Reflections about a tough market (NOTW#67)

Yes, I know indices are barely down from ATHs!

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Both indices were significantly down this week but remain close to ATHs. I took the opportunity this week to share some reflections on my portfolio and what I consider a tough market (even though indices are at ATHs).

Without further ado, let’s get on with it.

Articles of the week

I published three earnings digests this week. The first one was Nintendo’s Q2 earnings.

Even THEY raised estimates!

Nintendo reported (again) great quarterly earnings, with a pleasant surprise: even its (historically) conservative management team decided to significantly raise guidance, overwhelmed with the existing demand for the SW2. This quarter clearly confirmed that analysts’ estimates were (and still are) too low (if we needed any confirmation!).

The company reported outstanding earnings, raising SW2 hardware/software and SW1 software guidance by a significant amount. If Nintendo’s management raises guidance in Q2, it probably expects actual numbers to be significantly higher than what they’ve communicated to the market. I wouldn’t be surprised to see 25 million SW2 sales this year. The company also held a corporate management briefing the following day, which portrays that the historical cyclical nature of the business and management’s reluctance to monetize the IP is, in fact, changing. You can access the presentation here.

The second article of the week was Zoetis’ Q3 2025 earnings review.

Terrible Expectations Management

Zoetis reported a pretty bad quarter yesterday. Not only did the company miss revenue estimates, but it also lowered its organic revenue growth guidance for the year. The stock unsurprisingly dropped considerably:

Unlike Nintendo, Zoetis reported pretty poor earnings, with the lowlight being how poorly management has communicated with investors and managed expectations. One can argue whether what’s happening to the company in terms of Librela and macro is a valid justification, but one can’t deny that management should be held to a higher standard.

The third article of the week was Stevanato’s Q3 earnings update.

This is the thesis

Stevanato reported strong Q3 earnings today, though there are many moving parts. The company is currently seeing pockets of significant strength, offset by some weakness in engineering and an unfavor…

The company reported very solid earnings, but there were many moving parts that have likely put some downward pressure on the stock. I don’t really care, as I feel that Stevanato’s story is far from over and that the quarter was a pretty good reflection of the investment thesis.

Without further ado, let’s see what the markets did this week.

Market Overview (and some reflections)

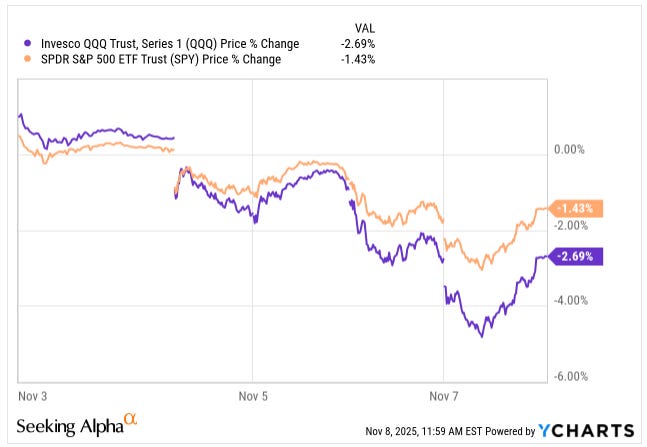

Both indices were significantly down this week, especially the Nasdaq:

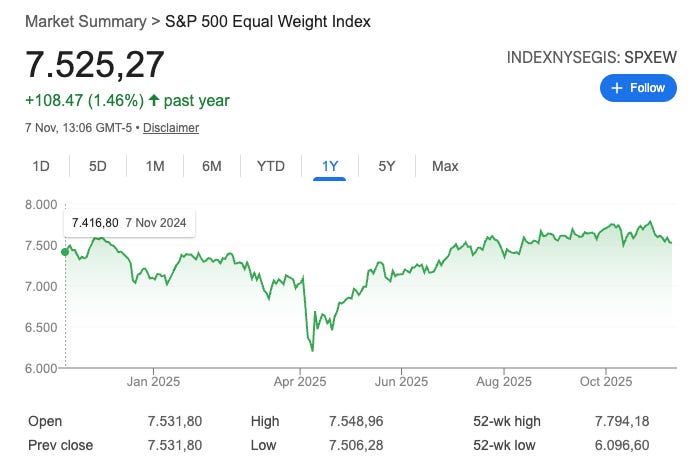

Even though there was a lot of volatility/news this week, I wanted to take advantage of this NOTW to share some portfolio/market reflections. The fact that the S&P 500 and the Nasdaq are barely down from all-time highs doesn’t mean that every investor is having a fun time this year. The strength in the leading companies in the indices and in the AI trade has been exceptional, but things are far different outside of those. For example, the S&P 500 equal-weight is barely up 6% this year and only 1% over the last year:

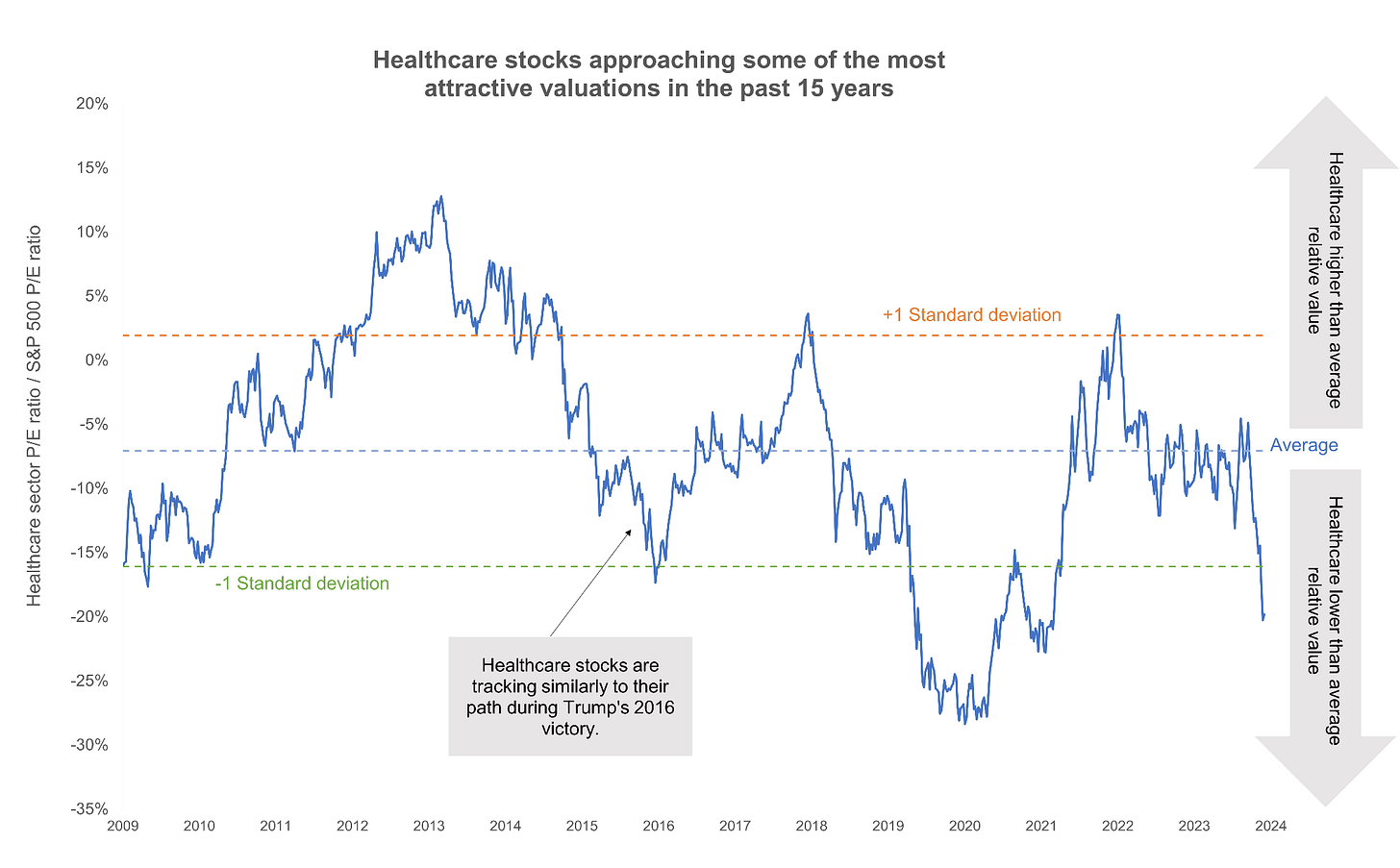

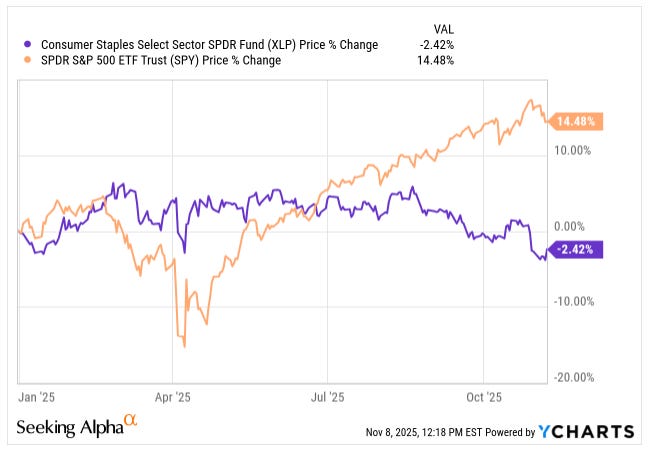

This portrays that, even though the S&P 500 is close to all-time highs, many sectors/companies are not having a fun year (some are even the cheapest they’ve been in many, many years). Take, for example, Healthcare and Consumer Staples/Defensives (some of these charts might be outdated, but the trend has not changed and maybe even become stronger):

Even though investors who are underperforming the S&P 500 this year (like me) would be inclined to use the charts above as an excuse, I don’t think they should be used as such. The reason is that one of the things that makes the S&P 500 such a great financial instrument and so tough to beat is that it concentrates on very high-quality companies (companies that, by the way, are freely available for everyone to purchase). Taking this advantage away from the index when it suits our narrative well wouldn’t be entirely fair. If any of the Mag 7 or the “AI trade” falters in the future and the index underperforms the equal-weight index, I am pretty sure nobody will say their outperformance was achieved thanks to a concentrated index (obviously, everyone will say it was skill).

What I want to portray with this is that the realities of many portfolios are likely to be very different than what indices portray. If this reality is different for good or bad, we’ll only know with the benefit of hindsight. One thing I won’t negate is that it’s a frustrating experience. For example, I own several companies that, for X, Y, or Z reason, have not been performing well lately (maybe an understatement in some cases). Some of these will definitely be mistakes (not immune to these), but I believe they can be broadly characterized into two main buckets:

There’s simply no appetite for them because the market at large is positioned in the AI trade. I would include “healthcare” in this bucket, as many top lines are accelerating and valuations are pretty reasonable (yet still no appetite).

There’s an existing narrative that AI will be detrimental to some businesses. I would include software (both HMS and VMS) in this bucket.

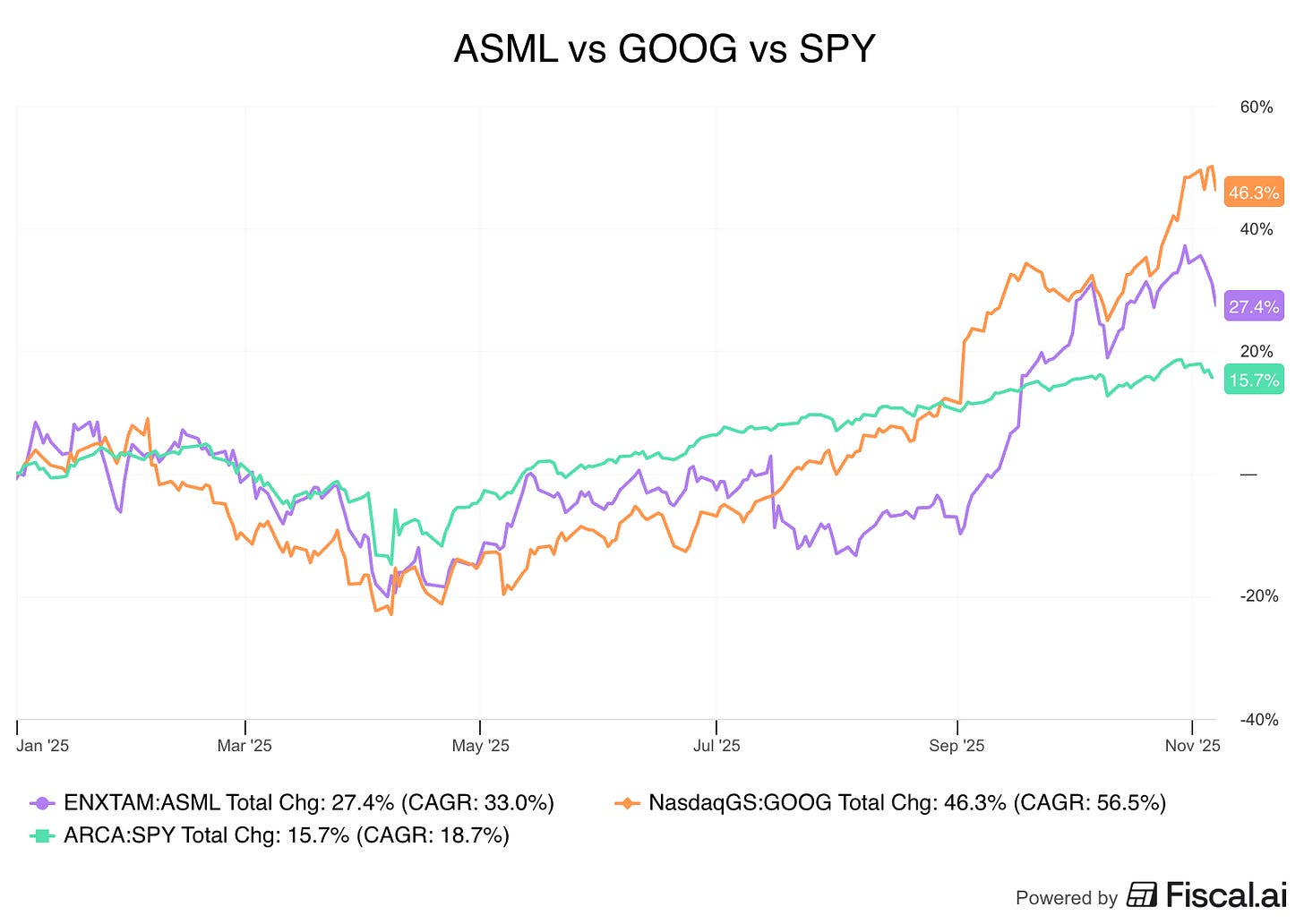

The second point on narratives is interesting because, depending on who you speak to, they’ll tell you that narratives take a long time to change, but some will also tell you the opposite: that narratives can turn on a dime. On this AI topic, I believe that my experience is that the latter is true. Let’s take a look at two examples: Google and ASML. Not long ago, Google was seen as an AI loser, but it has become an AI winner in a very short time (literally, it took a judge’s antitrust decision to flip the narrative). On the other hand, we have ASML, which was seen as an AI laggard while companies like Nvidia and TSMC reaped the full benefits of the AI trade. That also changed relatively quickly, and the stock was up about 50% in a month. Both stocks, by the way, were trailing the index significantly over many months and were obviously getting “ridiculed” by the bears:

It might appear very tough to believe that narratives can change on a dime when one is positioned on the “wrong” side of a narrative, but there are plenty of examples that demonstrate they can. This “non-linearity” of stock returns is arguably what makes investing challenging, especially in a bifurcated market where only a handful of stocks are leading the way. Not being exposed to the AI-trade this year likely translates into underperformance, but it says little about what will happen going forward. It’s definitely frustrating to see things not play out as expected while indices march to ATHs, but this is part of the game, and one must hold a portfolio of companies they believe will maximize their forward IRR, regardless of whether that IRR is achieved linearly or not (of course, all things equal, I would much rather prefer linearity).

I don’t know if you, the person reading this, are having a tough year or, conversely, a great one, but I wanted to share some reflections here in case you’re in the former category. Note that in times like these, it’s perfectly normal to feel inclined to change the strategy or to try to chase the next shiny thing, but the appropriate choice is to reflect and understand how one can improve without necessarily completely reshuffling one’s process. I have a pretty good advantage here as I’m aware that, by the time I am thinking about chasing the next big thing, it’s most likely not the next big thing. I would like to share this meme that I found funny, which was shared by my friend @PythiaR this week:

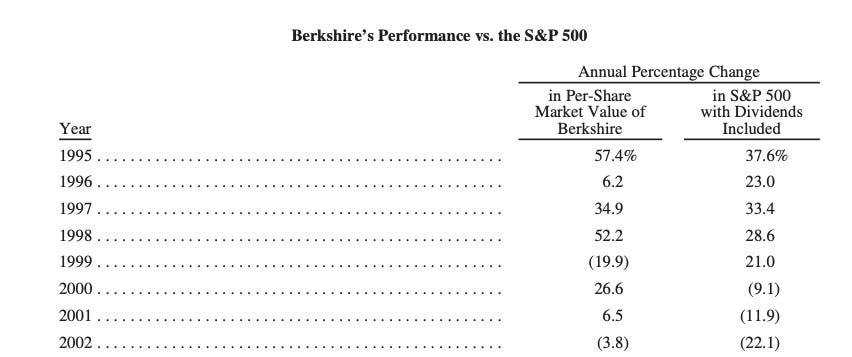

In case you don’t get the reference, Warren Buffett significantly underperformed the index in 1999 (-20% vs +21%), as everyone was getting rich during the internet bubble. He was obviously mocked because people believed he was old and did not understand technology. Turns out he went to outperform the index quite considerably when the bubble burst:

I am not claiming that neither you nor I is Buffett (chances are that we are not) or that we are currently in a bubble (the environment seems pretty different from the year 2000), but that this is a game that’s played over the long-term and the most important thing is to survive. How many people do you think blew up during the dotcom bubble? I’d say quite a few!

What I wouldn’t recommend, either, is blaming everything on the market and a “bubble” or whatnot (which doesn’t mean you can’t have an opinion, btw!). That probably takes away much of the focus needed to stay put during a period of underperformance.

The industry map was red this week, especially the tech sector (which is why the Nasdaq was down considerably more than the S&P 500):

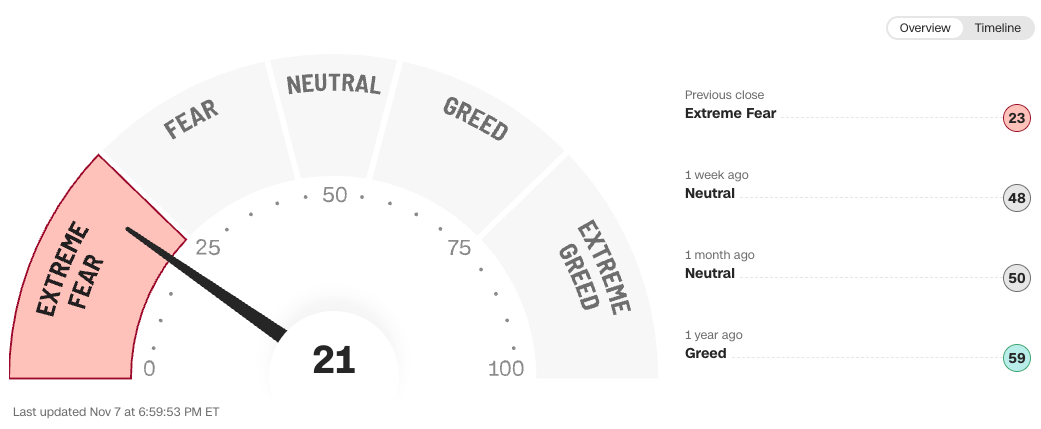

The fear and greed index worsened, and is not in extreme fear, despite indices being close to ATHs. This might be due to what I discussed above regarding what’s going on under the hood:

My transactions this week and the cash disclosure

I added to several positions this week and also started to disclose my cash position in the spreadsheet. I feel there are quite a few companies that are undervalued in my portfolio (more on this later), so I added to a couple of those: