Intuit: Q1 Earnings, a partnership with Amazon, and the Government’s threat

Hi reader,

Intuit reported earnings a while ago (November 21st), but I still thought it would be interesting to write an article about them, not only due to the earnings per se but also due to some more relevant information we got this week. As this earnings article comes a bit “late” and nothing has changed about the investment thesis (good news), it’ll be less detailed than usual.

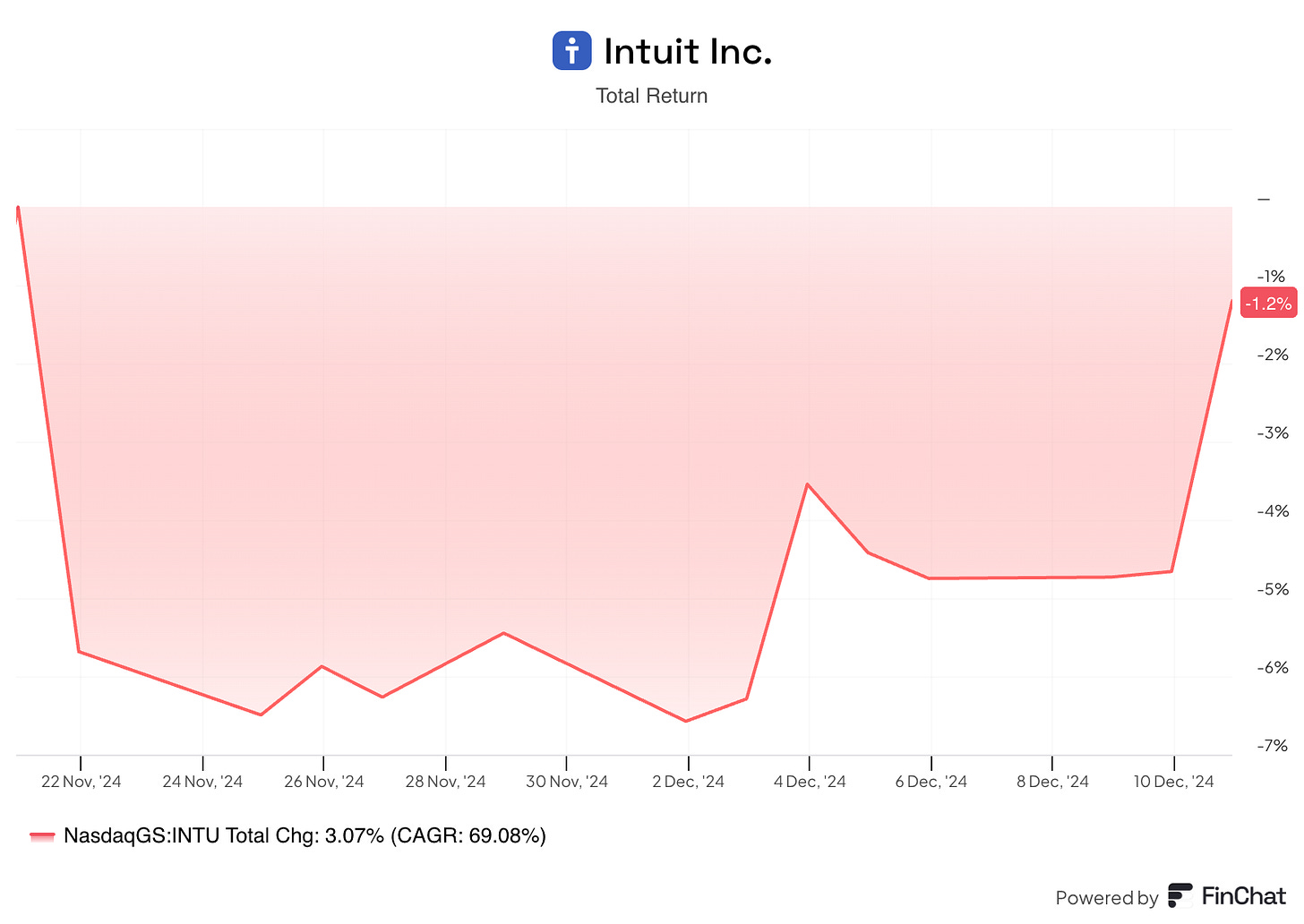

I published an article on Intuit shortly before the company reported earnings, explaining why I was trimming my position. Intuit’s valuation felt stretched considering its expected future growth, so I decided to reduce its weight in my portfolio. In short, it was purely a valuation-based decision. The stock suffered a drop post-earnings, but it has crept higher since, and it’s practically flat:

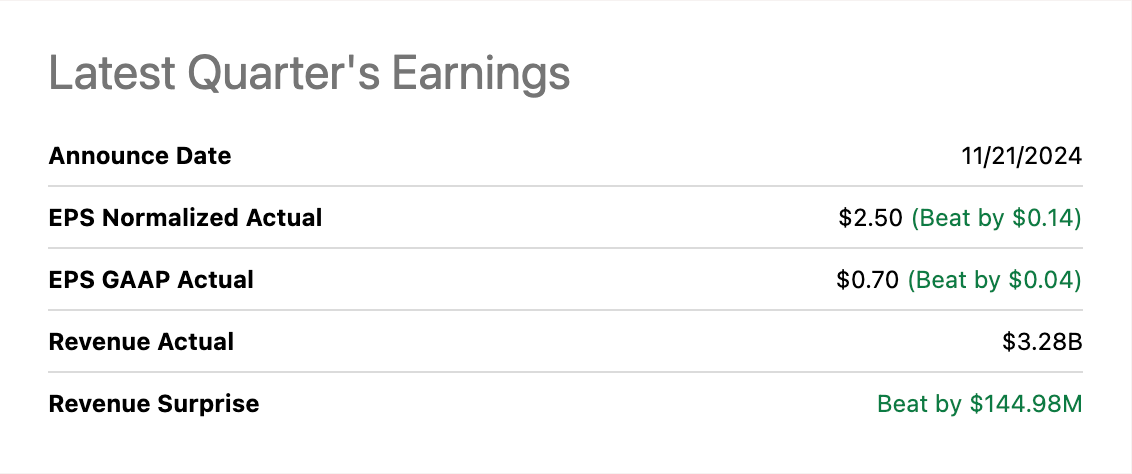

In what pertains to the numbers, Intuit reported yet again good earnings, beating analysts’ top and bottom line estimates:

This should not take us by surprise because Intuit is used to beating estimates. For context, the company has beaten revenue and EPS estimates in 70% and 88% of the past 16 quarters. It’s also a bit unfair to judge Intuit’s beats and/or misses quarterly because, as I’ve repeated in other articles, the company’s consumer group (tax) tends to be volatile and introduces quarterly unexpected volatility into the numbers. The reason is that filers have a relatively extensive period to file their taxes, and Intuit can’t control when they choose to do so. One thing that Intuit knows for sure is that people will eventually file their taxes, meaning that the yearly results will reflect business performance.

Something that also changed regarding quarterly cadence was the timing of its marketing campaign related to Global Business Solutions Group (Quickbooks + Mailchimp):

Last year, the campaigns took us a little longer to come into market. This year, our campaigns were ready earlier, and the team decided to go to market earlier.

Intuit doesn’t manage the business for any given quarter because it makes no sense and because numbers related to the tax season are not entirely under their control. For these reasons, quarterly numbers can be noisy, meaning we shouldn’t focus too much on them even if the market wants to do so.

There were several highlights in the release, let’s start with the mid-market. Quickbooks (and related apps) performed well again, but an increased focus was given to Intuit’s mid-market ventures. Some months ago, Intuit released the Intuit Enterprise Suite to cater to larger customers, and it seems to be doing well thus far: both QBO Advanced and IES grew 42% year over year. Truth is that we don’t know over what base this growth was achieved, but the mid-market is definitely gaining share in the Quickbooks franchise. While the market is skeptical due to this customer base requiring a human sales organization, Intuit believes it will be high-margin and a no-brainer for enterprises….

Current customers are finding it easier and less costly to upgrade to IES than switch to an entirely new platform.

The reason it’ll be high-margin probably comes from the fact that, while it definitely requires higher expenses to bear fruit, ARPU is significantly higher. ARPU for QBO Advanced is around 5x that of the standard QBO, and IES ARPU is multiples that of QBO Advanced (although we don’t have the exact figures because it will probably vary case by case). There were similar margin-compression fears among investors when Intuit launched its virtual expert platform (Turbotax and Quickbooks Live), but management was right in that it would be accretive to margins thanks to higher ARPU.

Pricing is also something that the market is worried about. According to many analysts, Intuit is leaning too much into its price lever in Quickbooks. It technically expects to do so going forward as well, as management expects around half of Quickbooks’ future growth to come from pricing. I believe this is a pretty misguided opinion because it completely ignores the impact the transition to mid-market will have on price/mix (which is not the same as increasing prices outright). Sasan Goodarzi explained this pretty well during a recent conference:

So to your question around price, we're actually the low cost provider with self employed. We're either completely free with like QBO money or we're at a very competitive price. So price doesn't actually play a role in that $40,000,000,000 TAM. We're actually the low cost provider. In the middle segment, which is the small businesses, that's where we actually have a lot of pricing power because the more we get businesses to use our end to end platform, we're actually saving them a ton of money, we're saving them a ton of time and we price for value.

And a lot of pricing that we do, we do a lot of testing. And that's why, by the way, we've shared at Investor Day, our retention is actually up a couple of points compared to the last couple of years because of the value that we create. And then in mid market, we're actually, again, the low cost disruptor. A lot of our ARPC growth comes from the fact that it's not price at all. It's all ARPC growth because the customer is so much larger.

Even on the topic of pure price increases, Intuit believes they still have significant pricing power (which I agree with). If you are self-employed or the owner of an SMB, you’ll know that this type of product typically makes a very low portion of total costs but that it's mission-critical to run your business (and also very tough to change due to the learning curve and fear of screwing something up!) The evidence seems to point out the switching costs here:

We saw low attrition after our price changes.

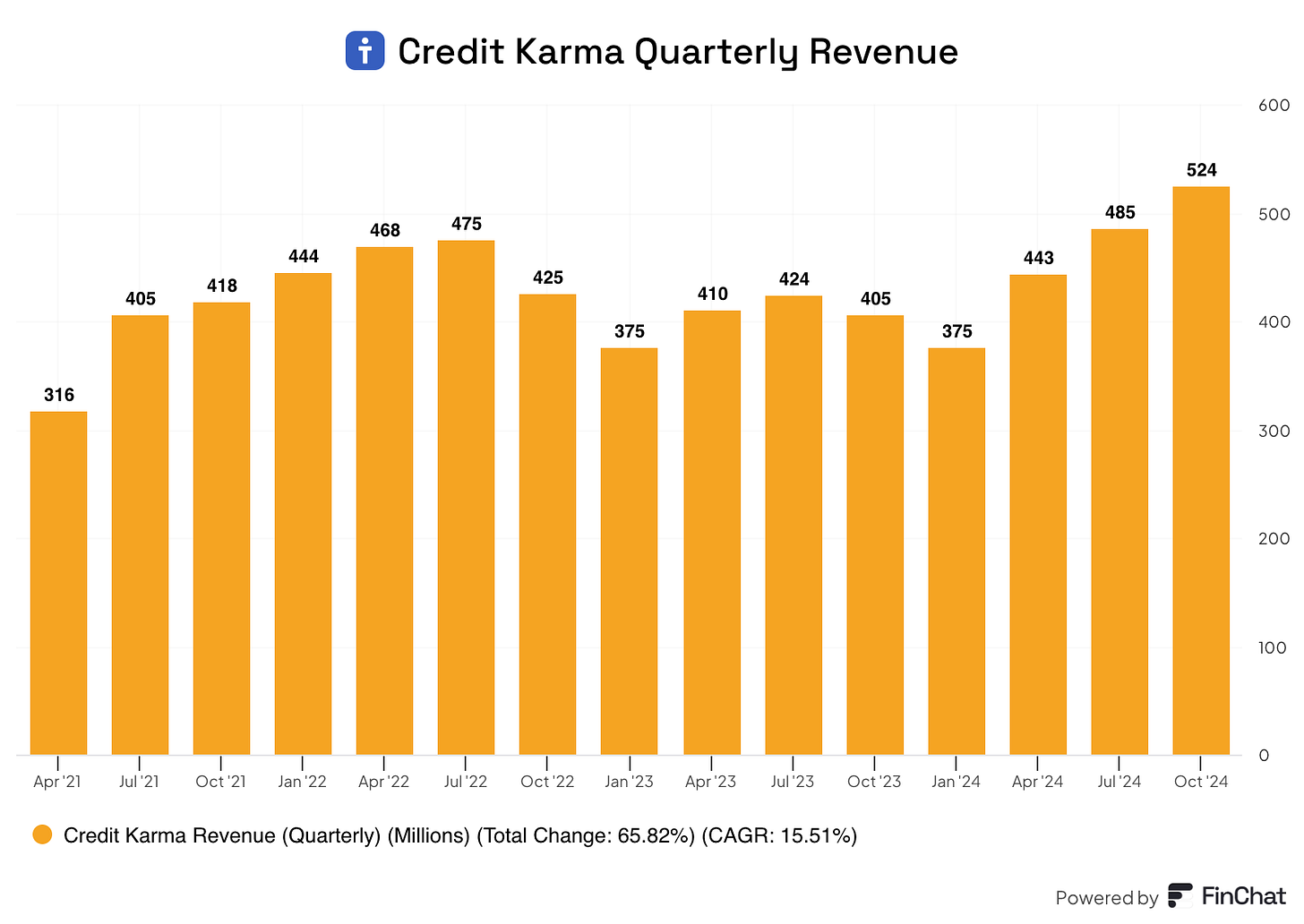

Credit Karma was also a highlight this quarter. Revenue continued accelerating in what management attributed to a 50/50 effort by their execution and the overall macro environment. The turnaround in Credit Karma is real, and management continues to look into ways of combining it with Turbotax:

Intuit’s management has not demonstrated great inorganic capital allocation skills (i.e., M&A), but one thing you can count on when it comes to Intuit is organic execution. Credit Karma is a good example.

But…enough talking about the good side of the earnings release; let’s take a look at the lowlights. No surprises here, the lowlights were the same as for the past few quarters or even years: Mailchimp and international. Both continue to perform below expectations (they are also probably related due to Mailchimp’s international exposure), and management believes it’ll take a while until this sorts itself out…

We are expecting it to take a few quarters to deliver improved outcomes at scale.

Investors have heard this for quite a while, and it’s honestly not difficult to see that Mailchimp was not a great acquisition (put mildly). Intuit also paid a hefty price for Credit Karma, but at least this acquisition is proving itself out despite its cyclicality; Mailchimp can’t say the same.

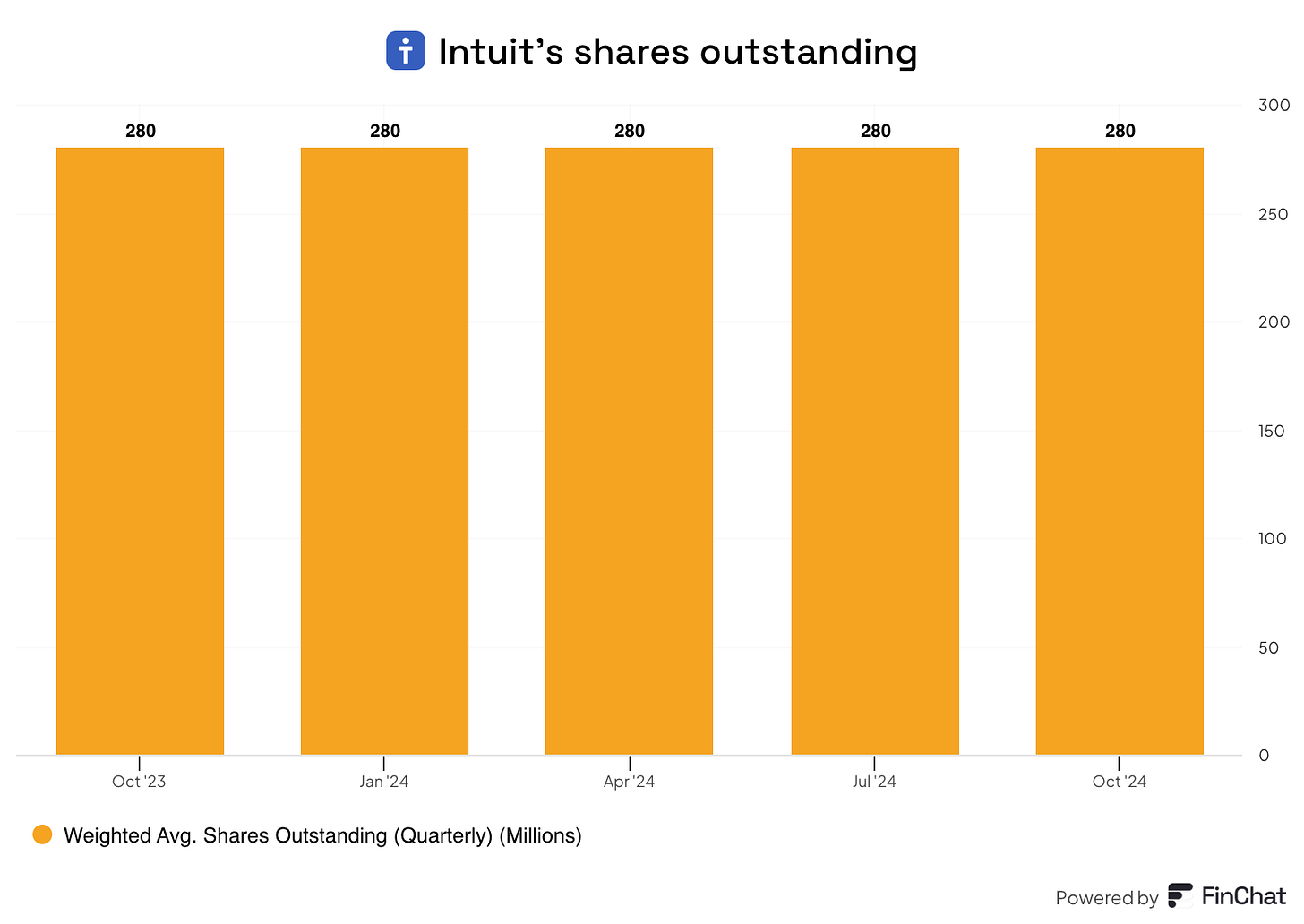

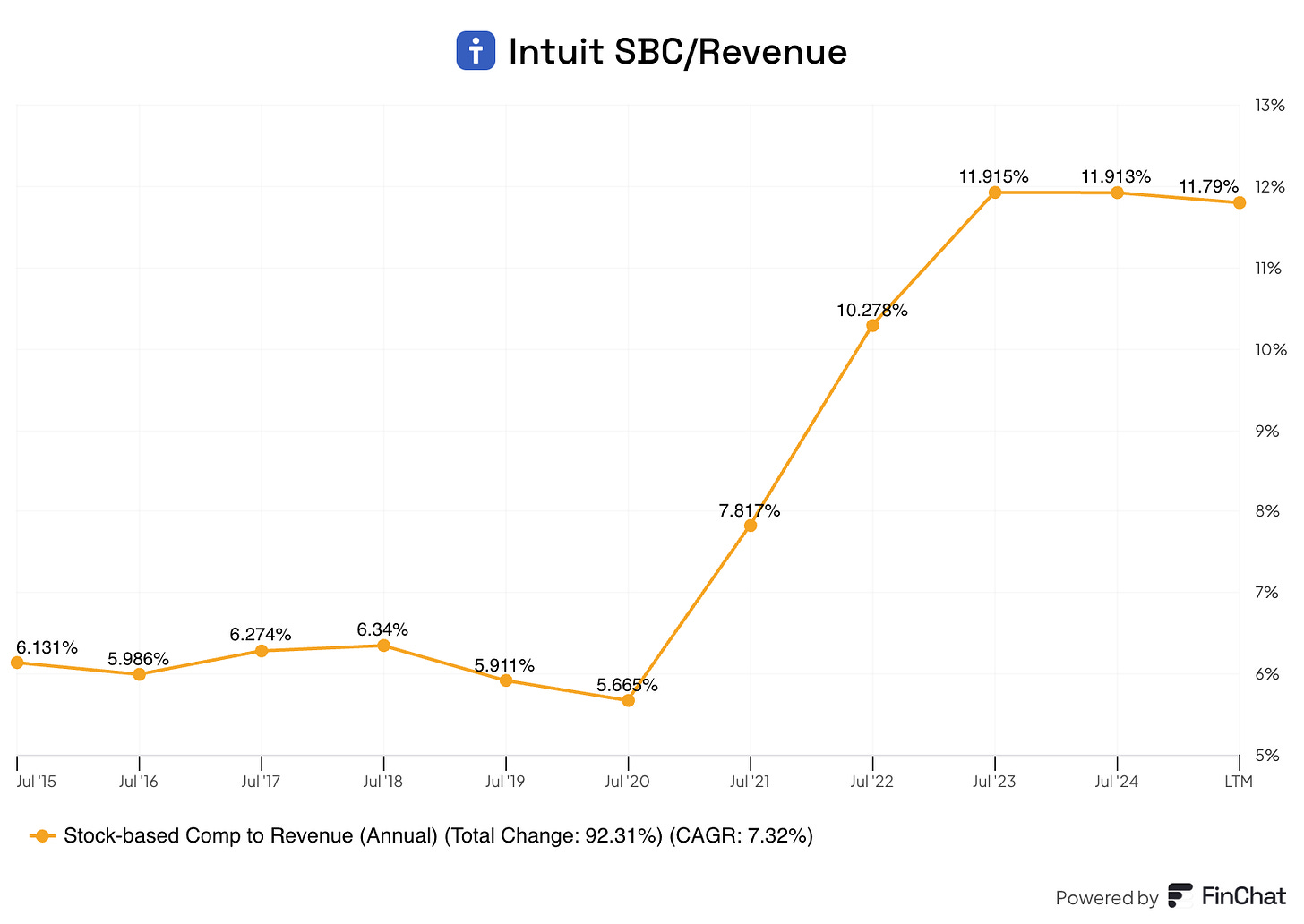

Another thing that came with these acquisitions was significant SBC, which remains at nosebleed levels. Intuit is a good example of why I adjust Free Cash Flow for SBC when assessing valuation. The company has spent $2.9 billion in share repurchases over the last twelve months, and its outstanding shares have not even budged!

These repurchases are not a benefit for shareholders but rather for employees and should be accounted for as such. SBC as a percentage of revenue seems to have peaked and should moderate going forward (albeit it still remains in nosebleed territory). You can clearly tell in the graph below when Intuit started acquiring companies:

There was also good news regarding guidance (in the annual, that is!). Intuit missed Q2 guidance expectations but alluded to the volatility I discussed earlier, claiming that it would not impact yearly numbers. Management reiterated full-year guidance and claimed they’d decide to raise it (or not) in Q3 even if the business is currently performing above expectations. The reason is that Q3 includes the tax season, which brings considerable revenue and earnings for Intuit, so they prefer to wait and see how that plays out (which makes sense).

Looking at past Q3s we can see that Intuit tends to be pretty conservative with guidance. The company has raised its annual guidance in Q3 4 times in the last 4 years. There are also things to be optimistic about this year, especially on the Quickbooks side of things, where management expects a recovery in the SMB environment. This recovery is not baked into guidance:

Our belief, which is not baked into our guidance, is that we will see an improved environment as we look ahead in 2025.

Execution in financial markets not only comes from the reported numbers but also from underpromising and overdelivering (i.e., managing expectations), and Intuit has a track record of doing just that.

Is the new government a threat to Intuit?

Many claim that the new government will threaten Intuit’s tax business because the DOGE (Department of Government Efficiency) has hinted at the development of an app to file taxes. I’ve explained several times throughout my Intuit articles why I don’t see this as a risk, and the reason is two-fold:

There are already free offerings in the market

Intuit’s future is in assisted, a place that the government will have a tough time disrupting (mainly because it’s not in their best interest to help citizens save taxes)

Sasan Goodarzi, Intuit’s CEO, gave a pretty lengthy explanation about why he doesn’t see this as a risk during a recent conference:

Yes, I've gotten this question for 20 years, and I'll be brief in answering it since we're almost out of time, but this is actually really, really important. Free already exists. Every single person in the United States has access to free software. Keith, you could get your do your taxes for free. But the majority of folks don't because they want to delegate the responsibility, the accountability to somebody else.

So another free tax offer, which already exists, the government has 2 versions of free tax offer that's already available, will not structurally change the market. And I'll just remind you that there are 2 formidable players that came to market with free tax offer. One was Credit Karma with 100,000,000 customers before we bought them, no change. When we bought Credit Karma, we sold that tax business to Block Square, no change in the market. Why?

Because structurally, free is available to everyone. So it's just simply not a threat. Plus, when you look at free, it's not something we monetize. So it's not a threat at all. The big future is the assisted market.

He went as far as to mention during the earnings call that he has personally spoken with the new leaders:

I am personally engaged with the new leaders and the new administration coming in. The last thing that sort of is on the minds of the new leaders coming in is adding to the bureaucracy and adding to the investment levels of something that already exists in private industry.

This has been a risk for Intuit for many years, but I don’t think it’s a material risk. By the time the Government ends up offering a credible DIY solution, most of Intuit’s profits will most likely be generated in assisted. Assisted already makes 30% of tax revenue and is growing considerably faster than the DIY business.

Good things tend to happen to good companies

There was some good news this week for Intuit, portraying that good things tend to happen to good companies: Intuit announced a strategic collaboration with Amazon for Quickbooks to be the platform of choice for its sellers. The press release did not give much detail, but Sasan Goodarzi shared some more details in a recent conference:

It will be rolled out progressively: it starts with integrating data and AI so that Amazon sellers can see more information

It also touches the marketing side: it will help sellers market better on the Amazon platform

It will end up being a comprehensive offering: it will eventually span all of Intuit’s services

The best thing about this is that someone would think that Amazon sellers would get a special price from this partnership, but it turns out they will not:

There’s no discounting. Everything is at full price.

Quantifying the opportunity here is pretty tough, although it does seem significant. There are around 1.1 million sellers on Amazon’s platform in the US, some of whom are probably already using QuickBooks. Suppose 30% of these sellers convert to Quickbooks; that’s a potential opportunity for 330,000 additional customers. If these were to choose the standard Quickbooks subscription (which markets for $50/month), then this would result in subscription revenue of $66 million/year. This is not a needle-moving amount for Intuit, but it doesn’t account for additional services (which tend to be the bulk of revenue) and are rough estimates. We’ll have to wait to see how it develops.

This news portrays that good things tend to happen to good companies. The best thing is that many of these things tend to be unpredictable and, therefore, pretty much impossible to consider in a valuation model. Several months ago, Intuit had no Amazon partnership or Enterprise Suite solution, both of which now promise to be significant opportunities for the company. This is why (unless things get completely crazy in terms of valuation) it makes little sense to completely sell out of good businesses.

In the meantime, keep growing!