Data center, data center, and more data center

Texas Instruments' Q4

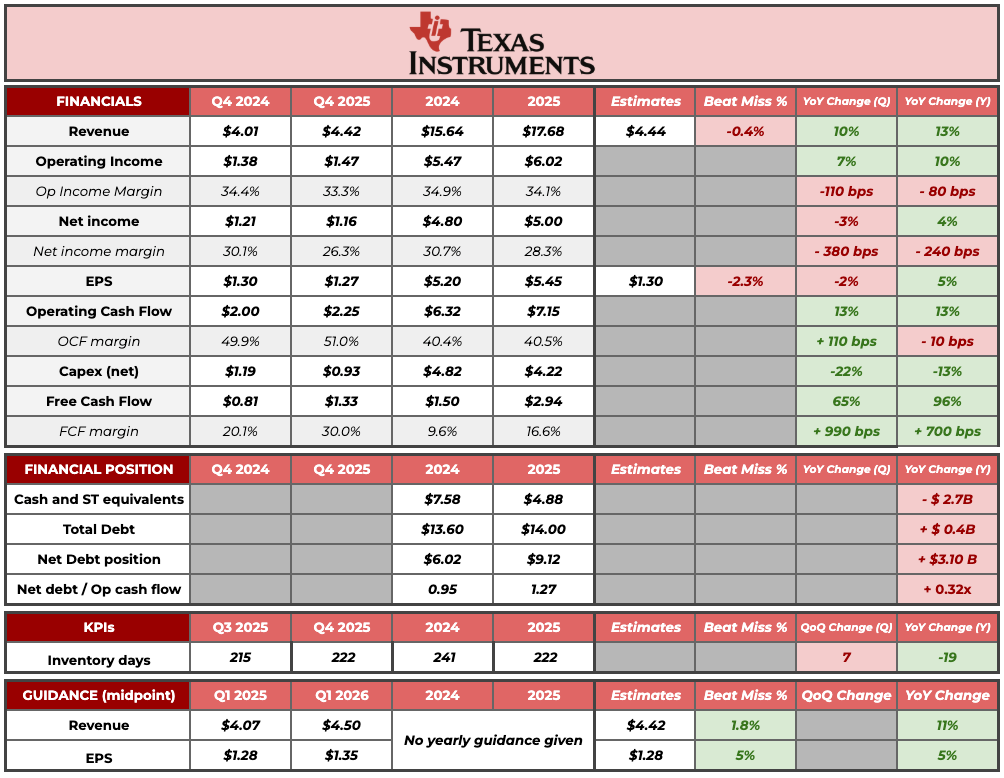

Texas Instruments reported a good quarter yesterday, with the stock following suit in after-hours trading. This is what I wrote last quarter with the stock down 9% after reporting earnings:

Texas Instruments’ Q3 was similar in some ways to its Q2: the company reported strong quarterly numbers (that significantly beat expectations, if ignoring some one-offs) only to follow these with somewhat “weak” guidance. As expected, the market did not like this much and the stock dropped considerably in after hours trading to $165:

Q4 was pretty much the exact opposite: relatively soft quarterly numbers but a very strong guide.

The strong guide was most likely one of the reasons that made the stock pop. Just for context, here’s how significant the guide was (I can´t recall what analyst said this):

Q1 guidance is significantly stronger than seasonal, and if my math is right, it seems like it’s the first time you’ve guided up sequentially since right after the financial crisis 15 years ago.

The other thing that, in my view, drove the stock was the commentary around data center. As promised, management started to disclose data center as an independent end market (I believe they expected to do this in 2026, but did it in Q4). All end markets were up in 2025:

Industrial: $5.8 billion, up 12%

Automotive: $5.8 billion, up 6%

Data center: $1.5 billion, up 64%

Personal Electronics: $3.7 billion, up 7%

Communications: $500 million, up 20%

Management was quick to point out that, despite all end markets growing in 2025, most of them are still significantly below their 2023-2024 peak. They also claimed that the next peak should be higher because content per end market equipment is “exploding.”

One thing is clear to me: end equipments are being redesigned with more semis every day. It will continue to be the case in the future. This is why I’m continuing to stay very optimistic and encouraged by the investment we’ve made in the past several years.

Haviv Ilan, TI’s CEO

Let’s say it has been an atypical recovery for TI…

It’s been one of the slowest, if not the slowest recovery ever in our history at a time where I think more semis are used in our life.

Haviv Ilan, TI’s CEO

Let’s focus a bit on data center. Data center grew 70% in Q4 and generated roughly $450 million in revenue. Assuming that seasonality is non-existent in this market due to the continuous strong investment it’s receiving (data center has grown through seven consecutive quarters), we could say that data center is a $1.8 billion revenue run rate business for TI and its accelerating (Q4 growth was ahead of yearly growth). This ultimately means that Texas Instruments is slowly but steadily becoming an “AI company,” just what the market likes to see!

It’s kind of sad to see that only AI-related stuff does well in the market nowadays (irrespective of fundamentals), but it is what it is and TI’s management was quick to start disclosing their AI exposure to take advantage of the positive flows. Note that not only is data center disclosed as an independent segment but management also considers it “core.” TI’s core segments (automotive, industrial, and data center) now make up 75% of total revenue.

Now, the strong guide needs some context. First and foremost, it’s not pricing related. Some recent rumours have pointed out that analog players have been raising prices. This led several analysts to believe that pricing was the “missing” variable behind the guidance surprise. However, management argued that their expectations for pricing have not changed (although they reserve the right to change their opinion) and that they still expect prices to come down 2-3% per year.

The second thing that we should be aware of is that (albeit improving) Texas Instruments is not known for its visibility. The company enjoys very short lead times (that’s why they built inventory) so they basically react to what they see in front of them. The strong guide came from stronger orders during Q4, but we must be aware that visibility is significantly worse after that. Yes, management admitted to having received longer-term orders, but TI has a customer-friendly policy (unlike many of its peers), so these orders could still be cancelled should things change!

What I believe is worth focusing on is the Free Cash Flow trajectory. FCF grew 94% in 2025 (17% margin). This is despite…

TI holding a significant inventory position (not great for working capital)

Capex still being elevated from the investment cycle

Both things are likely going to normalize next year. TI is still guiding for Capex of $2-$3 billion in 2026 (they will give more detail in the Capital management update the 24th of February). We must subtract two things from this number…

The ITC which increases to 35% next year

The potential grants of $1.6 billion that TI is entitled to

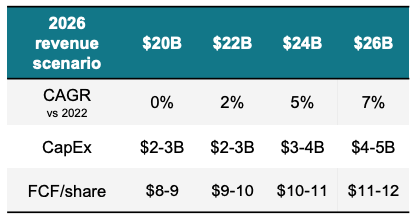

I have absolutely no visibility around the second, so let’s just assume the 35% ITC. A 35% ITC results in net capex (midpoint) of $1.6 billion before any grants. Operating Cash Flow in 2025 was $7.15 billion. Let’s assume this grows 10%-12% next year (ignoring any working capital benefits, just from pure revenue growth), resulting in Operating Cash Flow of around $8 billion. Both things result in Free Cash Flow of $6.4 billion. This means that, after growing 94% in 2025, we could expect FCF to maybe be up triple digits in 2026 (again, assuming no grants are received). This would result in around $7 of FCF per diluted share in 2026, which is below management’s low-end scenario:

The fact that it’s lower makes somewhat sense due to the slower cycle recovery and management’s recent commentary, but there are significant sources of upside to these numbers such as…

The money from the direct grants

The fact that the ITC of 35% was not used to build the table above

A stronger recovery than expected from the market, resulting in higher growth and more favorable working capital

I would say that $7 in Free Cash Flow per share next year is still a pretty conservative number, albeit one that still provides Texas Instruments with strong FCF growth. Evidently, the market is not stupid and the stock is somewhat anticipating the significant increase in FCF. So let’s take a quick look at what the valuation looks like at current levels.

Is TI still a good deal?

Recall that I usually provide 4 scenarios to assess TI’s valuation. Here they are: