Even THEY raised estimates!

Nintendo's Q2 2026 Earnings Digest

Nintendo reported (again) great quarterly earnings, with a pleasant surprise: even its (historically) conservative management team decided to significantly raise guidance, overwhelmed with the existing demand for the SW2. This quarter clearly confirmed that analysts’ estimates were (and still are) too low (if we needed any confirmation!).

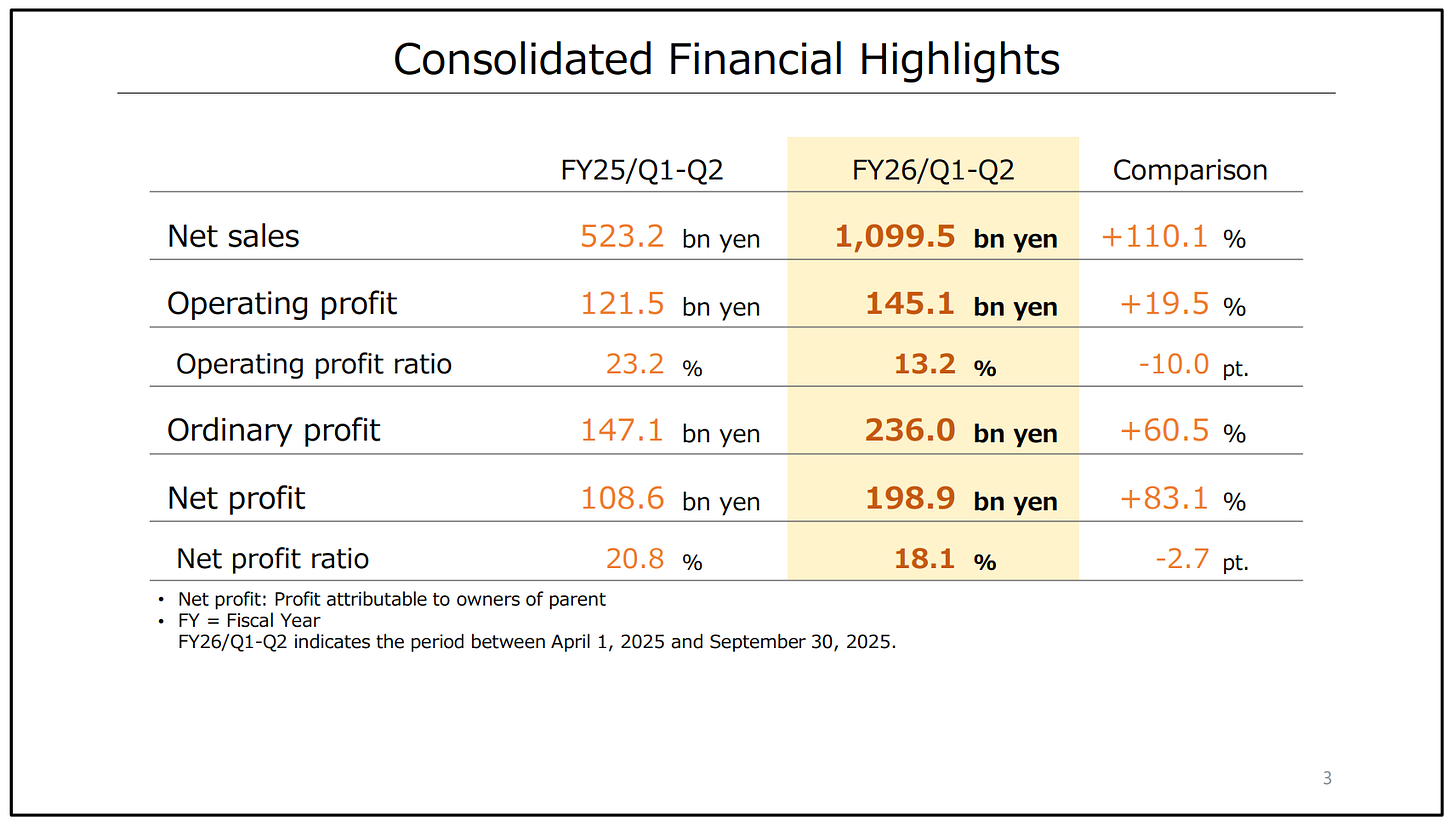

The numbers for the first 6 months show a continuation from Q1: robust revenue growth driven by SW2 sales…but margins compressing significantly:

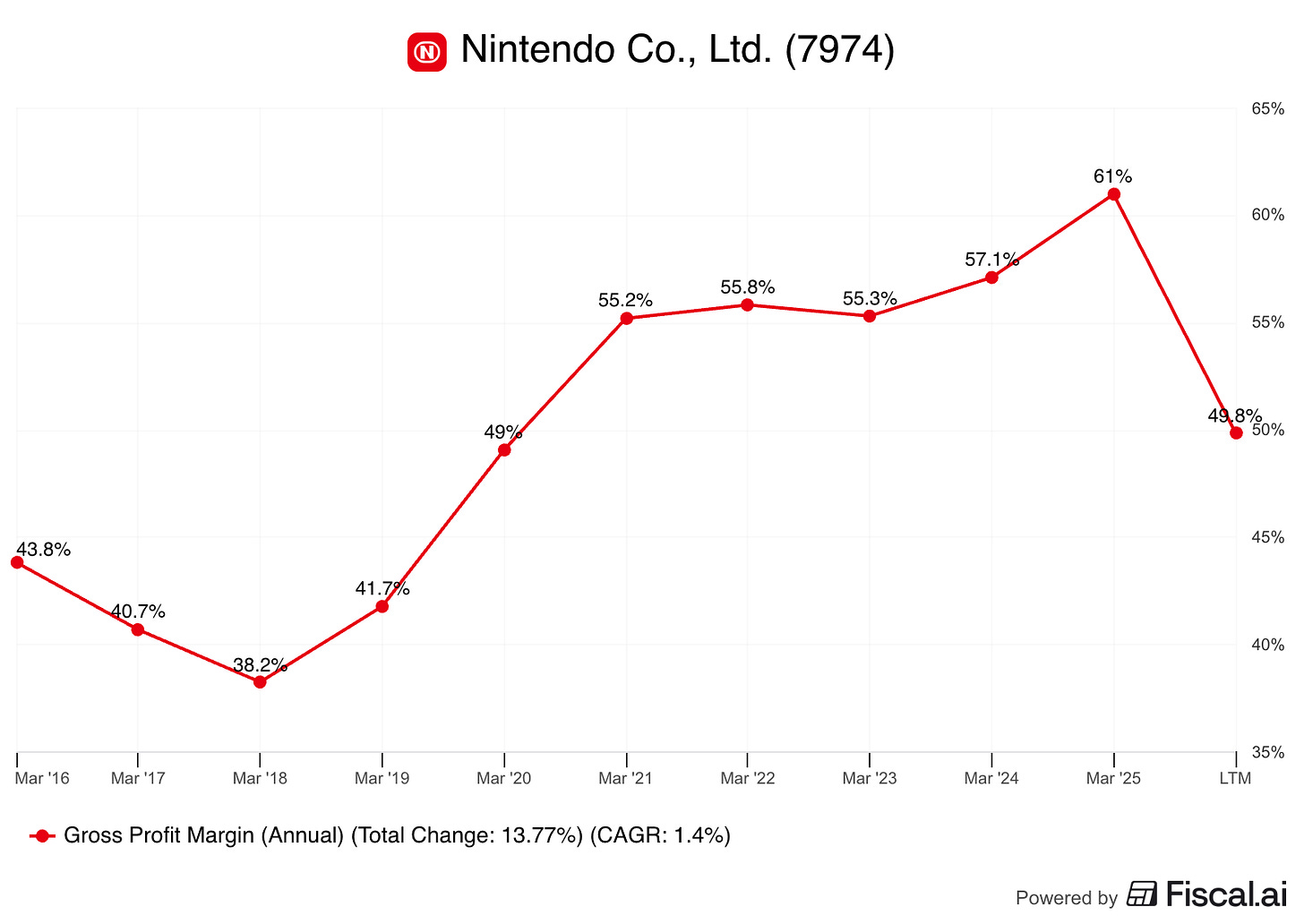

Margins compressed due to several factors, none of which are worrying. The first one is that, in the current phase of the SW2 cycle, hardware sales are significantly higher than software sales. To this, we must add that the SW2 is sold at a lower gross margin than the SW1. Margin compression is normal during the early stages of a console cycle, but the equation will flip as the installed base grows and software sales take over. You don’t have to believe me if you don’t want to; we can look at how the SW1 cycle played out. In the graph below, you can see how the gross margin bottomed in the first year of the SW1 only to subsequently expand 1,700 bps through the cycle:

What’s interesting about this cycle is that we may see the gross margin start from a higher base this time around (still TBD). The reason is that Nintendo currently has two coexisting, related, and successful platforms. The SW1 franchise is still generating abundant software sales (unlike the Wii U when the SW1 launched). We’ve had two very hardware-heavy quarters for the SW2, and gross margins only slightly dipped below the FY18 base despite the SW2 carrying lower gross margins than the SW1. There’s a paradox here, though. The more successful the SW2 is, the lower the gross margin will be during the early stages of the cycle. However, this success should, in theory, translate into higher profits down the line through the sale of higher-margin software to a significantly larger installed base.

If we go lower down the income statement, we can also see that Nintendo continues to spend considerable amounts on R&D and Advertising. Nothing out of the ordinary for a company trying to aggressively build an installed base that will bring a highly profitable earnings stream down the line.

I believe it’s fair to expect more significant operating leverage in this cycle than in the SW1 cycle. The reason lies in the IP ventures. Even though Nintendo only released the Super Mario Movie toward the end of the SW1 cycle, we now have management’s confirmation that these IP-related ventures will be more recurring (at least once a year). This should help Nintendo drive sales while getting paid to do marketing (sort of), which is one of the things that makes Nintendo special. When Nintendo aired the Super Mario Movie, S&M as a percentage of sales decreased considerably!

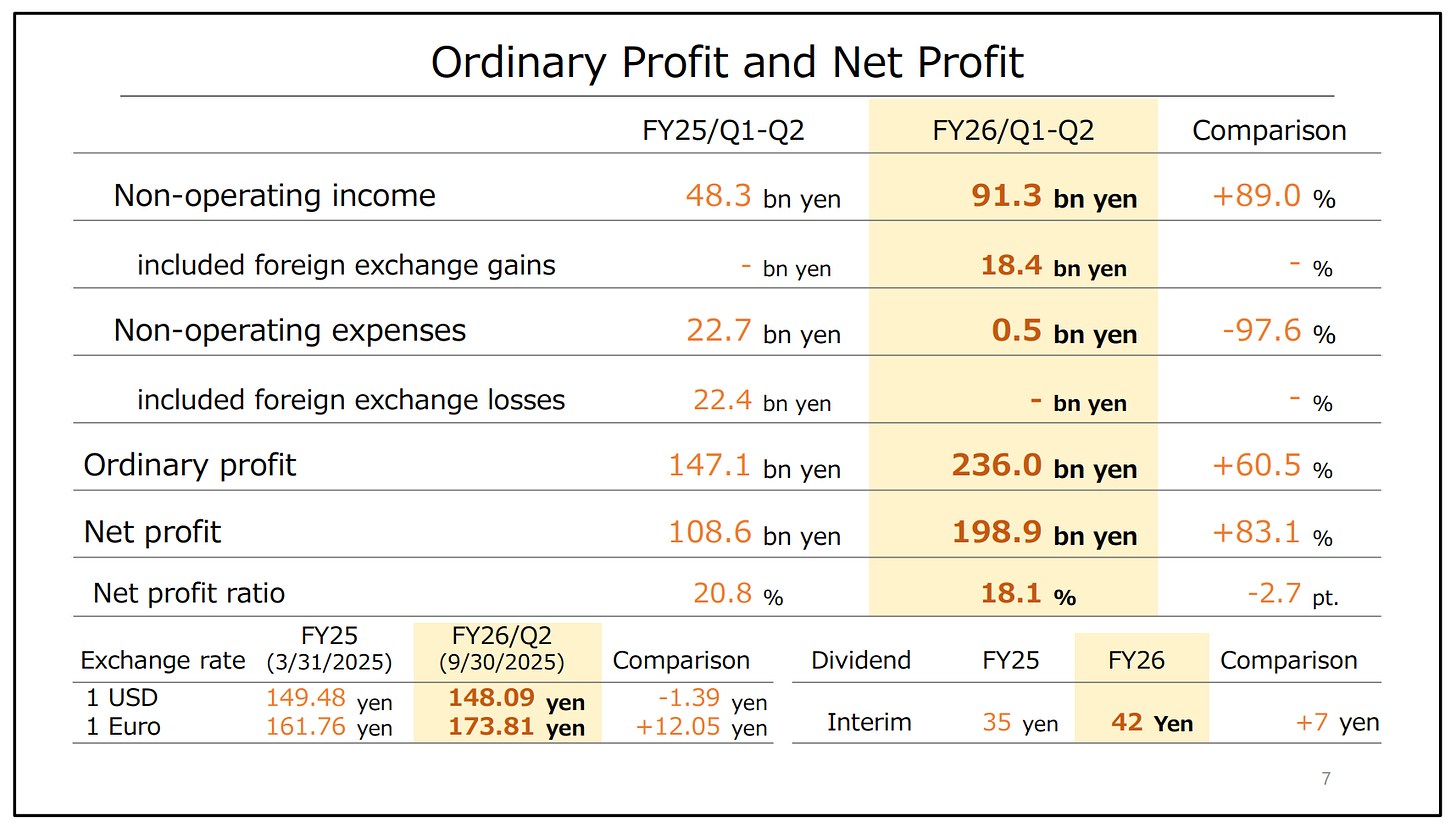

Ordinary profit and net profit rose considerably despite the lower gross margins and higher Opex:

The reason was two-fold:

Nintendo had foreign exchange gains during the first half vs losses in the comparable period last year, and experienced an increase in its share of the profits of participated entities

Nintendo enjoyed a 32.3 billion yen gain from the sale of investment securities

I wouldn’t take any of these as recurring and operational, and therefore, the point I made above stands: margins are set to compress significantly as the installed base is built, only to skyrocket from there.

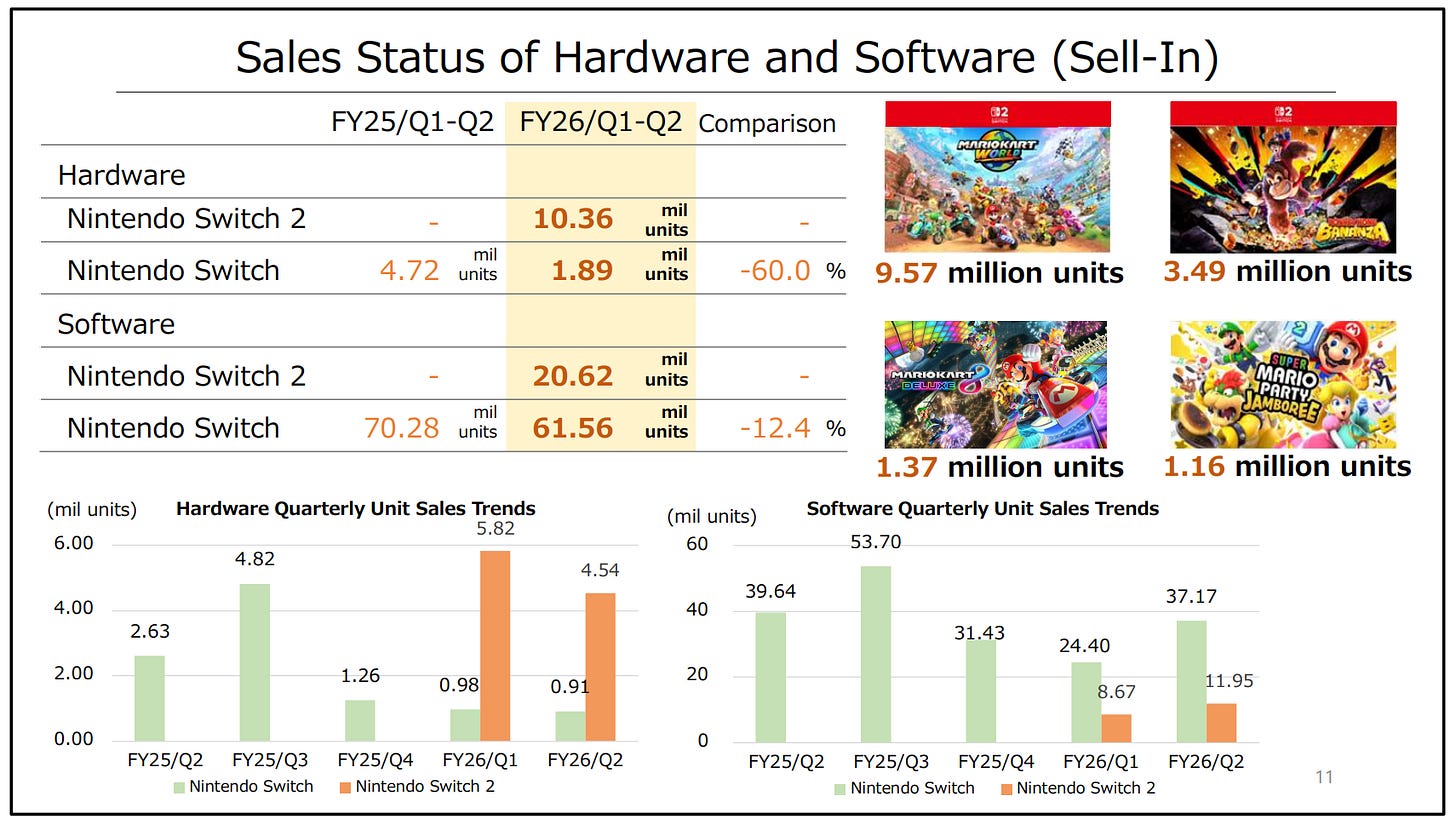

The highlight of the quarter was both the SW2 sales numbers and the guidance. Both are closely related because the SW2 numbers have been running considerably ahead of management’s expectations, prompting them to increase guidance. Let’s start with the former.

Nintendo has sold more than 10.3 million SW2 in just two quarters (4.54 million in Q2 alone). These sales have come with 20.6 million in software unit sales, for a tie ratio of pretty much exactly 2:

One thing to note here is that none of those numbers include Pokémon Legends Z-A (released October 16th), which has been an incredible hit and was also sold as a bundle with the hardware. In its first week, Pokémon Z-A sold around 2.9 million SW2 copies (5.8 million considering SW1 and SW2), which is 14% of the total software sales for the SW2 over the first 6 months (in just a week!).

Even though SW1 hardware sales are considerably decreasing, Nintendo still sold 1.89 million units and, more importantly, more than 60 million software units. At an average price of $60, the SW1 is bringing $3.6 billion in high-margin revenue that can be reinvested into the SW2. It’s evident on all fronts that Nintendo’s starting point in this cycle is strikingly different from what it was when the SW1 was launched.

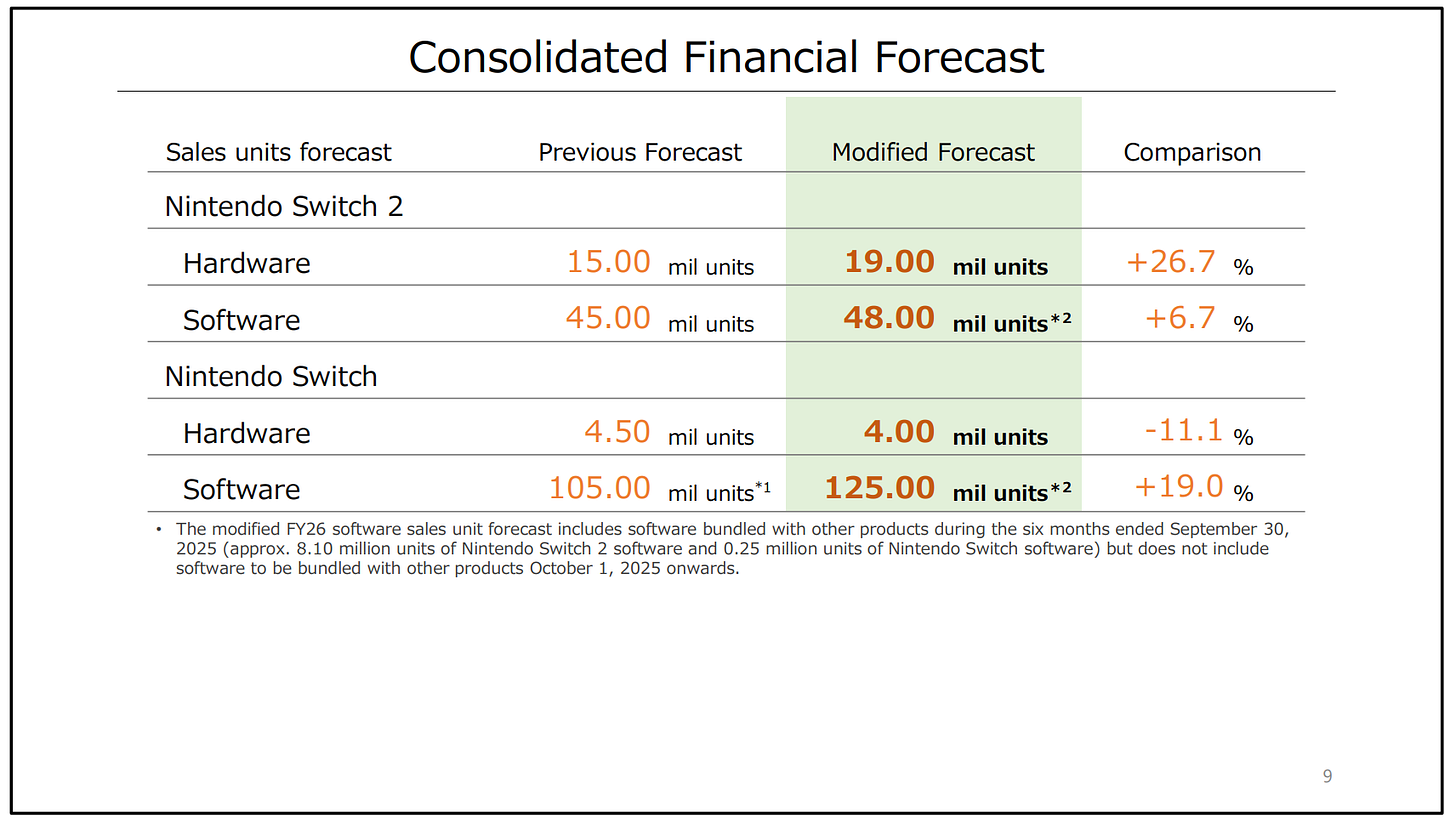

The excellent results over the first 6 months for the SW2 led management (which is typically conservative) to bump up their outlook quite considerably. Nintendo now expects to sell 19 million SW2 units, up 27% from their previous estimate:

If we take the Q2 number (4.54 million Switch 2 Sold) and assume it will be similar in Q3 and Q4, we get to management’s guidance. The only problem with this thought process is that Q4 is the holiday quarter, in which sales should trend well above the 4.5 million figure. This, together with the recent rumors (discussed in a past NOTW) that Nintendo is asking suppliers to manufacture 25 million SW2 this year, makes me think the numbers are still conservative despite the considerable guidance increase. In short, management’s expectations might be higher than what they are communicating to the market.

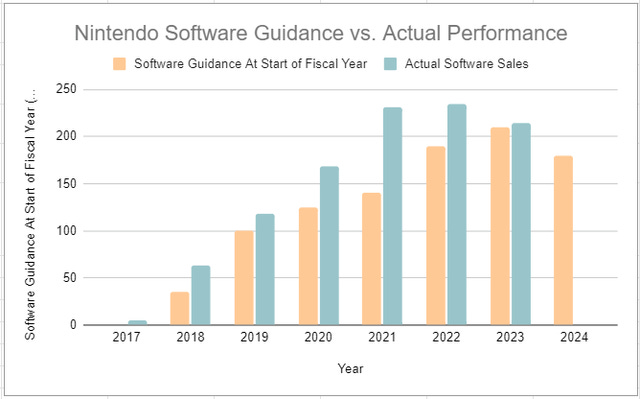

The software guide was raised as well, but only by 7%. Several factors might explain the divergence between the two. The first is that one of the expected blockbusters of the Zelda saga this year (Hyrule Warriors: Age of Imprisonment) has been reportedly delayed to next fiscal year (even though Nintendo still lists it as launching this week in its earnings presentation, and there’s no official message from the company). The second (and most likely) reason is that Nintendo tends to be much more conservative with its software guide. I always like to bring this chart by my friends Brett and Ryan at Chit Chat Stocks to show the historical performance of the software guide vs. actual software sales:

If we assume that Hyrule Warriors is getting delayed (which might not be the case), this guidance hike becomes even more impressive. In this business, it’s the software that sells the hardware, and Nintendo significantly boosted both metrics despite one of this year’s blockbusters being supposedly delayed. Note that I still believe the numbers above will prove conservative by year-end.

Regardless of whether you believe management is being fair or conservative here, the current guide is now above the market’s expectations. Having a conservative management team that guides above yearly analyst estimates with two quarters to go is always a great sign.