Trump’s Crusade on Deere (and the Investor Day highlights)

Deere received two pieces of relevant news this week that led me to write this article. Trump announced a new aid package for farmers and (as usual) had some words for what he termed as “tractor companies,” of which he only outright mentioned Deere. The company also held an Investor Day in New York on Monday.

Without further ado, let’s jump right in.

Trump’s Crusade on Deere (and “tractor companies”)

Trump announced this week a new $12 billion aid package for farmers. The rationale was pretty straightforward: farmers have suffered the “trade war” but (of course) the US has gotten “so much money” from tariffs that they can pay them back to make up for it. Imagine how a farmer might feel reading this: “Hey, we’ve used you for political reasons but here’s a couple billion dollars.” Trump also quietly mentioned that China might end up purchasing more soybeans than originally expected (yet another tailwind for soybean farmers). Until here, everything seemed great news for Deere.

That is… until Trump mentioned that they also plan on removing the environmental restrictions from the machinery to “help” tractor companies. He claimed that these environmental restrictions make Deere’s equipment (and those of other “tractor companies,” as he called them) very expensive. Not only does he believe that if these environmental restrictions are removed the COGS of equipment manufacturers will go down but that these “savings” will be passed on to farmers (even claiming that price drops would be enforced, so much for the US being a “free market”).

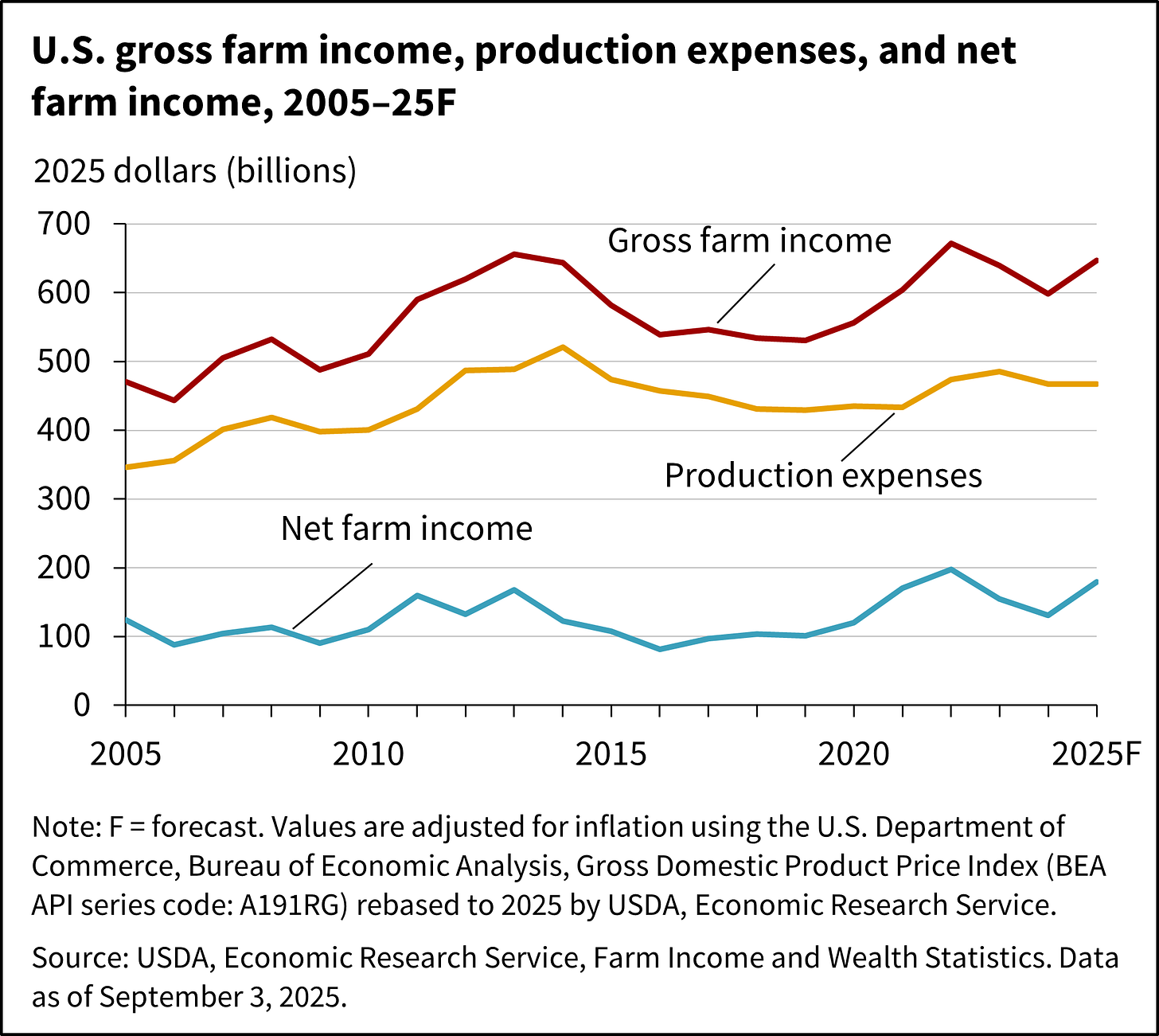

This is not great news for Deere for two reasons, but let’s first explain why Trump is confusing the terms “costly” and “expensive.” Yes, equipment machinery has gotten more “costly” over the years, but this machinery has also helped farmers become more productive and save costs. In fact, official data shows that production expenses have definitely increased over the years (not only caused by machinery), but that net farm income has also inched upward through the years:

The bottom line is that it’s unclear whether equipment in particular has gotten more expensive despite the price increases (historically in the 2%-3% range). Many people mistakenly believe that machinery makes up a significant portion of COGS for a farmer (this belief probably comes from its mission criticality and high ASPs). Farm equipment (including D&A) typically makes up around 30% of a farm’s COGS, with the largest COGS component by far being crop inputs (fertilizer, seed, chemicals…). Crop inputs can make up more than 50% of COGS. Labor doesn’t make up a huge portion of COGS, but the problem with labor resides in its accessibility rather than its cost (i.e., not many people are willing to work on a farm).

Deere (as I’ll discuss later), is helping farmers save on crop inputs (through features like exact apply, see & spray…) and is also helping farmers solve their labor shortage. This means that, while there’s no denying that prices have increased over time (at a pace not significantly faster than inflation), equipment is helping reduce other (more significant) elements of COGS (with Deere and other manufacturers taking their fair share of the value added, of course).

To this we must add that Deere’s equipment has a significantly higher second-hand value compared to that of peers, which means that farmers are buying assets with a relatively high terminal value (which makes Deere’s equipment comparably cheaper to that of peers). This higher terminal value then feeds into Deere Financial, which is able to provide accessible financing to farmers. So, all in all, Trump’s opinion seems a bit misguided.

Regardless of whether Trump is right or wrong, what he said is not great news for Deere for two main reasons. The first and obvious one is that an eventual (and forced) decrease in prices is not great, although it shouldn’t be too bad if COGS do come down by an equal amount (this assumes that Trump’s claim about environmental restrictions being related to higher COGS is correct). Note that Deere and peers probably made Capex investments to adhere to environmental restrictions and Trump is now basically saying that this money is going to go down the drain.

The second (and probably less obvious) reason is that environmental restrictions were one of Deere’s “lines of defense” against the FTC’s right to repair complaints. Deere argued that some repairs could only be conducted by its dealers because providing the software to farmers could lead to these bypassing environmental restrictions. In the following section of the article I’ll discuss how Deere might be anticipating an unfavorable ruling (although the judge ruled in favor of companies like Tesla and Harvey Davidson in the past on similar complaints).

So, the bottom line of this section is that, even though Trump said what he said, the reality is much more nuanced and there’s a reason to believe that equipment is getting more costly, but not necessarily more expensive.

Investor Day Highlights

Earlier during the day of Trump’s words, Deere hosted an Investor Day in New York to discuss its Smart Industrial Strategy. The company remains focused on the Smart Industrial Strategy they shared in 2023 and is more confident today in the value it will add over the long-term. A few years ago, management shared expectations of unlocking $150 billion in value for customers (of which they expected to take their fair share). This week they somewhat updated their expectations, claiming they’ve already unlocked 20% of this $150 billion and that it’s getting larger: