewhat different structure to other in-depth reports, as I’ll discuss the risks and the valuation in a final section titled ‘What I’m concerned about.’ This is what you can expect:

Section 1: What AAON does and what makes it unique

Section 2: The financials and growth drivers

Section 3: Competition and moat

Section 4: Management and Capital Allocation

Section 5: What I’m concerned about (and the valuation)

Without further ado, let’s get on with it.

(Paid subscribers also get access to the PDF version of this report that can be found just after the paywall)

Section 1: What AAON does and what makes it unique

AAON manufactures custom and semi-custom HVAC equipment for (predominantly) the commercial/industrial and data center industries. Commercial/Industrial is by far AAON’s largest segment today, but data centers is growing extremely quickly and promises to be an integral part of the company’s growth story going forward (data center revenue currently makes up around 10% of revenue but 20% of the order book).

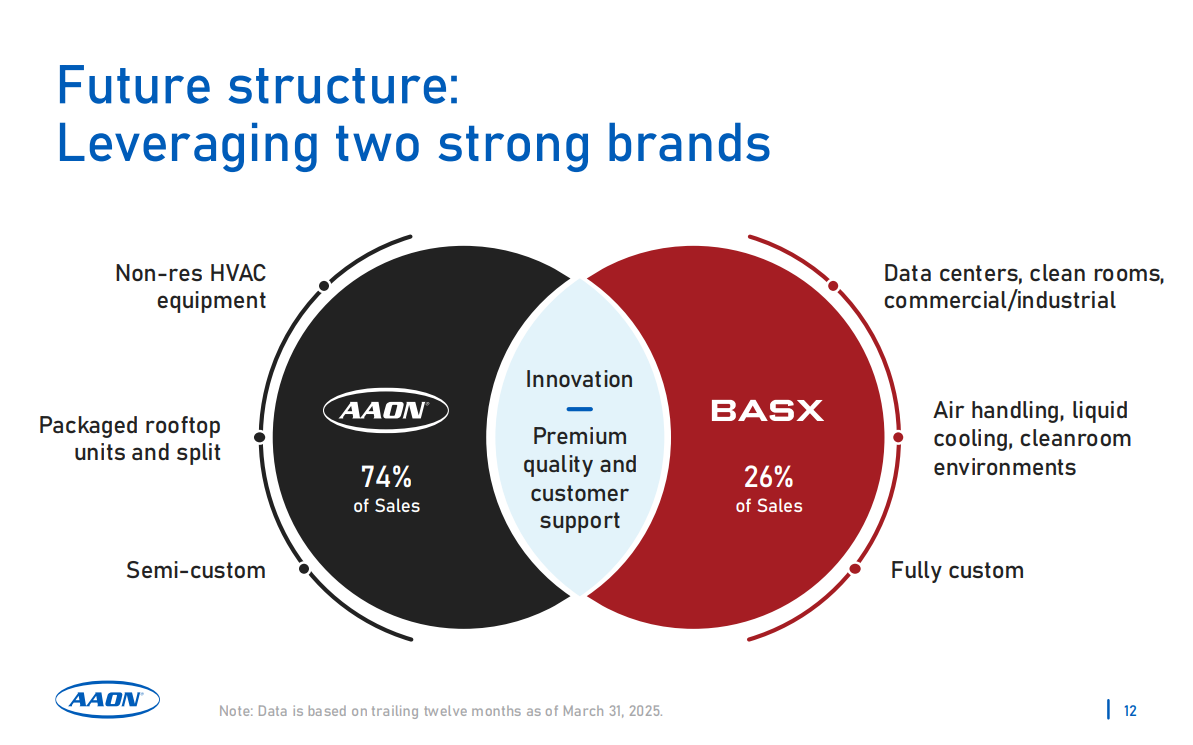

The company’s operations can be divided into two brands, AAON and BASX, with the latter being acquired in 2021 and primarily focused on more mission critical applications (like data center and clean rooms for lifesciences/semiconductors).

AAON began its foray into the HVAC industry as a small player with little to offer against the big guys, but Norm had a plan: to carve out a niche. Most peers did two things that AAON decided to do differently from its early days. They…

Sold standard equipment

Operated in commoditized and competitive markets like residential

Norm decided that the only viable way to win would be by focusing on semi-custom equipment, which the company would primarily sell in complex commercial and industrial projects. Here’s an excerpt of Matt Tobolski (current CEO) explaining the company’s roots:

So when we look at AAON as an organization, you know, looking back to the original formation of the company back in '88, the whole premise of why AAON was launched in the first place was really to bridge the gap at a time in the industry where there were really only two ways to buy kind of a commercial rooftop product. And that was a catalog solution, with little little configurability and little options set to it, or the other extreme, a full custom product. And the goal of AAON was to really bridge that gap with a software driven, you know, automation driven, semi custom configurable product where you can get a lot of the value that you would historically get out of a custom solution. But due to the automation, due to the software enablement tools that are in place, do it at a much more cost effective price point. And and that really was the the premise of AAON at initial launch.

The idea behind semi-custom solutions was that customers would focus on total cost of ownership instead of price. This strategy would make the company almost entirely forfeit the enormous, price-sensitive residential HVAC market, but Norm was fine with this. The company has grown through the years together with educational institutions and (more recently) data centers. These customer groups have one thing in common: they expect to own their buildings for a very long time. The longer term oriented a customer is, the better deal AAON’s equipment becomes.

Semi-custom comes at a price, though. AAON’s products tend to retail at a premium in the market (historically around 15%-20%). However, over the equipment's life, they are often the better option due to their energy efficiency and low maintenance requirements. Getting here was no easy feat for AAON. Even though selling semi-custom equipment seems like a no-brainer if manufacturing costs were not a consideration, the tricky thing is being able to master semi-custom manufacturing in a way that allows the company to generate attractive gross margins while selling its equipment only at a 15% premium. This is core to AAON’s competitive advantage.

This unique approach has helped AAON carve a niche that might not be apparent when looking at broad industry numbers but that becomes apparent once we dig deeper into these. HVAC equipment is typically segmented by tonnage, which refers to the amount of heat that can be removed from a given space every hour. AAON’s customized solutions make much more sense in the large tonnage market than in the small tonnage market where spaces are smaller and the benefits of customization are less aparent. The company did not end here by coincidence: management refused from its early days to become a big player in the low tonnage market because it lacked differentiation:

From an earnings call: Based on our 2022 combined sales of $771.1 million at AAON Oklahoma and AAON Coil Products, we estimate that we have approximately a 12% share of the greater than five-ton rooftop market and a 2% share of the less than five-ton market.

From an expert call: The breakpoint for me, I see where if you’re just competing on price is about 50 tons and then AAON starts to look better as price goes. Any time there’s something that needs more than just your basics, AOON starts to really take over.

They go from two tons to 240 tons, which for most manufacturers, they tip out at 140/150.

AAON’s competitive positioning is misleading if we just look at general industry numbers because most of its peers are playing the “volume game” whereas AAON is playing the “value game.” As per Norman Asbjornson:

The bigger the market, the fewer people are in it because the fewer is the dollar amounts that’s available. Everybody cuts down at some point, so you have less competition.

In short: AAON’s market share rises in tandem with tonnage. Note that this is not “just” a strategy, it basically underlies everything AAON does. In 2019, the company finally opened its NAIC lab (Norman Asbjornson Innovation Center) in which management had invested millions over more than a decade. The NAIC allows AAON and its customers to test HVAC equipment of up to 300 tons across 12 testing chambers. This is 3x the tonnage capacity of any other lab in the world:

AAON has also benefit immensely from pursuing flexible manufacturing since the early days. This has served the company well to adapt to the continuous regulatory changes the industry has faced without facing a complete overhaul of its manufacturing lines; peers can’t say the same. Manufacturers of more standardized equipment have had to “rehash” their manufacturing lines and have raised prices significantly to offset increased costs. These dynamics have resulted in a narrowing of the price premium existing between AAON’s equipment and comparable offerings, therefore resulting in AAON becoming a better value prop comparatively to the industry. According to management, this brings something unprecedented: the floodgates of the volume markets are now open!

We’re not the niche player we used to be. We are moving more mainstream.

Historically, two factors prevented this niche offering from becoming mainstream, the first factor being price. The second factor is value. Up until recently, a vast majority of end users were not focused on total cost of ownership. Over the past two years, the market has begun to shift dramatically in AAON’s favor. The price premium of AAON equipment has narrowed, as government regulations related to the minimum energy efficiency standards have forced most of our competition to reengineer their equipment. The cost of manufacturing across our industry has gone up significantly more compared to our costs.

But, what does AAON sell specifically and how does it make money? Let’s start with the second question. AAON generates revenue through primarily two sources…

Equipment sales

Parts sales