Adobe’s Tug Of War

Q4 Earnings Digest

Hi reader,

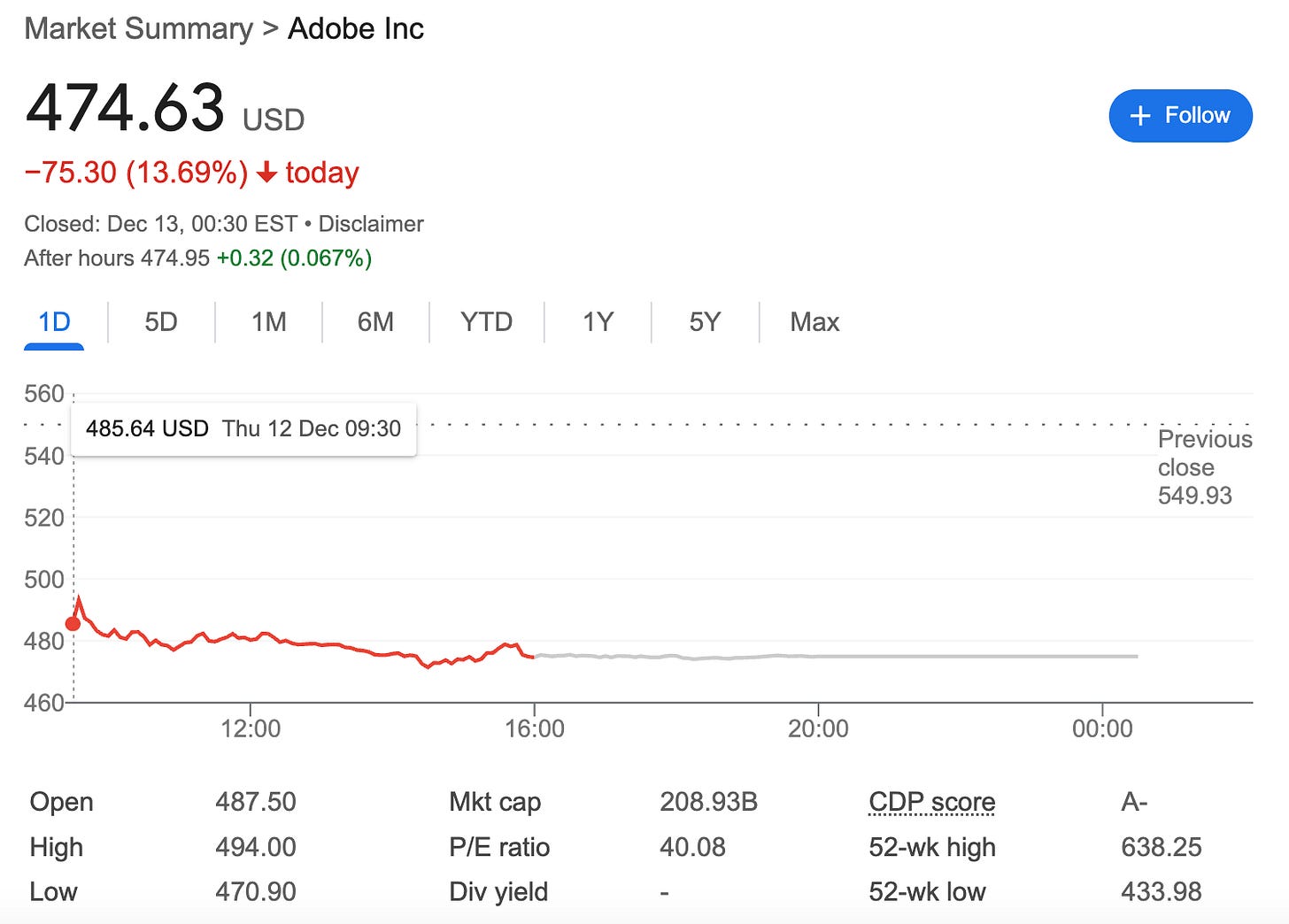

Another quarter…and another selloff for Adobe’s stock due to soft guidance. Adobe had seen its shares trade significantly lower after 3 out of the 4 previous earnings releases, and it was not going to be different this time. The company’s stock sold off significantly the following day:

It’s surprising to see such volatility around earnings events for such a large company (+$200 billion market cap), but I guess this is the price one has to pay when the market is unclear whether Adobe will be an AI winner or an AI loser. The reality is that many investors are growing concerned about Adobe’s monetization strategy around AI, or better said, the lack of such strategy.

Adobe was definitely reactive (rather than proactive) to the AI threat, but it has moved at a pace few expected it to and is developing an integrated suite of AI products. The company’s AI ventures have been successful to date in taming competitive fears and increasing adoption, but not so much in terms of direct monetization.

Most analysts believe this lack of monetization comes from Adobe’s impossibility to monetize these products directly because they’ve been commoditized. The real reason, however, seems to be that management is aware that they’ve been commoditized (let’s not forget that Adobe offers other generative models across its product suite) and prefers to stimulate their adoption across the Adobe suite before milking customers. It’s quite surprising how Adobe's AI risk has gone from…

It’ll disrupt the business due to a differentiated value proposition

To…

Products are commoditized and Adobe will not be able to monetize them going forward

Both are indeed risks, but this narrative change demonstrates how giving an opinion is free, especially when there’s no money on the line. Adobe’s management was always aware that these products would get commoditized (they’ve not hidden it), so the company pursued a different strategy from its peers to differentiate.

Adobe’s earnings

Adobe reported solid numbers in Q4 and FY 24, and it seems reasonable to assume these were not the cause of the post-earnings drop. The company beat analysts top and bottom line estimates: