The Revival of Healthcare (Jinxed It!), What Sora 2 means for Adobe, and more (NOTW#62)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Markets were up again this week, with one notable highlight: healthcare stocks rose significantly. I discuss this in the market commentary and share several relevant news for portfolio companies.

Without further ado, let’s get on with it.

Articles of the week

I published two articles this week. The first one was an in-depth report of the position I have just added to my portfolio. I explain all that there’s to know about the company:

History

What it does

Financials and growth drivers

Competition and moat

Management and incentives, capital allocation, and valuation

Reasons why the stock might be cheap

The second article of the week was my view on ASML’s current valuation after the run. I gave some context, explained why I am now open to trimming, and also shared the price at which I will trim my position.

I will trim ASML when it gets to this price

The last time I wrote about ASML (‘ASML’s China Risk’), the stock was trading at roughly €647. Pop up a chart of ASML’s stock today, and you might be surprised to see it trading just under €900. A +40% jump in just under a month

Without further ado, let’s see what the markets did this week.

Market Overview

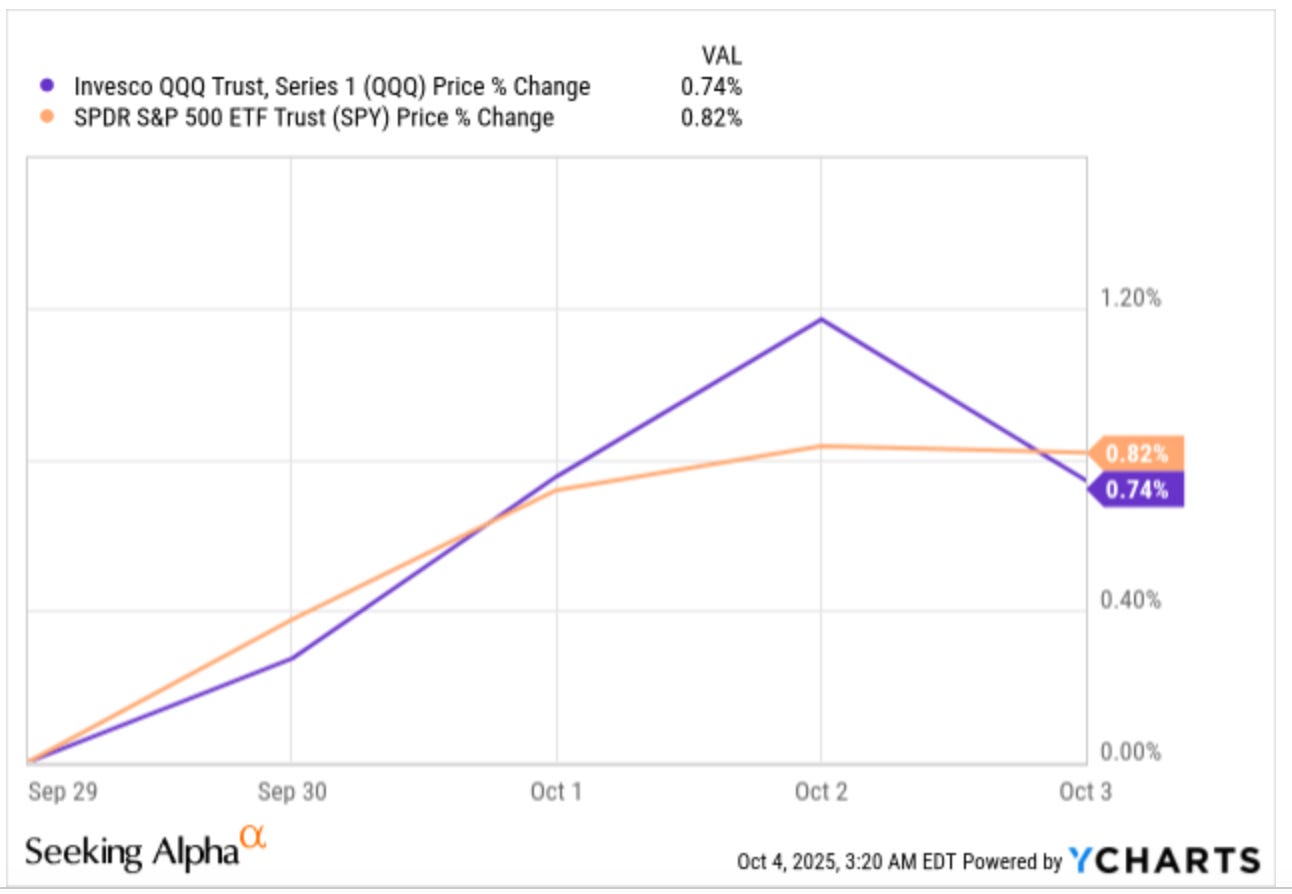

What I am about to tell you might not surprise you much but…both indices were up again this week!

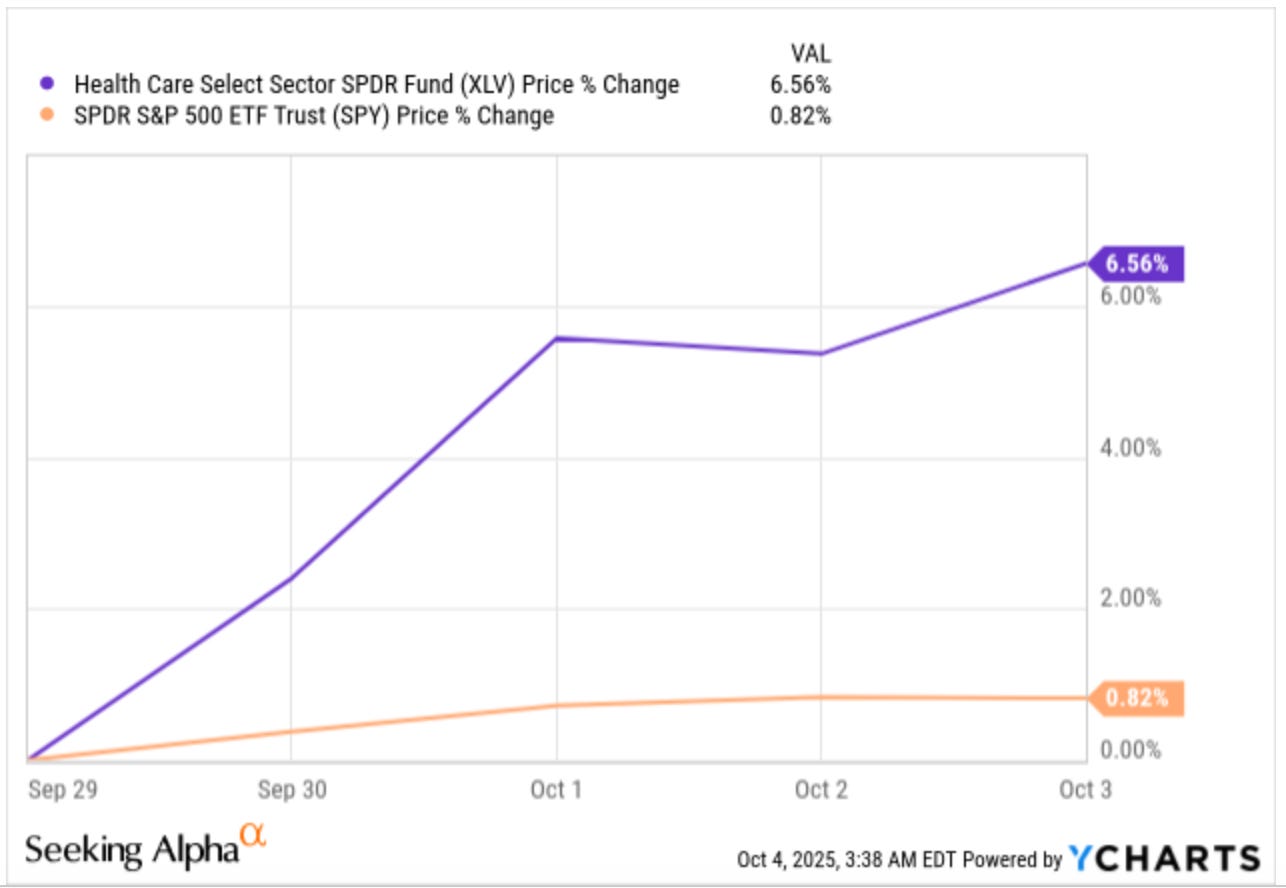

Just like last week, I don’t think there’s much to comment on. One thing that I thought might be interesting to discuss is the “revival” of healthcare (I might have just jinxed it by saying it, I did last time!). As you may be aware, healthcare has been relatively weak over the past two years due to the post-pandemic destocking headwind. The industry was a massive beneficiary of the pandemic, but most management teams overlooked the fact that they were not only benefiting from direct COVID sales but also from a massive stocking that was occurring as customers double-ordered to avoid facing supply crunches. It’s honestly eye-opening to go back and read several earnings calls to see how everyone was missing it (I would include myself here, at least in terms of the duration of the destocking).

Anyways, you already know how markets work: they overshoot to the upside, and the overshoot to the downside. Healthcare might have experienced both situations over the past 5 years, and I think it might have overshot to the downside quite significantly. I mean, the cycle is already recovering, many of these businesses are very defensible, and they will probably grow their bottom lines at a HSD/LDD clip, so it’s just a matter of when they are in favor again. “When” is the key consideration here, and you can take one of two routes. You either…

Buy and wait

Try to time the inflection

If you’ve read my work before you know that I am not a fan of #2, not because it’s not profitable (it is) but because it’s very tough to get it right (who thought ASML would be up 40% in a month?!). This is why I buy and wait (although being too early can cost a lot of money so it’s also something to have in mind). The XLV (a healthcare ETF) significantly outpaced the indices this week:

I don’t know if this is a fake breakout or not, but if it is, I will probably increase my exposure to healthcare in the coming weeks/months. I currently own three healthcare stocks (all of them picks and shovels), which make up 20% of my portfolio. Two have worked great (one I even had to trim because it was giving me vertigo), whereas another one has lagged the indices significantly. One interesting thing to note is that the healthcare sector “just” makes up around 14-15% of the S&P 500, meaning that if we see a healthcare rally, then portfolios that are more heavily exposed to healthcare should do better (all else equal). As you can see, mine is just slightly over indexed to healthcare (it’s pretty diversified).

By the way, last time I said that healthcare was breaking out, it was a false breakout, just fyi! Note that healthcare also appears to be a great asymmetric bet on AI, which is not easy to find nowadays due to the prevailing uncertainty. I wrote about this topic here.

The industry map was somewhat mixed this week, but you can clearly see what I discussed about healthcare:

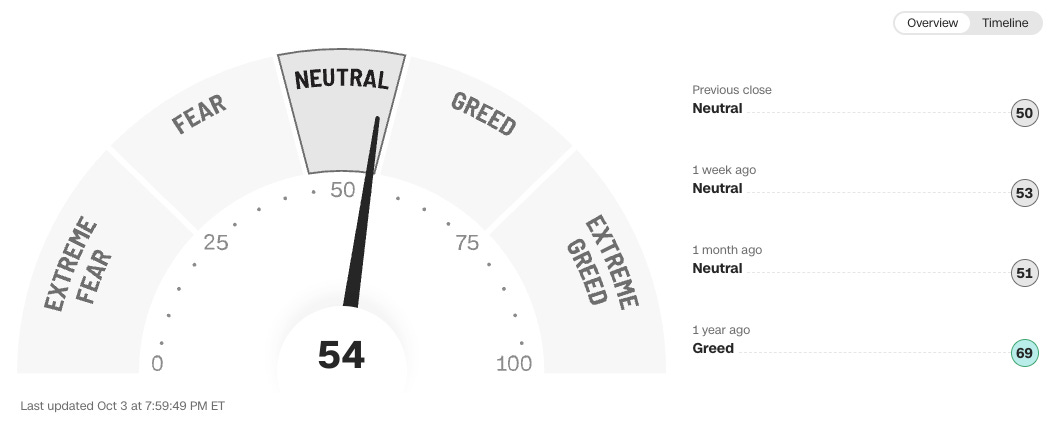

The fear and greed index remained in neutral territory:

The rest of the content where I share my transactions and company-specific news is reserved for paid subscribers.

A new position, adding to an existing position, and a trim

This week, I added a new position to the portfolio (you can read the in-depth report here), added to an existing position, and also trimmed one of my positions: