NOTW #7: The market "pullback" and Hermes' earnings

Hi reader,

Both indices were down again this week, following the tone of the past couple of weeks. Despite many calling for the beginning of a “bubble burst,” the reality is that the Nasdaq is not even yet in correction territory, even less so the S&P 500. There was also some interesting news this week from several companies, including a digest on Hermes’ earnings.

Without further ado, let’s look at this week’s articles.

Articles of the week

I uploaded two articles this week, although one was a podcast. I held a great discussion with Ryan O’Connor, CIO of Crossroads Capital. You’ve probably heard of Ryan before if you are a Nintendo shareholder. He is an extremely intelligent investor, and I highly recommend listening to the conversation if you have time this weekend.

The week's second article was my Diageo deep dive. I analysed the company in detail to understand if it offers a good opportunity today. I go over the following topics:

Section 1: History and What the company does

Section 2: The Financials and Growth Drivers

Section 3: Competition, the Moat, and Risks

Section 4: Management & Incentives, and Capital Allocation

Section 5: How the company complies with the Best Anchor Stock traits

Section 6: Current status and valuation

Section 7: Concluding remarks

The history section was shared for free and you can read it clicking the button below:

Diageo: An Unprecedented Boom and Bust

Hi reader and welcome to yet another Best Anchor Stocks deep dive,

This was the 4th Deep Dive I have uploaded to Best Anchor Stocks. You can check these below:

Market Overview

The indices were down again this week and by no small amount. The Nasdaq was down again significantly more than the S&P 500, dropping more than 2%:

We can now more or less claim that we are maybe at the beginning of a market correction (at least in the Nasdaq), although it’s still one much lighter than what many people want to make us believe. The Nasdaq is not even 10% off highs yet and many investors are acting as if it is the end of the world. Recency bias is real and the reality is that we’ve not seen red for a while, so it might take some by surprise. The truth is that seeing red is fairly normal in the stock market:

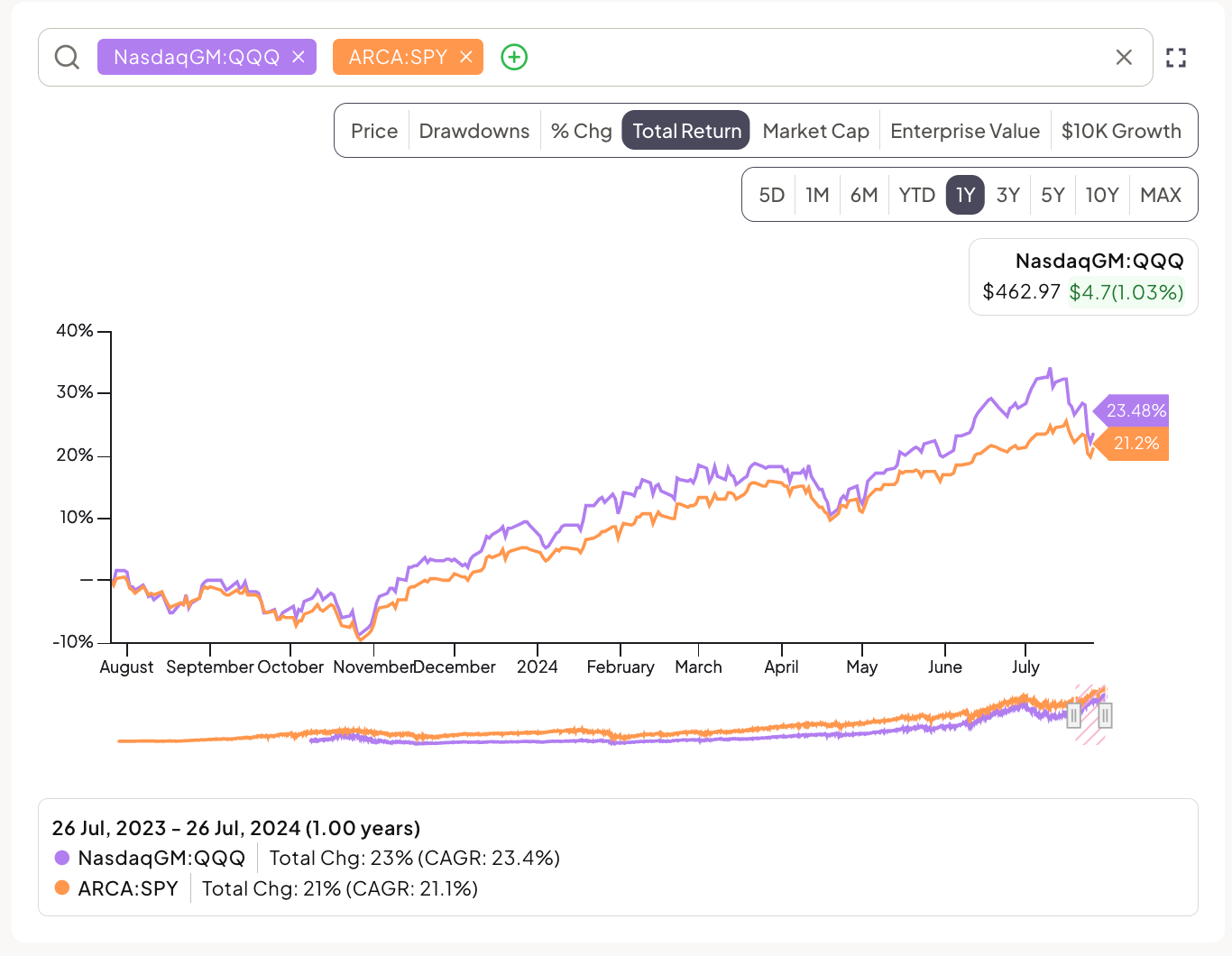

Even if the Nasdaq were to correct further, this could simply be categorized as a normal correction after its magnificent performance over the last months. If we zoom out a bit, we can see both indices are up more than 20% just over the last year:

What’s interesting is that my portfolio is doing pretty much the exact opposite of the indices lately. For example, it was up this week despite the poor performance of the indices:

There are, in my opinion, two things that explain this diverging performance. The first one is that recent indices performance has been primarily driven by companies such as Nvidia, which are now not performing as well. For example, Nvidia was down more than 4% just this week. Nvidia’s performance was a clear tailwind to index performance over the last year, but it can well become a curse if things turn south (I somewhat discussed this topic with Ryan O’Connor in my most recent podcast). Regardless of what its price does, I still believe it’s a great company, although it’s out of my competence circle. I honestly don’t have enough insight into the competitive dynamics of chip design, but seeing your largest customers (who have great talent and lots of money) invest billions to design their own chips might not paint a rosy picture for the future.

The second reason for recent portfolio outperformance has to do with earnings season and cherry-picking. Several companies in the portfolio have recently reported good earnings and the market reaction has been positive. I wouldn’t have cared one bit if the market decided their stocks were worthy of being “destroyed” like those of other companies after reporting great earnings, as I would’ve comfortably added to my positions.

As for cherry-picking, as much as my portfolio has beaten the index over the past week, it has significantly lagged the indices year to date. Of course, this has been caused due to the aforementioned great performance of Nvidia and the rest of the megacaps, of which I only own one:

No excuses here, though. The mega caps were freely available to purchase, and my only explanation for not doing so is that I believe my portfolio is better positioned for the long term as it is. Headwind to this performance was also my mistake with Five Below, which dropped significantly after a profit warning and the CEO's resignation (something I discussed here). I see a lot of people making “fun” of others for not outperforming the index, but these people tend to have one thing in common: they never share their performance. I wonder why. Transparency will always be present here at Best Anchor Stocks, and you can see the performance of my portfolio (updated weekly) in this link.

Anyway, just wanted to share that despite many bears coming out of the cave to claim we are in for a sharp pullback, the reality is that the Nasdaq is barely 8% off highs. We might indeed be in for a sharp pullback, and I think that would make quite a bit of sense after many months without seeing one. Markets will do what they gotta do over the short term, something that should not distract long-term investors from their objective. One of the things that continues to distract investors time and time again is factor rotation, which I discussed in last week’s NOTW.

The industry map did not change much compared to last week: most technology-related industries were red whereas the rest of the market was relatively weak. It’s normal to see some divergences in the different sectors due to earnings season:

The fear and greed index remained in neutral territory:

This is all this week. The rest of the content, which brings the news of the week for the companies in my portfolio (including Hermes’ earnings this week) is reserved for paid subscribers: