AI takes down another industry (NOTW#77)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

The market was down this week, driven again by the SaaSpocalypse. SaaS is not the only industry that AI has “taken down,” we had a new one this week. I believe the market went a tad too far this time (I talk about it in the brief market commentary).

Without further ado, let’s get on with it.

Articles of the week

I published three articles this week. The first one was my in-depth report on what I believe will be a long-term compounder from an emerging market.

30%+ Revenue CAGR. Emerging Market. A Blue Ocean.

Today I’ll venture into a new country and a new industry. Some will say that this is a dangerous thing to do, and while I do agree, I must say that today’s investment thesis has many parallels in other geographies (and even industries).

The company has compounded revenue at 30%+ rates since it IPOed and I believe it’s competitively advantaged to continue growing at 20%+ rates for the foreseeable future. Everyone tried to guess it by saying it was Mercado Libre (MELI) or Nubank (NU), but it’s neither of these two companies and I bet that you probably have never heard about the company. I started a position this week.

The second one was Texas Instruments’ earnings digest.

Data center, data center, and more data center

Texas Instruments reported a good quarter yesterday, with the stock following suit in after-hours trading. This is what I wrote last quarter with the stock down 9% after reporting earnings:

The company reported very good earnings (especially the guide) and can now be considered an AI-play! (only half joking).

Finally, the third article of the week was Danaher’s Q4 earnings digest.

A Myriad of Reasons for Conservativeness

Danaher reported Q4 earnings yesterday and the stock dropped almost 5%:

Okay earnings with a conservative guide (followed by TMO, who also guided conservatively). I explain in the article why I believe the conservative guide makes sense.

Without further ado, let’s see what the markets did this week.

Market Overview

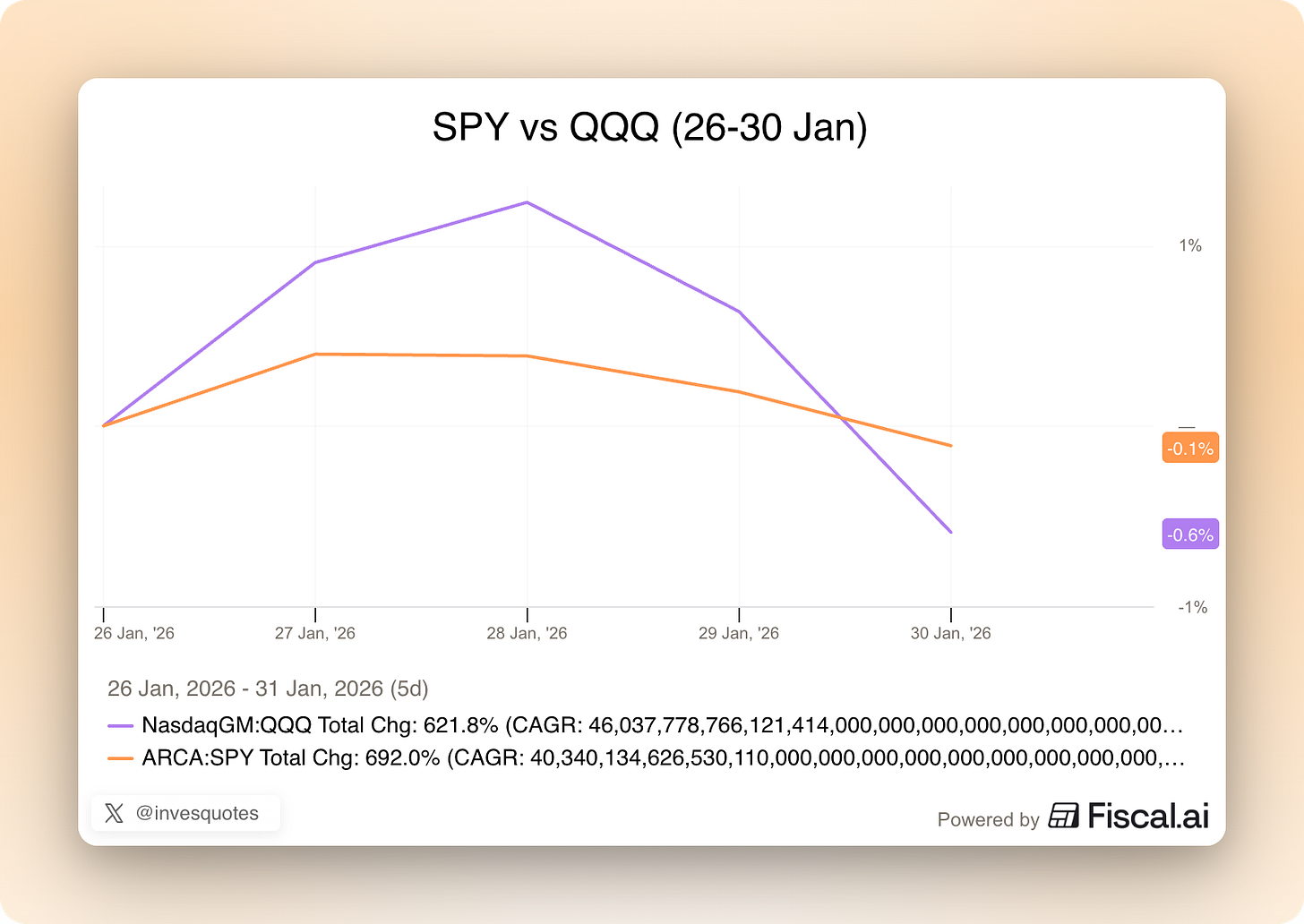

Both indices were down this week:

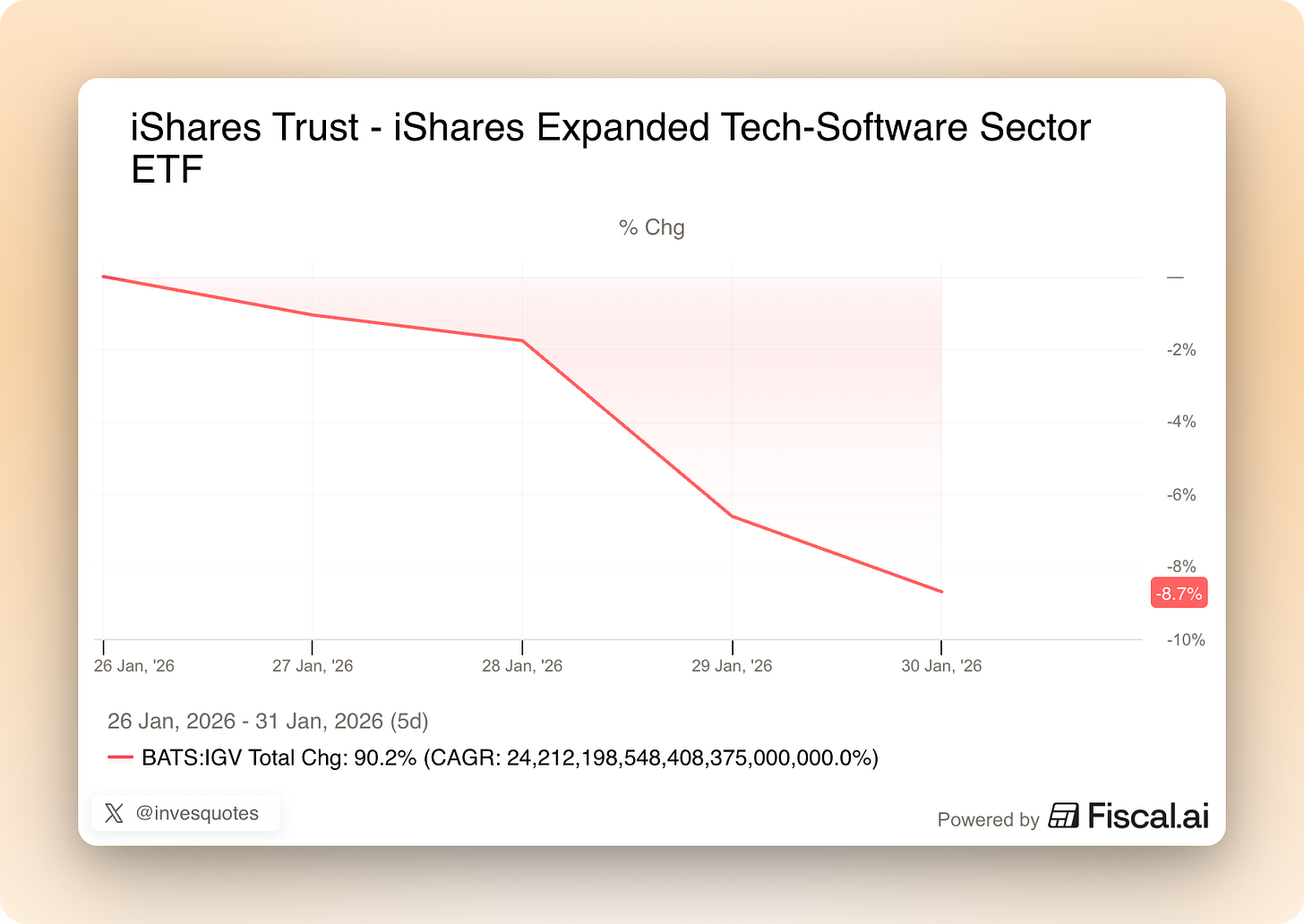

Two weeks ago, I titled the NOTW “SaaSmageddon” and maybe I could’ve titled this one “SaaSpocalypse.” Software did not have a great week (again) and the IGV was down more than 8%:

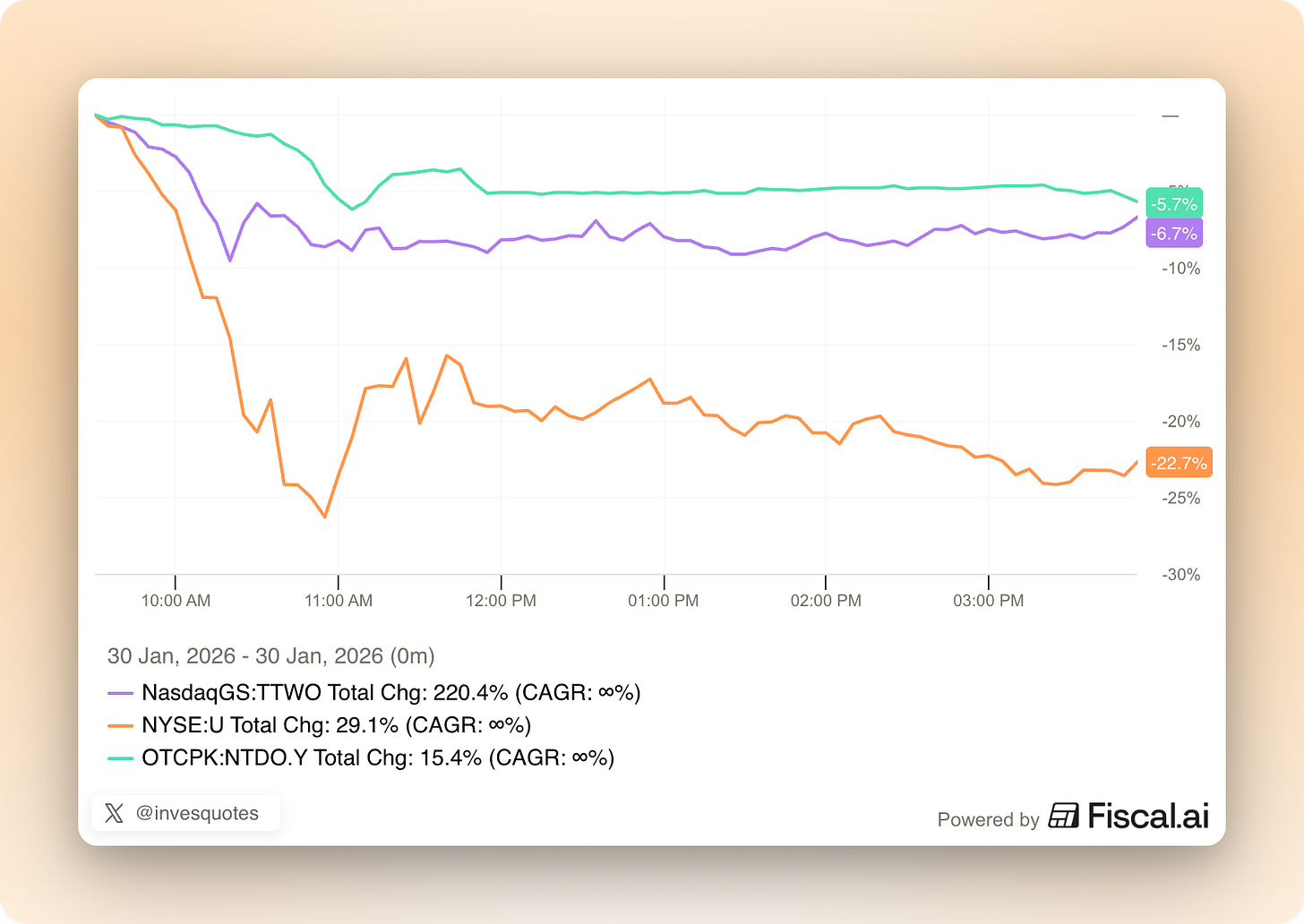

AI also took another victim this week: the videogame industry. Google unveiled Project Genie to develop “worlds.” The market believed this was terrible news for game developers (and their picks and shovels) and decided to indiscriminately sell the stocks of several videogame-related companies. Take a look at how much stocks like Take Two (TTWO), Unity (U), and Nintendo (NTDOY) declined on Friday:

I find it particularly interesting that the main bear case for Nintendo has historically been that it developed games that looked like dogshit due to their low resolution. The company proved this bear case wrong (or at least proved wrong that it mattered to do well) as it outsold pretty much all competitors with inferior graphics. It took a while for the market to realize that Nintendo’s “moat” did not rely on developing high resolution games but on developing fun games around its decades-old IP. I highly doubt AI changes any of this. In fact, if anything, I’d say that it might be hugely accretive for Nintendo as it might enable the company to develop games more efficiently and at a higher resolution using its unique IP. I added to my position on Friday.

What seems pretty evident is that the stock market shoots first and asks questions later. I believe it has always been this way, but this behaviour seems to have been exacerbated by self-reinforcing narratives. Many people will see stocks down on a given narrative and will think that the narrative must be right because the stock is dropping (i.e., the price moves confirms the theory). This makes the stock drop further, and it reinforces the belief that the narrative must be, therefore, right. While there’s no denying that AI is here to stay and that it can have a significant impact on many industries, it seems that the market is taking it a tad too far in certain instances.

Investing against narratives is pretty painful (I must say that I am suffering this pain early this year, and no, it’s not only SaaS) but I find it very hard to invest purely behind momentum. Momentum/narratives are currently driving markets and I can promise you that a lot of self-denominated long-term investors you know are falling prey to said momentum strategy. I can’t say I can blame them because it has worked incredibly well lately. You might think that I like pain for following the painful strategy of investing against narratives, and you might be right!

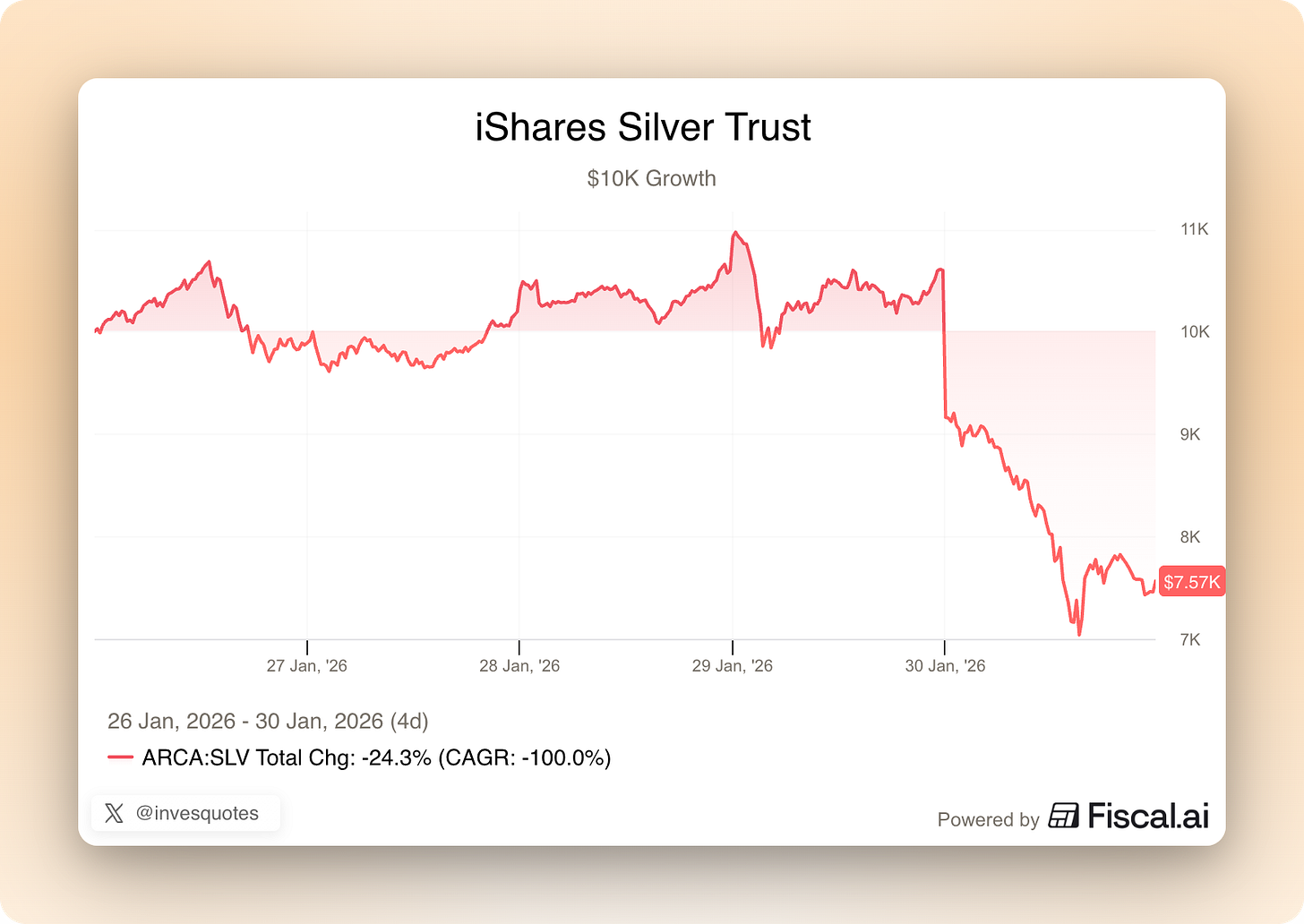

The reality is that narratives can also shift fast in one’s favor (or against them) and they tend to do so when it seems less likely. This should not be confused with the affirmation that narratives always shift and reverse; you may well find a narrative that ends up being right and significantly reduces the terminal value of a company or a given industry. When momentum changes or narratives shift, things can get very very ugly and very fast. Take a look for example at SaaS, and also at several metals like silver…

Of course, being on the “wrong” side of the narrative doesn’t feel great, but an investor has to own it and focus on their conviction while remaining open minded (it’s okay to admit a mistake at a loss and move on).

The industry map was (as almost always) mixed this week and reflected what we saw in SaaS companies:

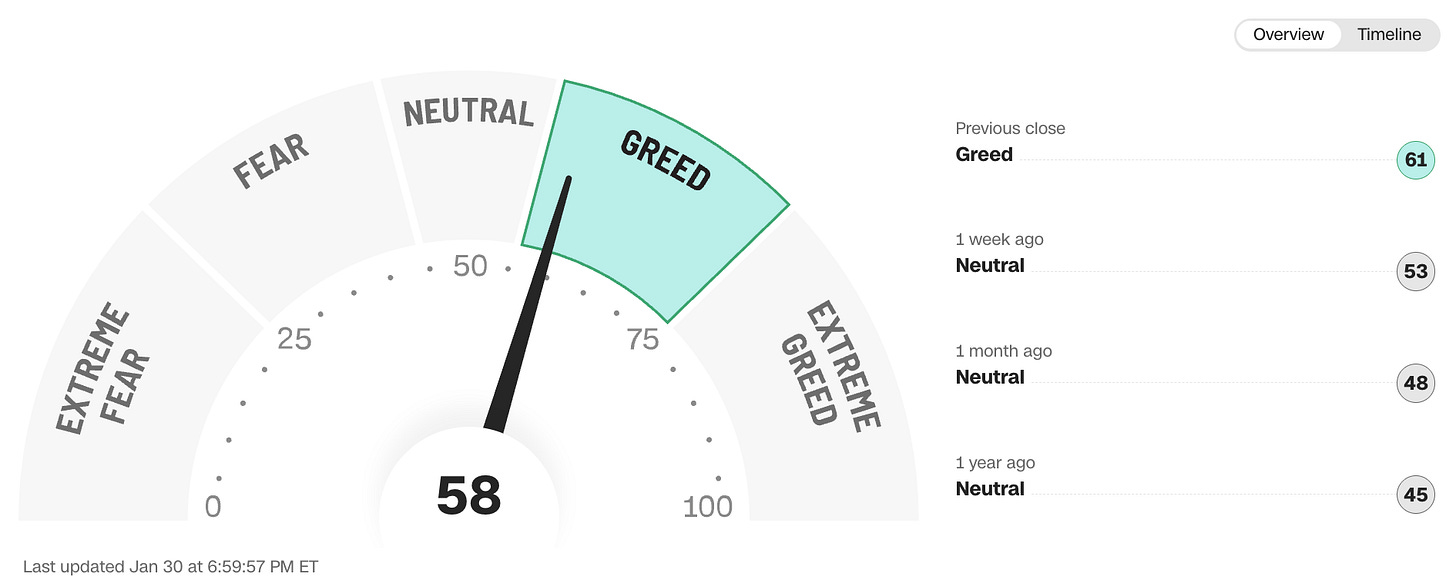

The fear and greed index improved to greed territory although I must say I see all but greed across my portfolio!

My additions (and sales) this week

I added to several positions this week and trimmed my largest position (no longer my largest position, of course) and fully sold out of another position. I also started a new position (the company which I profiled in my most recent in-depth report). This might seem like a lot of movement, but this is not something that stresses me too much when there’s a lot of volatility. Volatility is there for the investor to take advantage of.

Here’s what I added to and sold this week: