Why you should be careful with forecasters (NOTW #34)

Best Anchor Stocks has a long-standing partnership with Finchat (I use it for my research) and I would like to share with you this week what I believe to be a game-changing feature: custom metrics.

With custom metrics, users can create their own metrics to better understand the companies they analyze. This is an excellent feature by itself, but what makes it even better is Finchat’s KPIs. The combination of KPIs (which are not found elsewhere) and custom metrics now allows investors to build metrics that not many providers offer. The resulting metrics from custom metrics and KPIs are evidently non-accounting metrics, but if you’ve read the book ‘The End of Accounting’, you’ll understand why they are so useful.

Let me show how custom metrics work using some companies in the portfolio. For example, you might want to know the average revenue per EUV and DUV system for ASML. We know the average price of DUV should be significantly lower than for EUV, but with Finchat’s customer metrics we can now know by how much:

The gap between them is very significant and has been increasing. As high-NA EUV becomes part of the mix, we should expect this gap to increase further.

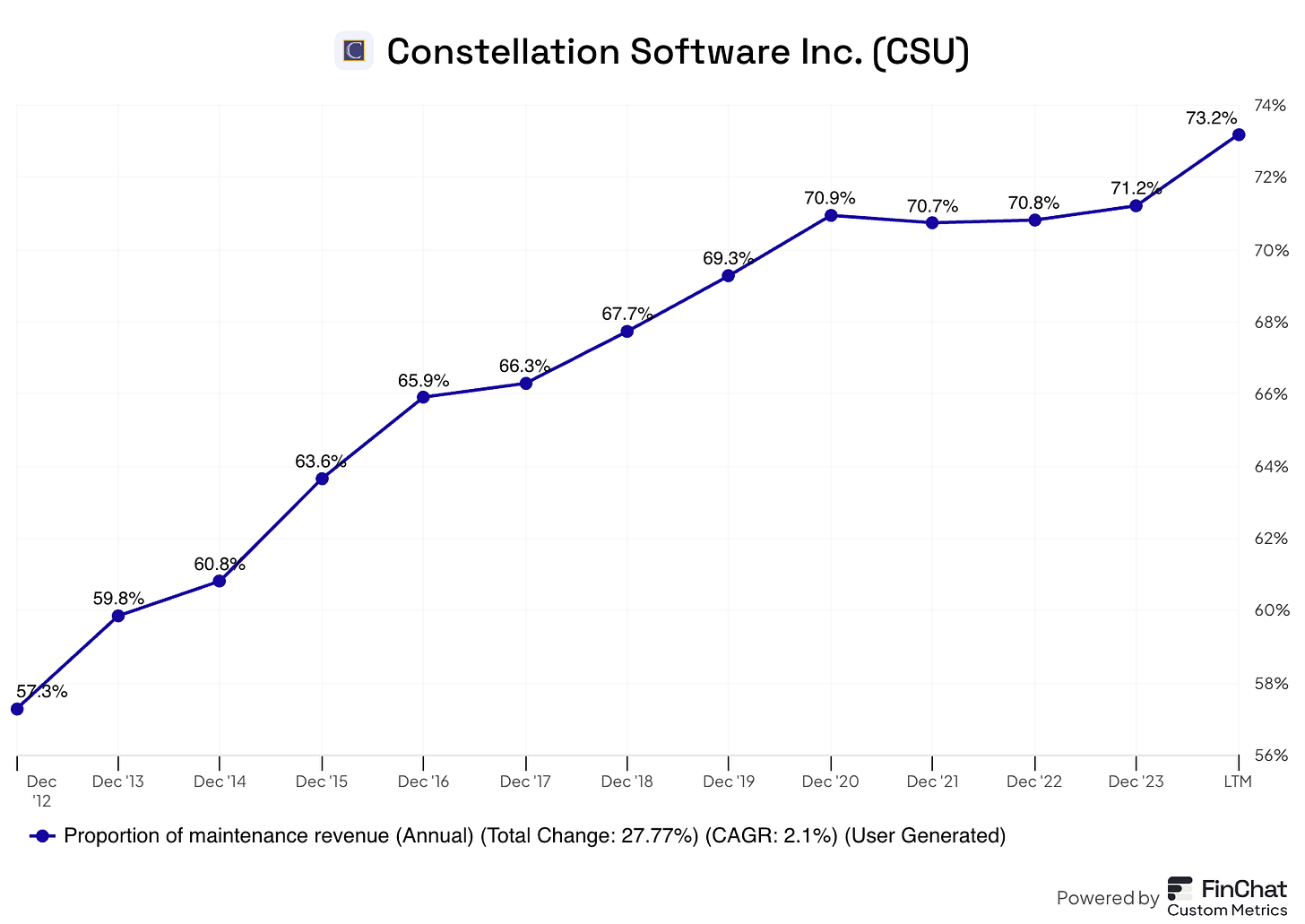

Another interesting custom metric we can build is maintenance revenue as a percentage of total revenue for Constellation. Constellation favors this revenue source over all others because it’s the most recurring. Building the custom metric, we can quickly see that maintenance revenue over total revenue has increased substantially over the past years:

I don’t want to share too many examples here, but you get how this works but I just want to remind you that you can become a Finchat Plus or Pro user at a 15% discount. You just have to use this link to sign up.

Let’s jump right into the News of the Week.

Yet again, geopolitical uncertainty caused a pretty volatile week. Both indices were down despite Friday's recovery and are pretty much flat year to date. It will never cease to surprise me how many people go into “panic mode” when indices are barely 5% off highs, but I think I might have an explanation (discussed in the market commentary).

Without further ado, let’s get on with it.

Articles of the week

I published three articles this week, two earnings digests and one podcast. The week's first article was Copart’s Q2 earnings analysis, in which I discussed the valuation in detail. I believe Copart is an outstanding business, but it’s far from cheap at these prices. The good news is that great companies can grow into apparently rich valuations much faster than we can imagine.

Is Copart's Valuation Justified?

Copart reported another outstanding quarter last week (it seems like I say this in every Copart earnings digest). The stock, however, dropped around 2.8% following the earnings presentation:

The week's second article was the first earnings digest I have ever published for Keysight. The stock dropped significantly after reporting a better-than-expected quarter, which was surprising. I share a valuation exercise to help you understand the current valuation.

Keysight, Much Better than the Drop Would Suggest

Keysight reported its first quarter as a portfolio company this week. Although the market reacted negatively to the company’s earnings (almost a 7% drop), I must say that I believe there were more positives than negatives in the release:

Finally, I also published the transcript of my most recent podcast episode: ‘Quality Where You Least Expect it to w/ Jeremy Kokemor.’ We discussed several topics and dug deeper into companies like NVR (a homebuilder) and Murphy USA (one of the players of the convenience store industry). You can listen to the episode on Spotify:

Or watch it on Youtube:

Paid subscribers also have access to the transcript of this and future episodes.

Although I am not making a promise, I will try to publish a new in-depth report next week. The report is about a high-quality business that is trading significantly off highs. If you want to have access to the full report, feel free to become a paid subscriber of Best Anchor Stocks:

Market Overview

Both indices were down this week, especially the Nasdaq which was down almost 6% at some point:

We continued to experience geopolitical uncertainty this week, with the Trump administration claiming that the EU is next regarding tariffs and the episode we saw in the Oval Office between the Ukrainian President and Trump/JD Vance. I will not comment on what I think about it (I keep my political views to myself), but I’ll only say that it created something the market hates: uncertainty.

What does seem surprising (and something I have discussed on other occasions) is to see so much panic in an environment where the leading indices are barely 5% off all time highs. Don’t forget we have had two consecutive +20% return years, so I’d say that more than surprising, the current drop is normal and healthy.

Many are suffering the drop to a greater extent due to how their portfolios are built. It’s normal to see high-growth companies fall more than the indices, but maybe some people who can’t stand 20% drops should not invest in these companies. I have nothing against high growth, and I believe time has proven that growth is extremely important in generating outstanding long-term returns, but one should know what they are buying before the drop comes. Two years through which making money has been relatively easy don’t do a favor to risk management, and a drop in the market might end up uncovering who has “been swimming naked.”

It’s also surprising to see how quickly people forget. The indices were down significantly in 2022 (barely two years ago), but most have already forgotten that this can happen again! We’ll see how it plays out, but I also believe that focusing too much on the index can be counterproductive if you are investing in individual companies. Sure, no company will be insulated from a broad market drop, but over the long term, what really matters is what one holds in the portfolio, not what the index is doing at any given moment. It’s also funny to see how market pundits continue to make forecasts like these:

I mean it’s fine to make forecasts (investing is a forecasting game to a greater or lesser extent) but why take the forecasters’ opinions as if they own a crystal ball? Let’s not forget that Tom Lee forecasted in 2021 a record 2022, warning that “big gains would not come until the second half” (link). What ended up happening is that the S&P 500 was down 19% and the Nasdaq was down more than 30% in 2022. One thing I’ll give Tom Lee: being a permabull forecaster significantly increases the probability that he does well over the long term (the permabear can’t say the same!).

The industry map portrayed the differential in the S&P 500 and the Nasdaq performance this week. Most tech-related industries were significantly red, whereas all other industries were pretty much green:

As discussed earlier, the fear and greed index dropped to extreme fear:

This is all for this week, the remaining sections where I discuss the news for the companies in my portfolio, my transactions, and more.