Terrible Expectations Management

Zoetis' Q3 2025

Zoetis reported a pretty bad quarter yesterday. Not only did the company miss revenue estimates, but it also lowered its organic revenue growth guidance for the year. The stock unsurprisingly dropped considerably:

I’ve seen many people claim that a slight revenue miss (0.2%) and a lowered guidance should not cause such a sharp drop in a company’s stock, especially given its reasonable valuation. I would firmly agree with this view IF the problems were contained in those two financial metrics. The problem, however, did not stop there. Management managed expectations terribly and, over the past few quarters, has completely lost the narrative with the market (never good news, even though not critical in the long term).

Before digging deeper into this topic and Zoetis’ valuation, let’s take a quick look at the quarter.

Zoetis’ quarter

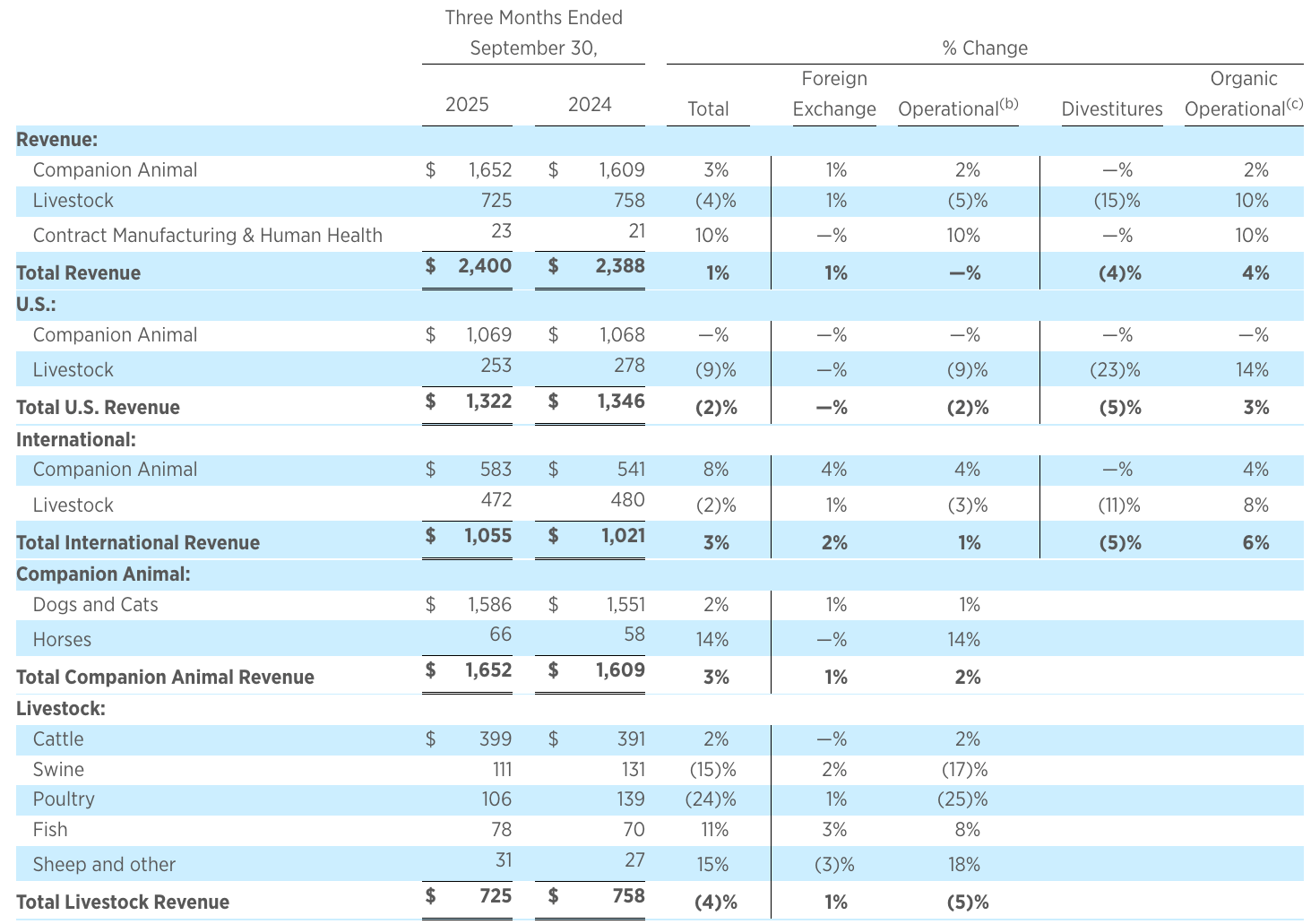

Many will claim that Zoetis is “trading at 20x earnings while only growing 1%.” Even though the headline is great for clickbait, it misrepresents what’s going on under the hood. Zoetis recently divested its MFA (Medicated Feed Additives) business, which is creating a headwind to reported revenue. To account for FX and this divestiture, Zoetis reports organic operational growth. In Q3, organic operational revenue growth was 4%, and organic operational growth in Adjusted Net Income was 9%. So no, Zoetis is not really growing 1% YoY.

With all that said, let’s take a more detailed look at the numbers. Livestock was surprisingly strong in the quarter, saving Zoetis from a complete “disaster.” This segment grew 10% operationally in Q3 (a growth rate one typically doesn’t see) and was accretive to Companion Animal’s 2% growth. The strength in Livestock was broad-based (+14% in the US and +8% in International Geographies), but Companion’s performance was very dissimilar across geographies. Companion Animal was flat in the US and grew 4% in International Geographies:

So, what happened? Several things. First, OA Pain Mabs were an ongoing headwind, especially in English-speaking countries. Librela has not enjoyed positive publicity in the US (warranted or not), and this spread to several international geographies. As a result, Librela’s sales dropped a whopping 15% year over year globally (which was a much more pronounced drop in the US of -26%). This is not great to see, especially as the OA Pain Mab franchise was theoretically going to be one of the key sales drivers over the coming years (its development in Europe surely pointed to that), and it’s now a significant headwind.

It also shows why one shouldn’t really focus on the headlines from people who haven’t done any work on the company. Many claim that Zoetis’ stock’s poor performance over the last 5 years is just a matter of normalizing valuation ratios. While partly true because Zoetis’ valuation at the pandemic peak made no sense, this completely misses the fact that one of the most significant tailwinds for the company “suddenly” turned into a headwind.

Zoetis’ other key franchises (dermatology and parasiticides) experienced slower growth due to tough comps, but they at least grew. The Simparica franchise (parasiticides) grew 7% operationally, whereas dermatology grew 3%. Management attributed their slower growth and overall weaker performance to several things…

Tough comps (especially for parasiticides as Simparica grew 27% YoY in the comparable quarter)

Competitive dynamics (especially in dermatology, as there was promotional activity around preliminary launches)

Macro issues (i.e., vet visits)

According to management, #1 and #2 were within their expectations, but #3 took them by surprise. This sounds strange because management has been claiming for many quarters that their business is not as exposed to vet visits, a claim somewhat confirmed by Zoetis’s growth over the past few years, even in an environment of declining vet visits. What they didn’t say is that the business is highly exposed to therapeutic vet visits, and that these visits have been trending down for several quarters:

We saw three quarters in a row of therapeutic visit pressure that has certainly impacted where the quarter landed.

Lower therapeutic vet visits theoretically result in fewer patient starts, and they attributed some of the quarter’s (and guidance) weakness to this. Maybe it would’ve been a good start to be completely transparent as soon as therapeutic vet visits started to falter. The question is:

Who in their right mind raises guidance in the middle of therapeutic vet visit headwinds?

The fact that these “macro issues” are surfacing as competition across certain franchises intensifies is definitely not something that will make the market comfortable (and rightly so).

Management’s incoherence

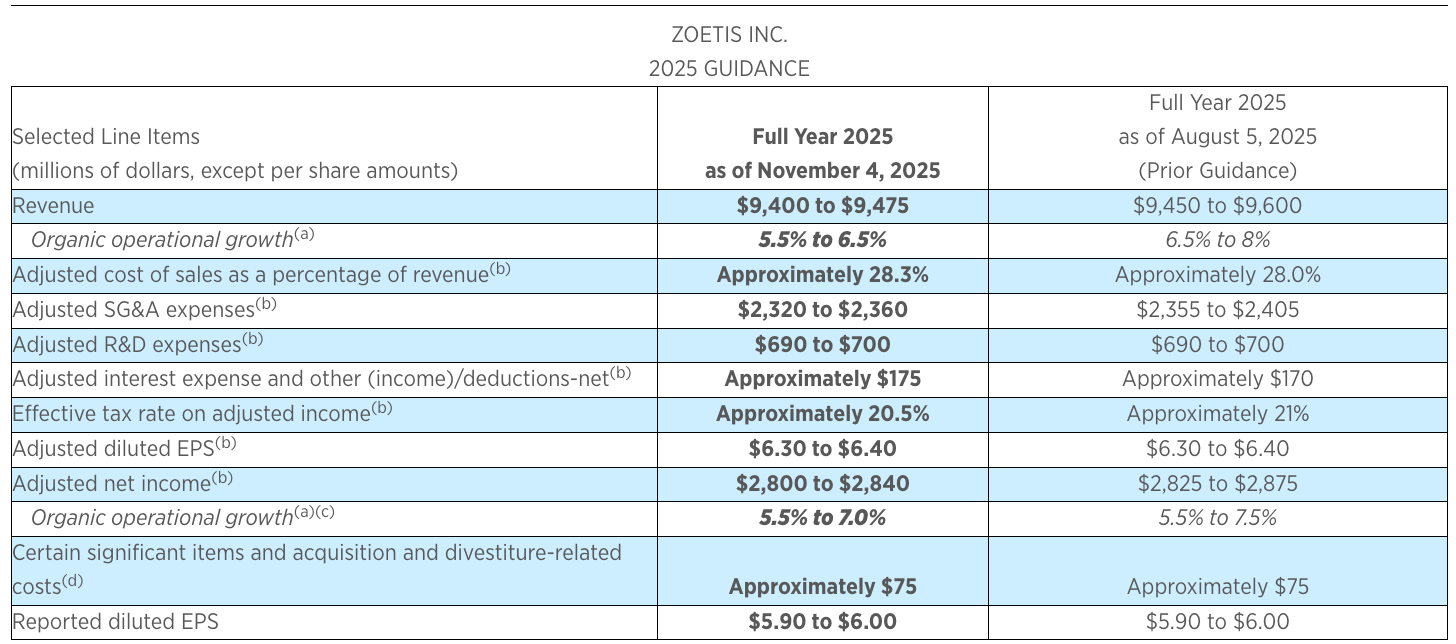

The company lowered its revenue guidance significantly, from a range of 6.5% to 8% organic operational growth (7.25% midpoint) to 5.5% to 6.5% (6% midpoint). The only good news is that they somewhat held the guidance in Adjusted Net Income and expect the same diluted EPS:

This is not great, but there’s something that makes it even worse. In Q2 2025 (i.e., the last quarter), management raised guidance from a midpoint of 7% to7.25%. Raising the guide one quarter only to lower it the next is terrible expectations management, no matter how one looks at it. To add insult to injury, the CFO decided it made sense to repurchase more than $330 million in stock in the quarter (I’d give one thing to Zoetis: at least they return pretty much all excess cash to shareholders!).

This is just one of the mistakes that management has committed over the past few quarters, but it is not the only one. Here are a few…

Management downplayed the impact of vet visits on the business, only to use them as an excuse when things turned south. I am not saying that it’s unwarranted that macro has something to do here, but they should’ve been transparent from day 1, so that it doesn’t appear as if they were using the “macro” wildcard

Management downplayed the impact of competition, but they did mention it had an impact during the quarter. In fairness, they did mention that the impact was what they expected and that it’s normal to lose share in the early instances of promotional activity by competitors

Management downplayed the impact of Librela’s negative publicity. The result is evident to everyone: they reacted late.

What’s interesting to me is that the result of all of this has been the “firing” of the head of R&D (Robert Poulzer), when in reality, who should’ve been sacked are both the CEO and CFO for completely losing the narrative against the market. Note that analysts (rightly) had been worrying about issues #2 and #3 for a while, but management decided to remain optimistic. I don’t believe temporarily losing the narrative against the market has much impact over the long term, but there’s no denying it will take some time to regain the narrative, and it will most likely be a bumpy ride.

The green shoots

Believe it or not, there were some green shoots in the earnings release, though most are contingent on management’s visibility (which we now know is not the best). The first one is that they don’t believe the exit rate in Q4 will be representative of 2026 (i.e., 2026 might still be an okay year despite ending 2025 on roughly 3% operational organic growth).

I don’t see how we’re exiting the year in the fourth quarter to be a read-through to what 2026 will be.

They also mentioned that they see stabilization in the OA Pain Mab franchise. This means that the OA Pain Mab franchise (excluding Lenivia and Portela) can return to growth in 2026 (which would be a pleasant surprise).

Another green shoot could be found in the sales channels. In an investor conference mid-quarter, management mentioned the following:

As we’re here in the quarter, and as we’ve talked about a few times, if you look at distributor inventories in the U.S., for example, those have been in the lower end of the range from where we’ve historically operated at since the first quarter of 2023. In the third quarter, we’ve seen those trends a bit down from where they exited Q2. We’ll continue to monitor those as well.

This destocking impacted the quarter, but management did see a recovery. The fact that distributor inventory is at low levels leaves some space for some sort of stocking tailwind in 2026, but it’s probably too early to tell. In the meantime, Zoetis continues to build its alternative channels, which grew 21% YoY.

Finally, the company will also enjoy the “innovation tailwind.” Now, we don’t yet know to what extent or when (as I discussed in a prior NOTW). Zoetis will be hosting a webinar on Innovation on December 2nd.

The valuation

After ranting about Zoetis above (deservedly so, I must say), it’s time to take a look at the valuation. Despite management’s missteps, I still believe Zoetis is a quality business operating in an appealing industry that is resilient and offers optionality (higher penetration + unmet needs). Interestingly enough, Zoetis is now trading at a discount to its closest publicly-traded peer, Elanco (ELAN), across pretty much any metric one looks at. This was not on my bingo card for this year. I believe Zoetis is a significantly superior business to Elanco, even though the market doesn’t seem to agree.