Is Copart's Valuation Justified?

Q2 Earnings Digest

Copart reported another outstanding quarter last week (it seems like I say this in every Copart earnings digest). The stock, however, dropped around 2.8% following the earnings presentation:

If we zoom out, we can see that after experiencing a strong recovery in 2023 (Copart was up 61%), the stock has significantly lagged the indices in 2024/2025. The stock is currently around 11% off all-time highs, so nothing alarming:

One reason for the lag might be that the company’s valuation probably ran ahead of its fundamentals in the 2023/2024 period. The stock might simply be taking a well-deserved breather after a period of strong returns (remember that stock market returns rarely come linearly). While a drop in the stock price could’ve been another way of “correcting” this high valuation, the market seems to be allowing Copart to grow into it.

The objective of this article is twofold. First, I will discuss the earnings, and then I will conclude by discussing the current valuation. The first part of the article is free to read, whereas the second is reserved for paid subscribers.

Copart’s earnings

Here’s the summary table for Copart:

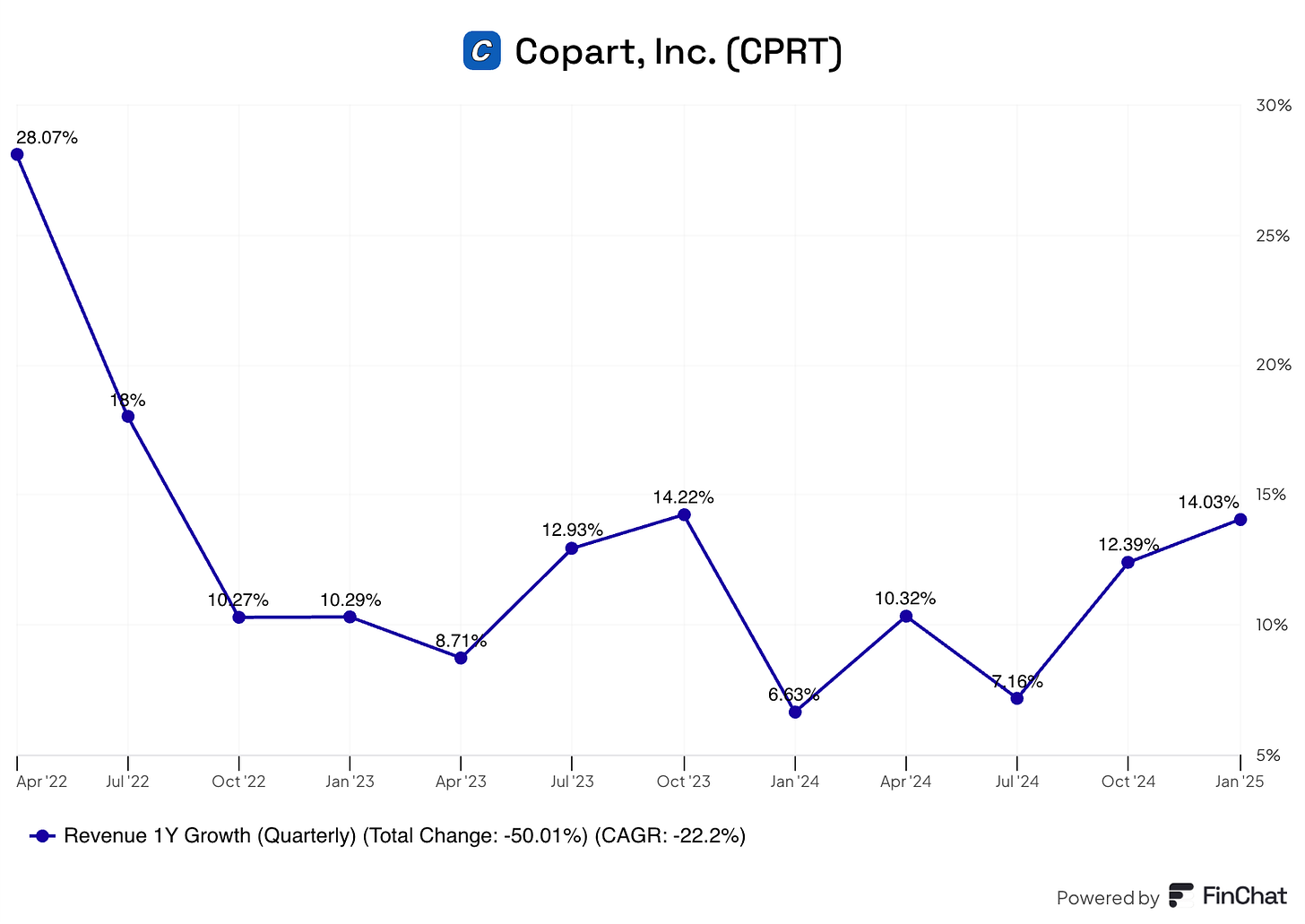

The first thing I believe is worth highlighting is revenue growth. Copart continues to grow at a pace that few expected it to (myself included). If you were to go back in time to 2017 when Copart was growing at a 14% clip and were asked to forecast the growth in 2025… it’s improbable you would’ve arrived at the 14% figure Copart reported in Q2. This doesn’t mean that your decision-making process was wrong, just that high-quality companies tend to be more durable than the laws of capitalism give them credit for. Companies like Copart are exceptions, and while one can look for these kinds of businesses, when valuing a business it’s probably better to assume that the laws of capitalism might show themselves at some point.

It was Copart’s second consecutive quarter of revenue acceleration:

The fact that it was a busy storm season and that the company enjoyed somewhat easy comps helped, but this doesn’t de-merit Copart. Something I believe the market might be starting to give Copart credit for (through a higher multiple) is that the company is increasingly “derisking” from an autonomous point of view. The reason is that non-insurance revenue continues to outpace insurance revenue (albeit we don’t know the current proportion of insurance and non-insurance revenue). BluCar revenue grew 27% this quarter, and Purple Wave grew 8% (over the last twelve months) amid industry challenges.

It seems pretty clear that when autonomous eventually arrives (I think it will take quite a while to impact Copart), a smaller proportion of Copart’s profits will be exposed to accidents. So long as these non-insurance sources continue to creep higher, autonomous becomes less of a terminal risk question for Copart (albeit remaining one).

Copart doesn’t disclose how much volume is coming from non-insurance sources, but management did disclose insurance volume growth and mentioned that non-insurance unit volume outpaced insurance volume growth, excluding CAT units. Insurance volume grew 8% in the quarter, but excluding CAT units, volume growth was closer to 4%. This implies that non-insurance volumes grew somewhere between 4% and 8% during the quarter. I look forward to the non-insurance business becoming significant enough to be disclosed separately!

That said, there’s no denying that Copart will always be exposed to accidents (to a greater or lesser extent). The trend in the total loss ratio, however, also isolates the company from the risk of fewer accidents. The total loss ratio hit an all-time high this quarter at 23.8% (temporarily impacted by CAT units), a trend that not only creates more volume for Copart but also significantly improves the quality of its inventory:

This transition to a higher-quality fleet is why the Manheim Used Vehicle Index and Copart’s ASPs are not good comps. Copart remains in the sweet spot where it’s getting higher volumes and of higher quality (which it can later sell at a significantly higher price). This is evident in the fact that ASPs remain relatively resilient in the face of increasing volumes, which was not historically the case.

This trend of newer cars getting totaled also allows Copart to cater to non-insurance buyers through insurance volumes. This makes Copart less reliant on non-insurance volumes to increase liquidity for non-insurance buyers, and management believes the company is still very early in the opportunity here.

Margins are another interesting point of discussion. Copart’s gross and operating margins contracted during the quarter and the first 6 months of the year. The main reason is that Copart continues to invest ahead of demand. In another masterclass of long-term thinking, Jeff Liaw explained how Copart manages its margins:

I wouldn’t take a temporary margin contraction as a warning sign, as I believe Copart has many levers to increase its margins over the long term. One of these is the international business “closing the gap” with the domestic business. As discussed in other articles, Copart pursues a slightly different model in many international geographies to convince its customers that the consignment model is the better model for all stakeholders. The consignment model is not only more profitable for Copart but also carries less inventory risk. We are already seeing early signs of this transition playing out. Management discussed Germany’s example:

This is also starting to show itself in the margins. International gross margins have roughly expanded 400 basis points since 2020 (although I’d say this metric is somewhat misleading because it’s heavily dependent on mix and the rate of investment in new geographies). I don’t know if international will ever make it to domestic gross margins of around 50%, but if it ever does get close to these, that means that gross margin expansion is far from over at Copart. Global gross margins are in the 45% area, so if international ever reaches domestic profitability as the model transitions to consignment (and assuming no margin expansion in the domestic market), global gross profit margins can potentially expand 500 basis points on this transition alone. Management believes that the transition to the consignment model is inevitable.

Net income margins did increase substantially during the quarter but for non-operating reasons, namely taxes and interest income. Taxes were lower this quarter and seem to be at a non-sustainable level. The effective tax rate this quarter was the lowest it has been since Q2 2022 when it also proved to be temporary. Growing interest income is nice, but it is dependent on interest rates, which neither management nor investors control. Copart ended the quarter with $3.8 billion in cash and no debt, which not only helps the company remain durable but also protects its profits from a rise in interest rates.

Something that I believe is worth double-clicking on is cash conversion. Copart’s cash flows have improved markedly in Q2 and over the first 6 months of its fiscal year. The reason was improved cash conversion, and while there are many moving parts to explain this improvement in cash flows I want to focus on the opportunity that Copart has to grow faster and in a more profitable manner (regarding cash flows) by solving its customers’ problems.

Copart has embarked on a trip to help insurance companies turn their salvage vehicles faster. The company has undertaken several initiatives to do this, like Title Express and AI-enabled image recognition tools. The ultimate goal of these tools is to help insurers make a decision faster and, once they’ve made this decision, help sell these cars faster. Both play in Copart’s and the insurers’ favor.

Copart benefits from more volume and faster cycle times. The faster Copart can auction a car, the less time it spends on its land and the less land the company needs to sell the same number of cars (i.e., it increases land efficiency). For insurers, a faster process also translates into significant economic gains because the less time money is tied to a salvaged car, the better. It’s basically a win-win.

Title Express is growing fast, and insurers are not looking back:

Bureaucracy and regulation are definitely bottlenecks in this process, but the more of the process that Copart manages to vertically integrate, the better it will be for its business in the long term. In short, it’s in Copart’s hands to make the process more efficient and better for every stakeholder. This is something that probably flies under the radar for Copart. The total loss ratio is not only rising due to macro trends (i.e., more technology in cars), it’s also rising due to micro trends as Copart makes the process much more efficient and therefore makes totaling a car the economically preferable option. The impacts are not yet recognizable in the numbers, but there’s no denying that the opportunity is there.

Some words on tariffs

It seems like we’ve gone from the buzzword being “AI” to the buzzword being “tariffs.” Every management team is talking about them, and Copart was no different. Management succinctly presented how its business is exposed to tariffs, and despite there being many moving parts, tariffs are overall neutral for Copart’s business. These are some of the moving parts…

Inbound tariffs increase repair costs and, therefore, increase the total loss ratio (good)

Inbound tariffs would also increase PAV (pre-accident values) and, therefore, would offset some of the increase in the total loss ratio that comes from increasing repair costs (bad)

Higher PAVs would also increase the prices of the cars that Copart sells at auction, so the company would make more fees from its auction (good)

On retaliatory tariffs, Copart believes that the countries that buy these cars don’t have strong automotive industries and therefore won’t implement retaliatory tariffs

Overall, tariffs seem like a nothing-burger for Copart.

Taking a look at Copart’s valuation

As usual, I’ll use a 10-year inverse DCF to understand what’s baked into the current valuation. I'll then work on a model to determine how realistic the inverse DCF's outputs are. This is the two-step process I typically follow.