The New Wall of Worry

ASML's Q4 Earnings Digest

I sense a bit of concern that we may be the bottleneck basically for our customer. This is not the case. Certainly not this year. And again, for next year, we have plenty of time to continue to follow basically the demand.

ASML reported Q4 earnings last week. Earnings were pretty good, but you know that analysts (and the market in general) are experts in finding something to worry about (bonus points if it confirms their priors!). ASML’s new wall of worry seems to be tight capacity (i.e., supply).

We should not forget that the wall of worry literally 6 months ago (not kidding) was not capacity but pretty much the exact opposite: excess capacity driven by lower-than-expected demand. ASML was not getting orders (at least not to the level the market expected) and this, together with Christophe Fouquet’s concerns on “not being able to confirm growth for 2026,” led the market to believe that ASML had a demand problem.

Interestingly enough, the market believed that one of the enablers of AI had a demand problem while it also believed that hyperscalers and LLMs faced supply problems (due to demand being so strong). Being ASML one of the picks and shovels of said supply, holding these two views simultaneously seemed strange. The reality was that ASML was simply in the middle of no man’s land (a good analogy would be the eye of the storm): capacity was tight across most of its customers, but these were still opting to defer capital expenditures by upgrading their current infrastructure and working at full capacity. The reason was that some of these customers (mainly TSMC) were unsure about the durability of said AI demand.

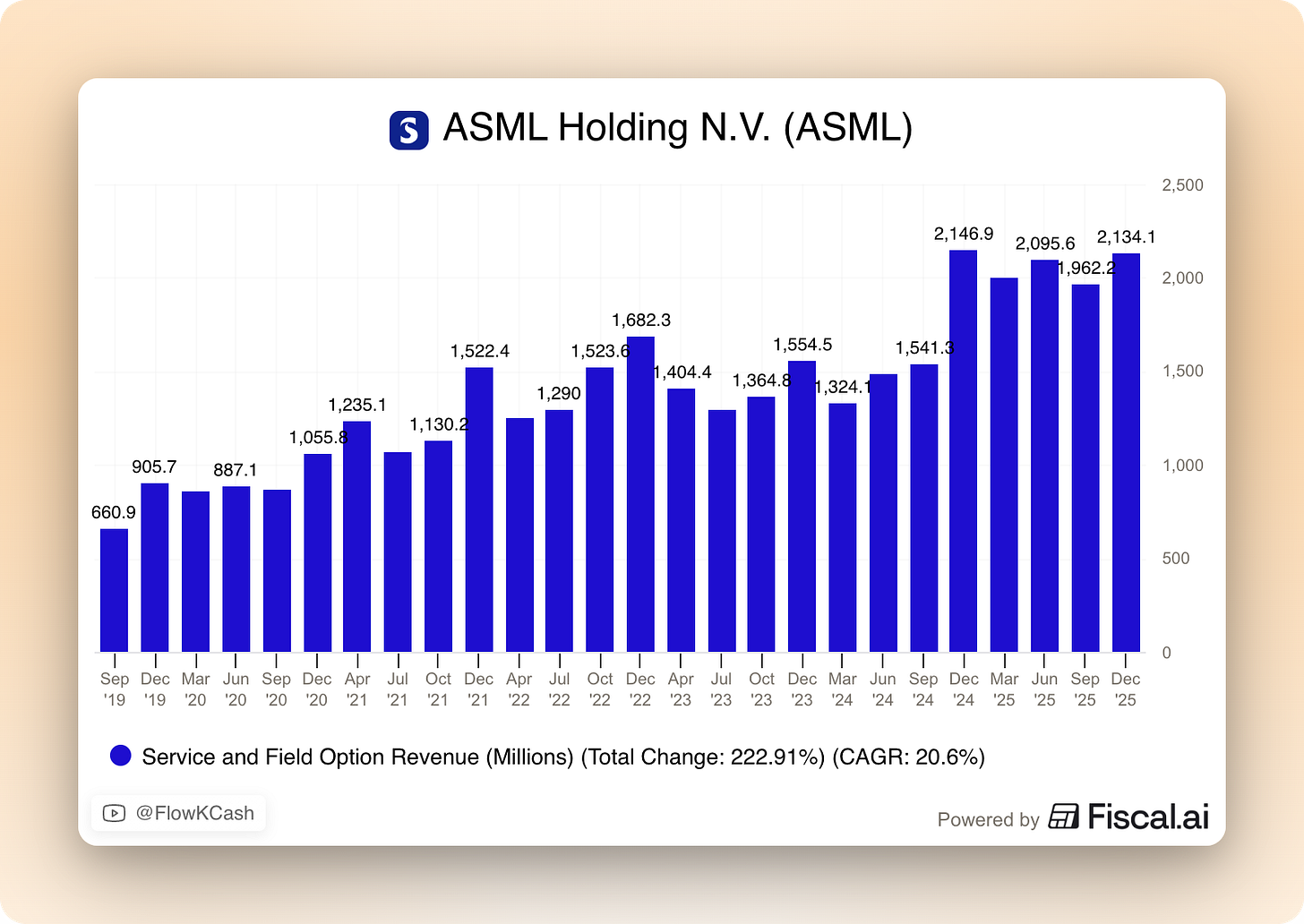

This meant that one could theoretically hold both views simultaneously while on the surface appearing to be correct. This “no man’s land” trickled down into ASML’s IBM (Installed Base Management) sales, which shot up pretty significantly in 2025 while orders were “below expectations:”

But then, something changed. The chipmakers began to seriously consider capacity expansion due to the durability of AI demand and positive news flow started to mount for ASML. Rumours about capacity expansion were ultimately proven right. First, it was TSMC. The company announced a pretty sizeable increase to their capex plans for 2026:

In 2026 we expect our capital budget to be between $52 billion-$56 billion as we continue to invest to support our customers’ growth. About 70%-80% of the 2026 capital budget will be allocated to advanced process technologies, about 10% will be spent for specialty technologies and about 10%-20% will be spent for advanced packaging, testing, mask making and others.

As a result, in the last three years our CapEx dollars amounted to $101 billion but is expected to be significantly higher in the next three years.

Then came Intel, although Intel raised capex in a way that required actually reading the call and not just focusing on the numbers. I touched on this topic on a recent NOTW:

That said, when you look at CapEx, it’s a little bit more nuanced than just it’s going to be flat to slightly down. It’s actually down significantly in space, so we’re spending a lot less in space. We think we have a good footprint in terms of clean room, and what we’re devoting more of our dollars to is tools, so we are ramping up tool spending quite a bit in 2026 relative to 2025 to address this supply shortfall as well, and in fact, every quarter, we’re seeing kind of wafer start increases pretty much across the board across Intel 7, Intel 3, and 18A.

Lastly, memory players decided to join the party. With the AI bottlenecks quickly jumping to the memory producers, ASML now has credible customers not only in logic, but also in memory!

All of the above began to become priced-in by the market a while before it happened (but for no apparent reason), leading to strong performance in ASML’s stock in 2025. ASML is an interesting case on how quickly narratives can shift. The stock started to go up for seemingly no apparent reason, making bears “disappear” and every news release becoming “bullish” for the company. When the stock was at $700, everyone continuously parroted that China was close to developing EUV. This quickly disappeared as soon as the stock worked. You know, it seems as if price drove the narrative.

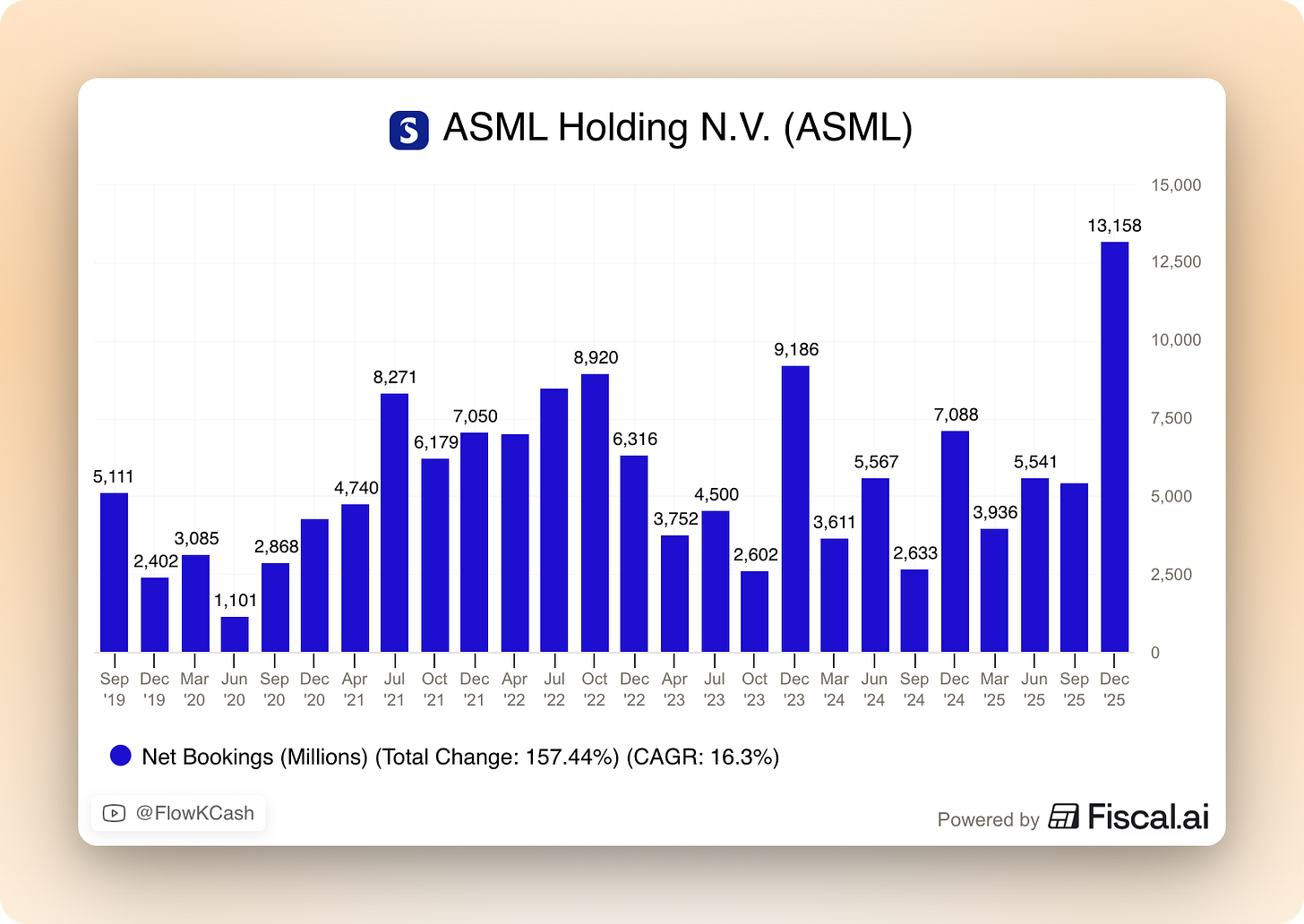

So, let’s take a quick look at demand numbers. For starters, ASML enjoyed its strongest quarterly bookings number ever: €13.2 billion!

Despite how impressive this number is in and of itself, it still doesn’t capture much of the logic upside ASML can enjoy as both TSMC and Intel start ramping capacity. Management stated that there was a higher participation from memory than usual:

Net bookings in the quarter were slightly weighted towards memory, with 56% of bookings and logic accounting for the remaining 44%.

Management also expects memory will play a larger role than usual in 2026 sales numbers. ASML’s most advanced systems (low-NA EUV and above) relied historically on the logic players. With one of said players (Intel) falling significantly behind the other, bears believed that TSMC would enjoy (and exert) monopsony power on ASML. While I didn’t view this as worrying (because TSMC also needs ASML), this has been proven wrong. Not only because Intel is trying to adopt EUV, but also because memory players are now in the mix.

On another note, ASML’s management was proven right (again): litho intensity is increasing (not decreasing) as productivity across the EUV family improves. This is also true in memory despite 3D structures becoming the norm. Many people believed that 3D structures would destroy litho intensity, but the reality is that EUV layers are increasing because it’s becoming economically plausible to displace multipatterning DUV. Management also shared some thoughts on technology cliffs:

Now, you talk about a cliff. Customers don’t like cliffs. Cliffs are very bad for operation. What customers like is optimized technology over several nodes. No one wants to buy a lot of tools and be stuck with them.

I believe that disruption is a common misperception in semicap land. Many believe that if a new, lower-cost, comparable technology becomes available the industry will rush to adopt it. I believe that visibility for semicap companies is higher than many believe because production systems are very ingrained in the operations of customers. Chip production is both a value and volume business (more the latter), so I highly doubt that 90 degree turns in strategy are on the table.

With the demand topic now behind us, ASML has to climb a new wall of worry (albeit one that management put to rest during the call): capacity. One would think that becoming a bottleneck would be good for the stock (one only has to ask the memory players), but there’s a caveat here: pricing. While memory players are raising prices like crazy, ASML is unlikely to do the same thing even if its products eventually become a bottleneck (they could, however, ask for a larger prepayment). ASML’s behaviour, in my view, demonstrates more long-termism and also the fact that the demand for its tools are more secular than the competitive advantages inherent to memory players. In short, memory players have to enjoy it while it lasts, whereas ASML has to nurture long-term relationships with the industry to continue being locked-in in the foreseeable future.

The capacity woes probably stem from two places. First, ASML’s 2026 guide. The management team issued a guidance that calls for growth between 4% and 19%. This wide range led analysts to believe that ASML’s capacity was the driving factor between being in the high end or being in the low end. The reality is that it’s fab buildout timings rather than capacity constraints that drove the wide range.

The second reason is that ASML was capacity constrained during the pandemic, so the market believes the same thing can happen this time around. What’s interesting is that the fact that ASML was capacity constrained during the pandemic makes it less likely that it will suffer the same fate this time around (on a separate note, this is similar to Nintendo, which suffered NAND shortages during the launch of the SW1 and prepared for the launch of the SW2 by stockpiling memory). Management argued several times during the call that capacity is not the bottleneck:

I think the way I would summarize it is that we have, I would say, the flexibility to react to the development of the market. We have created basically the right flexibility to see the market coming.

We think that our increase in capacity goes nicely hand in hand with the completion of fabs by our customers, such that we will not be the limiting factor in them being able to increase their capacity.

They ultimately claimed that the only missing piece would be people but that they could respond to that faster should they need to:

We’re not going to put in people for an output of 90, because that would make no sense.

All in all, great earnings “masked” by the new (and unproven) capacity woes!

Why I decided to trim my position

I want to briefly touch on why I decided to trim my ASML position before earnings.