A Rare Opportunity in Hermes?

H1 2025 Results

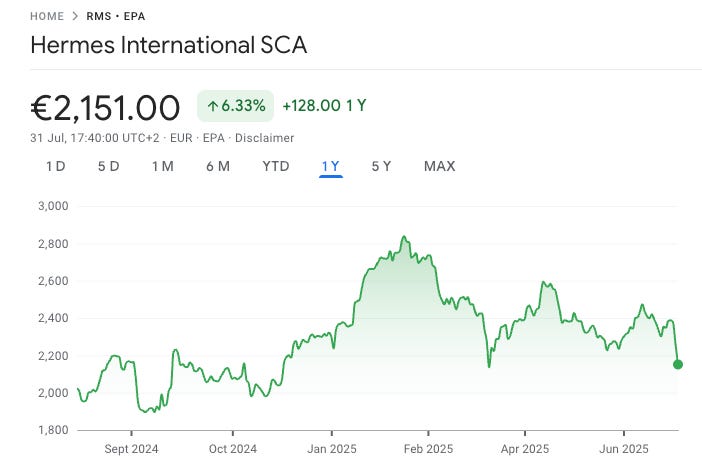

Hermes reported pretty good earnings this week, although context is needed to understand them fully. I’ll quickly go over the numbers, the highlights from the call, and will lastly look at the valuation. The stock is currently suffering a 20% drawdown from its ATHs (all-time highs), which, although seemingly minor, is quite the rarity for a business like Hermes. The stock has been down 20% or more from highs only a handful of times over the last two decades (including broad market selloffs):

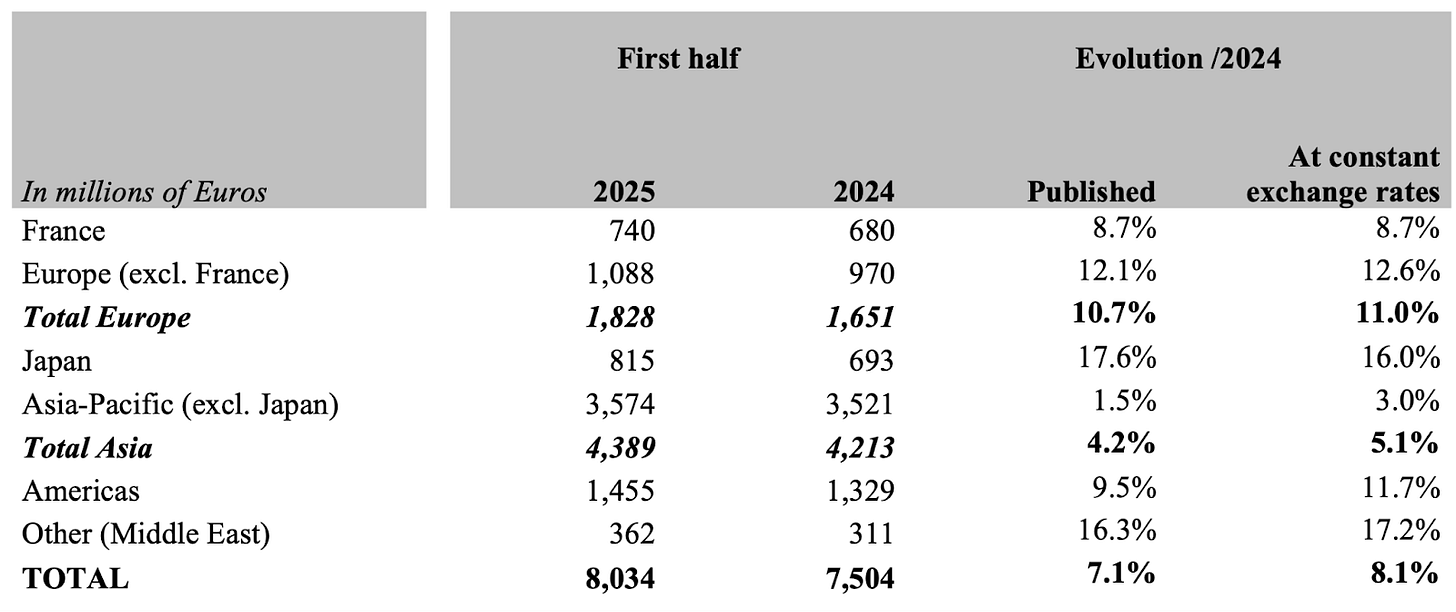

Hermes delivered 8% organic growth in revenue for H1 2025, posting growth in all geographies. Europe, Japan, the Americas, and the Middle East were particularly strong:

Asia, excluding Japan, remained weak, driven primarily by China. You might be aware that the luxury environment in China is currently not the best and has faced numerous challenges lately. Hermes’ management noted that they have not yet seen signs of a recovery but that they expect one in due time.

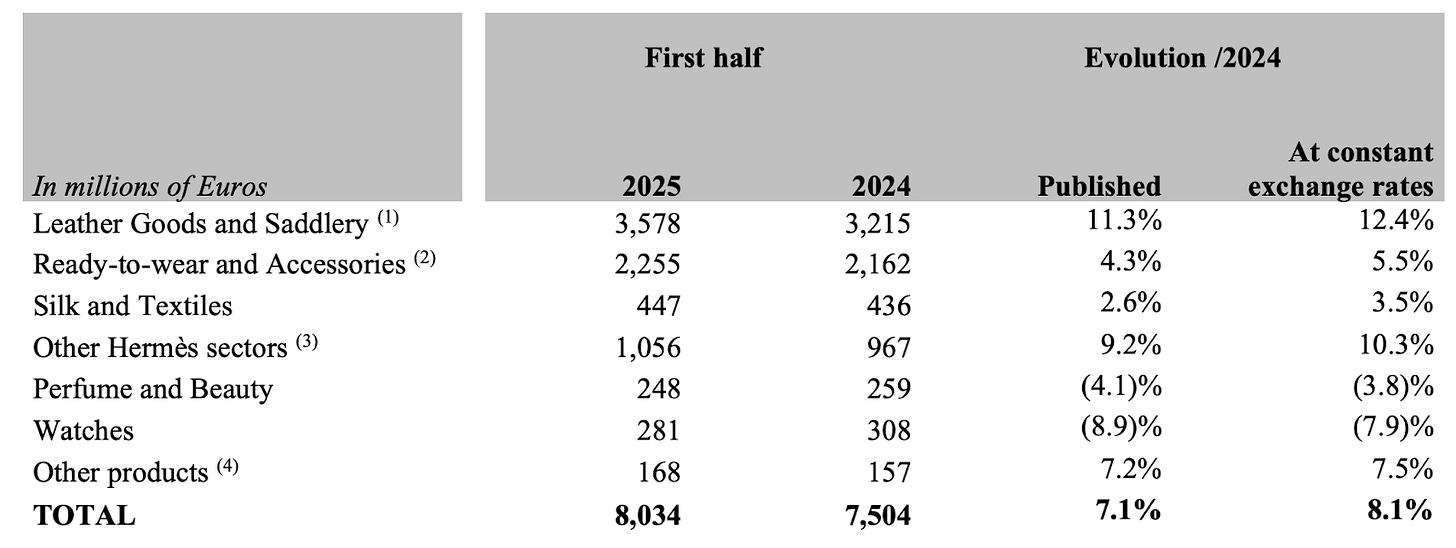

If we look at growth across metiers, we can see that Hermes excelled where it typically does best: Leather. Not only is 12% growth in leather impressive by itself, but more so when we compare it with “peers” such as LVMH, which reported a 7% decline in this category during the first half. Management attributed the outstanding performance to an “increase in production capacity” as there’s significantly more demand for this metier than Hermes can recently supply (i.e., the metier grows as supply comes online).

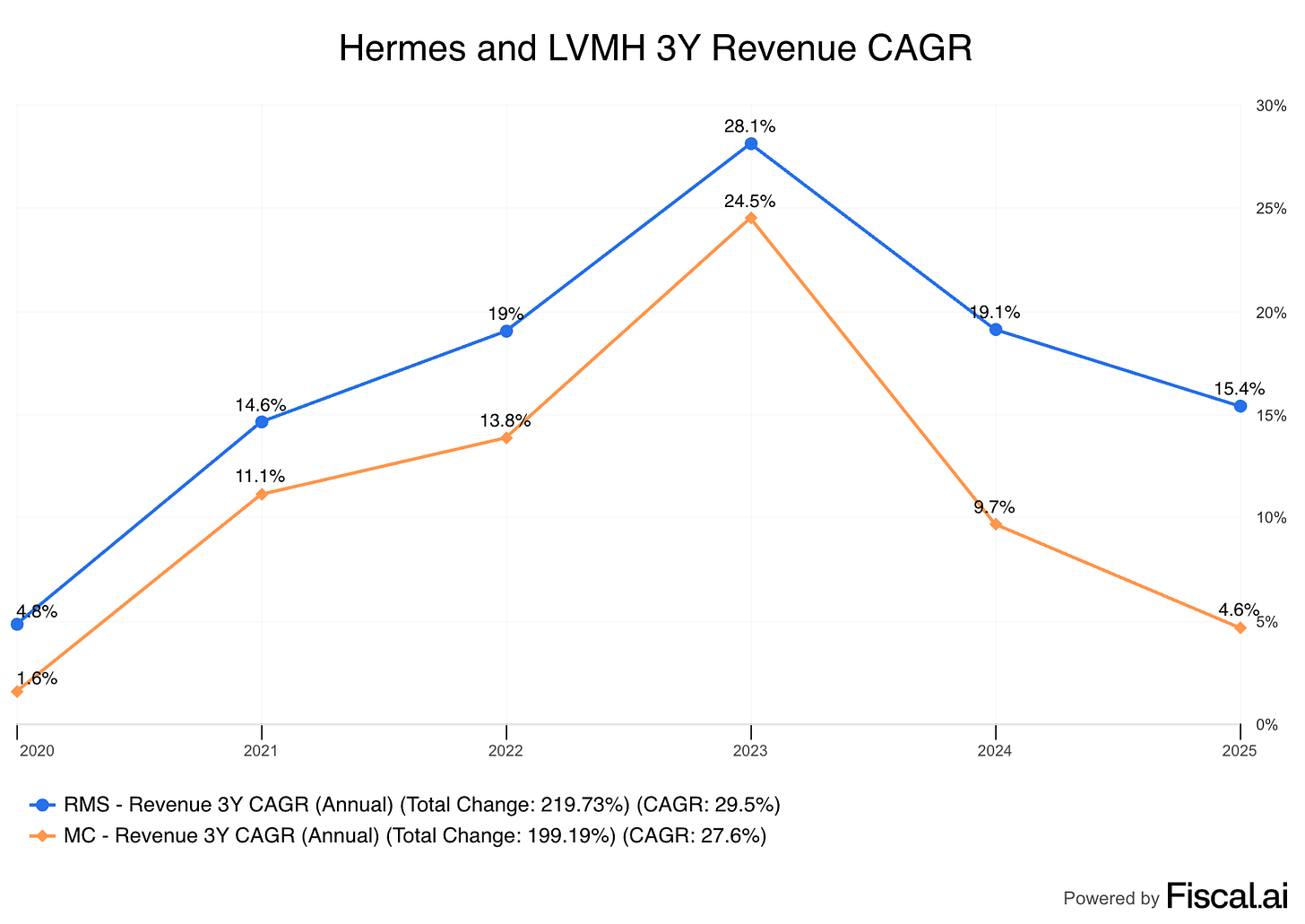

One of the best things about Hermes is that, even if it slightly underperforms on the way up, it tends to make up for more of said underperformance on the way down. In the graph below, you can see Hermes' 3-year revenue CAGR compared against that of LVMH. On the way up, one would be inclined to ask: Why would I pay up for Hermes when it’s growing at a similar rate to LVMH? This question quickly dissipates when times get rough because the gap widens significantly. Note that, in the most recent 3-year period, Hermes has achieved a 15% CAGR in revenue compared to LVMH’s 4.6%. This is the reason why the market is willing to pay up for Hermes:

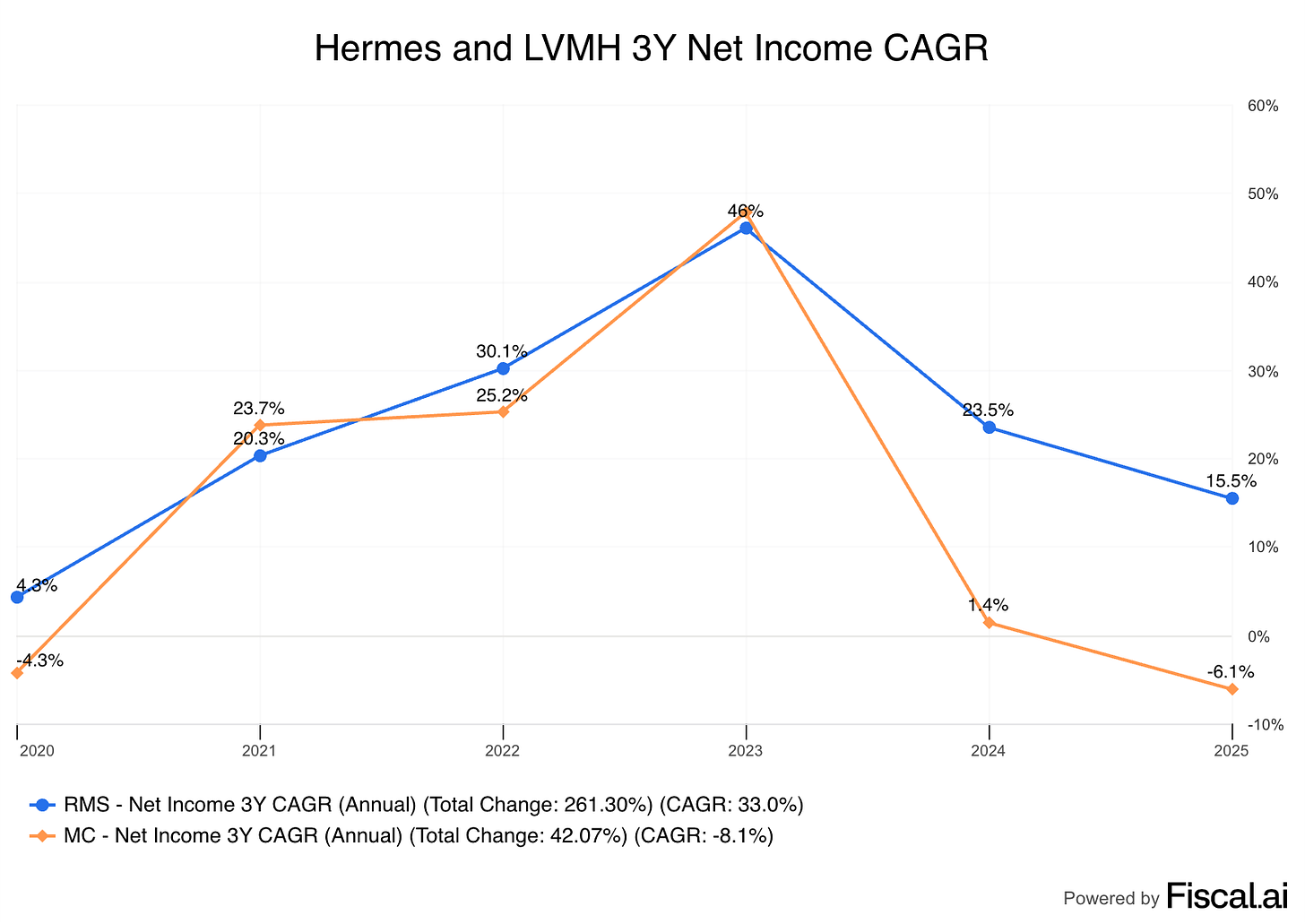

This effect is exacerbated when looking at profits. During the good times, LVMH managed to grow its earnings faster than Hermes at some point. Now, when things got rough, LVMH’s earnings declined, whereas Hermes still managed to post a 15% CAGR. This means that the starting point of the next upcycle for both companies is probably going to be very different:

Some of Hermes’ metiers were weak. The Watch industry has been pretty weak for a while, and Hermes has not been immune to it. What’s most interesting is that the two other metiers that didn’t enjoy excellent performance were Silk and Perfume & Beauty:

These are uncoincidentally those metiers that are most exposed to the aspirational luxury customer. It’s Hermes’ way of getting people into the franchise to eventually convert them into loyal customers. Management mentioned that the traffic of said customers had indeed been weak:

I can tell you that the clients who discover Hermes, step into the store for the very first time and often their first purchase will be a belt or a perfum or silk. These people are slightly less numerous at the moment. Our aspirational client base is not coming to the stores as much as they used to.

This is something that one should’ve expected just by reading the earnings of “peers.” What’s outstanding about Hermes is that it’s capable of posting 8% growth despite the headwinds of lower aspirational customer traffic and a weak China. This is what ultimately differentiates Hermes from LVMH and other players:

However, at Hermes, we have a very loyal customer base and once people buy a Hermes product, they very often come back and remain loyal to Hermes.

So, what did the market not like?

Hermes is trading at a hefty valuation, but revenue growth was better than feared and even accelerated compared to Q1, so what was the problem? I am not 100% sure about this but it might have been related to margins. Hermes’ margins contracted during the first half of the year and are expected to contract further in the second half. Even though management does not guide to margins, they did say that…

They expect COGS to be higher in H2 than H1 due to normal seasonality

Operating investments will be significantly higher in H2 than in H1

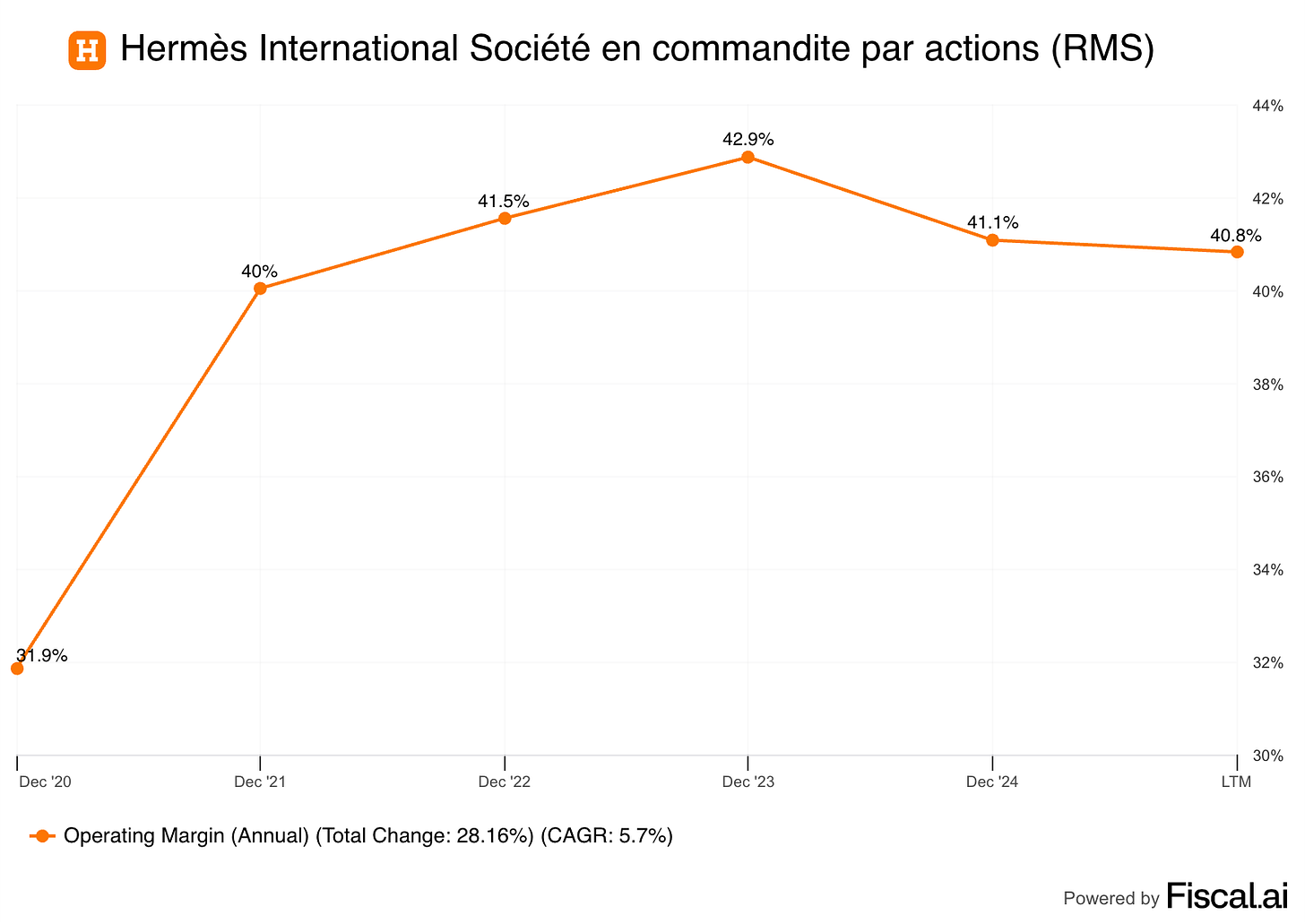

Hermes invested €300 million into its operations in H1 and expects to invest around €700 million in H2. If we look at more of a longer-term trend, we can see that the company’s margins have been dropping after peaking in 2023:

This has been the result of a weakening aspirational customer and China, together with management’s investments in capacity. Hermes wants to build 4 leather workshops over the next 4 years, and these workshops take some time to become operational. They must be constructed, and artisans must be trained to maintain high-quality standards. This means that it’s normal to see somewhat of a bump in margins as capacity ramps up. Note that management has always said that they don’t manage the business for margins.

If I am being honest, I am zero worried about the margin development at Hermes. Once said capacity ramps up (the probability of underutilization in leather is very low), we should see these creep up as revenue accelerates. Note that it’s not that Hermes doesn’t want to grow faster in leather, it’s that it can’t because it doesn’t have more capacity.

Another interesting topic is that of taxes. The French government enacted in 2024 some “temporary” additional taxes for French corporations. These will be payable in 2024 and 2025, and Hermes expects an impact of €260 million in 2025, resulting in an increase of more than 7% in their tax payments this year. This impacts net profit, which was down 5% in H1 2025. Now, this is expected to be temporary (only 2024 and 2025), and therefore, Hermes should experience a boost to net profit in 2026. We don’t know if a new tax will be enacted for 2026, but if there isn’t one, then the P/E ratio (which many people love to quote) is probably going to be misleading.

So, overall, a strong quarter by Hermes considering the context. The company managed to grow at a HSD clip even while facing two significant headwinds, portraying why it’s not like its peers.

Is Hermes a buy today?

Many of you have asked me if I would be willing to add to my Hermes position now that it’s down 20% from its highs. I have a small position with a cost basis €1,812, and I would like to boost it if the market gives me an opportunity, but is this the opportunity I was waiting for? Let’s take a look.