Becoming the farm's operating system

Deere's Q2

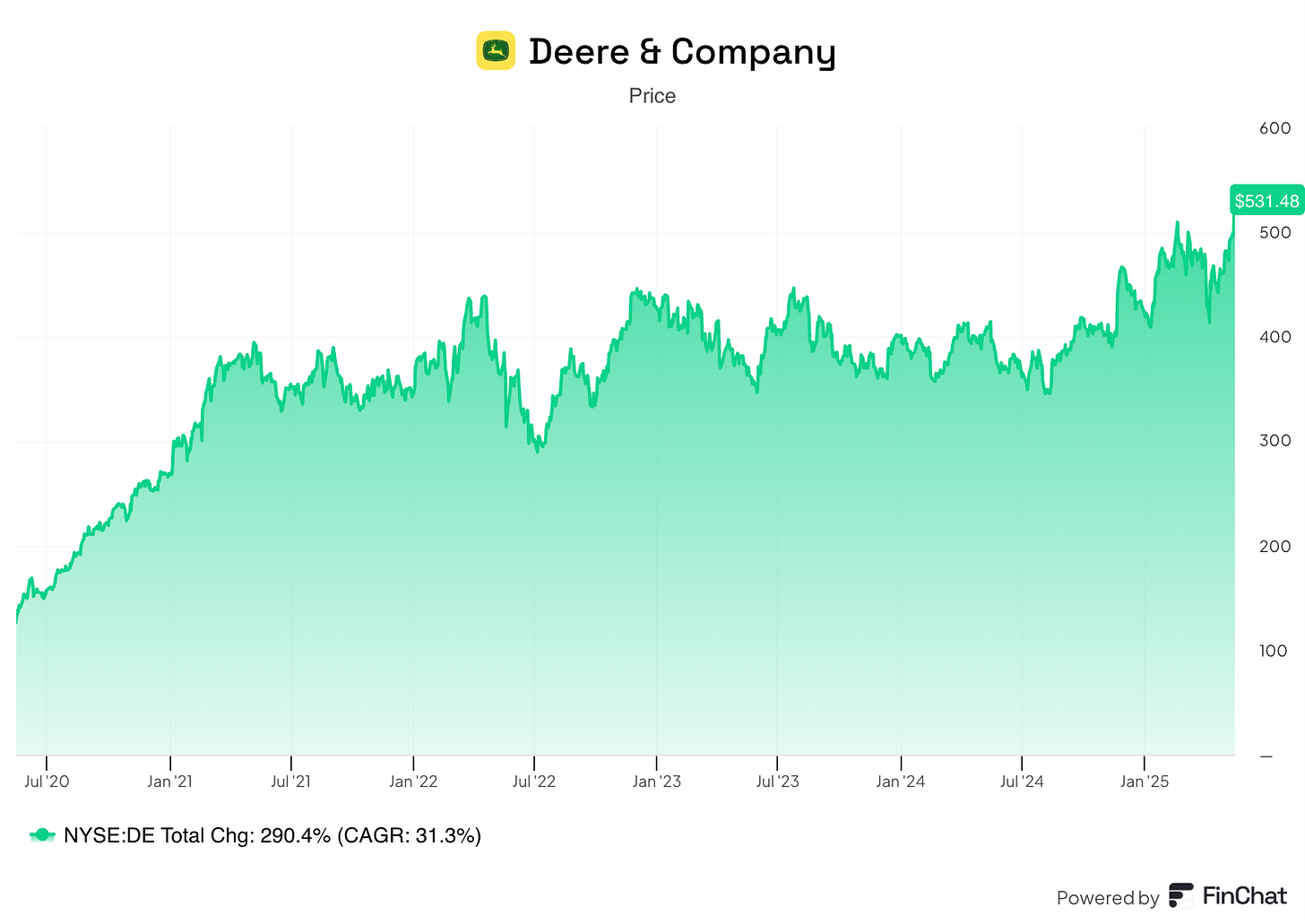

Deere reported great earnings last week, and the market recognized these as such despite the slightly lowered guidance. The stock is now solidly above $500 and has breached a new all-time high:

The best thing is that Deere’s stock does not seem expensive despite setting a new ATH. I don’t plan on making this article very long (it’s more of a recollection of my notes from the quarter), but I do want to discuss three things:

The numbers

The highlights from the call

A valuation update

If this is your first time reading about Deere, don’t forget you can access my free in-depth report here.

Let’s start with the numbers.

The numbers

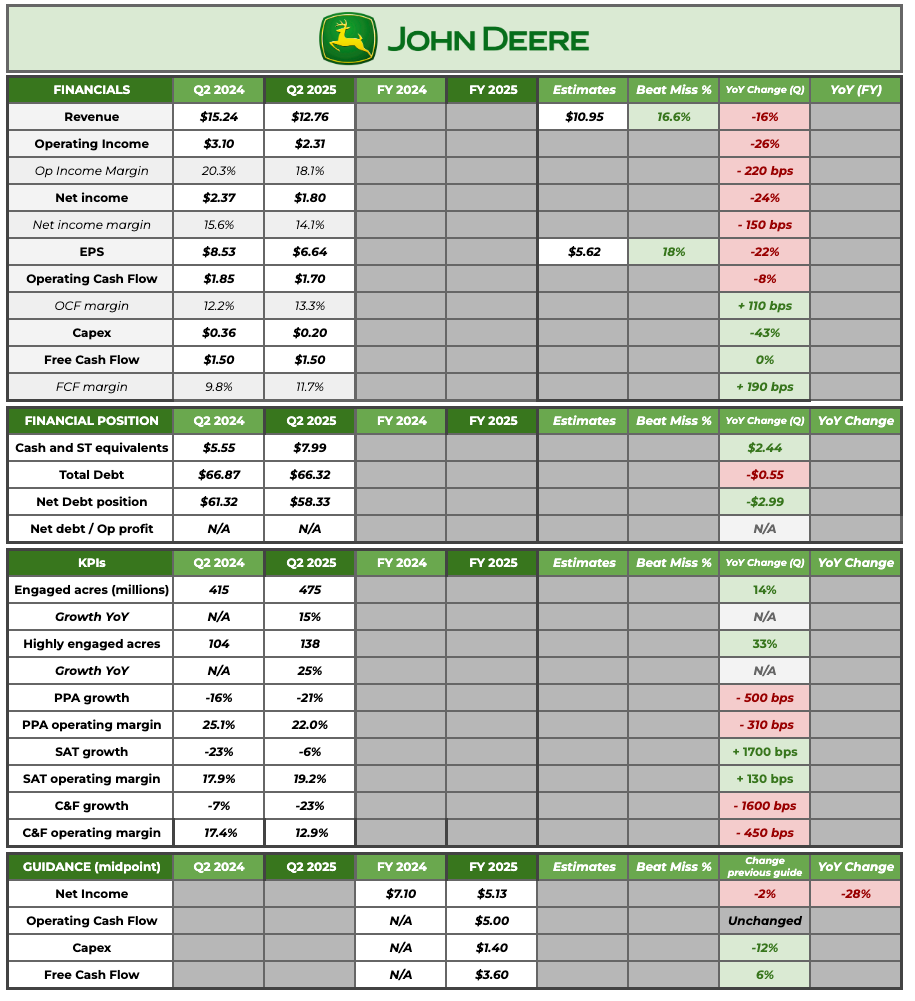

Here is Deere’s summary table:

The first thing to point out is the beat. Deere beat both revenue and EPS by double digits. The trend in EPS beats is interesting and portrays how the Deere thesis is unfolding. Even though Deere is inherently a cyclical and unpredictable company, profitability beats have been the norm over the past couple of quarters: Deere has beaten EPS expectations 9/10 quarters since FQ1 2023. The magnitude of the beats/misses also tells its own story. The only EPS miss occurred last quarter, and it was a mere 2% miss. On the contrary, EPS beats have averaged 16%! This, in my opinion, portrays that the market has not yet adjusted to Deere’s structurally higher profitability.

Margins were a very positive surprise this quarter. Deere posted an 18% operating margin this quarter despite being at or around the cycle's trough. For context, this quarter’s operating margin is only 200 bps below Q2 2024, when sales were 19% higher. Management’s target operating margin for the full year (14.5%) remains unchanged despite a significantly higher margin for the first two quarters. Analysts were puzzled by this conservatism as it would imply 80% decrementals in the year's second half vs. 30% for the first half. Management argued that tariffs will most likely have an outsized impact on margins during the second half and would translate into significantly weaker margins in H2. While I’ll discuss tariffs later, this simply demonstrates that Deere’s margin forecasts at the start of the fiscal year (pre-tariffs) were arguably extremely conservative!

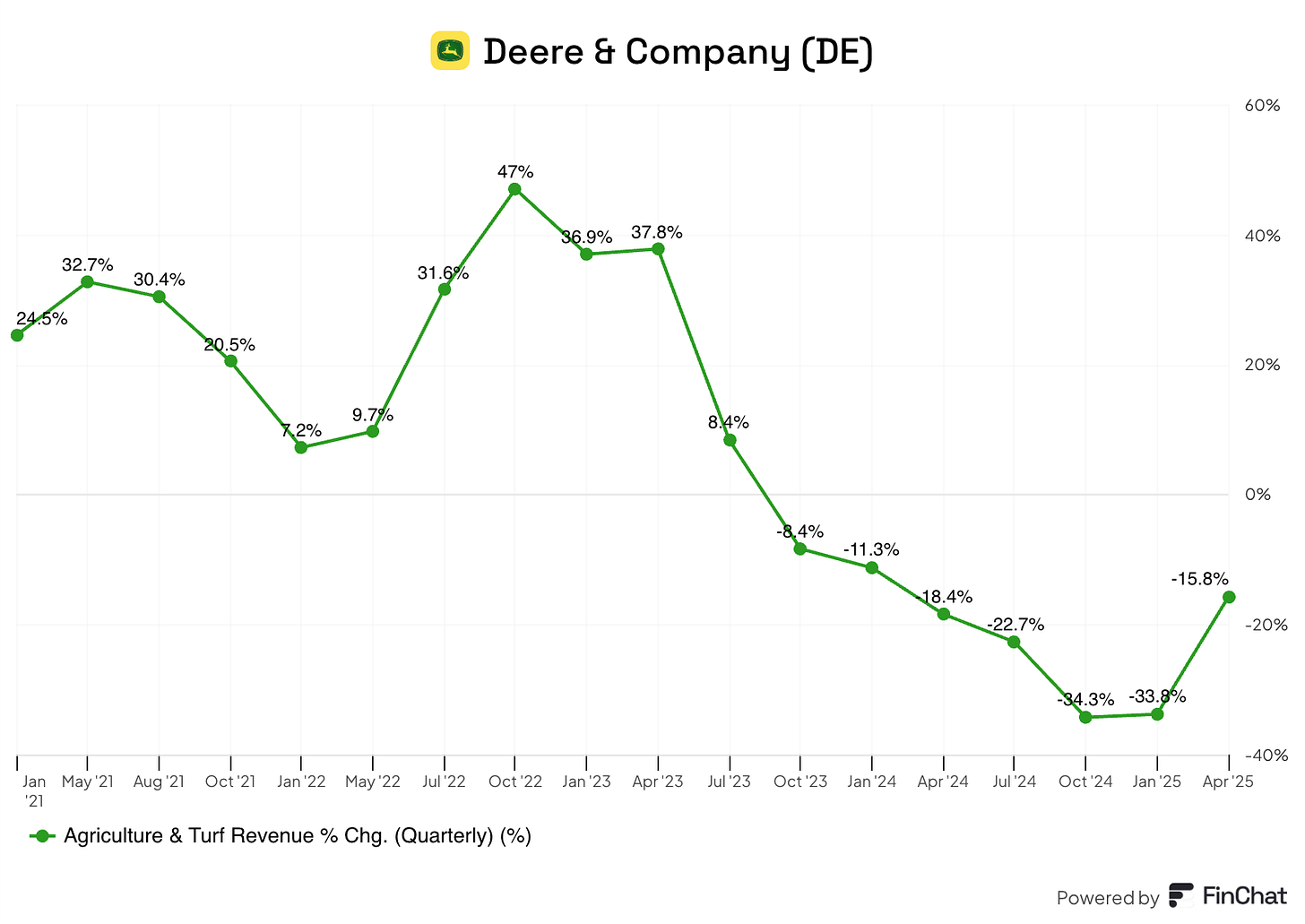

It’s also worth discussing the state of the current cycle. There are not many changes in this front: Deere’s sales continue to decline but the rate of decline is moderating and management still expects Q4 to be a positive growth quarter (would be the first one in the last 9 quarters):

Management mentioned some things that could unlock the farm cycle, namely, a Farm bill and the announcement of several trade deals. The farm bill is already an ongoing discussion in Congress, and trade deals will likely be announced in the coming weeks/months. I don’t invest in Deere expecting a cycle inflection tomorrow, but I obviously welcome it. It does seem that the trough is already behind us, and we are getting closer to the inflection (the stock seems to be anticipating this inflection to an extent).

Deere continues to generate significant cash flows as it manages its inventory tightly, allowing management to continue repurchasing shares. Over the last year, Deere has repurchased $2.4 billion worth of shares while improving its financial position:

These share repurchases add up over time. Deere’s outstanding shares are already 4% lower than at peak revenues (2023). This means that Deere will benefit from three significant EPS drivers in the next upcycle:

Revenue growth

Higher margins

Fewer shares outstanding

All in all, an excellent quarter quantitatively speaking for Deere. Both sales and margins were stronger than anticipated, and the cycle inflection continues to be within reach.

The highlights from the call

There were several interesting highlights during the call. I have divided them into three buckets: Tariffs, Technology, and South America. Let’s start with the topic du jour: tariffs (I believe I have discussed tariffs in ALL earnings digests thus far). Deere is a manufacturing business that is not immune to tariffs. In last quarter’s earnings call, management claimed that most products sold in the US are assembled in the US and that exposure to component sourcing from Mexico and Canada is limited. This was back when only Mexico and Canada seemed to be in the spotlight. With tariffs now being rolled out worldwide, the impact is more significant. Deere suffered a $100 million tariff headwind in Q2 and expects the full year impact to be around $500 million (so $400 million to go).

Interestingly, most of this impact accrues to the construction segment because most of Wirtgen's equipment is manufactured in Germany. Management did mention they are doing several things to offset the impact of tariffs, but that prices are unlikely to be one. The reason is twofold:

They want to be careful with pricing after the price hikes the industry experienced during the pandemic. Note that this is, in my opinion, what many people got wrong about the cycle: it was not driven as much by units but by significant price taking due to inflation. Units, not price, determine cycles in the industry.

The order book for the year is pretty much full, and they want to honor their committed prices (i.e., prices might increase next year, but not this one)

Management also tried to appeal to the Trump administration and the American farmer by committing to ongoing investments in the US:

We are prepared to invest $20 billion in the US over the next decade as we spearhead new product development, cutting-edge technologies, and more advanced manufacturing.

They also mentioned that the current volatile environment might benefit Deere. Agriculture is one of the industries first impacted by tariffs, and (according to management), this volatility has led to less financing from banks into the ag sector. This means that Deere’s in-house financial segment might have become a competitive advantage by making its products comparatively cheaper than those financed with external sources (financing costs are significant for farmers).

The second topic to highlight was technology. There are a couple of things to touch on here. First, Deere confirmed the synergies between its ag and construction segments. Management announced the launch of the John Deere Operations Center for road building and claimed that the ag tech stack is ready to be applied in road building due to its similarities with agriculture:

Given the significant similarities between large ag and road building in terms of repeatable jobs and price execution to define specifications, we can extend the John Deere tech stack to Wirtgen equipment.

Management also explained how they view their technology stack. They do so through three areas: capabilities, adoption, and utilization. Capabilities are the building blocks that enable Deere’s technology stack. On adoption, there were several interesting highlights:

There have been 10,000 orders globally YTD for Precision Essentials (with Brazil accounting for 35% of said orders)

Renewals are starting to come in. Management targets a 70% renewal rate, and they have already renewed two-thirds of the machines so far

Utilization also brought highlights:

We’re seeing greater utilization on the same machines in the 2025 season, and those same customers have invested in more Sea and Spray units this year.

As shown in the table above, both engaged and highly engaged acres continued to grow at a good pace

The “success algorithm” (I came up with this term) is pretty straightforward here. The tech stack seems to be there, so Deere has to roll it out to as many farmers as possible and ensure that these find value and use it more every year. Note that if technology gets adopted en masse in the industry, it’ll arguably start a network effect. Farmers sell a commoditized product, so the focus should be on costs. In short, farmers not using technology in a technology-driven industry will most likely get priced out of the market.

Management then categorized their SaaS offerings into three buckets: precision digital technologies, sense and ag technologies (usage-based), and autonomy. Management is still targeting February to have a fully autonomous corn production system, and they claimed that these offerings will most likely come bundled in the future. Slowly but steadily, Deere is becoming the operating system of farms.

Lastly, I wanted to touch briefly on South America. Deere continues putting Brazil front and center of its discussions, which is positive considering how prone Brazilian farms are to embracing technology. The company has gone as far as to host its next investor day (June 10th) in Brazil. Most of Deere’s business is in North America, but South America is also a significant market. The company derives around 13% of revenue from Latin America, up from 9% in 2019.

Taking a look at the valuation

As I discussed at the beginning of the article, Deere’s stock is close to its ATHs. It’s also up 38% from my cost basis (not counting dividends). This means that there’s one question to answer:

Is Deere still cheap?