Adobe’s Q4: Déjà Vu

Adobe’s Q4 was pretty similar to Q3 and, in fairness, very similar to every quarter for the past 2-3 years: despite reporting yet another beat-beat-beat (guide) quarter, the market demonstrated once again that it simply doesn’t care. The stock initially shot up 5% when earnings were released (no human had had time to read them, though), but eventually flipped red. Sounds familiar? It should!

Analysts continued to fixate on topics such as “AI acceleration” and “aggressive monetization” while completely ignoring that AI is becoming a transformational force for Adobe and that the company is in fact monetizing AI (maybe not to the extent the market wants or expects). Adobe continues firm in its double digit growth trajectory, pace which is expected to continue next year.

Even though the current situation is frustrating, the good news is that Dan Durn (Adobe’s CFO) is not standing still and is taking advantage of the narrative to aggressively repurchase shares. Shares outstanding were down 6% this year, and this pace of share repurchases is something I expect will continue going forward. Adobe generated around $10 billion in Operating Cash Flow in FY 2025, or around 7% of the company’s market cap. If we assume Operating Cash Flow grows 10% next year and add it up to the $6 billion in cash, Adobe could potentially repurchase $17 billion worth of shares next year. At current prices, this is equal to roughly 12% of the outstanding shares.

Of course, this number requires some context. A portion of these repurchases would simply serve to offset dilution and Adobe is unlikely to entirely drain its cash position (although the company could issue debt to repurchase shares as it enjoys a net cash position). For these reasons, I believe it’s more realistic to assume that Adobe could repurchase around 7%-8% of its shares outstanding next year should it want to be aggressive. This has important implications for “per share” metrics (as I’ll discuss later in more detail).

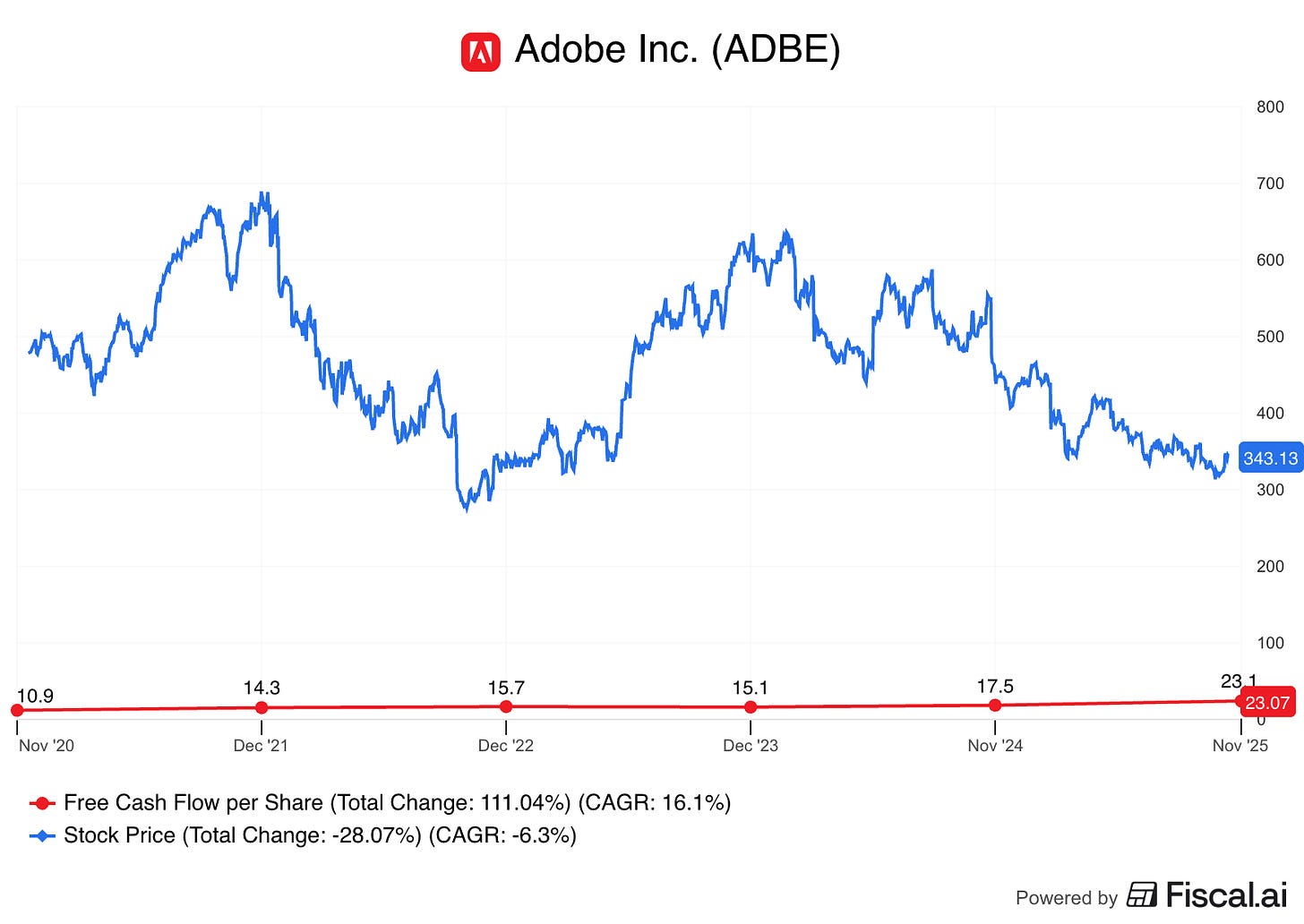

It’s normal to feel frustrated as an Adobe investor. The company’s Free Cash Flow per share has risen at a 16% CAGR since 2021, but the stock is down 6% over the same time frame:

Many will claim that this is what you get for paying an “xx multiple” for just “double digit growth.” While this is definitely true, investors should focus on the future. I believe it’s undeniable that, if Adobe can continue its growth (which doesn’t seem to be ending anytime soon), the shares are currently undervalued. I’ll go over the valuation in a bit more detail later.

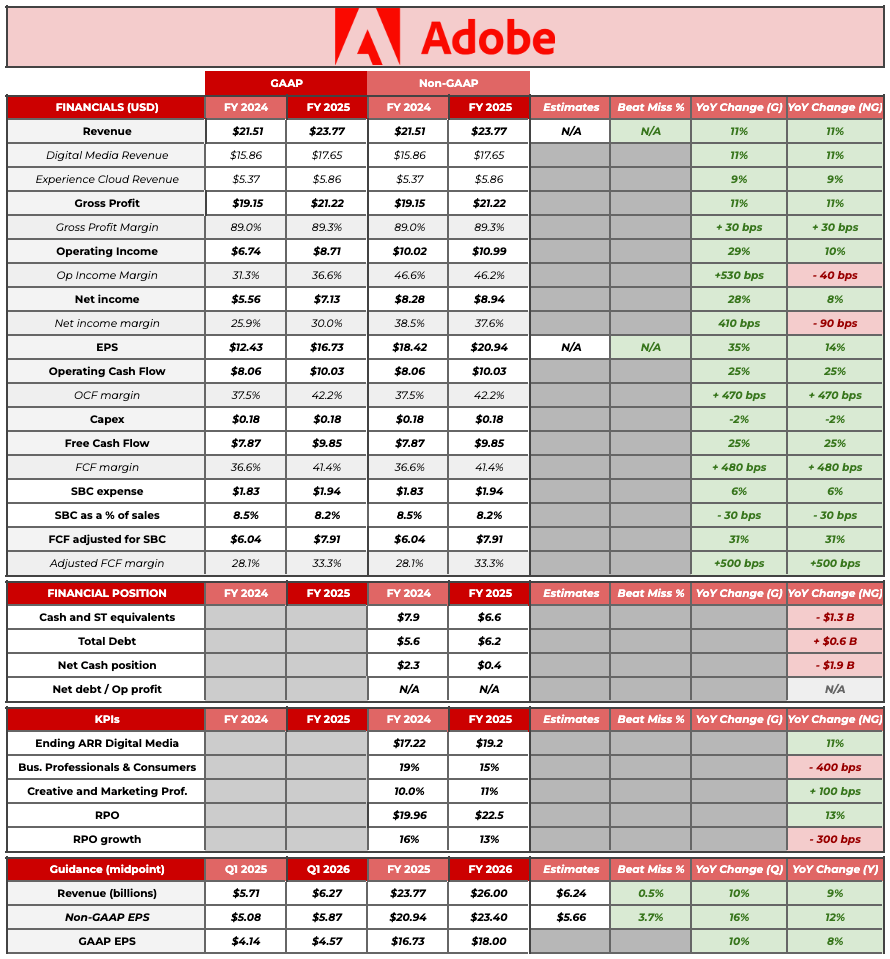

Let’s start with Adobe’s summary table where I’ll focus on the yearly numbers:

I would like to focus this article on Adobe’s strategy, and I’ll do so across three “tiers:” top of the funnel (i.e., adoption), usage, and monetization. Even though the three are relevant, the market continues to fixate on the latter and ignores the first two. Let’s start with the top of the funnel. Early signs that generative AI will be very accretive to the top of the funnel are very encouraging. I’ll leave some examples below (in no particular order):

“Products including Acrobat, Creative Cloud, Express, and Firefly, achieving total MAU growth greater than 15% year over year.”

“Over 25,000 businesses purchased Express or Studio for the first time in Q4 alone, accelerating quarter over quarter.”

“We drove 2x quarter over quarter growth in first-time subscriptions of Firefly.”

“Growing our base of creative users across Firefly, Express, Premier Mobile, and other freemium offerings. MAU for these offerings surpassed 70 million in Q4, growing 35% year over year.”

“So overall, we’re seeing strong seat growth. We continue to believe that we have a lot of user acquisition ahead of us.”

These numbers don’t “include” Adobe’s recently-signed partnerships with OpenAI and Google, which might serve to widen the top of the funnel even further. In all fairness, we should also be cognizant about the evolution of marketing expenses; Adobe’s S&M spend grew ahead of revenue this year (+12%). This could indicate one of two things (you’ll choose one or the other according to if you are a bear or a bull):