Reading between the lines

Nintendo's 9M Earnings

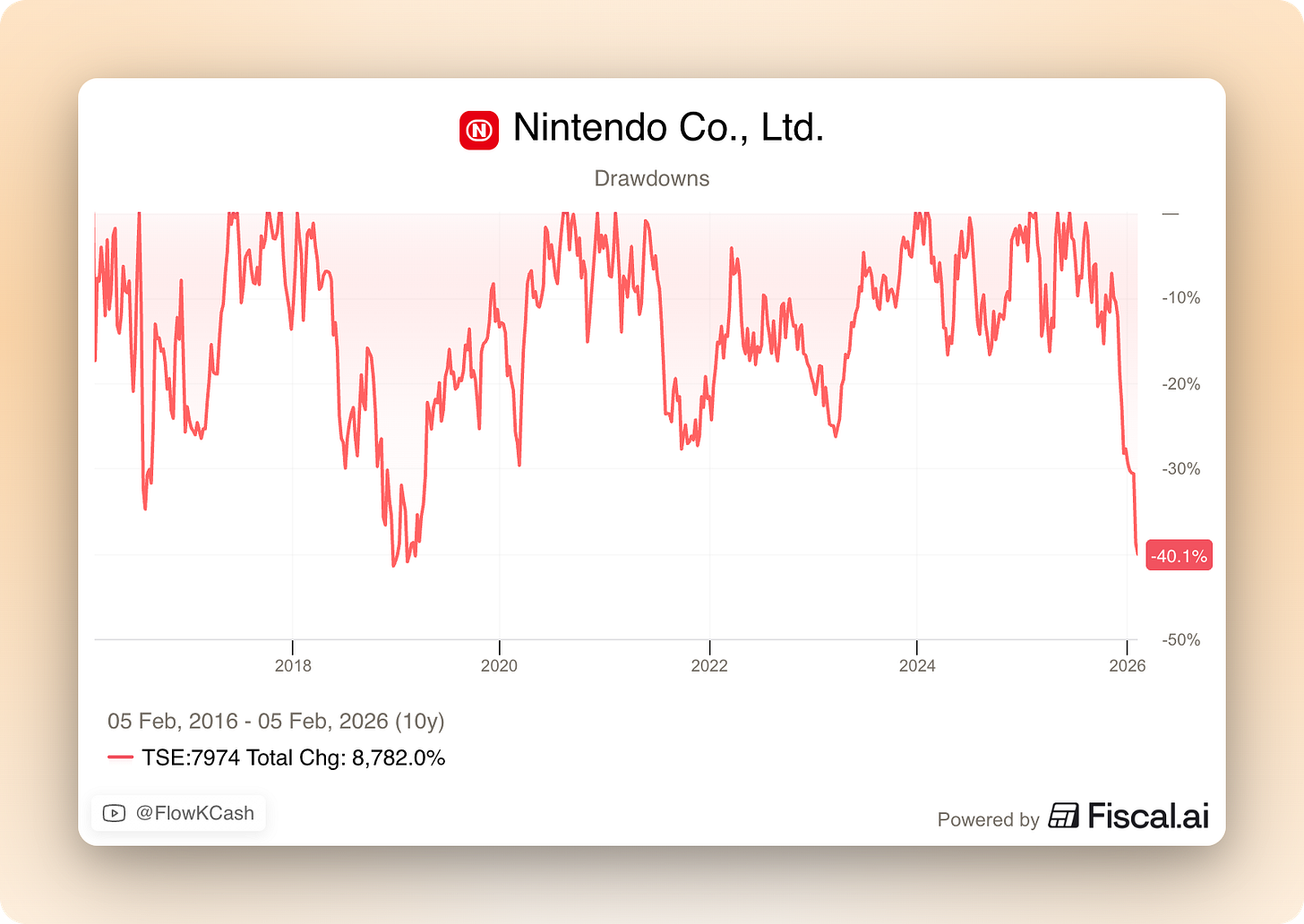

Nintendo reported 9-month earnings on Tuesday and the stock suffered (in Japan) one of its worst reactions in a long time (it was down 12% at one point). The following days weren’t great either, and Nintendo is now suffering its second-largest drawdown of the last decade:

This begs the question:

Were Nintendo’s earnings that bad?

I’ll go over these in this article, but if you are time constrained, let me tell you that the answer is “no.” Earnings were actually pretty good, but one has to go beyond the headline numbers to understand why. The poor stock reaction could probably be attributed to two things (besides all the memory fears):

Nintendo apparently missed profitability estimates (leading some to believe that this was due to rising memory costs; it wasn’t)

Management did not raise the guide despite strong results over the first 9 months

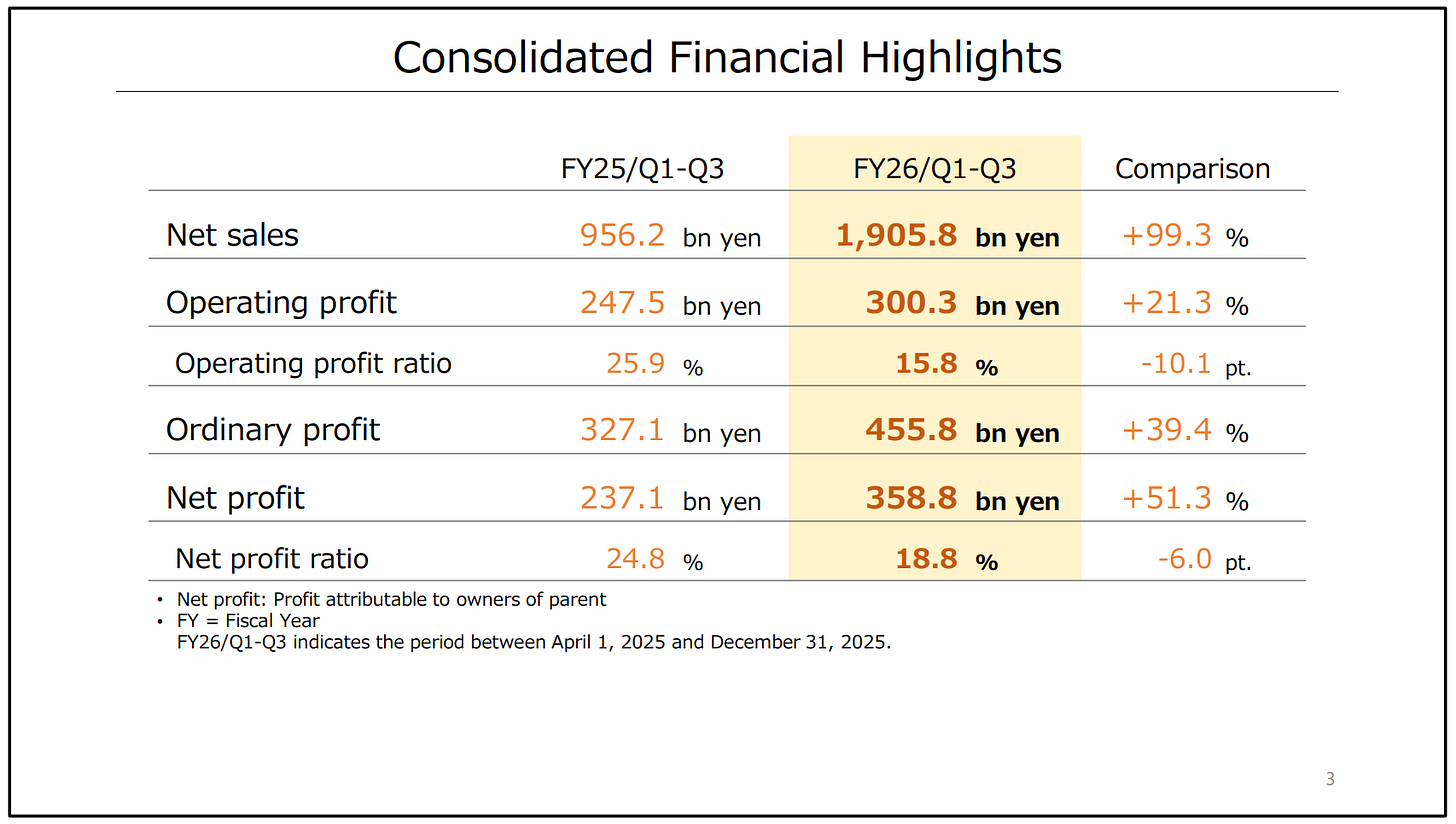

Despite the above, Nintendo grew its 9M sales and operating profit by 99% and 21%, respectively. For the always important holiday quarter (Q3), Nintendo’s sales and operating profit rose 86% and 23%, respectively:

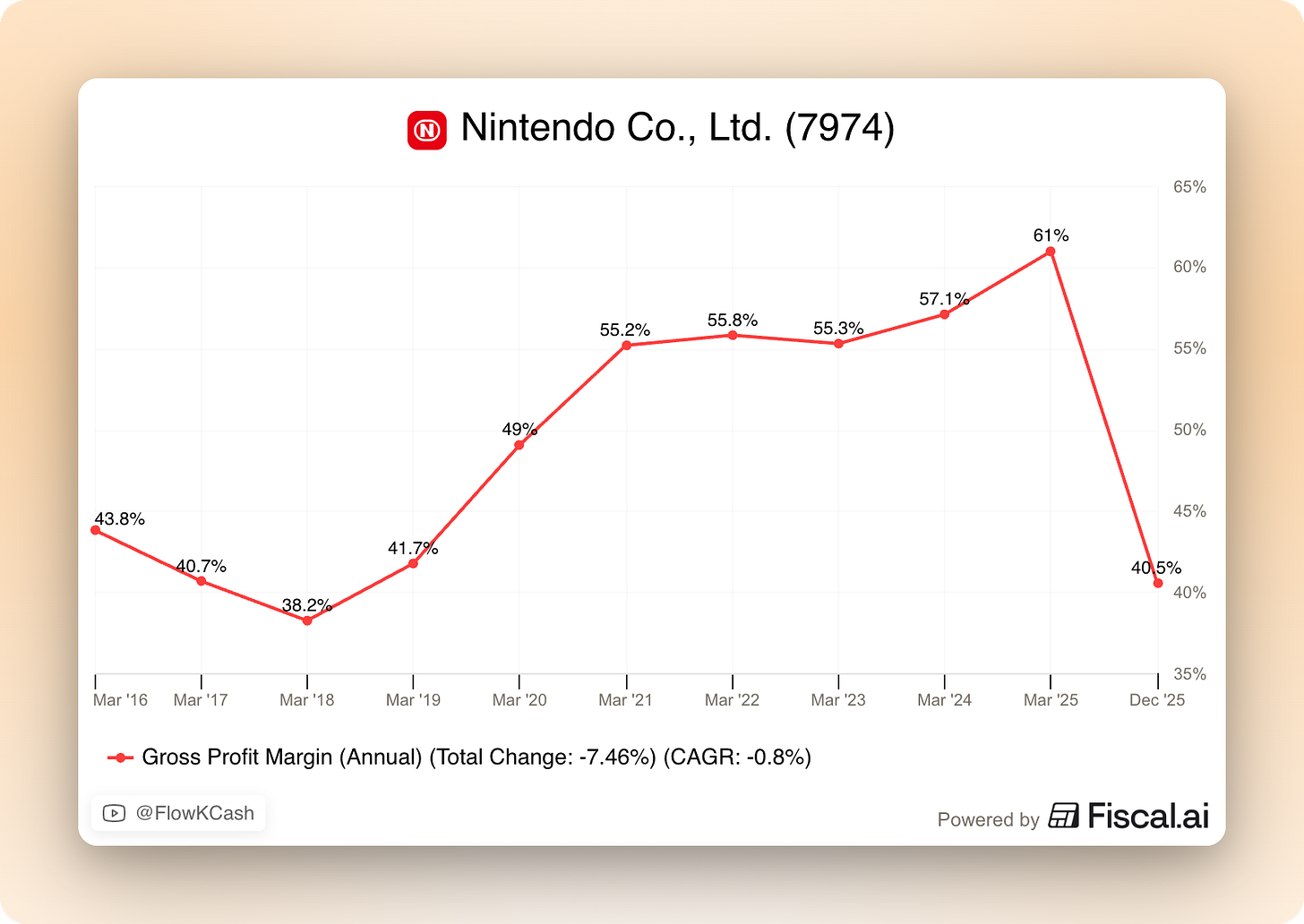

Let’s talk about margins. Nintendo’s margins supposedly came in below expectations, but I believe that the market is misunderstanding how this business works. Margins come under pressure during the early stages of a hardware cycle (especially one with a weak 1P lineup). This is caused by an abnormally high proportion of hardware units sold (which are lower margin than software) as Nintendo builds the installed base that it will later monetize with software releases. The opposite happens as the cycle develops: profitability inflects significantly once software sales take over hardware sales and as the company achieves manufacturing efficiencies. This dynamic was pretty evident in the SW1 cycle:

Two things are worth taking into account here. First, Nintendo’s profitability should be structurally higher this time around as the company continues to sell software to its 150M+ SW1 installed base. Despite a poor software lineup for the SW2, gross margins remained higher than in Nintendo’s FY 2018 despite selling a similar number of hardware units. This is more impressive considering that management confirmed that SW2 profitability is below that of the SW1. One thing I had not taken into account is that the yen depreciation is putting pressure on hardware margins because COGS are dollarized. This is not applicable to software (where costs are mainly yen denominated), so the impact should reverse once software sales take over.

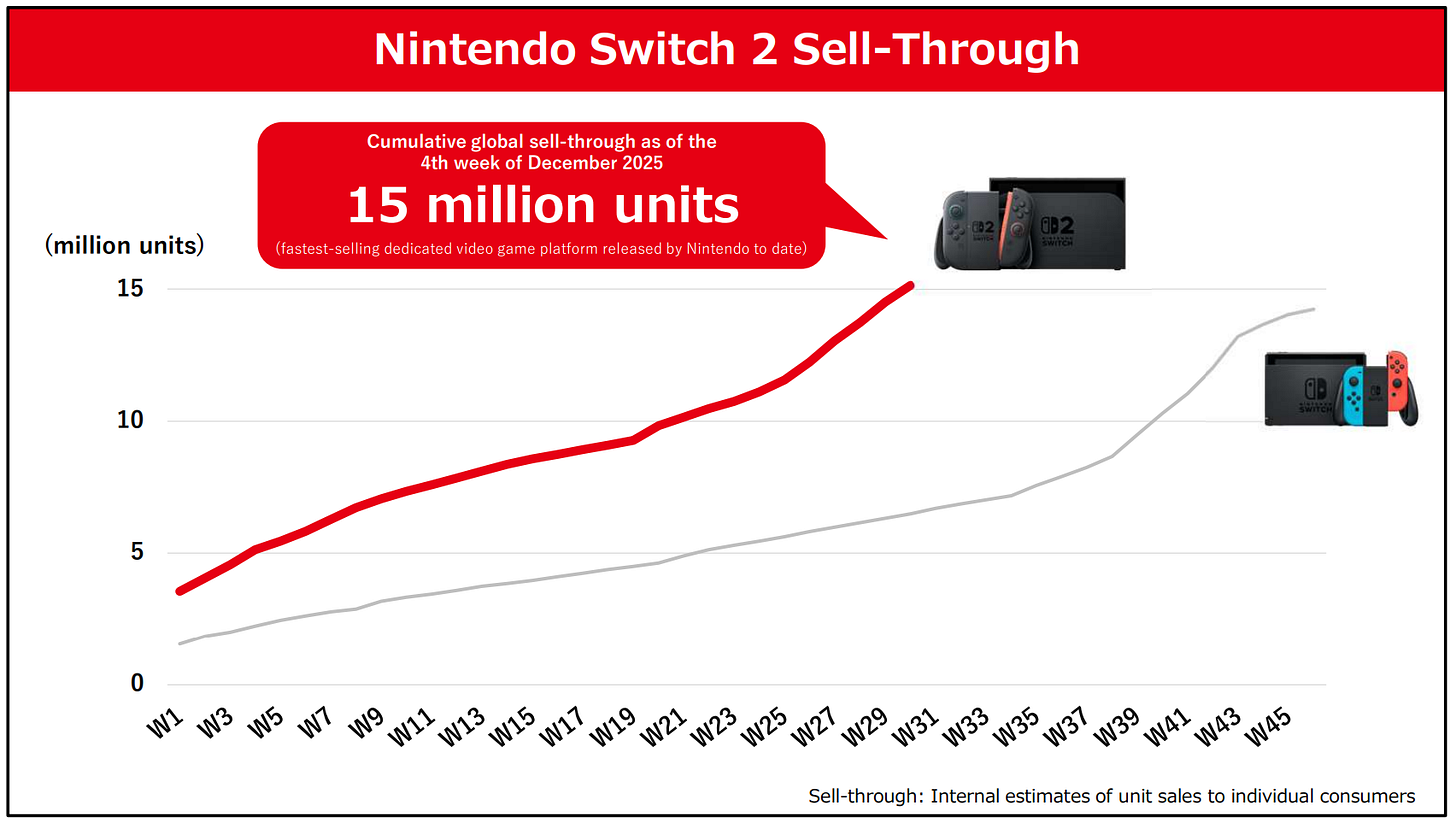

Now, bears will point out that margins came under pressure precisely because Nintendo did not sell many SW2 games. This is evidently true. Despite selling 15M SW2 since June, Nintendo “only” sold 38 million games. This results in a tie ratio of 2.5. Just for context, the SW1 sold 63 million games with an installed base of 17 million or so in 2018 for a tie ratio of 3.6. So, based on these numbers, one could definitely argue that software sales languished and that it was likely a reason for the “poor” margin performance (in addition to a higher proportion of hardware sales that naturally comes from the early stages of a cycle).

The question now should be:

Is this worrying?

I actually think it’s quite the opposite: it’s encouraging. Why? Because Nintendo has positioned the SW2 as the fastest selling console ever despite a poor 1P software lineup:

Some might rush to point out the “bad” in this, but I smell opportunity, and I believe this was a conscious choice by management. During the Q&A, Shuntaro Furukawa (Nintendo’s President) claimed that years 2 and 3 are the most important for a hardware system:

The second and third years of the Switch 2 are critical. If we increase the install base, we can significantly increase software sales. We will consider various options flexibly rather than being too swayed by short-term trends.

The way I interpret this is that Nintendo was aware that the SW2 would sell well regardless of the initial 1P software lineup, so they decided to save the heavy hitters (except Mario Kart) for FY 2027 and beyond. Note that Nintendo also has the Mario Movie to boost hardware sales in FY 2027. Some people claim that this strategy doesn’t make sense because they should frontload hardware sales to maximize profits. While this evidently makes sense, management is saying very clearly that they are after a long-lasting and recurring business rather than one that maximizes short term profits:

Prior to Nintendo Switch, our relationship with consumers was interrupted whenever they purchased a new platform, which presented challenges.

Now, there was also some kind of minor bad news in terms of hardware. Management acknowledged that the SW2 sold better than expected in Japan (despite being supply constrained until this week!), but was weaker than expected overseas. While I wouldn’t read too much into this considering the poor software lineup, we must also remember that Sony heavily discounted the PS5 during Black Friday/Cyber Monday.

The PS5/SW2 comparison is one that continues to surprise me, because it seems like a poor comparison to make. Many are pointing out that Sony outsold the SW2 during the holiday period (which is true), but what many don’t tell you is that, not only did Sony heavily discount the PS5 during Black Friday/Cyber Monday but that Sony also released a cheaper PS5 to compete with Nintendo in Japan (unsuccessfully so). If you want to give any kind of predictive power to such a feat, please be aware that the PS4 outsold the SW1 during a holiday period in the early stages of its cycle. The SW1 later outsold the PS4 during many periods and has become one of the best-selling consoles ever.

Nintendo’s (and the videogame industry’s) business is pretty simple: it’s the software that sells the hardware. Nintendo did not prepare a strong software lineup for the early stages of the SW2 cycle but still managed to sell north of 19M units. This bodes pretty well for future hardware and software sales down the line once Nintendo starts to release the heavy hitters (Zelda, Pokemon, a 3D Mario, the Mario Movie…).

Memory, memory, memory

Of course, the topic du jour for Nintendo (and pretty much for any hardware vendor) revolves around memory costs. If you have not been living under a rock over the past year, you’ll know that memory chip prices have skyrocketed, leading to worries about how they will impact not only hardware margins but even hardware availability (I discussed this topic more in detail in this article).

Nintendo’s management hinted during the Q&A at the existence of LTAs (Long-Term Agreements):

We strive to secure a stable supply of memory-related components through long-term discussion with suppliers.

They confirmed that memory pricing will not have an impact on Q4 (neither margins nor availability) and somewhat hinted that they are protected for a good part of FY 2027 due to their inventory:

We don’t expect an immediate major impact next year because of on-hand inventory and current production.

Management did say that it might have an impact if it lasts longer. In my article discussing ‘Nintendo’s Memory Woes,’ I explained that there could be a worse case scenario in which the problem was not higher prices but availability. Management basically ruled out this scenario:

While prolonged memory price hikes may affect profitability, we do not anticipate supply shortages affecting production plans for next year.

The impact on next year’s numbers from higher memory prices is still unknown, but management claimed they would share more details in Q4. The good news is that Nintendo seems to have prepared well for a memory crunch and has some levers to pull should hardware margins compress.

I believe the sell-off here has gotten a bit too extreme and I am getting north of a double digit IRR from these prices (while being conservative), which is why I added again to my position today.

Have a great day,

Leandro

Great stuff. Don't understand this sell-off. Games will come, it is crazy to think they won't when they have increased development budgets for 1P titles greatly since the time of the SW1 launch.