Markets weakening, 13F season, and what next? (NOTW#68)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

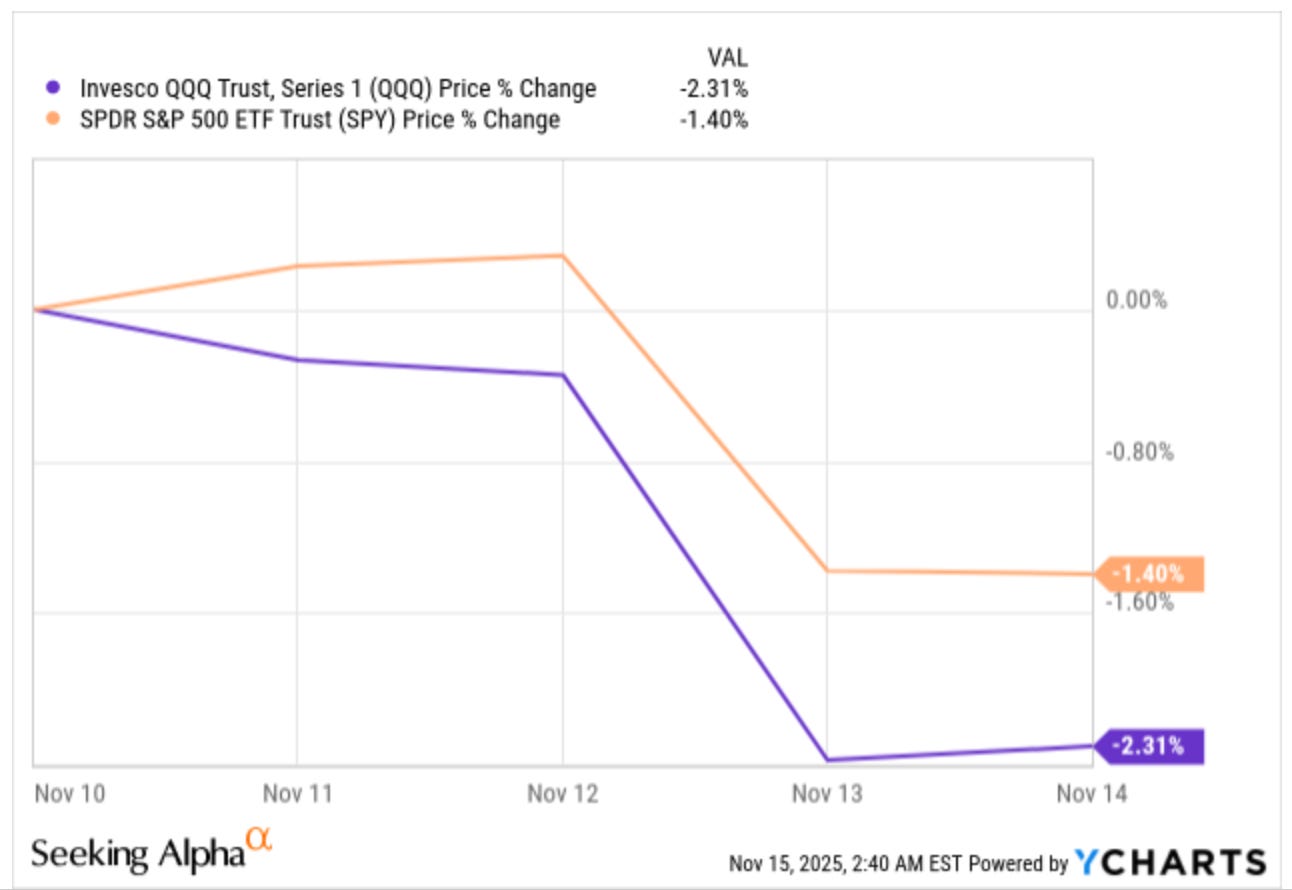

Both indices were down considerably again this week, but they are still well away from correction territory (needless to say, there’s a long way to go before considering the current environment a bear market). There might, however, be some parts of the stock market that have been in bear-market territory for a while.

Without further ado, let’s get on with it.

Articles of the week

I published two articles this week. The first one was Shift4’s (FOUR) earnings digest.

Shift4's Q3 Earnings

Shift4 reported its first earnings as a portfolio company, and they did not disappoint (neither on the fundamentals nor on stock price development). Shift4’s stock was initially down 10% in pre-marke…

The company reported strong earnings again, but the stock’s volatility did not disappoint! The good news for shareholders now is that there’s a reason for the stock to remain cheap: the most significant buyback in the company’s history.

The second article of the week was Constellation’s and Topicus’ earnings review.

Constellation's Q3: Swimming Against The Current

Constellation Software and Topicus reported earnings last week. If you follow both companies closely, you might have realized that their stocks have not been performing well lately. This is an understatement considering that Constellation is currently in its most significant drawdown in history (almost 40% off ATHs):

Both companies reported solid earnings but continue to get sold off (apparently) over the risk of AI disrupting their businesses. I share all the relevant numbers and the valuation, both of which are often misunderstood due to the relatively complex accounting.

I have been looking into many companies, but I have not yet found anything worth writing about (this could change very soon, though).

Without further ado, let’s see what the markets did this week.

Market Overview

It was yet another interesting week in financial markets. Both indices were down significantly for the second week in a row:

This is something I already discussed in last week’s NOTW, but even though indices are still not far from ATHs (all-time highs) and the fact that it could definitely get much worse, many things have already been “shot.” Markets have been supported for a good part of the last year by the “AI-trade”, so everyone is asking themselves what will happen if this support wanes. Will both indices drop while other sectors do comparatively better? Or will everything fall? As a kind of joke, I published the following on X this week:

Expectation: if the AI trade cools off, you will see money going into Software and Healthcare

Reality (probably): if the AI trade cools off, the market goes risk off, and healthcare and software keep going down to single-digit multiples

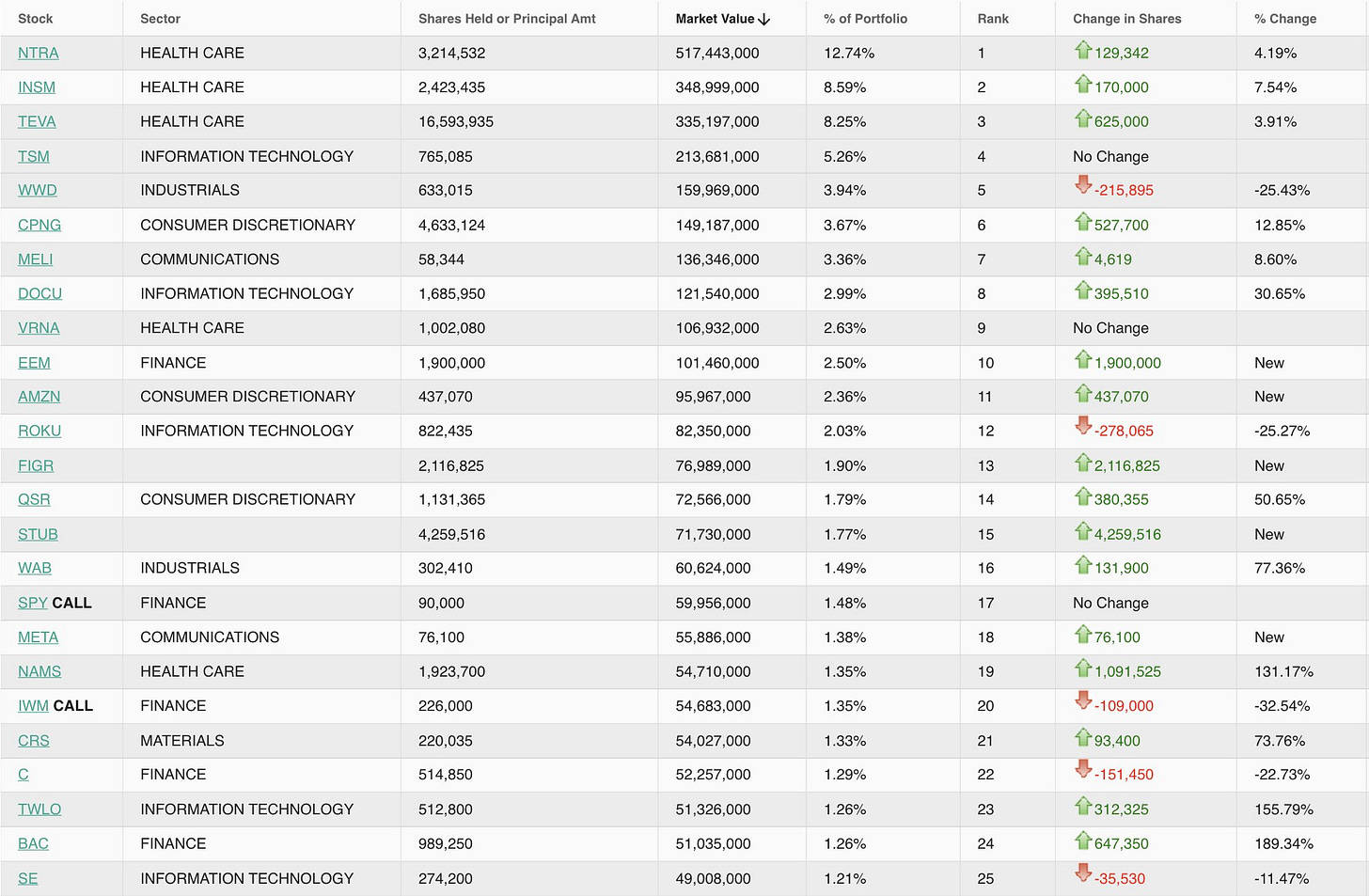

Being completely honest, I do feel that the healthcare industry is pretty appealing here (I’ve written about this before). This is the reason why around 20% of my portfolio is currently exposed to the healthcare industry. I found interesting that Druckenmiller’s top 3 are basically healthcare companies, and his exposure to AI has come down significantly:

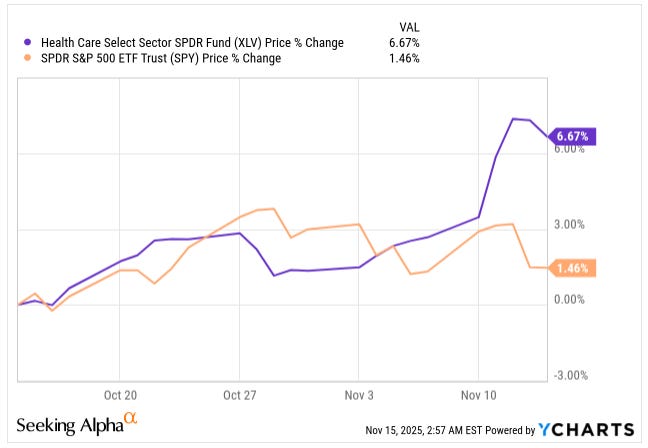

The best advice I can give here is not to over-obsess with the 13F season and to stick to your game. What’s undeniable is that healthcare seems to be doing quite well lately and is seeing steady inflows (something that hasn’t happened since the pandemic). The divergence of the XLV and the SPY has been interesting as of late:

Of course, the investment thesis is not just supported by a rotation but on the fact that many healthcare companies are at valuation lows while starting to accelerate their top lines. Interestingly enough, one healthcare company in my portfolio has significantly sold off (for no apparent reason, as results were pretty good), so I will most likely continue increasing my exposure.

The industry map was mixed this week, and what I have just discussed about healthcare can be seen pretty clearly below:

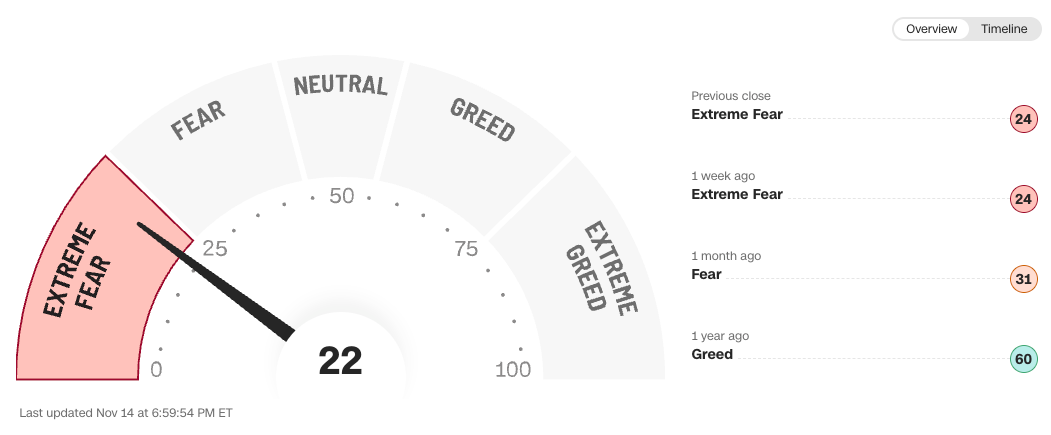

The fear and greed index remained in extreme fear territory:

My transactions this week

I only added to one position this week, as it continues to be sold off (imho) for no apparent reason and trades at an attractive valuation.