Shift4's Q3 Earnings

Shareholders should want this to remain cheap for a while

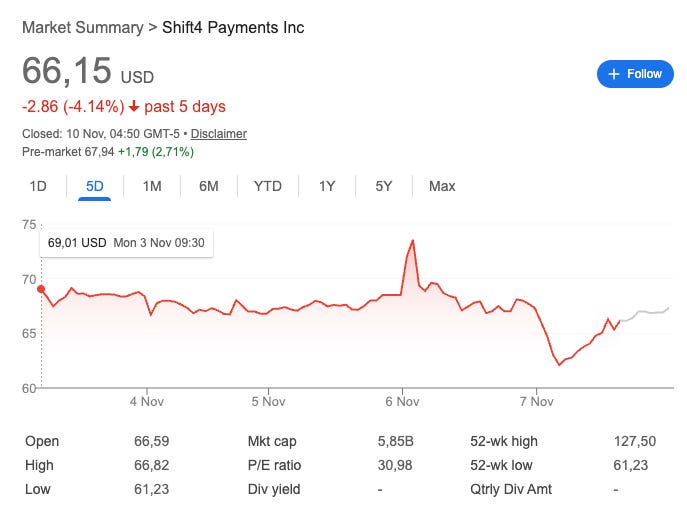

Shift4 reported its first earnings as a portfolio company, and they did not disappoint (neither on the fundamentals nor on stock price development). Shift4’s stock was initially down 10% in pre-market trading, was later up 13% at some point during the day, but ended the day slightly down. The day that followed this roller coaster, Block (owner of Shift4 competitor “Square”) reported earnings, and Shift4’s stock, like it usually does, went down considerably on those results only to recover a good deal of the drop during the day:

Incredible volatility in a matter of one week, but…are you not entertained? The good news for investors is that there’s now a reason to “cheer” the stock remaining cheap for a while (more on this later).

Let’s start with some headline numbers. Shift4 did not report good earnings from the POV (point of view) of algos and sell-siders. The company reported in-line revenue and slightly missed bottom line estimates ($1.47 vs $1.48). Although not great in a market dominated by algos, the actual numbers and the forward-looking commentary were significantly better and (imho) portray that the stock is quite cheap.

Q3 2025 was the first quarter that included Shift4’s “transformational” acquisition of Global Blue (closed in July). Even though this somewhat makes the reported numbers misleading, management decided to give the market what it wanted and reported organic growth. This, together with some changes coming to the company’s share and organizational structure, is starting to provide a “cleaner” story.

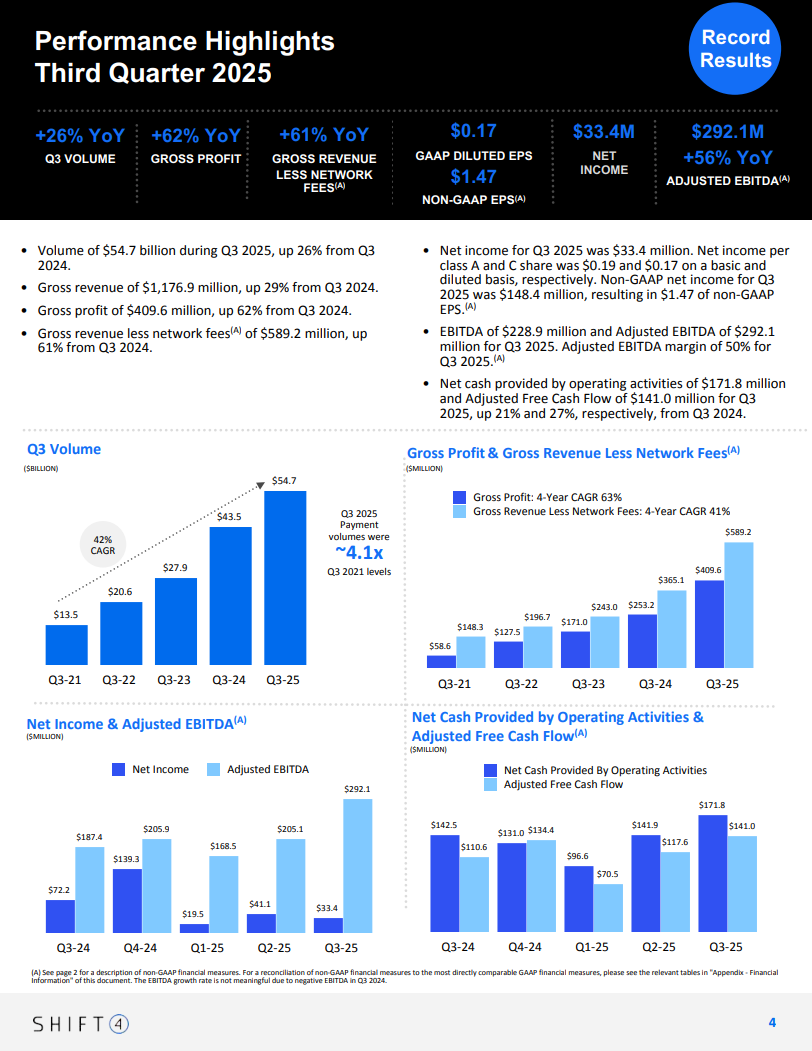

Before going into these in detail, I believe it’s best to go over some highlights in the numbers. I believe Shift4 presents these in a fairly straightforward way, so it’s best if I simply share them:

Gross Revenue Less Network Fees (i.e., net revenue) and EBITDA grew considerably, but enjoyed the tailwind of Global Blue. Note that GRLNF grew (+61%) ahead of EBITDA (+56%) because Global Blue is margin dilutive at first (not something that should surprise us, as we already knew it).

One thing that analysts have continuously asked management for is an organic growth number. The reason is that, due to all the acquisitions and all the subsequent cross-sells, it was tough to really grasp the pace at which the core underlying business was growing. Management provided this number for the first time in Q3: +18%. They also clarified how it’s calculated:

Organic year-over-year growth of 18% compares the performance of the base business by removing newly acquired revenue from both the Q3 2024 period and the Q3 2025 period.

I am still unsure if this can be considered an organic metric as it’s broadly understood in financial markets. Let me explain why —and why I don’t think this is as important as many people believe. Even though the organic growth number doesn’t include acquired revenue, Shift4’s growth model is not primarily about acquired revenue but rather about cross-sells. Say that Shift4 acquires a business generating $10 million in revenue in Q4 2024. This $10 million would theoretically be excluded from the organic growth metric, but what about all the potential synergies/cross-sells extracted from that company’s user base over the next 12 months? Would those count as organic growth? My interpretation of the above is that they would and that, therefore, despite being an organic growth figure, it’s somewhat dependent on the M&A story (I might be wrong here, and management might only include the cross-sells from companies acquired at least one year ago).

Regardless of the case, it’s perfectly fine because I consider it part of the business model. One thing I find interesting is that Shift4 is typically seen as the “complex” story compared to other peers like Toast, which primarily follows an organic growth model. While Toast is definitely simpler to understand, it doesn’t mean that it’s the best model for shareholders. What I am trying to say here is that Shift4 could stop spending money on M&A and pour that money into organic initiatives to become a “simpler” business. I doubt, however, that this would be the best choice for shareholders. I could also ask Toast to disclose its organic growth rate, excluding the money it spends on customer acquisition (which, in Shift4’s case, is primarily M&A). However, I don’t think anyone believes that organic growth should exclude growth from customer acquisition investments.

In fact, I’d go as far as to say that Shift4 is interesting mainly because it has chosen the superior model in terms of returns rather than the superior model in terms of simplicity. The market seems to value the latter higher than the former, but we’ll see what happens going forward.

Another thing that makes the growth strategy attractive is that it doesn’t rely much on comparable sales (something I discussed at length in my in-depth report). Management alluded to the environment as a “complex economic backdrop.” In hospitality and restaurants, comparable sales growth ranged from -4% to +1%. This is evidently not great, but there are several things worth pointing out. First, Shift4’s story remains one of upsells and cross-sells, meaning the company has ample room to continue growing without focusing too much on comparable sales growth. Many assume that comparable sales growth = organic growth. This is evidently not true. The “real” organic growth is probably somewhere in between Shift4’s organic growth metric and comparable sales (likely closer to the former). Regardless of how one views it, comparable sales growth is not as relevant a topic as many believe (albeit we shouldn’t ignore it).

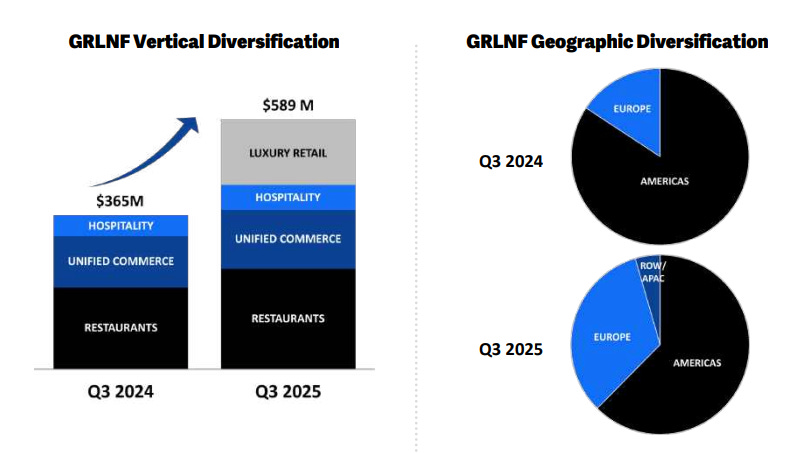

Secondly, even though many view Shift4 as a restaurant business, the company has become much more diversified over time, and less than half of GRLNF is currently tied to the restaurant industry. Geographical diversification has also improved a fair bit after the acquisition of Global Blue:

I feel it’s appropriate to discuss Global Blue, given how much of a game-changer it has been for the business’s profile.

Global Blue seems to be tracking nicely

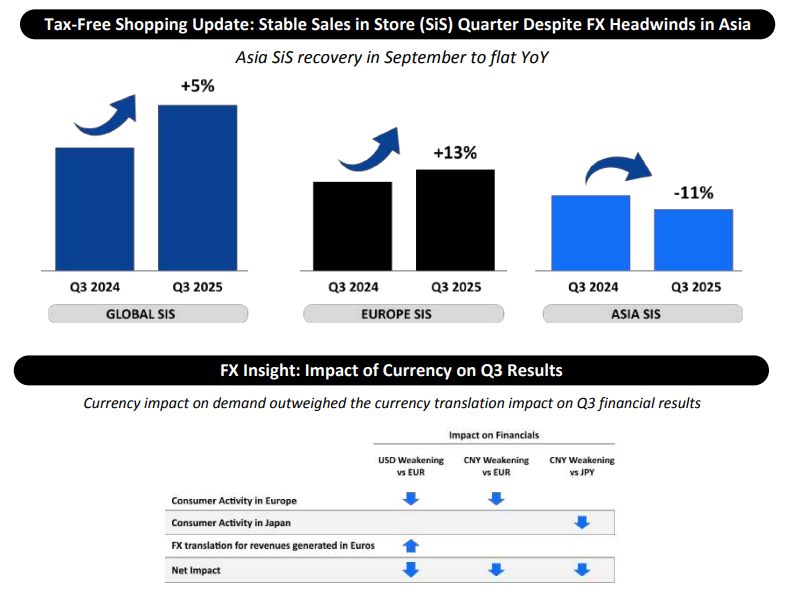

It’s undeniable that it’s still too early to tell if the Global Blue acquisition will pay off for Shift4. Global Blue grew 5% in Q3, with strong growth in Europe (+13% YoY) offset by headwinds in Asia (-11% YoY) due to foreign exchange.

At this point, most of the conversation revolves around the potential opportunity to cross-sell and the integration. Regarding the latter, management said it’s on track. They are still not leaning too hard on synergies, but products are starting to come together:

From an integration perspective, we are on track with previously discussed plans. Our three-in-one payment terminal for payments, currency conversion, and VAT refund eligibility detection is in beta.

This payment terminal is relevant to the story here because it enables Shift4 to become a one-stop shop for businesses currently using Global Blue’s software. The skepticism here comes from the fact that Global Blue serves several large retail players that are currently served by another great payments company: Adyen. Even though it seems a stretch to think that Shift4 will take significant share from Adyen “just” by owning Global Blue, I’d note that…

It’s definitely more likely than before (i.e., the likelihood of winning in retail is >0%)

The acquisition of Global Blue was not predicated on taking share from Adyen

This second point is interesting because management believes there’s ample room to take share from incumbents (bank terminals) in the SMB space:

It’s a great question, but I think it’s really important to distinguish between the headline customers that everyone knows and the breadth of the Global Blue business. Certainly in downtown Paris, everyone knows the Louis Vuittons of the world. The reality is you can just as easily go to a village on Lake Como in Italy, and nearly every merchant is using Global Blue. These are SMBs. We see a breadth of conversion opportunities from SMB all the way up to the largest of the enterprises. If history is a guide, the earliest success comes from all those SMBs. It is incredibly low-friction to switch from an existing bank terminal to what, from a product perspective, is going to be pretty revolutionary.

The only doubt I’d have as a shareholder is how much of the potential $500 billion cross-sell opportunity that comes with Global Blue is tied to very large enterprises and how much to SMBs. The right to win in the latter seems significantly higher than the right to win in the former. Even though management doesn’t share both numbers, considering the few synergies they considered when acquiring Global Blue, I think the numbers will work out either way.

Even though Global Blue is somewhat different from Shift4’s classic M&A playbook (in terms of size and industry), the quarter also included two other acquisitions that are textbook examples of Shift4’s playbook: Bambora and SmartPay. Let’s focus on Bambora, which appears to be the most significant opportunity.

In a recent NOTW, I shared that Shift4 had paid approximately 8.7x EBITDA for Bambora (about $80 million). With this money, Shift4 has acquired $90 billion in gateway volume, which portrays the beauty of the model. Here’s an extract from my in-depth report:

The interesting thing about the gateways is that, even though they provide a significant portion of the value in processing payments, the unit economics do not accurately reflect this value-added. A gateway provider would make around 4 cents on $30,000 worth of transactions. By convincing the customer to route all its volumes through Shift4 and bundling SaaS, Shift could potentially enjoy a 4.2x gross profit uplift.

That 4.2x uplift is calculated by Shift4 using a 50 bps blended spread (even though the current spread is around 60 bps). Let’s assume around 10% of Bambora’s gateway volume ($90 billion) converts to E2E volume at 60 bps spreads. This means that $9 billion converts from gateway to E2E volume, resulting in GRLNF of $54 million ($9 billion x 60 bps spread). At 50% EBITDA margins, that’s $27 million in incremental EBITDA, or what’s the same: Shift4 synergizes the EBITDA multiple to 2x even assuming conservative assumptions! I understand that this is not as simple as growing organically, but it does seem like a highly profitable way of growing!

The medium-term guide, the simplified share structure (+TRA?), buybacks, and debt

You might be reading the title of this section thinking…

What the hell do these topics have in common?

While some are indeed related, I could’ve simply named this section: “The rest of the topics,” but that wouldn’t have been as sexy, of course. Let’s start with the medium-term guide.

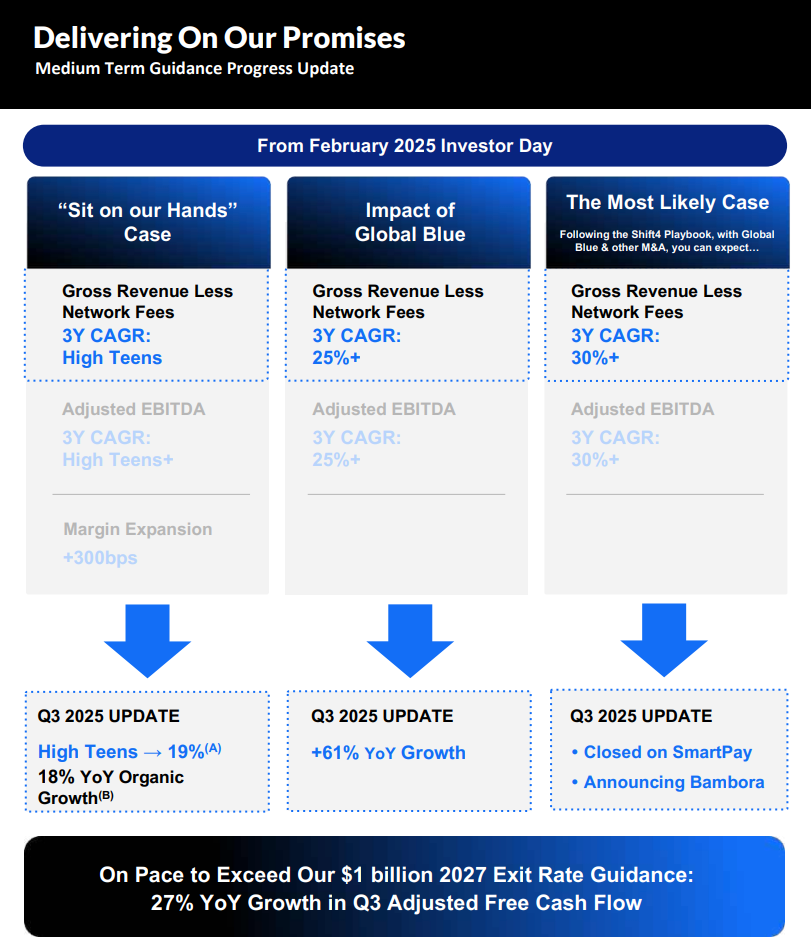

Back during Investor Day, management shared a slide with three 2028 guidance scenarios: (1) without Global Blue and assuming no further capital deployed into M&A (i.e., the closest proxy to organic growth), (2) including Global Blue but no further M&A, and (3) including Global Blue and further M&A. It’s this third scenario that management believes is now the most likely (albeit they already thought this back at investor day):

The last sentence of this slide is, imho, the most important. Management believes they are on pace to exceed the $1 billion in Adjusted Free Cash Flow guide shared during Investor Day (note that it’s an exit rate, not a TTM number, and that we should make some adjustments to the FCF figure, which I shared in the in-depth report).

The market clearly doesn’t believe this is going to happen, or maybe it thinks the story is too complex. It’s undeniable, though, that if it’s achievable, Shift4 is trading quite cheaply (current EV is $9.4 billion, meaning it’s trading at a 10% Adjusted Free Cash Flow yield in 2028 while growing organically in the mid-teens; can’t say the same about most stocks).

As management is not blind to the stock’s valuation, they have just approved a $1 billion repurchase program to be implemented right away, with an expiration date of 2026. At current prices, management could, in theory, repurchase around 15 million shares, or about 15% of the diluted shares outstanding. Management shared the rationale for the buybacks during the call:

You know, there have been times in our history where we weigh an attractive M&A pipeline against a valuation in our equity, and it’s a tough decision in this case. And Chris commented on our leverage profile. And that you know comes into this a little bit. But this one isn’t a tough decision. So we are you know trading at levels that we were trading at in December of 2020. And yet there’s 12 times the EBITDA in the business. And accelerating free cash flow and deleveraging at an accelerating pace as well.

So, what this ultimately means is that large M&A is likely off the table for a bit while they integrate Global Blue and buy as many of their own shares as possible. The company has somewhat high debt, but it’s manageable to conduct the buyback at an accelerated pace:

On debt capital structure. We are in the enviable position of being efficiently launched with all debt trading above par, resulting in access to an attractive cost of capital in multiple markets. As of Q3, our net leverage pro forma for the full year effect of Global Blue was 3.2 times, with notable deleveraging achieved quarter over quarter that resulted in our newly issued term loan already stepping down by 25 basis points of cost. I will take this opportunity to make clear that our leverage guidance remains unchanged, with a view that the business should not seek, should not exceed 3.75 times net leverage on a sustained basis.

The stock will do what it’ll do over the short to medium term, but at least there’s now comfort in knowing that management will be repurchasing shares while it remains cheap. This will likely continue until the market recognizes the business’s value. I don’t know when this will happen, but things are going to get much simpler now that Jared has been nominated to run NASA:

First of all, it’s great for the country. The ambition that we’ve seen inside our walls for 26 years really has always deserved a bigger stage. I think it’s a phenomenal thing for the country. Now, with regard to the company specifically, it’s likely to simplify our structure quite meaningfully. If you recall from the ethics agreement that he executed back earlier in the year, he is not required to divest the stock, but he will be relinquishing the super votes associated with his shares. It likely means a collapse down to a single share class, which I know a lot of investors will appreciate. Simplifying our TRA structure. I want to reiterate he intends to remain the largest shareholder of the business. This is something he feels passionately about.

This will likely have several positive impacts. First, it simplifies the story at all levels and might reduce the “complexity” overhang that the company has had for a while. Secondly, it makes Shift4 eligible for inclusion in many ETFs that only allow single-share structures. Don’t think any of these are a requisite for the stock to work long-term, but they are definitely welcome.

If you’d like to learn more about the company, you can read my in-depth report:

Have a great day,

Leandro

I'm still a little cautious on the debt. Maturities are out a bit and they have cash on hand for the full buyback, but that will put them close or above their 3.75x ceiling.

That recovry from Block's earnings impact was intresting to watch. Shift4's ability to bounc back so quickly shows som resiliance in the investor base. The valuation staying compressed could be a goo entry point if they keep executing on these fundamentls.