This is the thesis

Stevanato's Q3

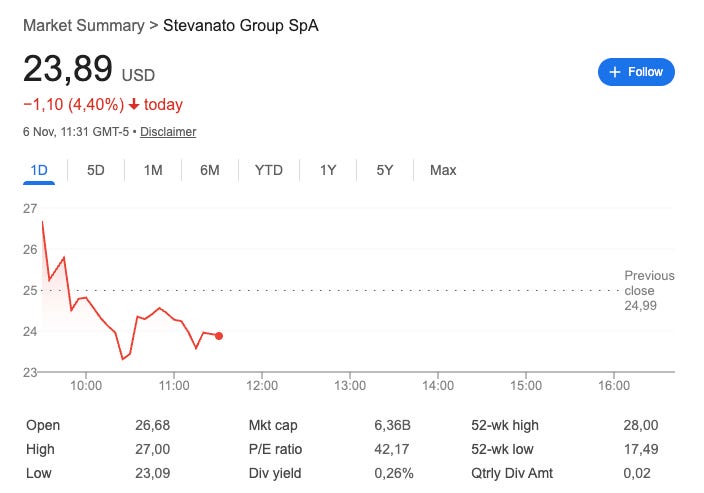

Stevanato reported strong Q3 earnings today, though there are many moving parts. The company is currently seeing pockets of significant strength, offset by some weakness in engineering and an unfavorable foreign exchange environment (outside of management’s control). This, imho, is not allowing the real story to shine through, and it’s likely one of the reasons why the stock was down despite the strong earnings:

Let’s start with the headline numbers, and I’ll later dig deeper into the moving parts. Stevanato reported revenue growth of 11% (constant currency). Growth was bifurcated across segments.

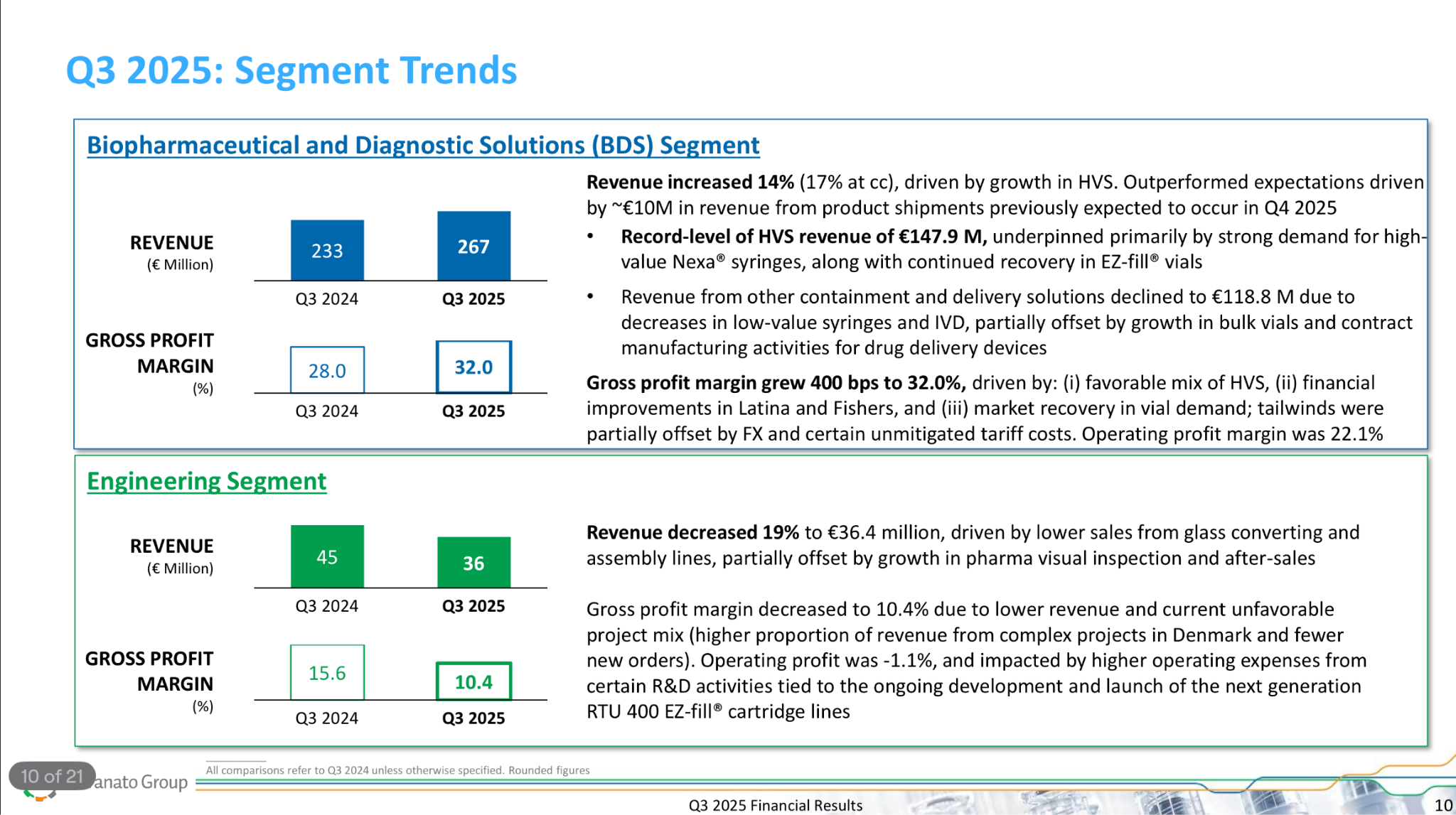

BDS reported a whopping 17% constant currency growth, whereas engineering experienced a 19% revenue decline:

There was a €10 million pull-forward in BDS revenue due to some Q4 orders being placed in Q3. Even excluding these, revenue would’ve grown comfortably in the double digits (even more so assuming constant currency). So, the story this quarter was the same that we’ve been experiencing for a while: a very strong BDS masked by a weaker engineering. The good news here is that this can only go on for so long before the engineering segment’s numbers are pretty much negligible relative to the consolidated numbers (only half joking?).

The forward commentary on engineering was not great either, as management claimed that customers are being more measured with their CapEx and capacity build-out. This should be no surprise to anyone who follows the pharma space: equipment has been in the dumpster all across the industry for a while. They do expect to benefit from the typical tailwinds that everyone has been discussing (US onshoring, etc, etc).

This quarter demonstrated the Stevanato thesis to perfection. BDS margins expanded 400 basis points on a 14% year-over-year revenue growth. This was achieved despite Fishers still operating at a negative gross margin and Latina still below the consolidated gross margin, despite the bulk vial destocking not yet entirely over, and despite the company facing tariff costs. Just to put some numbers around this…Stevanato added €34 million in BDS revenue this quarter and €20 million in gross profit, or what’s the same: achieved a 60% incremental gross profit margin! And this is despite the headwinds.

This should be no surprise, given that the gross margin midpoint for high-value solutions is around 55%, whereas it’s 25% for bulk products. HVS grew a whopping 47%, and the company is far from over in this transition, with HVS accounting for around 55% of BDS revenue during the quarter. Considering that all new supply is going towards HVS, we should see this number trend toward 100% over the coming years (i.e., margin expansion is far from over).

Of course, engineering was a headwind to profitability, but even then, Stevanato managed to expand its operating profit margin from 14.8% to 17.4%, resulting in 25% growth in operating profit. So, here we have a business that is growing operating profit at a 25% clip despite several ongoing headwinds (engineering operating profit margin was negative!). Of course, Stevanato is trading at an apparently hefty P/E multiple that, to some extent, accounts for this, but I believe it doesn’t do so to the full extent.

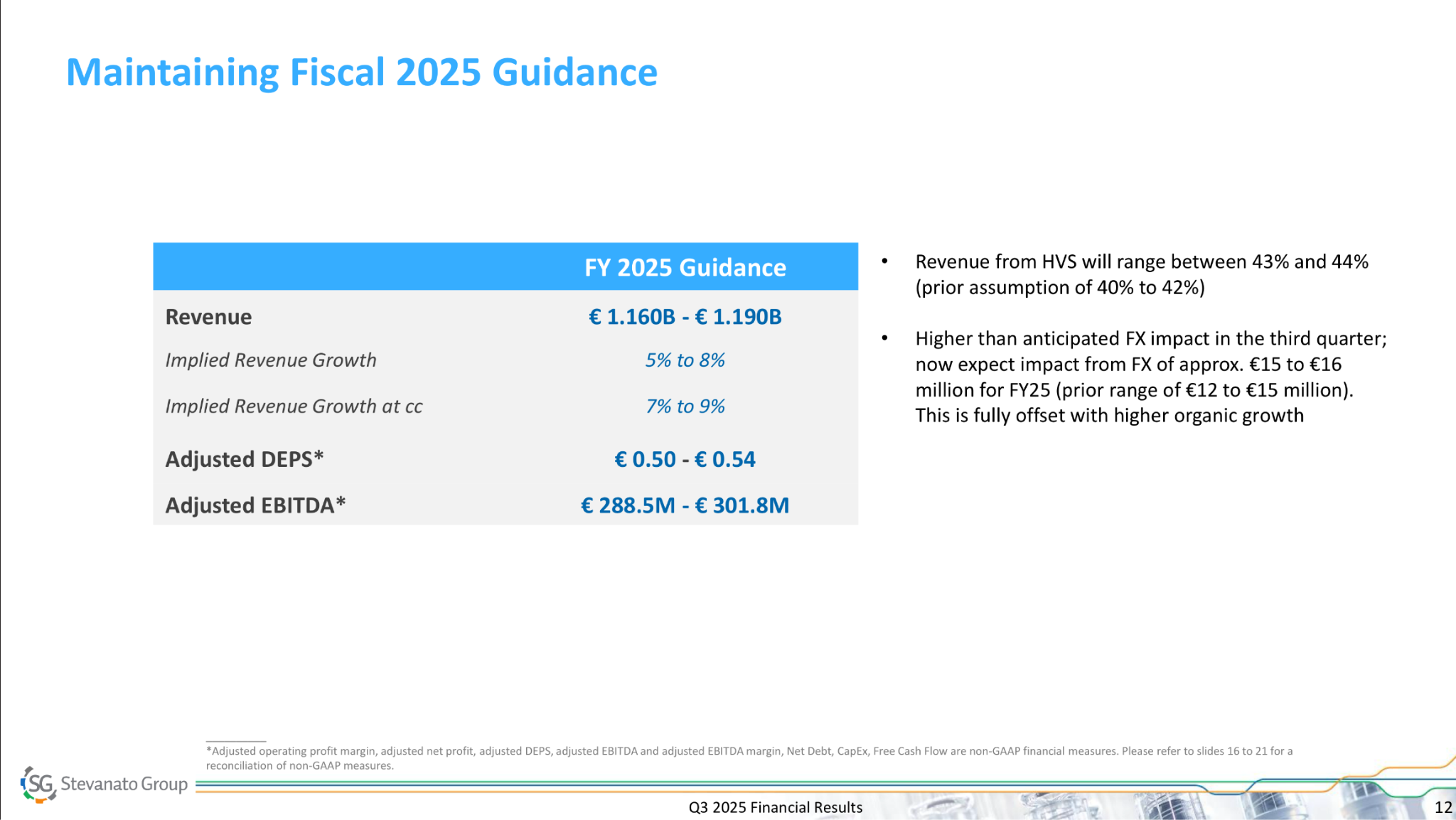

Guidance was the same story again: Stevanato implicitly raised its organic guidance, but the management team decided to leave it unchanged due to higher headwinds from foreign currency:

A guidance raise is likely what the market needed for a better reaction (albeit it’s not something I think too much about). This said, Stevanato should guide organically. Even though Stevanato has not raised official guidance this year, they’ve implicitly raised organic guidance a couple of times. Does this change the business’s value? Not at all, but it surely changes the market’s perception of the results. This should not matter over the LT, but I believe it also makes logical sense to guide to a number you can control rather than one subject to the ebbs and flows of foreign exchange.

2026 is shaping up to be another good year, and even though management did not confirm double-digit growth next year, they said it’s tracking nicely. The company will enjoy several tailwinds next year:

Latina and Fishers continuing to ramp up (full ramp up is expected in 2028)

Bulk vials destocking is becoming pretty much a tailwind in 2026

Better prospects for engineering

Continued ramp-up of margin-accretive HVS

…

There were a couple of other highlights during the earnings call that are worth mentioning. First, biosimilars. Management mentioned the following in the call:

EzFill cartridges are setting a new standard. Most recently, they were selected by a leading manufacturer for use with a GLP-1 biosimilar for type 2 diabetes, one of the first to receive FDA approval and launch commercially in the United States.

They did not mention the customer, but it might be Teva, Hikma, or Meitheal, and the biosimilar appears to be the generic of Novo Nordisk’s Victoza (liraglutide). In case there were any doubts that biosimilars are also opting for HVS, here’s the proof. They also commented on the potential agreement between the US administration and Novo/Lilly to reduce GLP-1 prices in the US. The argument was one that we already knew: they expect it to be a net positive to them because, just like biosimilars, it should result in higher volumes. As I was writing this, Trump announced the following:

Eli Lilly and Novo Nordisk are committing to offer Zepbound and Wegovy at Most Favored Nation rates for American patients. This will slash the cost of Wegovy from $1,350/month to ultimately $250/month... and reduce the monthly cost of Zepbound from $1,080 to $346.

Source: Rapid Response

This is excellent news for Stevanato, as it should drive significantly higher adoption, and both Zepbound and Wegovy are available only in injectable form.

In a previous NOTW, I shared a quote where West Pharmaceutical’s management claimed that it wasn’t about price anymore but about being able to offer a global supply chain. Stevanato is significantly ahead of peers in this regard, and that’s playing out in their favor:

The good news is that we see more and more clients that are looking to totally change their supply chain, and this is going to become more new opportunity for Stevanato because we are already in a very advanced stage of ramping up capacity in Fishers.

Finally, management also made some comments on the contract manufacturing business that they are investing in. In a relatively recent NOTW, I wrote the following:

Stevanato announced this week increased investments into “Drug Delivery Systems Capacity.” While I understand that providing proprietary Delivery Devices and Contract Manufacturing might sound like appealing (there’s a lot at stake), I don’t particularly like the business. It’s undeniable that this business is significantly lower margin and more competitive than HVP components, and it’s interestingly one of the things that West has been criticized for and that have bitten the company back over the past few years.

Management basically said that they are doing this to sell more HVS (makes sense).

Have a great day,

Leandro

The BDS segment growth at 17% is realy impresive despite the engineering weaknes. Markets often overlook the FX headwins when evaluating quarterly results, but that 19% decline in enginering seems more concerning for long term growth. Do you think managements strategy to prioritize HVS is the right move given the margin profile?