Contrarian for the sake of being contrarian? (NOTW#25)

Best Anchor Stocks has a partnership with Finchat (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Hi reader,

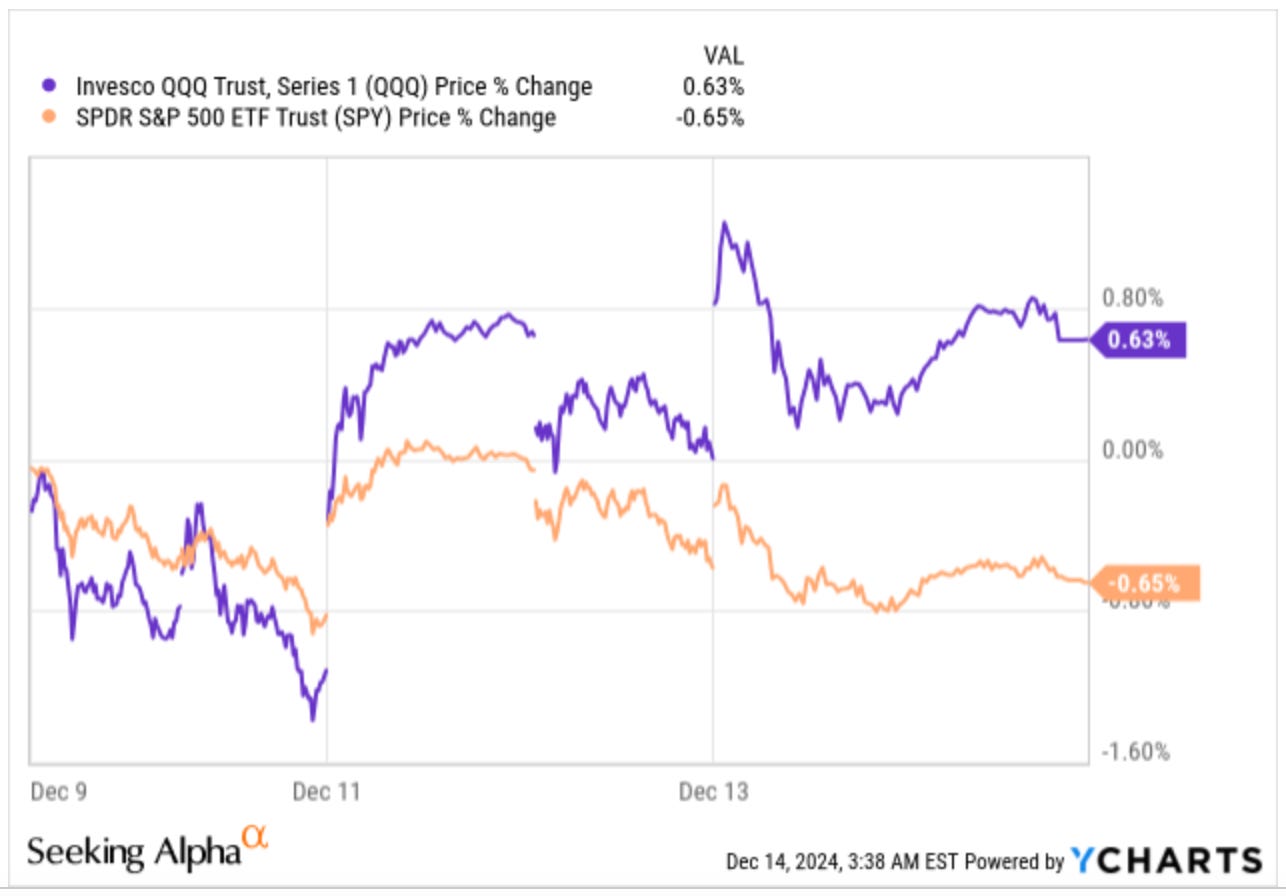

Both indices had diverging performance again this week, with the Nasdaq outperforming the S&P 500. The technology sector keeps performing better than the overall market (with some exceptions), and one of its top constituents (Broadcom) had an impressive reaction to earnings. I also discuss the topic of “contrarianism” in the market overview.

Without further ado, let’s get on with it.

Articles of the week

I published three articles this week: two earnings digests and one on a general investment topic. The latter, ‘When Money Sleeps,’ discussed dead money and its implications for investors. Many people fear dead money, but it can actually be a source of opportunity for individual investors.

I also published an earnings digest on Intuit, in which I discussed some new information we received this week.

Lastly, I published an article on Adobe’s earnings. The company’s stock fell 13% on Thursday (and a bit more on Friday) because the market fears Adobe will not be able to monetize its AI offerings. I discuss this and the valuation in that article.

Market Overview

The performance of both indices was pretty different this week (just like last week). The Nasdaq rose 0.6% whereas the S&P 500 dropped by a similar amount:

The market continues to favor the technology sector, creating much of this divergence. Broadcom’s (AVGO) results certainly helped because it went up significantly and makes up 1.6% of the SPY but 5.1% of the QQQ. Broadcom is yet another example of market inefficiency (or simply algorithms doing their thing). I honestly don’t follow Broadcom closely (so I don’t really know if it’s justified), but it’s a $1 trillion market cap company that was up 25% after reporting earnings:

The stock has increased by 600% over the last 5 years, so it seems the market did not do a good job pricing this one!

Another topic I’d like to discuss is contrarianism. Many investors consider themselves contrarians (in a good way) when they buy stocks that are going down, which is a bit misleading. First, being contrarian for the sake of being contrarian makes little sense, and it makes even less sense to believe you are superior for it. Any good investment is contrarian to a greater or lesser extent; otherwise, it would not beat the market.

The other thing I’d say is that one can also be contrarian by buying stocks that are going up, not just stocks that are going down. The definition of a “contrarian” is having a different opinion than the market’s consensus (i.e., than the heard), and that can happen when stocks are going up and when they are going down. If a stock is going up, but you believe its future prospects are much better than analysts expect, you can buy that stock and still make good money. To be fair, you can buy a great company even if you think the future will not be much better than what analysts expect and still make good money by riding optionality and better-than-expected execution (but this is a topic for another day).

Averaging up is (very) tough, but it tends to be a profitable decision. I know it’s cherry-picking, but imagine all the dollars that an early investor in Constellation Software would have left on the table by not averaging up through the years.

Don’t get me wrong; one can also be contrarian when a stock is going down if one believes that too much pessimism has been baked into the stock price. This can work, but it’s important to be aware that just because a stock is down it doesn’t mean that future prospects will be better than what the current stock price portrays. Never forget that you can lose 100% of your investment in a stock that’s down 50% already.

Most of the market was red, with some exceptions. Probably the most notable exception (besides Broadcom, as I discussed above) was Google, which the market now defines as an “AI winner” after being an “AI loser” for some time. I remember many people claimed that it was unquestionable that AI would completely destroy Google. The future is still uncertain, but it seems the company is doing just fine.

The fear and greed index remained in neutral territory, which I honestly don’t think is really the case. If I were to guess (I’ll never try to time the market), I’d say the market is closer to extreme greed than it is to fear, we’ll see: