Fighting the narratives (NOTW#72)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

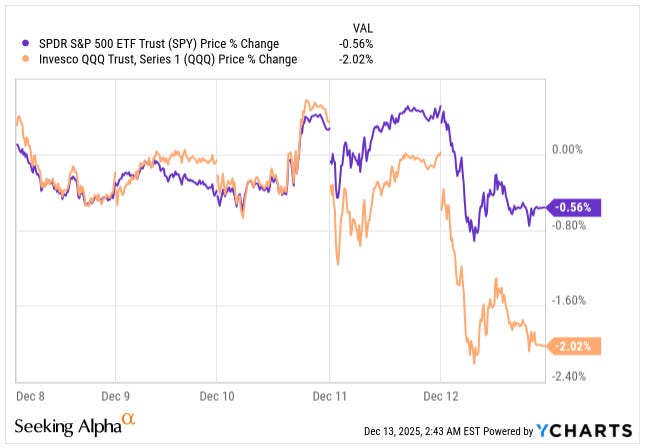

Both indices were down again this week and we could see a wide divergence in the performance of the S&P 500 and the Nasdaq, as company earnings shed some “doubts” on the AI trade. I’ll also share my point of view of the narratives behind two of the portfolio companies which have had lousy performance lately (the stocks, that is).

Without further ado, let’s get on with it.

Articles of the week

I published two articles this week. The first one was an update on Deere.

Trump’s Crusade on Deere (and the Investor Day highlights)

Deere received two pieces of relevant news this week that led me to write this article. Trump announced a new aid package for farmers and (as usual) had some words for what he termed as “tractor companies,” of which he only outright mentioned Deere. The company also held an Investor Day in New York on Monday.

The company received two pieces of “relevant” news this week: Trump’s Crusade and the Investor Day.

The second article of the week was Adobe’s Q4 earnings digest.

Adobe’s Q4: Déjà Vu

Adobe’s Q4 was pretty similar to Q3 and, in fairness, very similar to every quarter for the past 2-3 years: despite reporting yet another beat-beat-beat (guide) quarter, the market demonstrated once again that it simply doesn’t care

I decided to title the article “Deja Vu” in honour of the French expression that means “already seen.” It was not a dissimilar quarter to what we’ve seen over the past few years: great earnings that the market simply doesn’t care about.

Without further ado, let’s see what the markets did this week.

Market Overview

Both indices were down this week:

Even though the market has always been a maniac and pretty superficial at times, I must say that I am pretty surprised at the extent that it is true today: superficial narratives are moving stocks in ways I couldn’t have imagined. I don’t know if it’s AI that has made everyone trust the outcomes of models like Gemini or ChatGPT as the ultimate truth, or whether it’s the fact that narratives spread very fast in the modern age and everyone is looking for something that explains the daily moves of stocks. I don’t know what it is, but what does seem clear is that narratives can take hold of stocks pretty fast, the same way that those same narratives can change and send the stocks to new highs. Having conviction in what one owns has always been important, but it seems to be more important than ever today. In the company specific news section, I’ll talk about two of my portfolio companies that are currently suffering from said “narrative shift” and why I believe it’s unjustified.

One narrative or trade that is starting to lose steam is the AI trade. Leading AI stocks like Nvidia, Broadcom, and Oracle, did not have a great week and pushed the indices down (especially the Nasdaq) with them:

These companies are huge and have been massively successful over the past 5-10 (and longer) years, so needless to say, the past 5 days are not indicative of anything. This said, we might be seeing that some money is leaving the AI trade. As always, I have no clue what will happen going forward, but I do think the best idea is to focus on what one owns and why, and leave the rest to the market “Gods” (oh, and time and patience are always necessary). I know this is sort of a cliché, but if there are several things that are true these are that…

Someone is always going to be making more money than you (and they are going to let you know)

You are not going to own all the stocks that perform well

What I am about to say is pretty obvious, but I’ll say it anyway: there are thousands of portfolio combinations that can yield great returns over the long term.

The industry map somewhat portrayed the cool down of the AI trade:

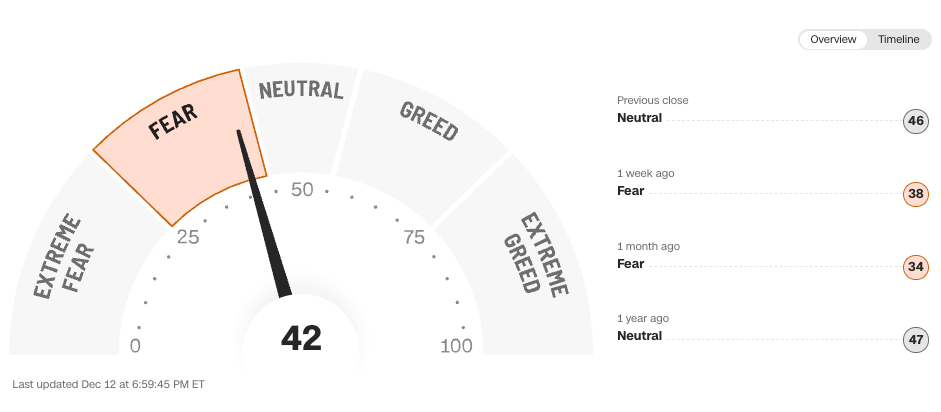

The fear and greed index improved slightly but remained in fear territory:

Company-specific news

This week, we had news from Stevanato and Nintendo: