Capex, from loved, to hated (NOTW#78)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Both indices were down again this week, a week in which one word took the headlines by storm: Capex. I explain why in the market commentary and also explain how I have evolved as an investor and why it’s not inconsistent with long-term investing.

Without further ado, let’s get on with it.

Articles of the week

I published two articles this week, both earnings digests. The first one was ASML’s earnings digest.

The New Wall of Worry

I sense a bit of concern that we may be the bottleneck basically for our customer. This is not the case. Certainly not this year. And again, for next year, we have plenty of time to continue to follow basically the demand.

The company reported great earnings but now needs to climb yet another wall of worry.

The second article of the week was Nintendo’s earnings digest.

Reading between the lines

Nintendo reported 9-month earnings on Tuesday and the stock suffered (in Japan) one of its worst reactions in a long time (it was down 12% at one point). The following days weren’t great either, and …

The stock was pretty weak coming into earnings and earnings did not seem to stop the bleeding, with the stock suffering its largest one-day drop in a long time. I explain why I believe the market’s narrative doesn’t make much sense.

Without further ado, let’s see what the markets did this week.

Market Overview

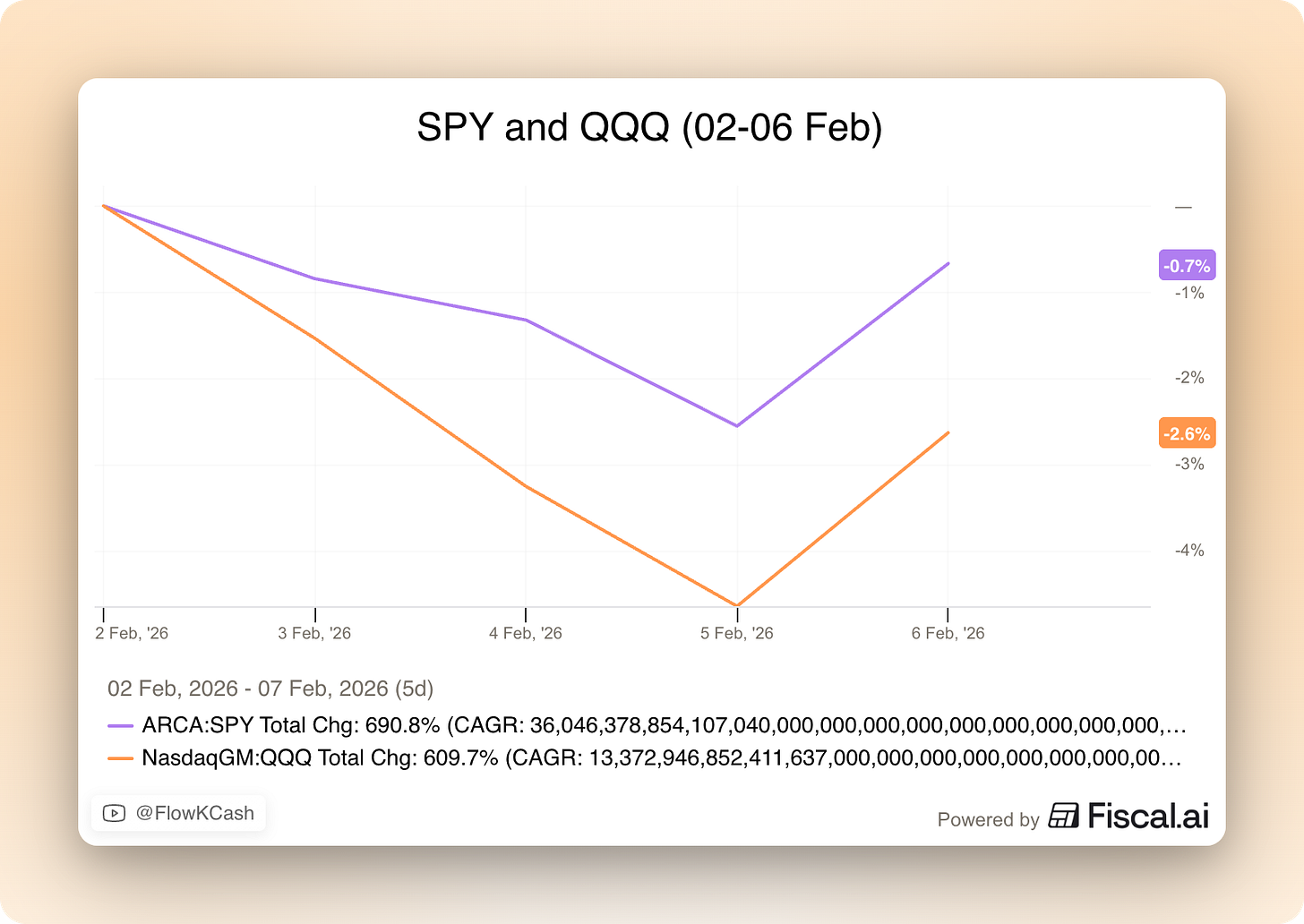

Despite enjoying a pretty good Friday, both indices were down again this week:

This week’s word was “Capex.” The hyperscalers have begun a Capex “war.” The winner will apparently be the one able to spend more Capex on AI. Meta and Google “shocked” the world when they reported earnings and announced their Capex plans, but Amazon decided to take it up a notch and announced a $200 billion Capex figure for 2026. Yes, you read that right: $200 billion. In case you are wondering, there are only 15 companies in the US that generate in revenue what Amazon is about to spend in Capex in 2026!

A couple of months ago, Amazon dropped considerably after reporting earnings because AWS growth came in below expectations. The market understood this “weak growth” (still grew 19% YoY) as a sign that Amazon was not investing enough in AWS and that it was losing ground to competitors in AI. The company reported pretty much the opposite this quarter: accelerating AWS growth and record investments. Despite Amazon satisfying the market’s demand (the Q2 demands, that is), the market decided to punish the company (and pretty much all of the Capex spenders). Who gained from these announcements? The picks and shovels (i.e., semis). The market seems to be worried about the returns the hyperscalers will generate on these investment, but if these are good, then a rational investor would want the company to invest as much as possible (we’ll see).

What seems evident is that the market is a bipolar beast that can change routes/opinions very fast. Just a couple of months ago, higher Capex was seen as a sign of strength, now, maybe not so much! One thing I have learned over these years is that, even if you are a long-only, long term, fundamental investor, the market context always matters. Pods are everywhere and narratives rule the world. While this market structure can provide incredible opportunities to long term investors, they can also penalize returns pretty significantly over the short (and medium) term when ignored. I know that many will think that none of this matters, but the market context does indeed matter so paying attention to it might be worth it.

Ignoring that the market is focused on momentum is ignoring how the market works and what drives stock prices. As I discussed in another NOTW, I am pretty terrible at investing behind momentum, but maybe should be more cautious investing against narratives (there’s a lot of middle ground in between). Narratives can be justified or not, but they surely impact stock prices. For example, I believe the narrative impacting two of my top positions is not warranted (which is why I have been adding), but there’s no denying there might be some “truth” or better said “reasonableness” to the SaaS narrative. Why? Because the terminal value is today more uncertain than it was before AI.

I think one common mistake investors make (and I have been prey to this mistake quite a few times) is not being flexible and open minded to continuing learning and evolving. At first I thought that fundamentals are the only thing that mattered, and while they surely do long term (or at least to a great extent), the short and medium term is muddled with many more factors than fundamentals.

One thing that I have learned is that you are not less of a long term investor if…

You sell something that you had high conviction in (things change or you might find a better opportunity elsewhere)

You change your POV quickly

Both things are perfectly consistent with long-term investing.

The industry map was (as almost always) mixed this week and reflected the Big Tech “selloff:”

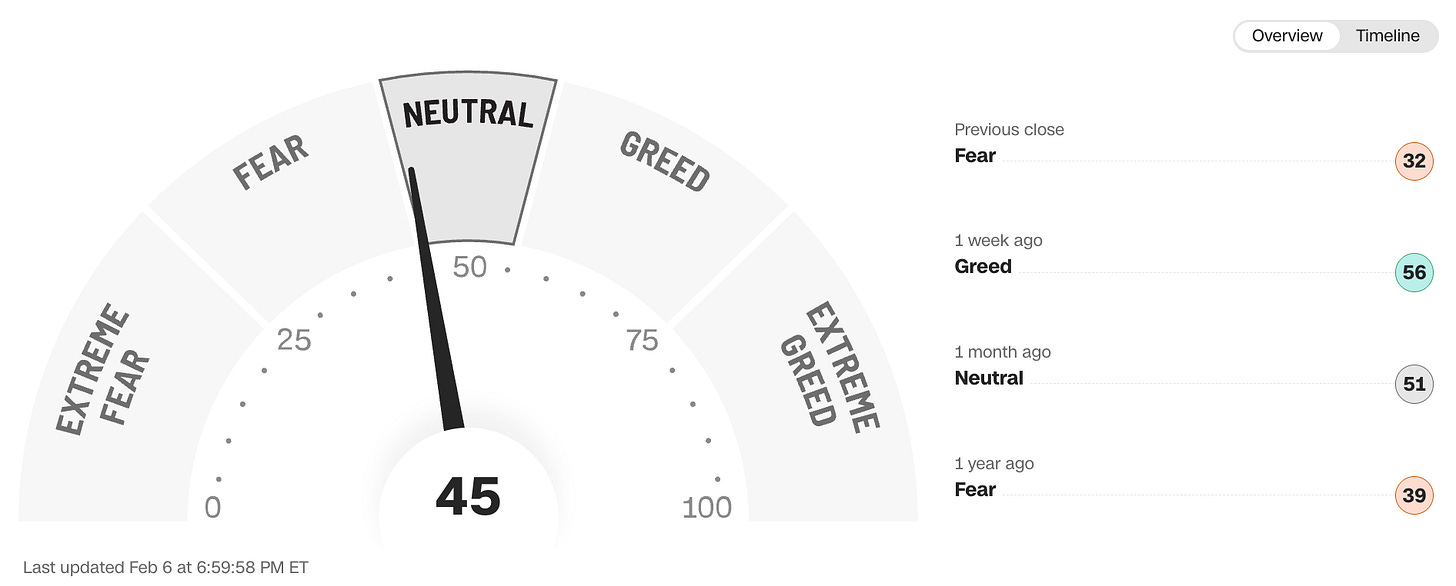

The fear and greed index worsened and was close to fear territory:

This is what I bought this week

I added to several positions this week, mainly those in which I believe the narrative is overdone and can quickly shift once the numbers become apparent: