Higher interest rates for the right reasons and why I am adding Keysight to my portfolio (NOTW#28)

Best Anchor Stocks has a partnership with Finchat (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Hi reader,

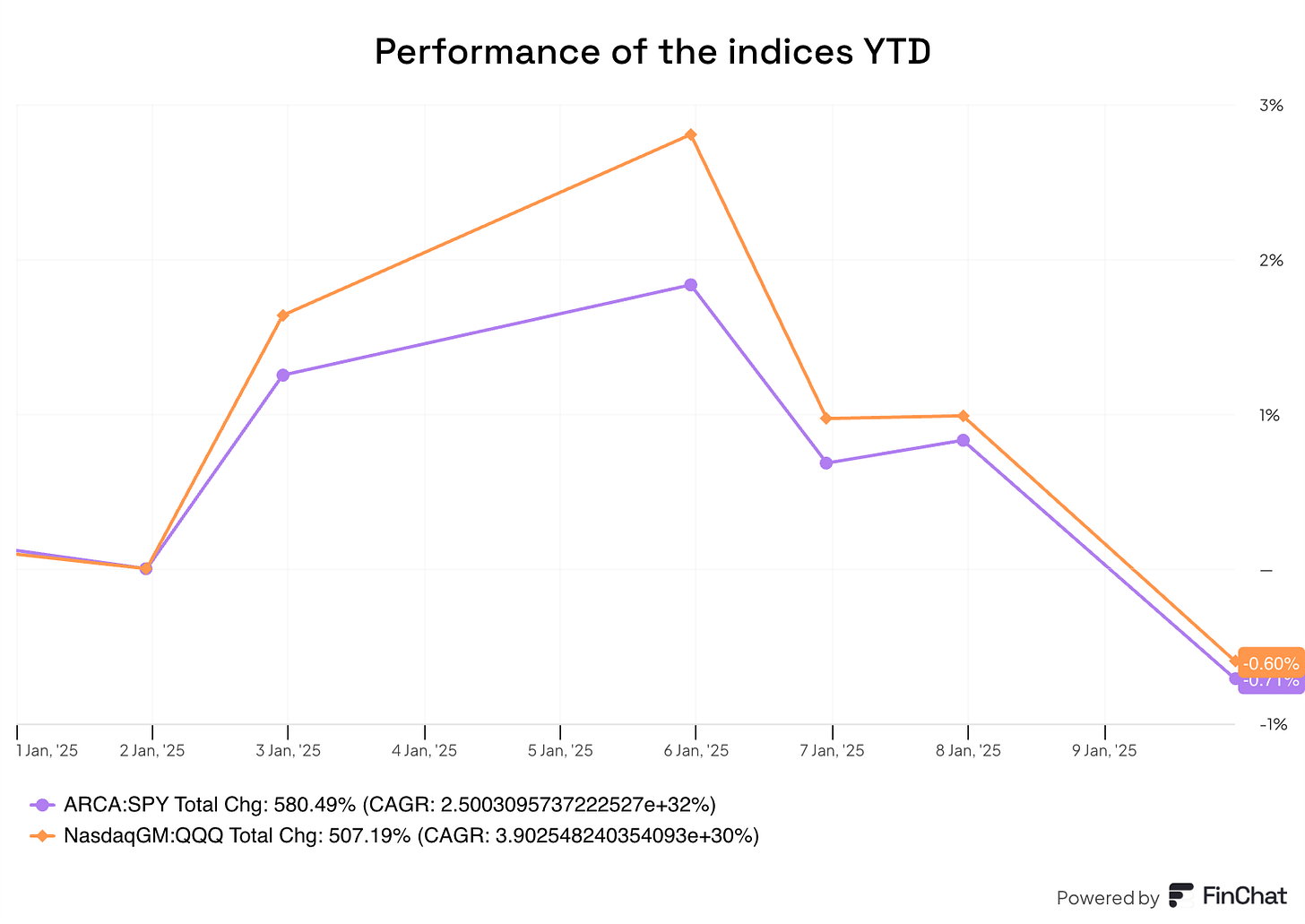

2025 is off to a rough start for the market, with both indices declining in early January. The reason might be related to interest rates (again), but we could even take it as good news (I explain why in the market commentary). I also discuss why I am adding Keysight to my portfolio.

Without further ado, let’s get on with it.

WhatsApp Community

Before jumping into the article I wanted to make a couple of announcements. First, that I have launched a community on WhatsApp to share content and have discussion about high-quality companies. The goal is to keep the conversations as much value add as possible. There’s a 1,000 member limit if I am not mistaken, so feel free to join soon.

If you want to join the community, you can do so using this link.

Articles of the week

Over the last two weeks, I have published two articles. The first was a comprehensive report on Keysight Technologies (KEYS).

If you read that report, you might have seen that I mentioned I had decided to watchlist the company for now. On Friday, I spoke with a Keysight customer and decided to start a position in the company. I’ll share why later in the article.

I also decided to open my Stevanato write-up for free. You can read the first part below:

The second article I published was my 2024 annual recap.

I share a bunch of information, such as…

Lessons learned

Portfolio performance

Podium of errors: $TSM $FIVE and $IBKR

What’s to come in 2025

Market Overview

The market has had a rough start to 2025. Both indices are down year to date in what everyone expects will be a negative year after two strong years. The QQQ is down 0.6%, and the SPY is down 0.71% thus far this year:

The reason? It's tough to pinpoint, but it seems to have something to do with the fact that the economy is doing better than expected. Jobless claims came in below expectations and at an 11-month seasonally-adjusted low. Why does the market not like this? Because the Fed will likely keep interest rates higher for longer if the economy is strong. This became evident in how the 10-year evolved this week: it’s off to a strong start this year:

As many famous investors have claimed through the years, interest rates are like gravity to asset prices. The reason is opportunity cost. Simply put, you can earn a higher return by investing in (theoretically) risk-free assets. This means that the return you should require on “risky” investments should also go up, and the market solves for this by lowering asset prices and, therefore, increasing forward IRRs (Internal Rates of Returns).

I honestly don’t care what interest rates do if they stay within acceptable bands. I much prefer a strong economy than the Fed reducing interest rates because the economy is going into a recession.

Another topic I would like to discuss is “arbitrary” time horizons. I spoke to a good friend this year who is a PM (Portfolio Manager) at a US firm about how arbitrary the returns people post online are. So, for example, you can end the year heavily underperforming the index only to gain all the underperformance back in the first 3 months of the new year. This will not matter to many people because the information they will use to “judge” you is the returns on the 31st of December. Of course, I understand that if people want to measure their yearly performance, it’s natural to use the calendar year to do so, but in the grand scheme of things it means nothing and the only horizon that matters is inception to date.

It’s unsurprising that nobody is sharing their 2025 returns, as most people are probably down and don’t want to share them right now. I completely understand, not because they are down but because it makes little sense to take arbitrary dates to share returns. I guess we’ll have to wait and see how 2025 (and beyond) develops.

The industry map year to date is pretty much “flat,” with not much worth pointing out:

The fear and greed index is nearing extreme fear, and that’s always good news to add to positions. As I’ve discussed many times, this indicator is probably only valuable when it’s at the extremes and not when it’s treading water:

Why I am adding Keysight to the portfolio next week

If you’ve read my Keysight deep dive, you’ll know that I believe Keysight is a quality company, but I decided to watchlist the company as I learned more and got comfortable with the business and capital allocation. It’s one of those companies that is very tough to really understand unless you’ve used its products (as it’s B2B).

Luckily enough, I had the chance to speak with a long-time customer of the company (both in wireless and wireline). I asked him plenty of questions, and he changed my perception of the company, especially on the competitive front. Here are the highlights I drew from our conversation…